RMD Results

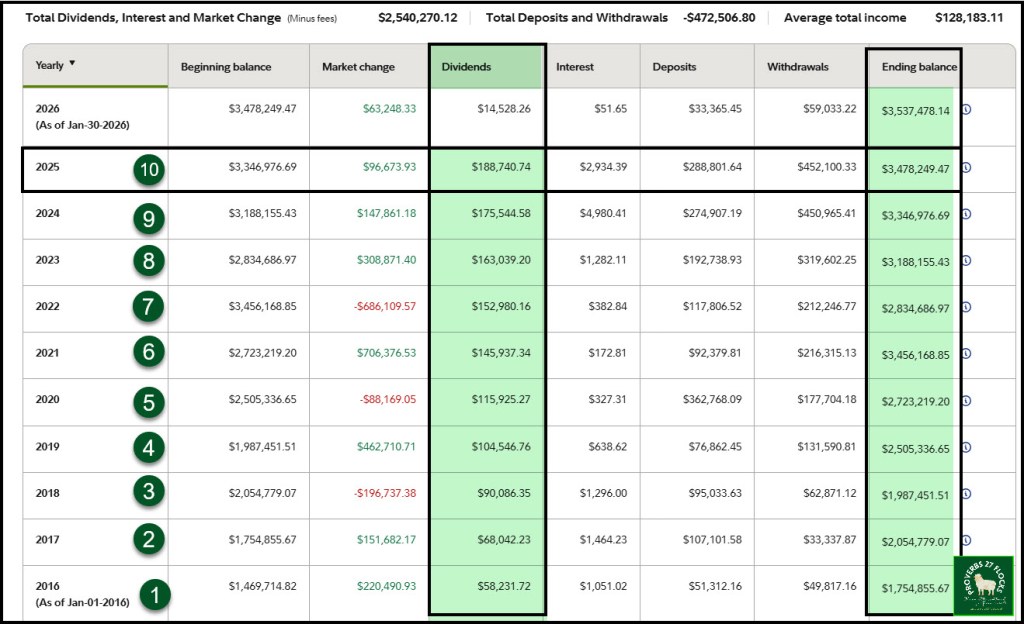

When I originally shifted to a dividend growth strategy, which I like to call my “Easy Income Strategy” the goal was two-fold. The first piece was to have increasing income that arrives with minimal or no work. That has proven to be very effective. This can be done without sacrificing portfolio growth, but it means you would minimize the use of bonds and bond ETFs as a part of the strategy. Bonds provide income, but they are poor from a dividend growth and total returns perspective. The following image is instructive.

The second piece of the strategy is based on a goal statement I created. All investors should have a goal statement for the year. The goal should be measurable and should be adjusted annually. If you don’t plan you can achieve nothing of meaningful value.

My Goal Statement

“Generate a steadily increasing stream of dividends paid by excellent, low-risk companies. The numerical objective for measurement: Grow dividend income to $200,000 in four years – when I am 75 years old. Dividends completely support the required minimum distribution (RMD’s) from the non-ROTH IRA accounts so that income-producing investments will not be sold to fund RMD’s.”

For 2026 I will reach 75 years old if I survive until this coming Monday. Fidelity says my Estimated Annual Income from our investments will reach $200,000 this year. This does not include income from any options trading activities.

The dividend income from my traditional IRA in 2025 was sufficient to meet and exceed our RMD requirements. Thankfully, options income in the traditional IRA was also quite good, so there was never a need to sell any income-producing assets.

RMD Calculator: LINK

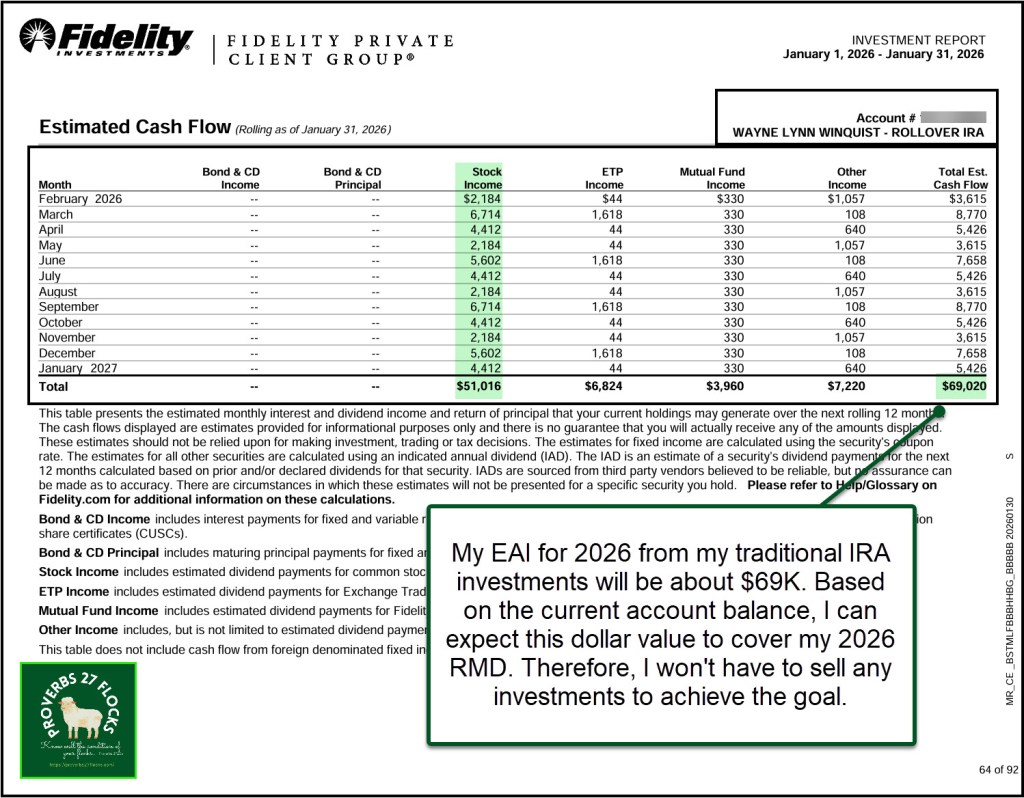

My EAI (Estimated Annual Income) for 2026 from my traditional IRA investments will be about $69,000. This is a conservative estimate, as it does not include any dividend growth. Based on the current account balance, I can expect this dollar value to cover my 2026 RMD. Therefore, I won’t have to sell any investments to achieve the goal.

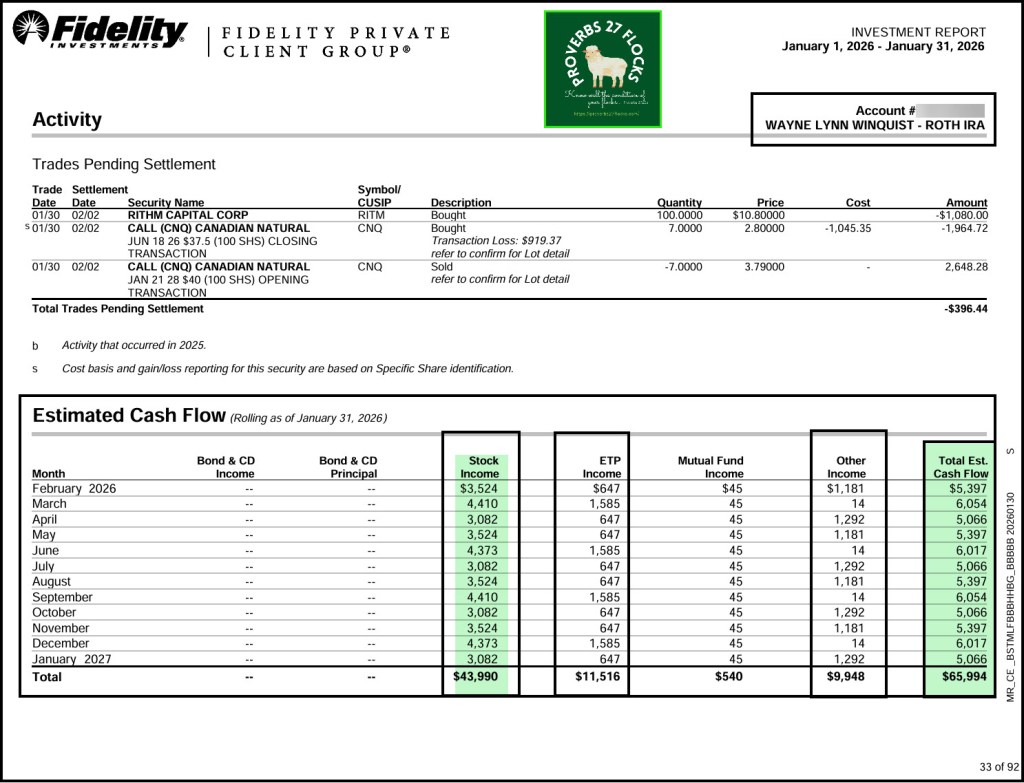

Part of the reason for my success in keeping my RMD low is the effort I have made in ROTH conversions. As a result of that effort, the tax-free income from my ROTH IRA has also increased dramatically.

How Do I Select Investments?

First of all, I use or current portfolio investments as the shopping list and add quality companies that raise their dividends if they meet the buy requirements I talk about in my blog posts. The list may be modified during the year by adding or dropping stocks or ETF investments after thorough analysis using my default criteria.

Secondly, I will evaluate ETFs using Seeking Alpha and the Fidelity Investments ratings. I refuse to buy junk investments and bonds.

Thirdly, I will consider low cost, index mutual funds using Fidelity’s tools. However, the cost of those funds needs to be less than 0.15%.

Finally, I will only buy stocks with reasonable metrics. Of course, having a Seeking Alpha QUANT rating that is Buy or better is desirable. This requires a subscription. The cost of the subscription is saved in dollars that aren’t wasted by terrible investments – in the long run.

Closing Thoughts

Do you have an investing goal that is something you can measure? Does it have a time element? Does it factor in the ultimate reality of RMD withdrawals? Does it ensure increasing income?

If not, perhaps you won’t be satisfied with your results unless you have “luck” and things just go your way by chance.

Future 2025 Q4 Year End Updates

I will continue the 2025 Easy Income Strategy review to explore a QCD charitable giving update, a 2026 EAI update showing easy income growth, the stocks I sold and those that I purchased in 2025, some new cryptocurrency ideas (maybe!), and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha (SA). If you decide to explore a SA subscription, please use the following link to receive a $45 discount (for a limited time as a Valentine’s Day “Special” from Seeking Alpha for your first year. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.