Another Reader’s Questions

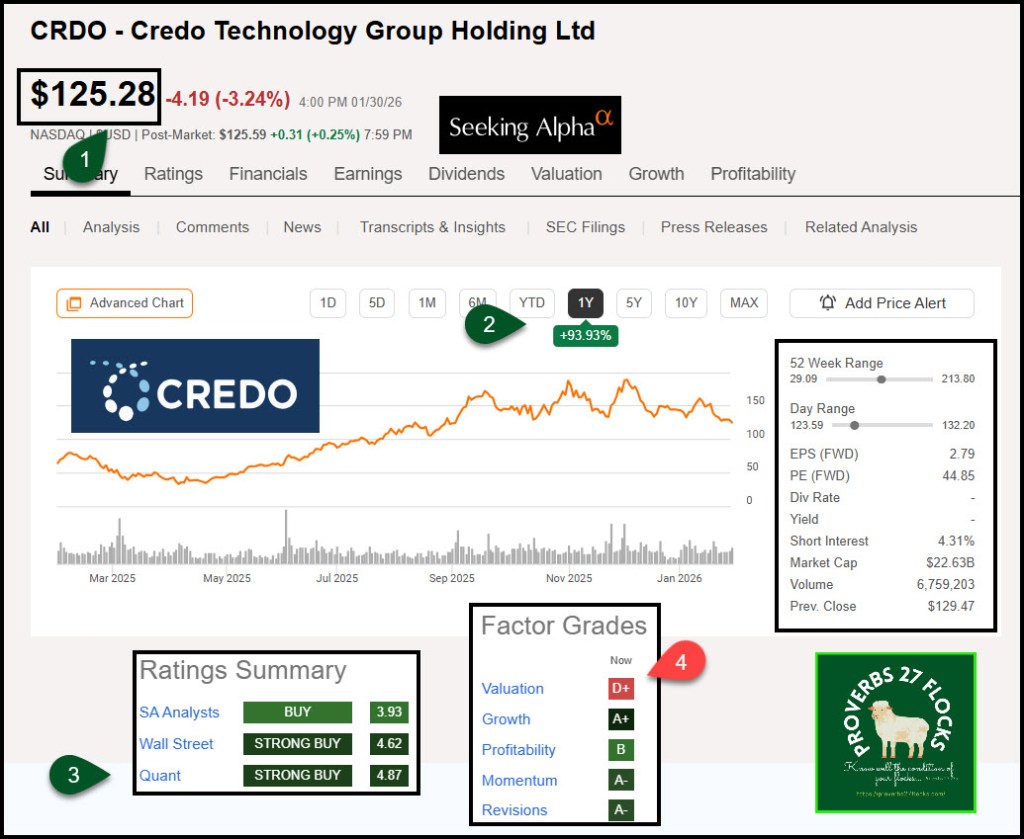

In a recent article I called “Some Quick Money from a Bank?” I suggested that it was a better use of my time to sell a cash covered put option for 100 shares of CRDO than to be enticed by the time-consuming checking account cash offers. Dino, a very observant reader, noticed that CRDO shares traded below my original PUT option contract of $130.

Five Excellent Questions

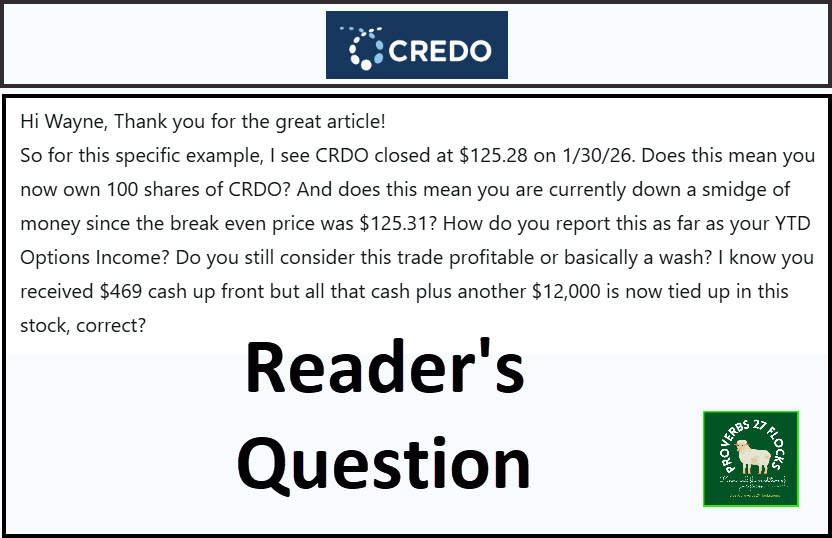

“Hi Wayne, Thank you for the great article!

So for this specific example, I see CRDO closed at $125.28 on 1/30/26. 1) Does this mean you now own 100 shares of CRDO? 2) And does this mean you are currently down a smidge of money since the breakeven price was $125.31? 3) How do you report this as far as your YTD Options Income? 4) Do you still consider this trade profitable or basically a wash? 5) I know you received $469 cash up front but all that cash plus another $12,000 is now tied up in this stock, correct?” – Dino

Five Quick Almost Answers

I will start by “almost” answering Dino’s questions and then do a deeper dive into the world of PUT options. Here we go…

1) Does this mean you now own 100 shares of CRDO? It would have meant that, but I avoided ownership in order to add to the cash I had already earned selling the original PUT option.

2) And does this mean you are currently down a smidge of money since the breakeven price was $125.31? So far I am not down. I will explain why in this post.

3) How do you report this as far as your YTD Options Income? I don’t usually factor this into my overall profitability because it is rare for me to buy a PUT that goes south.

4) Do you still consider this trade profitable or basically a wash? If this had happened, I would have had a slight “loss” assuming I could not make up the loss trading covered call options on the shares.

5) I know you received $469 cash up front but all that cash plus another $12,000 is now tied up in this stock, correct? If the option had been called I would have had $13,000 tied up in CRDO. The option contract was for $130 per share.

Setting Alerts

How did I know the CRDO share price had dropped below $130 per share without staying glued to my computer? The original contract looked like this: -CRDO260130P130. This means I had a PUT contract for $130 that expires on January 30, 2026.

It was very easy for me to know the price had dropped. I set up PRICE alerts for all options contracts, whether they are puts or calls. If the contract is a PUT, I want to know if the price is getting down close to my PUT contract obligation. If the price is going up for a covered call contract, I want to be able to do a covered call roll option, if possible, to adjust the new contract price up.

So, for example, because my contract was for $130, I might enter an alert to tell me if the price dropped to $131. That might cause me to go to my computer to consider next steps. That is exactly what happened.

What I could have done with CRDO

The first option would have been to do nothing. I would have paid $13,000 for the shares ($130 x 100 shares.) Then I could trade a covered call option on the 100 shares in the new week.

The alternative was to buy back the $130 PUT option and sell a new option at a lower contract price of $125 per share, adding to my profits. Of course, I had to extend the contract out to February 13, increasing the uncertainty of what price the shares might be on that date. If the shares drop to $100, I’d still have to pay $12,500 for the shares. That could happen. That is why someone was willing to buy the “insurance” from me.

Rolling the CRDO Option

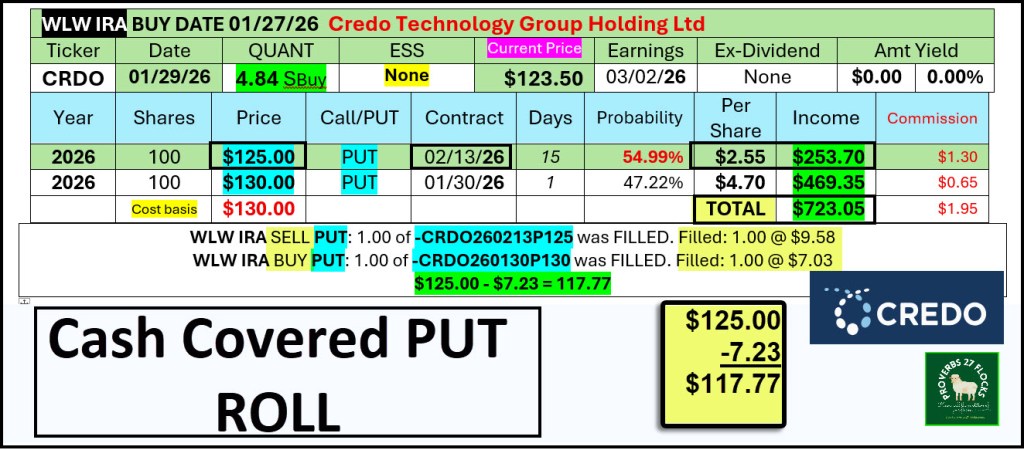

Sometimes the best thing to do is to let the option be called and buy the shares. This time, however, I decided to roll the put. Rolling a put requires a single transaction that doesn’t take any more time than the original Put contract required. Fidelity automatically creates a buy put order for the $130 contract that looks like this: “-CRDO260130P130 was FILLED. Filled: 1.00 @ $7.03.” In other words, I paid $703 to get out of the old contract that would have expired on Friday.

At the same time, Fidelity submits a second contract that looks like this: “-CRDO260213P125 was FILLED. Filled: 1.00 @ $9.58.” Note that in this case I am receiving $958 for the new contract that expires on February 1, 2026 with a contract price of $125. As a result, I have a net profit that is added to the original contract profit.

Because the first trade will not trigger unless the second trade also triggers, they are dependent on each other for the roll to work.

I have now earned $723.05 for the CRDO PUT contract work. The first trade was the sale of the cash covered put which netted me a profit of $469.35. Then, when I got an alert, I examined my choices and decided to buy back the $130 PUT and sell a new PUT with a contract price of $125. This resulted in a net additional profit of $253.70.

You can see the SELL and BUY details on the following image. It cost me $703 to get out of the old contract. At the very same instant, I made a profit of $958 on the new $125 contract. This was all accomplished with a single transaction that took five minutes of Fidelity’s Active Trader Pro “Trade Armor” window.

Important things to understand about this type of trade.

First of all, rolling does not remove risk. I still have the obligation to buy shares if the stock drops. Also, you can’t roll forever. The day is coming when you will either get the shares or I close the option (for a price), or the stock moves up and the option is not called.

A good roll usually will extend the time the option is open and will pay me something extra for extending the duration of the PUT.

What is a Roll?

A cash-covered put option roll is a way to extend or adjust a cash-secured put position instead of letting it expire or taking assignment. It is buying back the original contract and selling a different one.

What does it mean to “roll” a put? To roll a put means you: 1) Buy back your current put (closing it) and then simultaneously 2) Sell a new put at a different expiration, strike, or both. This is done as one combined trade, often for a net credit.

So what is a cash-covered put roll? It’s simply rolling a cash-secured put while still keeping enough cash reserved to cover the obligation. You’re saying: “I don’t want this put to expire yet—I want to move it forward or adjust it.”

Types of Cash-Covered Put Rolls

The first type is to roll out further in time with the same price ($130) but a later expiration. That would have earned me more than the $253.70.

The second type is to roll down to $125 but keep the same expiration date. That would have cost me something, so I prefer to avoid that option.

The most common choice is the one I did: Roll the price down and the expiration date out. This is best done with stocks that trade weekly options. Monthly options entertain additional risk. As it is I went from a 5-day contract to one that will expire in 14 days. The upside is that I made more income by kicking the can down the road.

Why would someone roll a cash-covered put?

The common reasons should be obvious by now. I wanted to avoid spending $13,000 and keep earning interest on those dollars. I wanted to earn an additional premium and I adjusted my risk down to $12,500.

January 2026 Options Income Results

During the month of January I earned a total of $8,324.07 from trading options contracts. This is up from 2024’s January total of $3,036.40 but down considerably from January 2025’s total of $18,627.38. There is a lesson to be learned here.

You cannot depend on options income to be considered a guaranteed income. Dividends are like a salary. You can usually depend on receiving that with little or no work. Options income, by way of contrast, is like getting a commission for selling an insurance contract. A cash covered call is one kind of “insurance” obligation and a cash covered put is a different kind of “insurance” for the buyer of your PUT contract. However, you can “get out of” (or delay) a contract if you roll the option.

Conclusion

My total time invested in trading CRDO is less than ten minutes. The risk, in my opinion, is fairly low. The dollars involved (given the size of my traditional IRA) is also low. Finally, the $12,500 is still earning interest while the option is pending.

Additional Resources

Here Are 4 Options Strategies You Can Try Right Now to Earn Extra Income

Profiting From Selling Put Options in Any Market

Managing Cash-Secured Puts for Income Strategies

Fidelity Investments Options Trading FAQs

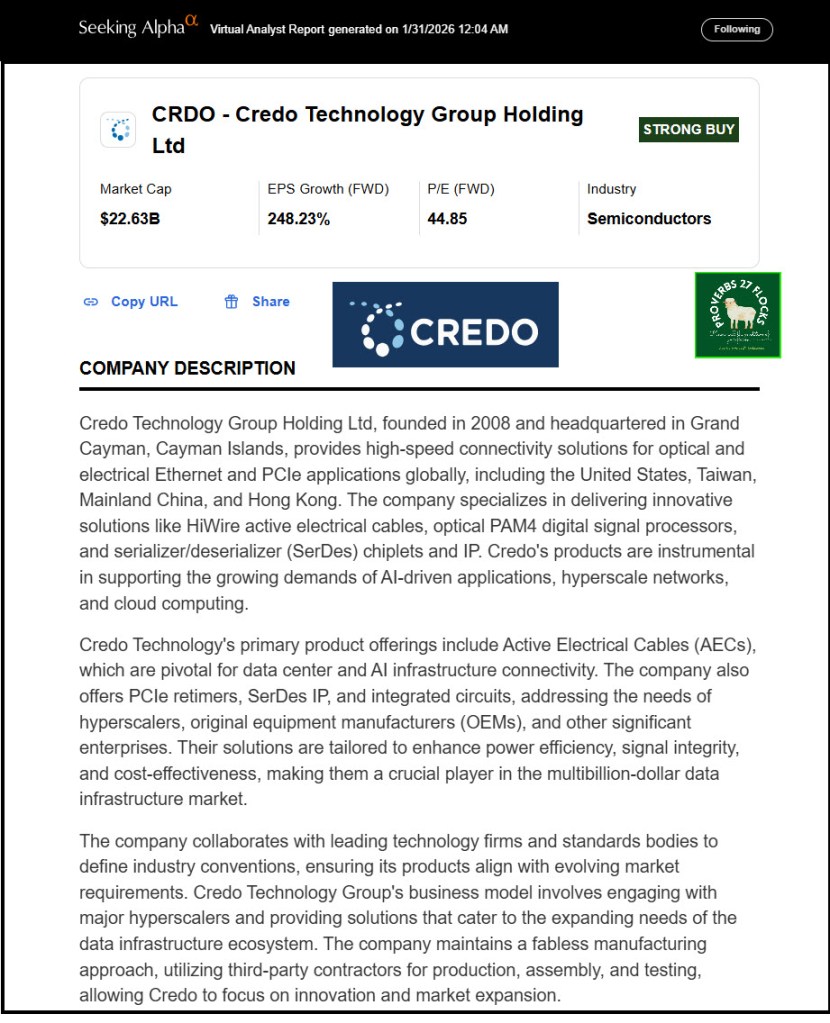

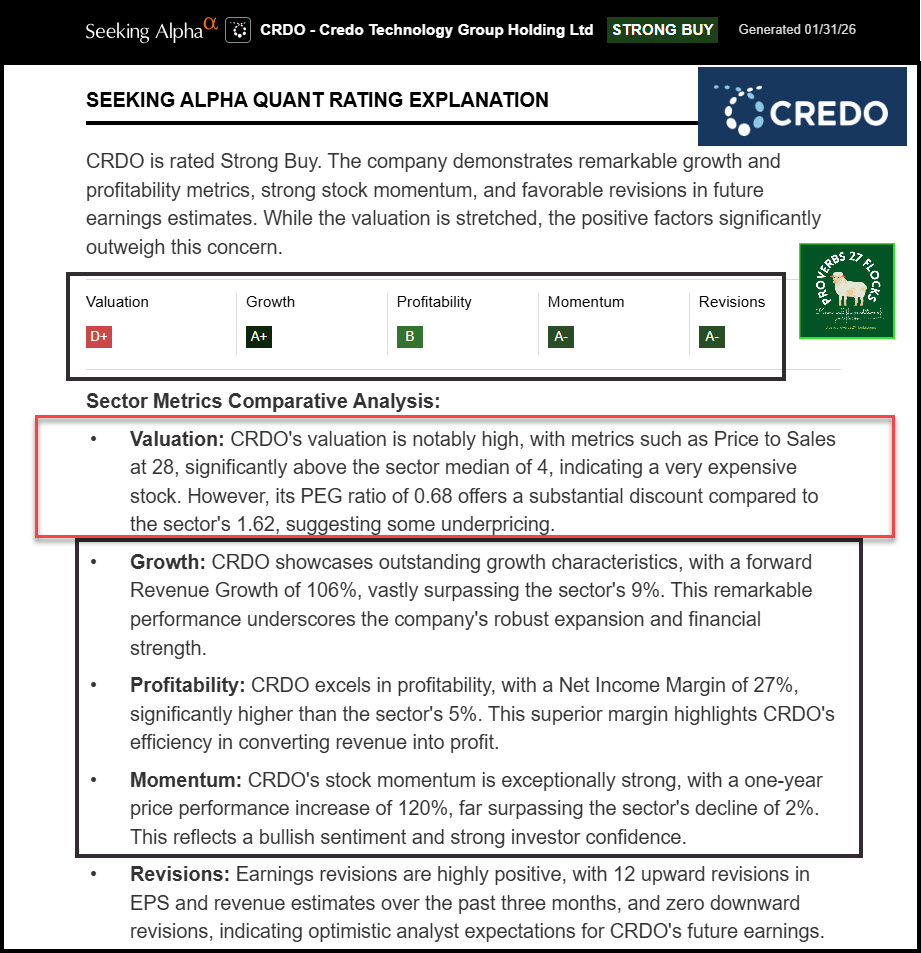

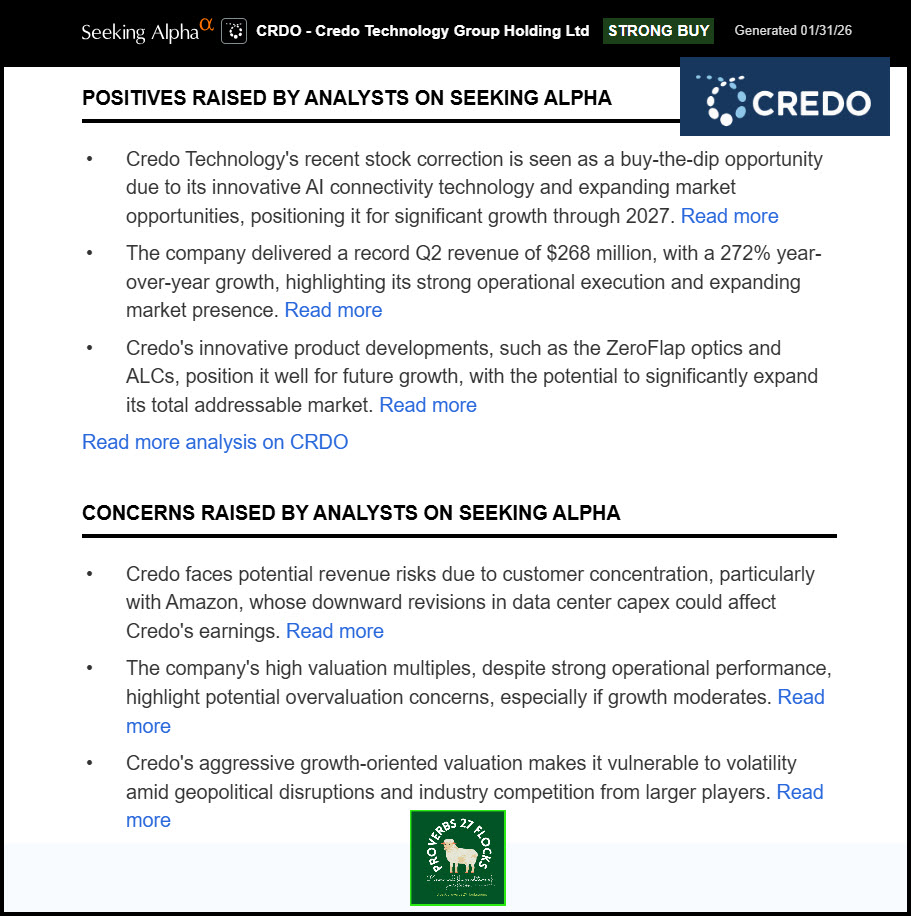

Seeking Alpha Summary Information for CRDO

These images help explain why CRDO is of interest to me. Always pay attention to the QUANT rating.

CRDO Company Profile

Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally. It provides HiWire active electrical cables solutions, including HiWire CLOS, SPAN, SHIFT, and SWITCH; optical PAM4 digital signal processors; low-power line card PHY; serializer/deserializer (SerDes) chiplets; and SerDes IP, as well as integrated circuits. The company also offers intellectual property solutions consist of SerDes IP licensing. In addition, it offers predictive integrity link optimization and telemetry; PCIe retimer solutions; and support and maintenance, engineering, and royalties services. The company sells its products to hyperscalers, original equipment manufacturers, original design manufacturers, and optical module manufacturers, as well as into the enterprise and HPC markets. Credo Technology Group Holding Ltd was founded in 2008 and is based in Grand Cayman, the Cayman Islands.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

Hi Wayne

do you ever close a trade early to lock in a profit? If so what are the steps?

LikeLike

If you are talking about options, then the answer is that I don’t try to “lock in a profit.” I want to either roll the option up or down and make money on each trade. I don’t buy investments I wouldn’t mind holding, so I rarely sell an investment unless the dividend is suspended or cut. Even then I do a make a few exceptions if I think the dividend issue is wise and relatively short-term in nature. I do think it is wise to have a list of “I will sell if…” criteria. I tend to be very patient with my investments, assuming they aren’t junk.

LikeLike

thanks for the prompt reply! I was asking about the cash cov’d puts. Any particular thing you look for on rolling? With the weekly’s in particular?

LikeLike

Got it. When looking at cash covered puts I am interested in reducing my potential cost basis to potentially buy the shares I wouldn’t mind owning if I were assigned the shares. I wouldn’t mind owning CRDO. This morning I did another roll down to $110 with an expiration date of 04/17/26. This added another $373.70 in income, and this increases my total income from the three trades to $1,096.75. That also means that if on April 17 I have to buy the shares, my true cost basis will be $99.03. Market pessimism might continue. However, CRDO’s EPS are forecasted to increase, so I think the current market sentiment is overly pessimistic.

LikeLike

Excellent article explaining the decision making process and execution.

Thanks for breaking this all down for us Wayne!

LikeLiked by 1 person

But UGH! I see CRDO and many other tech/software stocks sinking like stones from this “AI disruption” fear.

LikeLiked by 1 person

Yes, there are certainly dangers in the market regardless of the quality of an investment. I look at it this way: I was considering buying CRDO at $130 per share. Now I can get the same shares for no more than $110 based on my most recent PUT roll. That doesn’t even factor in the $1,096.75 I have made on the trades or the interest I am receiving on the cash while I wait.

Bear in mind that there could be an abrupt reversal on the next earnings date. I tend to take the long view if I think the company has value.

LikeLiked by 1 person

CRDO is shooting up this morning. Looks like I won’t be getting shares of CRDO from my cash covered put. That is OK because I made a nice chunk of immediate cash from selling a cash covered put.

LikeLike