Dividend Safety and Growth

Today I will explore another Seeking Alpha feature. Prudent investors in retirement and before retirement should understand the nature of their estimated annual income from their investments. They should also be aware of the risks associated with any investment, including the loss of income from stocks that are destined to perform badly when it comes to paying shareholders.

Our son sent me a text message this past week. In it he said, “I wish I would have read these articles before I bought a subscription to Seeking Alpha. I have wanted to follow this advice for years but deemed the cost too high. Now it seems like chump change in comparison to overpaying for a bad investment. If I had read your post first, I could have bought my subscription using your link!

I think SA would have saved me a few bad purchases over the years, but I am happy to report that SA rates my investments across my portfolios in the top 5% of investors. Must be doing something right.”

Chump change isn’t an expression we hear very often. “If someone refers to an amount of money as chump change, they’re saying it’s not really worth much or not enough to make any sort of significant difference. It’d be like if you needed $500 to pay a bill and someone offered you $5. It’s a nice gesture, but it’s chump change. What difference would that $5 really make to the issue at hand?” – Grammarist

For example, I view the cost of the things my wife puts in our Amazon shopping cart as chump change. The dollar amounts are so small that they are like a snail egg next to the ostrich egg of our monthly income. The cost of a Seeking Alpha Premium subscription is typically $299 per year, but there are discounts available. If you use my link at the end of this post you can see the current offers. The $299 per year cost of my subscription keeps me from making $5,000 mistakes.

Our son also used Seeking Alpha to evaluate his portfolio and said, “SA rates my investments across my portfolios in the top 5% of investors.” I’m not surprised. There is a tool in Seeking Alpha called the “Health Score.” I used to be in the “top 5%” but have seen a drop in my score due to my willingness to include higher-risk investments in my traditional and ROTH IRA. I’m far less aggressive with Cindie’s retirement accounts.

2026 YTD Income Report Card

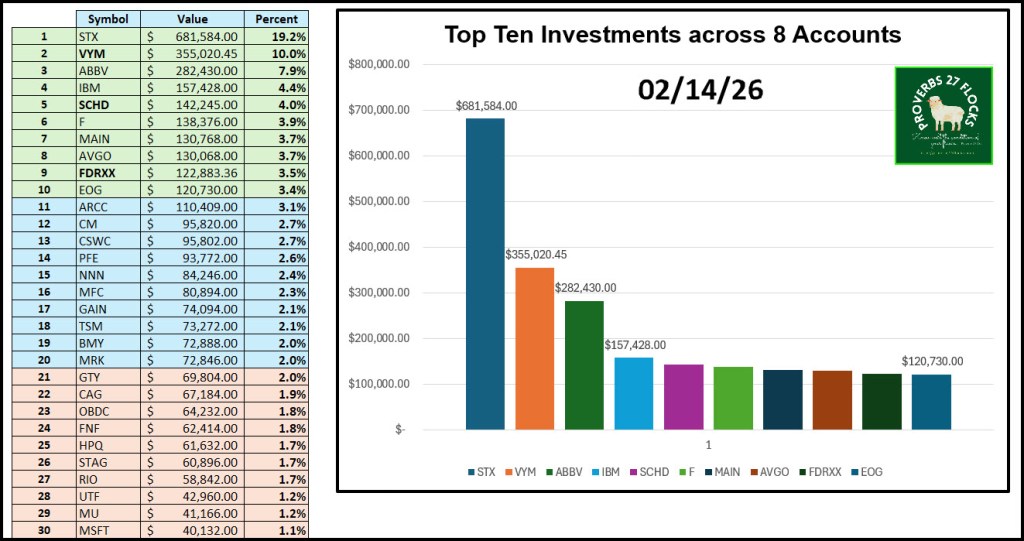

Our total dividend income is $18,697.92. That is $415.50 per day (including Saturday’s and Sunday’s.) That isn’t all. Total options income is $17,750.30. ($394.45 per day.) The “easy income” we receive in dividends from our investments should be relatively low risk. Most people I know can easily live on $400 per day. Actually, we really don’t need that type of investment income. We always want to think about how growing our income empowers our charitable giving.

What Matters?

Let me suggest five things that matter for pre-retirement investors and retired investors. Seeking Alpha can help you keep an eye on all of these.

- Growth in your investment. The price of your shares should go up. For this you want to focus on the QUANT Rating. If the QUANT rating is “SELL” or “STRONG SELL” you should read that to mean “high risk” and “very high risk.” Why introduce these investments in your portfolio? Here is an example: The FBND (Fidelity Total Bond ETF) is viewed as “safe” by far too many people. Yet it has a QUANT rating of “sell” primarily due to the momentum of the share price. FBND is ranked 76 out of 101 similar ETF bond funds. Using Seeking Alpha, I quickly identified number one in this class of funds: MGOV (First Trust Intermediate Government Oppty ETF.) I don’t recommend MGOV, but I do want you to see the power of the tool. It has a HOLD rating.

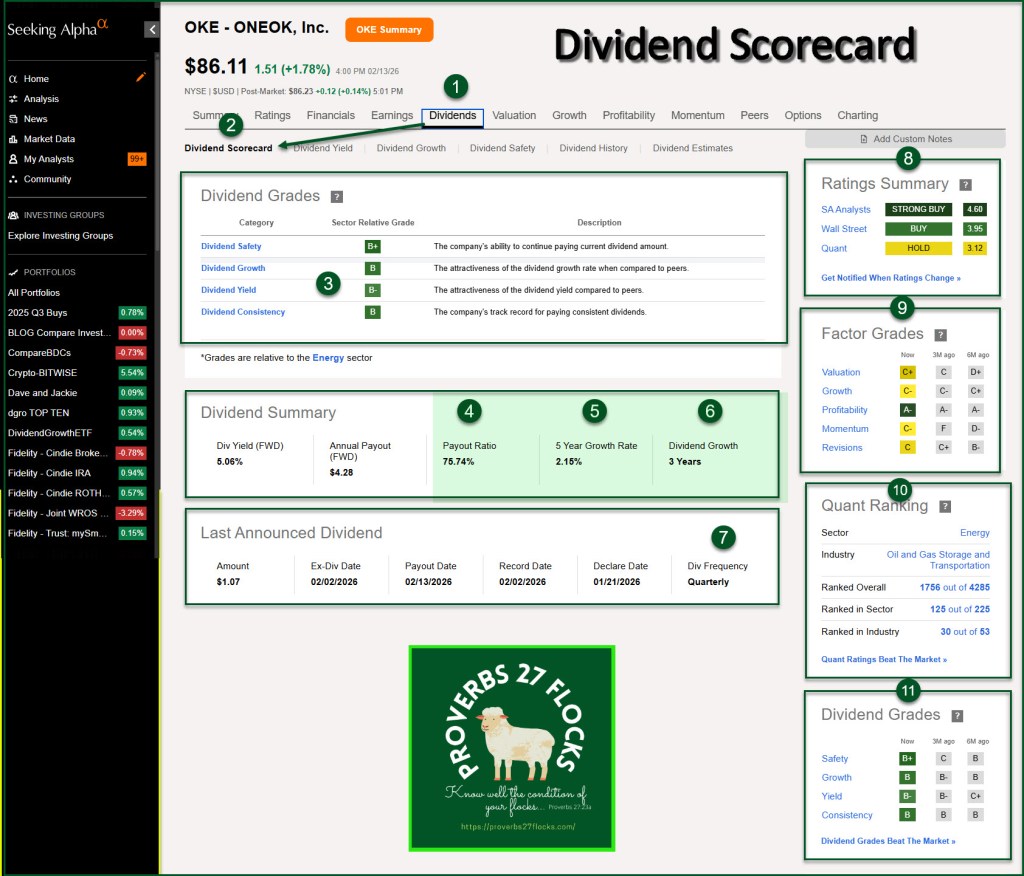

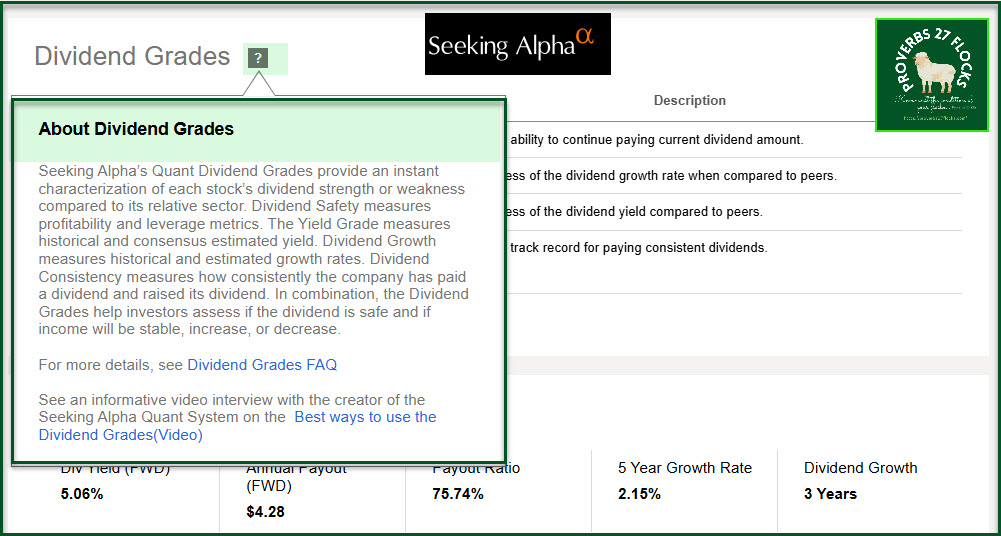

- Safety of your dividend income. You want to know that the dividend is reasonably certain if the stock or ETF pays a dividend. Seeking Alpha does a good job providing you with the dividend safety grades. So, for example, ABBV has solid dividend safety characteristics. Seeking Alpha’s Quant Dividend Grades provide an instant characterization of each stock’s dividend strength or weakness compared to its relative sector. Dividend Safety measures profitability and leverage metrics. The Yield Grade measures historical and consensus estimated yield. Dividend Growth measures historical and estimated growth rates. Dividend Consistency measures how consistently the company has paid a dividend and raised its dividend. In combination, the Dividend Grades help investors assess if the dividend is safe and if income will be stable, increase, or decrease.

- Dividend growth. Generally speaking, companies that pay a dividend also tend to have good price appreciation. This should make sense, as the demand for the income increases as the dividend goes up. That drives demand and can cause the stock to rise. For ABBV the five-year dividend growth rate is 6.56%. That is one reason I own shares of ABBV.

- The dividend payout ratio is a very important number. Think about it this way, if the company makes ten cents in profit, and then pays a twenty-cent dividend, they have to get the money from somewhere. Now, perhaps they have cash available from previous good quarters so this might not be an issue. However, if the company continues to pay out more than they make in profits, a day of reckoning is coming. Using ABBV again as an example, their payout ratio is 66.50%. This is acceptable and reasonably safe.

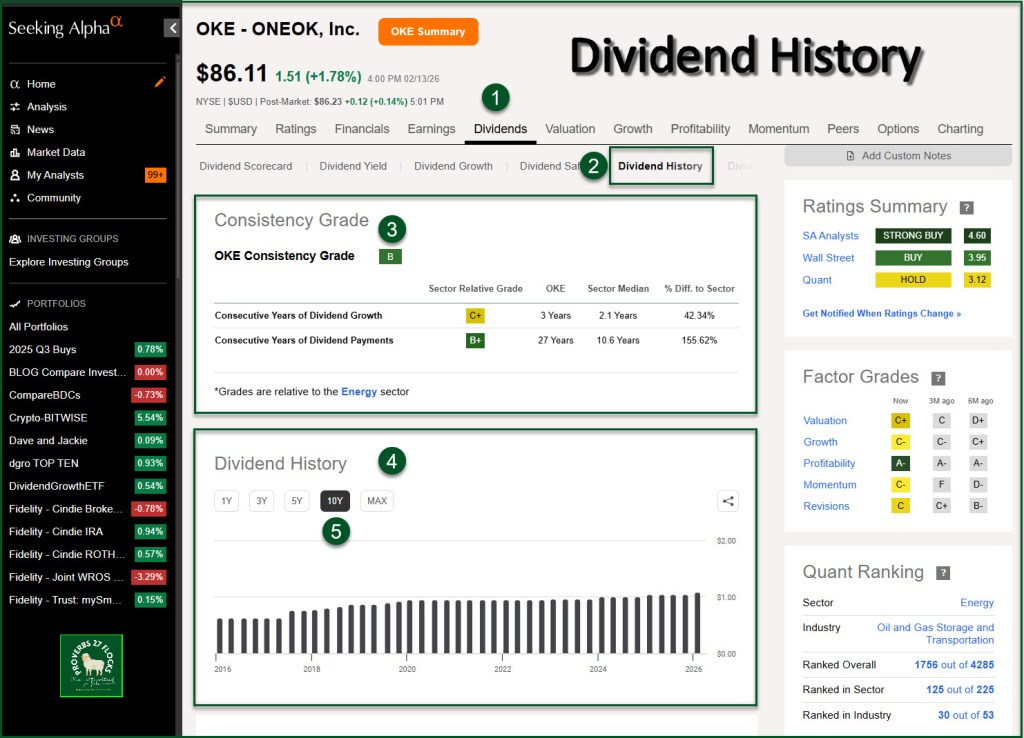

- Dividend cuts and suspensions are often an indication that there is trouble ahead. While Seeking Alpha cannot predict if and when a cut is coming, if the risk factor is in the red you should avoid the stock unless you are OK with losing the dividend at some point in the future. Since 2013 ABBV has never cut their dividend.

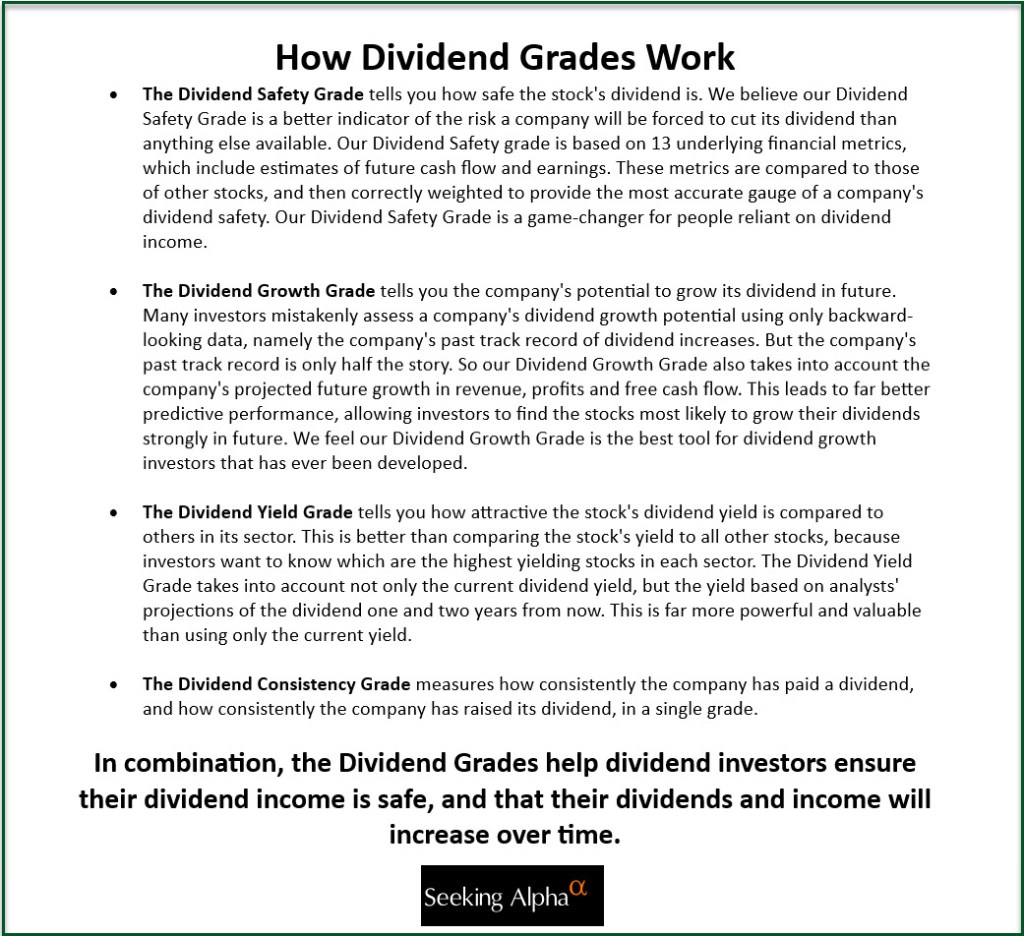

How Dividend Grades Work (Information from Seeking Alpha)

- The Dividend Safety Grade tells you how safe the stock’s dividend is. We believe our Dividend Safety Grade is a better indicator of the risk a company will be forced to cut its dividend than anything else available. Our Dividend Safety grade is based on 13 underlying financial metrics, which include estimates of future cash flow and earnings. These metrics are compared to those of other stocks, and then correctly weighted to provide the most accurate gauge of a company’s dividend safety. Our Dividend Safety Grade is a game-changer for people who are reliant on dividend income.

- The Dividend Growth Grade tells you the company’s potential to grow its dividend in future. Many investors mistakenly assess a company’s dividend growth potential using only backward-looking data, namely the company’s past track record of dividend increases. But the company’s past track record is only half the story. So our Dividend Growth Grade also considers the company’s projected future growth in revenue, profits and free cash flow. This leads to far better predictive performance, allowing investors to find the stocks most likely to grow their dividends strongly in future. We feel our Dividend Growth Grade is the best tool for dividend growth investors that has ever been developed.

- The Dividend Yield Grade tells you how attractive the stock’s dividend yield is compared to others in its sector. This is better than comparing the stock’s yield to all other stocks, because investors want to know which are the highest yielding stocks in each sector. The Dividend Yield Grade considers not only the current dividend yield, but the yield based on analysts’ projections of the dividend one and two years from now. This is far more powerful and valuable than using only the current yield.

- The Dividend Consistency Grade measures how consistently the company has paid a dividend, and how consistently the company has raised its dividend, in a single grade.

In combination, the Dividend Grades help dividend investors ensure their dividend income is safe, and that their dividends and income will increase over time.

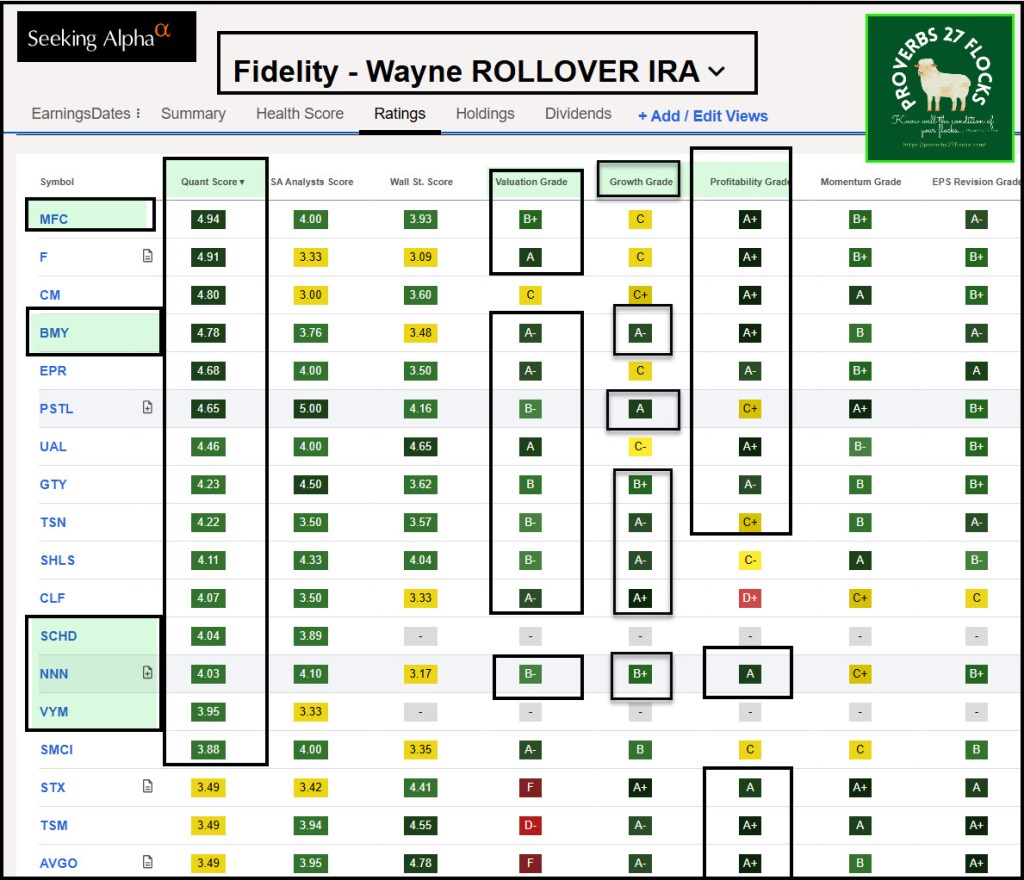

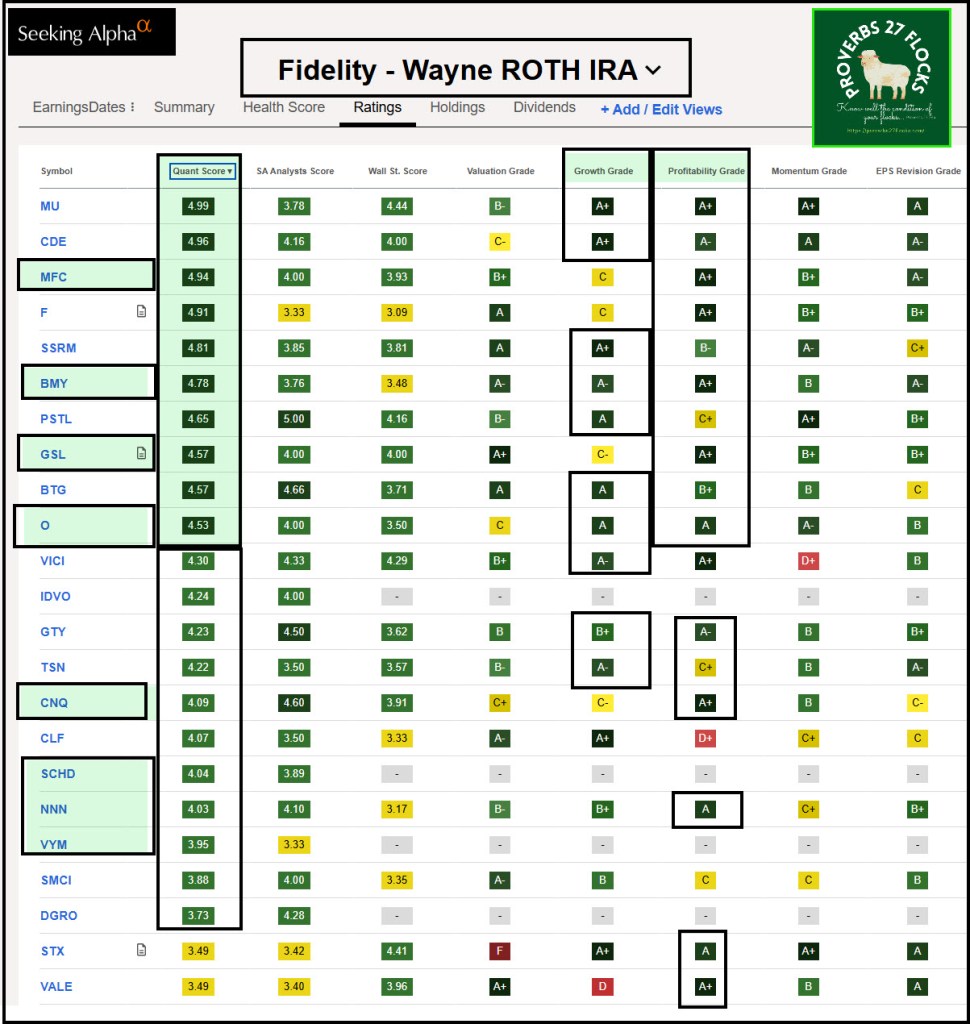

Portfolio Measurements Using Portfolio View

One of the reasons I have a paid subscription is that I want Seeking Alpha to help me see the quality of my investments (QUANT Ratings) and the quality and safety of my dividends. Here are two images from my traditional IRA and my ROTH IRA.

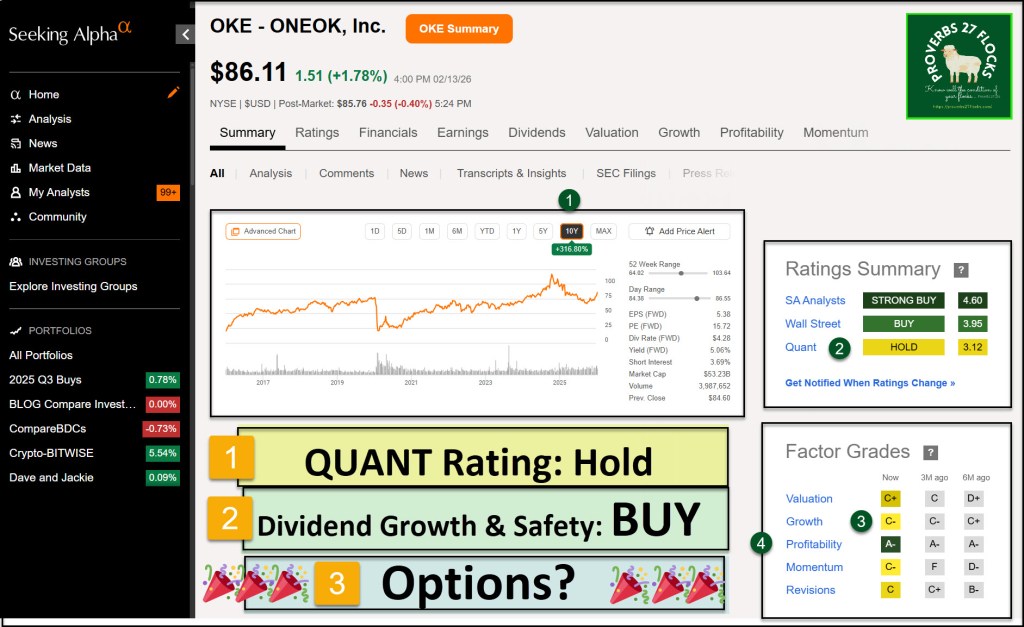

Explore OKE Using Seeking Alpha

By way of example, we own shares of OKE. Here are some images from Seeking Alpha that help me understand the quality of this investment. I trade covered call options on our OKE shares for additional income.

Summary

Use the QUANT rating to determine if the investment has potential to grow in value.

Use the Dividend rating to determine the quality of the dividend compared to similar companies in that sector and the risk of losing the dividend in the future. Check out this link: Seeking Alpha Game Changer

Interview With The Creator Of Dividend Grades (Video)

“We interview Steven Cress, Head of Quantitative Strategy at Seeking Alpha, to learn more about the Seeking Alpha Dividend Grades. The Dividend Grades evaluate the safety, growth, yield, and consistency of a dividend. Certain grades matter more to different types of investors. Watch the interview to find out how you should prioritize these grades for your investing style. The data updates daily, so you can always rest assured that the information is fresh.”

Seeking Alpha Subscription Information

The following offer is for “Valentine’s Day.” Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com