What Are Total Returns?

Most novice investors do not understand total returns. If you own chickens, there is more than one way to benefit. You can get eggs and eat them or sell them. You can catch the chicken and fry it. Or you can hatch the eggs and get more eggs to grow your flock and increase your egg and frier production. The same is true in the world of investing.

Recently I taught lesson number two in my investment training series to a family of four: the parents and two teenage daughters. Most people think the profit they make when they buy a stock or ETF or stock for $10 and sell it for $15 is $5. That may not be entirely true. In fact, for many stocks and ETFs, that is not true.

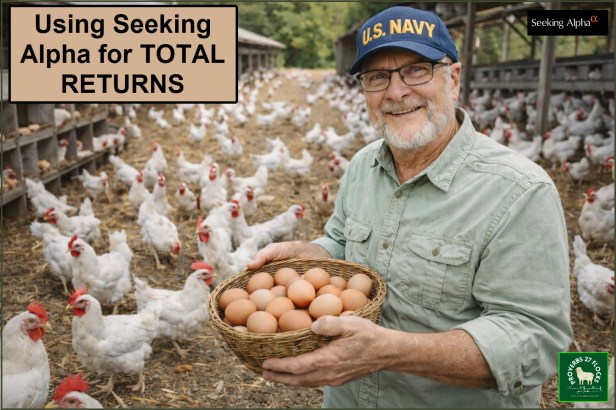

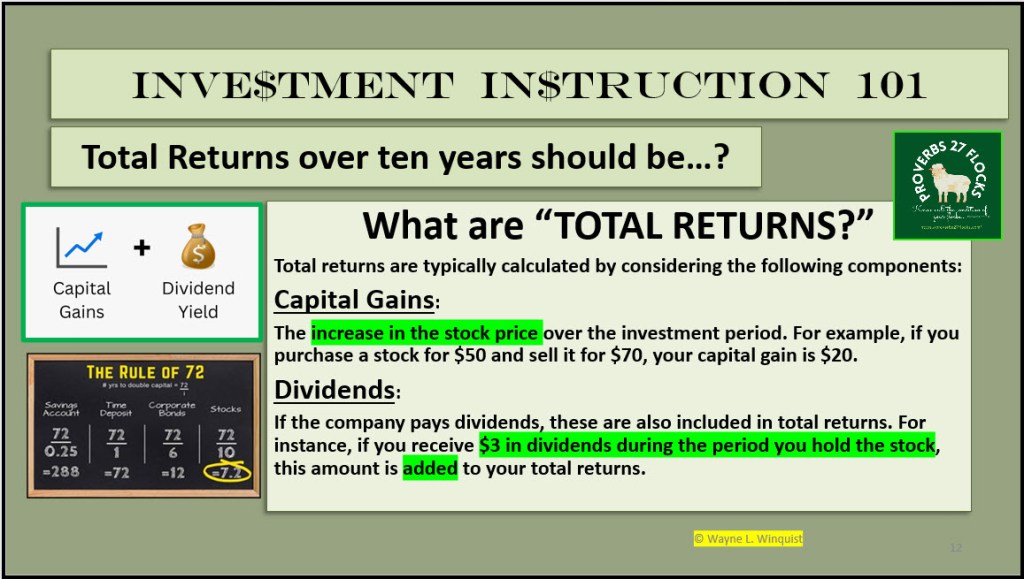

Here are two slides from the lesson I taught. They help explain the positive addition of dividends to the price returns to create total returns for ETF DGRO.

Our Portfolio

For me the total returns certainly include (1) the profit from the sale of an investment (if I sell – because you really don’t have a profit or loss until the day you sell) and any (2) dividends received during the time I owned the shares. In my case the total returns also include the (3) profits from selling covered call options or cash covered put options. Let’s take a look at one example.

ABBV Dividends and Options Income

I own 900 shares of ABBV in my ROTH IRA, 200 in my traditional IRA, and Cindie owns 120 shares in her ROTH IRA. That means we have 1,220 shares. The current annualized dividend payout for these shares is $6.92. That means, unless the dividend is cut or suspended (highly unlikely) that we will receive $8,442.40 this year in dividend income for our shares.

However, over the life of our ownership of ABBV we have received a total of $30,827 in dividends. We did not have 1,220 shares when I first started investing in ABBV in 2017, as I only purchased 450 shares of ABBV in 2017. I added shares almost every year since then.

The other missing piece is that I have been trading covered call options on the ABBV shares. That has added another $30,082 in profits since 2021 when I first started trading ABBV options.

Because we have not sold our shares, I cannot really say I have a profit or capital gain at this time. However the cost basis of my 900 ABBV shares in my ROTH IRA is $124.16 per share. The current price of ABBV as of Friday’s close is $231.50. Therefore, the true total profit if I sold would be considerable. Caution: Never count your capital gains chickens until you slaughter them at whatever price the market is willing to pay on the day you sell your shares.

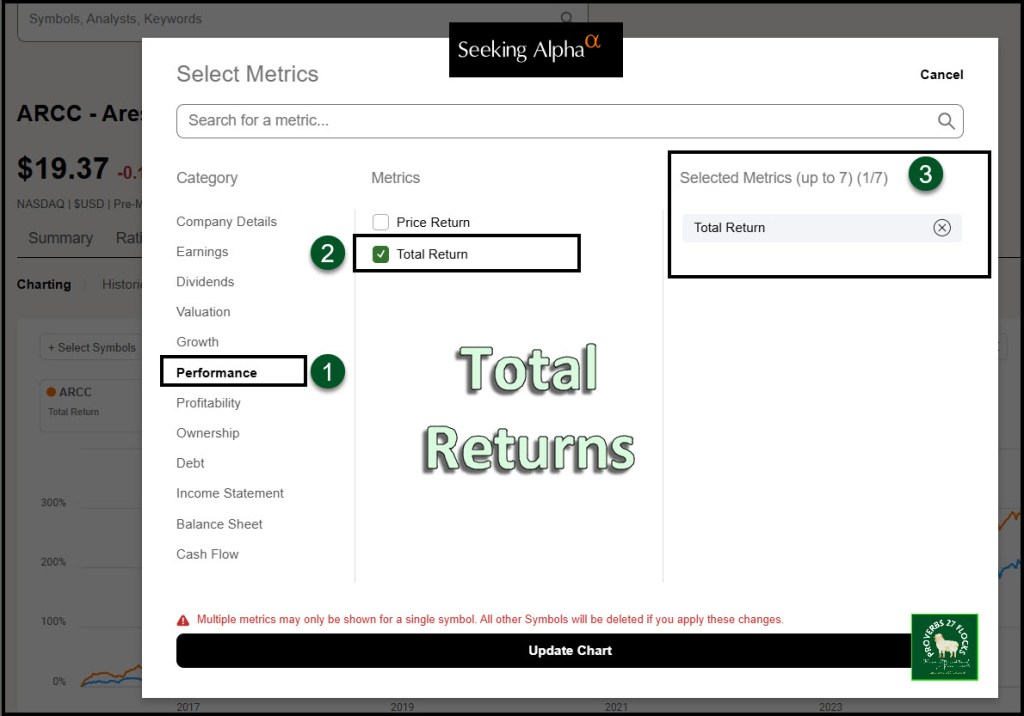

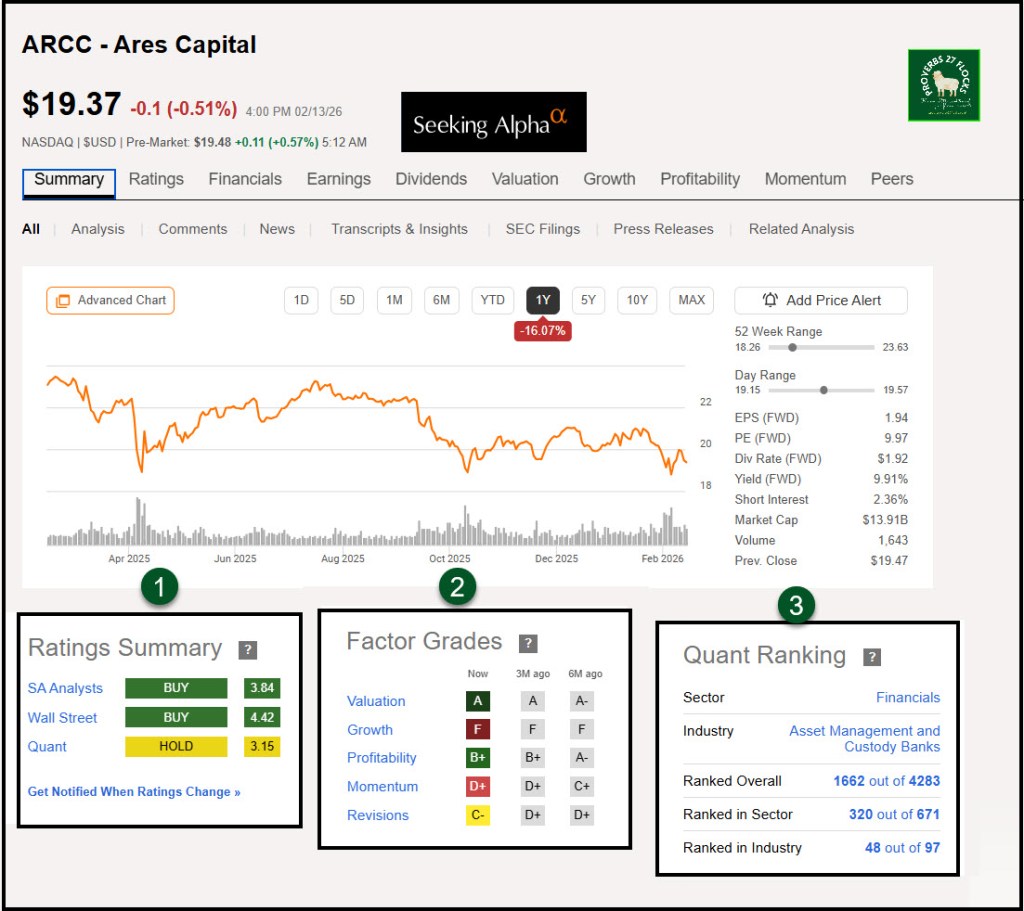

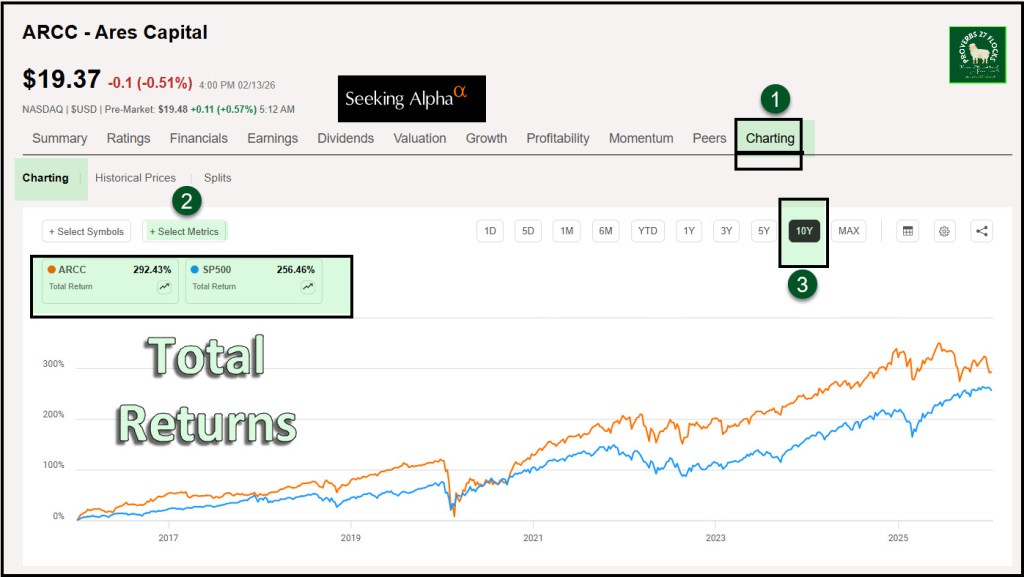

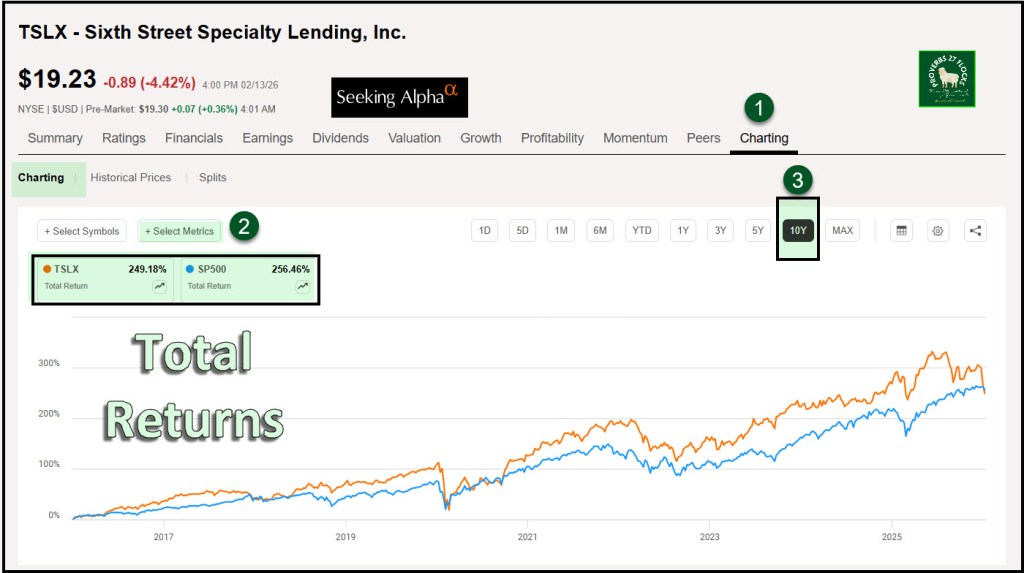

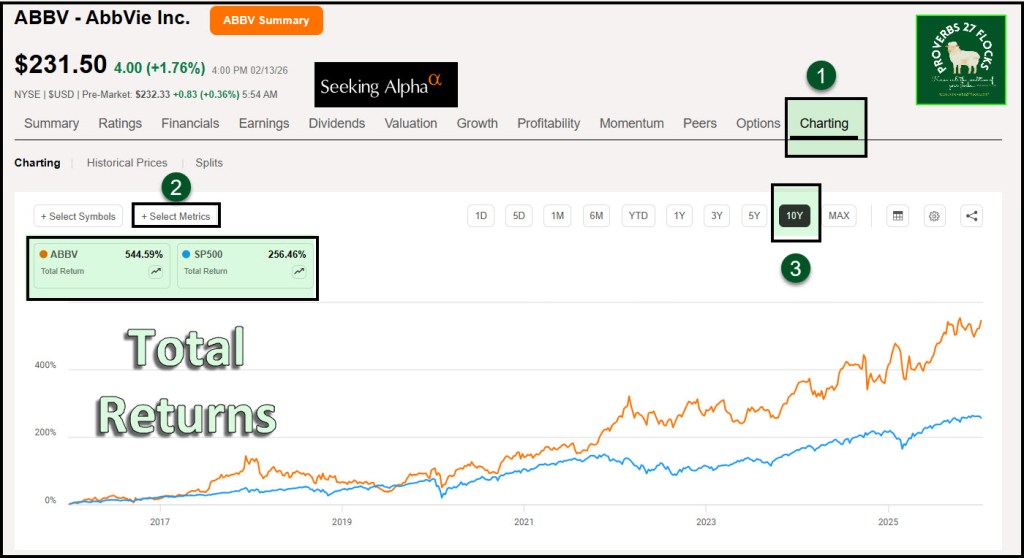

Total Returns Using Seeking Alpha Charts

It takes just a minute to see and compare total returns for various investments. When you select “Charting” from the top menu for any stock or ETF, you can then also select metrics and add symbols to compare multiple stocks against the S&P 500. This illustrates the comparison of ABBV with TSLX and ARCC.

Sometimes I just want to see one stock when I start my research. Here are the images for ABBV, ARCC, and TSLX of most importance to me.

An Obvious Caution

As most advisors and brokers will caution, past returns do not tell you about the future returns.

The phrase “past performance is not indicative of future results” warns investors that just because an investment has performed well in the past does not guarantee it will continue to do so in the future. This is important for making informed investment decisions, as market conditions can change unpredictably.

Having said that, you are likely to be more pleased with an investment with growing sales, profits, and growing dividends. All of those are historical in nature, but history often repeats itself. Nevertheless, diversified investments are a wise approach when picking even the very good investments.

Recommendations

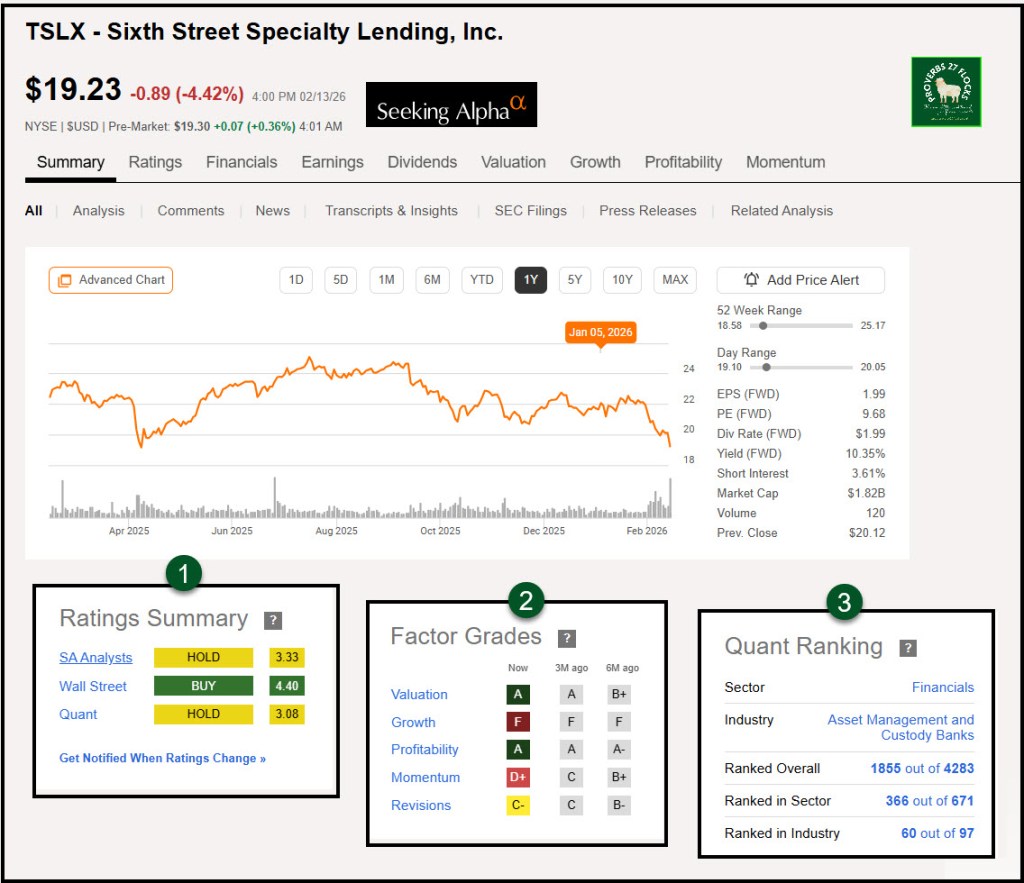

While I am uncertain about the future of any investment, I think it is time to buy shares of TSLX because investors are fearful and I believe their fear is overdone. Warren Buffett has two very often quoted statements. The first is Rule No. 1 and Rule No. 2: “Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1,” which emphasizes the importance of capital preservation in investing.

Another popular quote is, “Be fearful when others are greedy and greedy when others are fearful.” I think the fear is a buying opportunity.

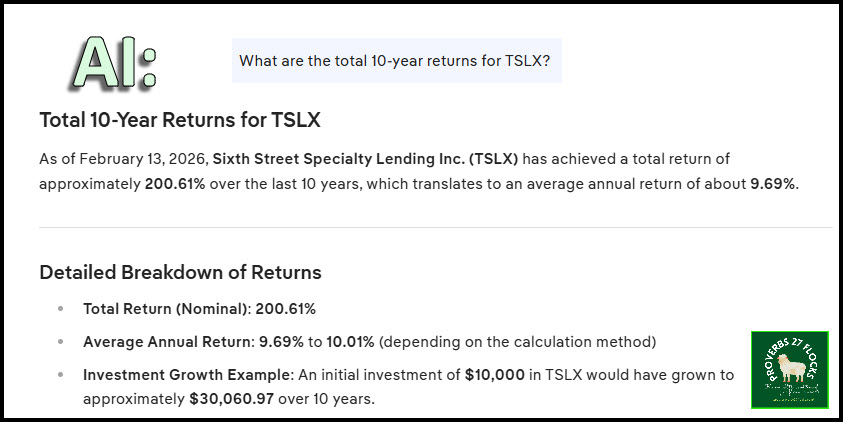

There are other ways to quickly see ten-year returns. You can leverage artificial intelligence.

Finding 10-Year Total Returns Using AI

Be careful when using AI, but I have found it to be somewhat helpful when wanting basic information about a specific stock or ETF symbol. Even if the numbers are a bit off, I have found the AI answers to be helpful in seeing reality. I used AI to find out the ten-year returns for ABBV, ARCC, and TSLX. Here are the answers I received. (Full Disclosure: I currently own shares of ABBV and ARCC.) At the current prices I am very tempted to buy shares of TSLX. I sold our shares in October 2025 to free up some cash.

“What are the total 10-year returns for ABBV?” As of February 2026, AbbVie Inc. (ABBV) has achieved a remarkable total return of approximately 1,020.57% over the past 10 years, which equates to an average annual return of about 20.34% when dividends are reinvested. This performance highlights AbbVie’s strong growth trajectory and the impact of its strategic product launches.

Detailed Breakdown of Returns

- Total Return (Nominal): 1,020.57%

- Average Annual Return: 20.34%

- Investment Growth Example: An initial investment of $10,000 in ABBV would have grown to about $112,057.16 over the decade.

Summary: AbbVie has shown impressive returns over the last decade, largely driven by successful product offerings like Skyrizi and Rinvoq, especially in the face of challenges from generics post-Humira. Despite some fluctuations and a slight decline in 2023, the overall performance underscores the company’s strong strategic positioning in the pharmaceutical industry.

“What are the total 10-year returns for ARCC?” As of February 2026, Ares Capital Corporation (ARCC) has achieved a total return of approximately 1,056.35% over the past 10 years, equating to an annualized return of about 12.14%. This impressive growth reflects its robust dividend payments and capital appreciation.

Detailed Breakdown of Returns

- Total Return (Nominal): 1,056.35%

- Average Annual Return: 12.14%

- Investment Growth Example: An initial investment of $10,000 in ARCC would have grown to about $115,634.89 over the 10-year period.

Summary: Ares Capital has demonstrated a strong performance over the past decade, marked by significant capital appreciation and a history of stable or growing dividends. Despite some fluctuations in recent years, such as declines in 2022 and a slight downturn in 2026 thus far, the overall trend shows resilience and strong growth potential.

“What are the total 10-year returns for TSLX?” As of February 13, 2026, Sixth Street Specialty Lending Inc. (TSLX) has achieved a total return of approximately 200.61% over the last 10 years, which translates to an average annual return of about 9.69%.

Detailed Breakdown of Returns

- Total Return (Nominal): 200.61%

- Average Annual Return: 9.69% to 10.01% (depending on the calculation method)

- Investment Growth Example: An initial investment of $10,000 in TSLX would have grown to approximately $30,060.97 over 10 years.

Summary: Overall, TSLX has demonstrated resilience with consistent returns, achieving double-digit economic returns for a decade. However, it is essential to note that it has experienced fluctuations, particularly a downturn in 2022 and a current dip in performance for 2026 so far.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com