Start with the Basics

One of my readers, Shawn, recently got a Seeking Alpha subscription and linked his brokerage account to Seeking Alpha. Then he asked a question: “Got this up and running. Wondering if you have any post or suggestions on how to utilize Seeking Alpha? When I go on to site there is so much info, wondering where the best place to start.”

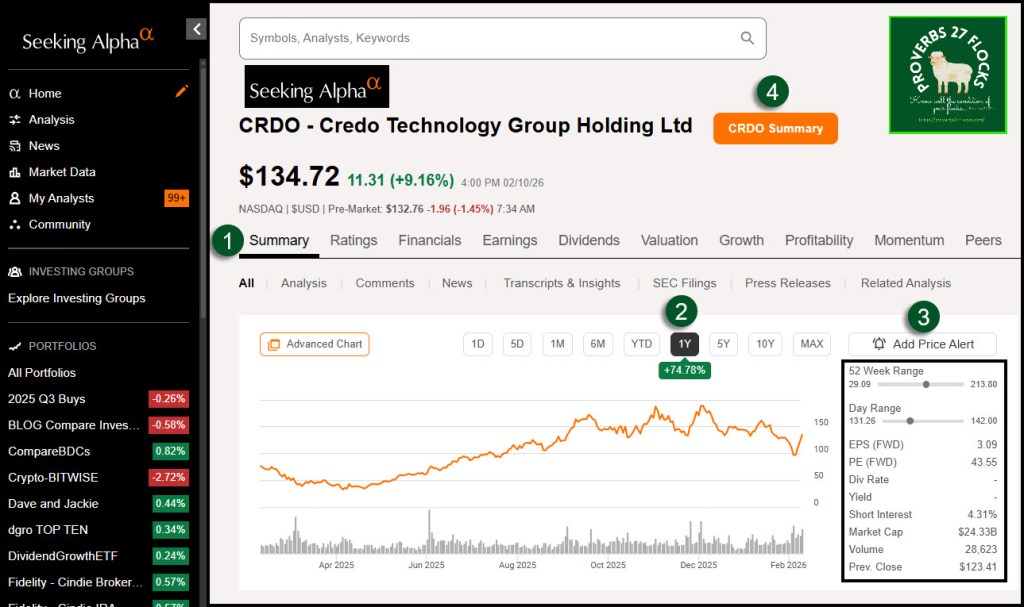

There are so many resources on the Seeking Alpha web site that it is easy to be overwhelmed. For example, if you are looking at an individual stock like CRDO (Credo Technology Group Holding Ltd) the main tabs are Summary, Ratings, Financials, Earnings, Dividends, Valuation, Growth, Profitability, Momentum, Peers, Options and Charting.

For an ETF like DGRO (iShares Core Dividend Growth ETF) the main tabs are Summary, Holdings, Ratings, Momentum, Expenses, Dividends, Risk, Liquidity, Peers, Options, and Charting.

My Favorite Starting Place

What do most investors care about? The answer tends to include things like profits, earnings, the growth of the company, the size of the company, the industry, the dividends (if any), and the trend of the stock price.

The best place to start for either a stock or an ETF is the (1) “Summary” tab. This section gives you a quick look at a number of the important pieces to evaluate an investment.

At the very top is a chart. You can decide how much history to include in your view. I like to see the 1-year view (2) most of the time. To the right of the chart (3) is some basic and important information, including EPS, PE, the Dividend Rate (if a dividend is paid), the dividend Yield, the “Short Interest”, Market Cap, Volume and the price of the stock at the previous close.

Sometimes there is a box at the top that says something like (4) “CRDO Summary.” This is another helpful overview of the company. I especially like the section called “Seeking Alpha Quant Rating Explanation.” For example for CRDO it talks about Growth: “Growth: CRDO exhibits phenomenal growth with Revenue Growth Forward of 106%, far exceeding the sector’s 9%. Additionally, its Operating Cash Flow Growth YoY is an impressive 2783%, showcasing strong financial performance.”

The Ratings, Grades, and Rankings

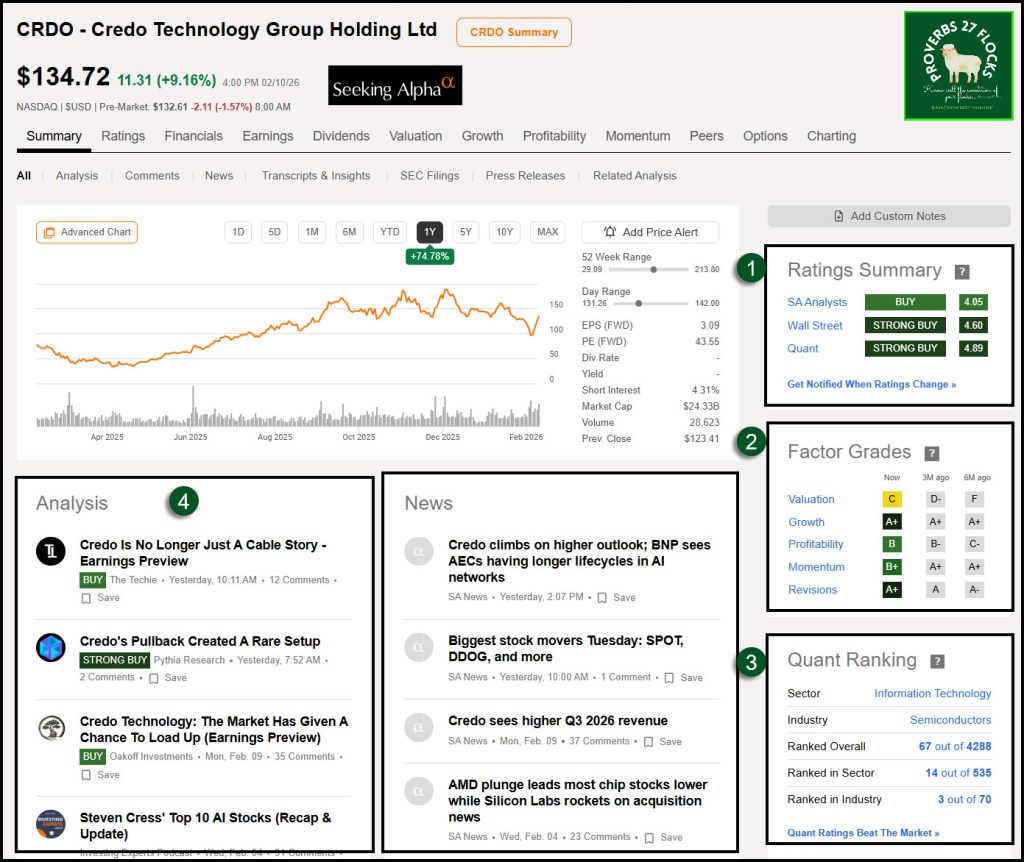

On the right side you can see three vital pieces of information (if you have a paid subscription.) The first is the (1) “Ratings Summary.” This box tells you about the views of three sets of experts. The first group is the SA Analysts. This includes one or more opinions from Seeking Alpha authors. If you want to read what some of them have said, look at the (4) Analysis section.

This portion also shows the views of Wall Street Analysts and the Seeking Alpha proprietary QUANT rating. In general, if all three are green I become more interested in the investment. However, I am really interested in the QUANT rating. (You can always click on the question marks to learn more about each section on the website.)

The next section (2) shows a summary of the Factor Grades that contributed to the QUANT rating. I am most interested in Growth and Profitability. CRDO is green in both categories.

The final box (3) provides the sector (Information Technology), the industry (semiconductors) and then some information about how the stock is rated “overall”, in their sector, and in their industry. So, for example, CRDO ranks high in all three cases.

The next piece can be helpful when considering any investment. If you click on the “Ranked in Industry” section you will see that MU and SMTC are rated slightly higher than CRDO.

The Rest of the Summary Tab

After I view these basics I decide if I want to scroll down to see more information. In my next post I will discuss what I look for in the remaining sections of the Summary tab. Then I hope to talk about “Portfolios” and the power of that feature for creating a watchlist or comparison of similar investments.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Note: The current offer will expire and the future offering will return for new subscribers. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com