Where and How I Discovered CRDO

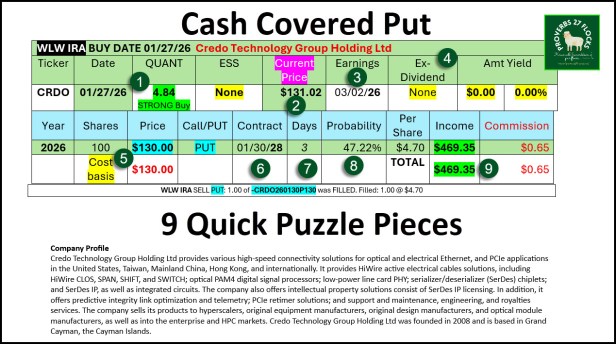

In yesterday’s post I talked about how I made over $400 in five minutes selling a cash covered put option on Credo Technology Group Holding Ltd (CRDO). Bill acknowledged that he was not familiar with Credo and he said the following.

“I did have one question out of curiosity. CRDO is not a company I have come across before, so I was wondering how it first got on your radar. Is it something you have been following for a while, something that came up in a screen, or did you find it through research on the sector.”

“I would be interested in hearing more about the process that took you from discovering the ticker to being comfortable putting a 13K cash secured put behind it. Understanding how you select a symbol is often just as helpful as the trade example itself.”

That is a very wise observation. Finding the opportunity is step one. Step two is knowing what amount of “risk” one faces when buying an investment or when trading options. Lets start with the easy part. Finding investments is relatively easy. This includes both stocks and ETFs.

The QUANT Factor

One of the reasons I include some Seeking Alpha subscription information (and discounts) in my investment posts is that Seeking Alpha helps me sort through the 4,000-6,000 investments available on various exchanges. I don’t have time or interest in looking at 6,000 companies. That number doesn’t include ETFs. As of December 2025, there are approximately 4,402 exchange-traded funds (ETFs) listed on U.S. stock exchanges. I want to quick look at the best of the best for a stock or an ETF. Seeking Alpha helps me do that.

What I Know About Semiconductor Companies

Because of the boom in artificial intelligence, the companies that provide infrastructure, power, software, hardware, and services to enable AI are potential investments of interest. The fast way that I do this is to think about the stocks I already own. So, for example, Cindie and I own shares of NVDA, MU, AVGO, FSLR, QRVO, SWKS, and TSM.

Related companies in hardware and software are MSFT, HPQ, FTNT, PGY, SMCI, GEN, PGY, RPD, and STX. If I want to find companies similar to HPQ, I can go to Seeking Alpha and enter that ticker symbol in the search box. I can then scroll down and look for a box on the right side that says “QUANT Ranking.” In that box there are hyperlinks to take me to places like the sector, the industry or even down to the “Ranked in Industry.” If I click on the “Ranked in Industry” I will see that the “Top Technology Hardware, Storage and Peripherals Stocks” are ranked by best to worst based on the QUANT rating. HPQ is currently number 14 out of the 26.

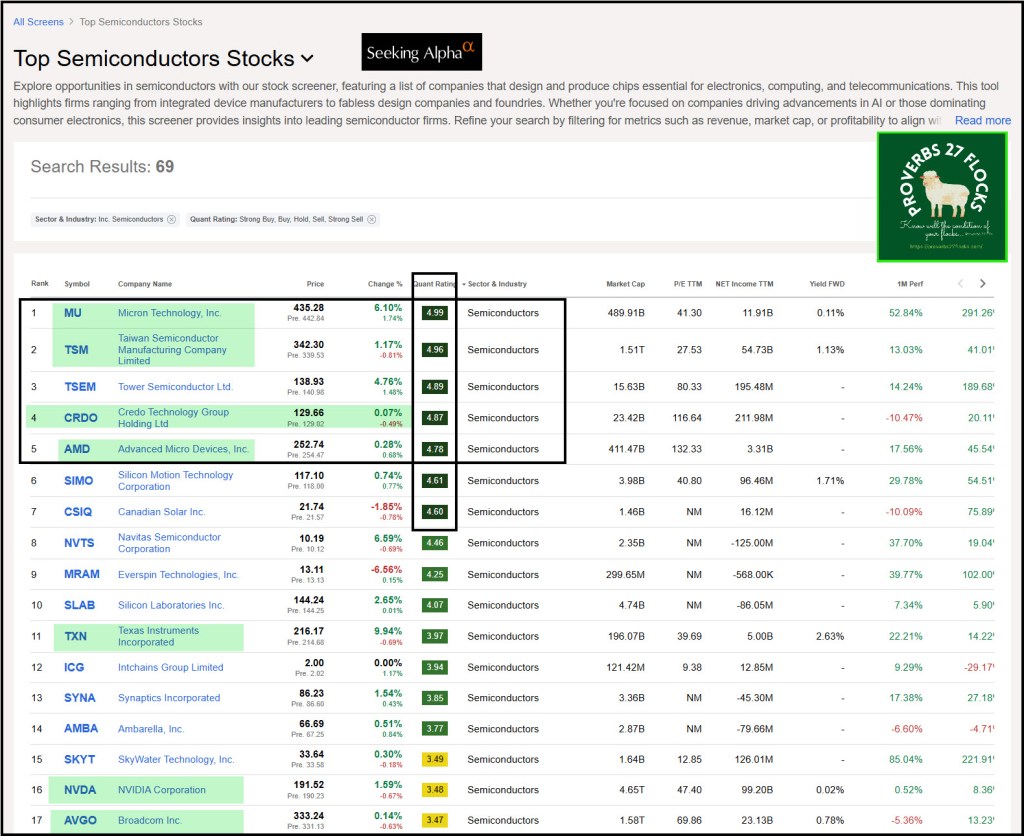

I did something similar to identify CRDO. I started with NVDA and then clicked on “Ranked in Industry.” This shows me 69 results. As you can see in the following illustration, MU, TSM, TSEM, CRDO and AMD are in the top five. So these could be the cream of the crop in the “Top Semiconductors Stocks.”

There are multiple paths one can take to find comparable investments. For example, when looking at CRDO, you can click on “Peers” at the top of the Summary Page. This will reveal stocks like GFS, ON, STM, FSLR, and ALAB. However, of these five only CRDO has a “Strong Buy” QUANT rating.

Looking at ETF Peers

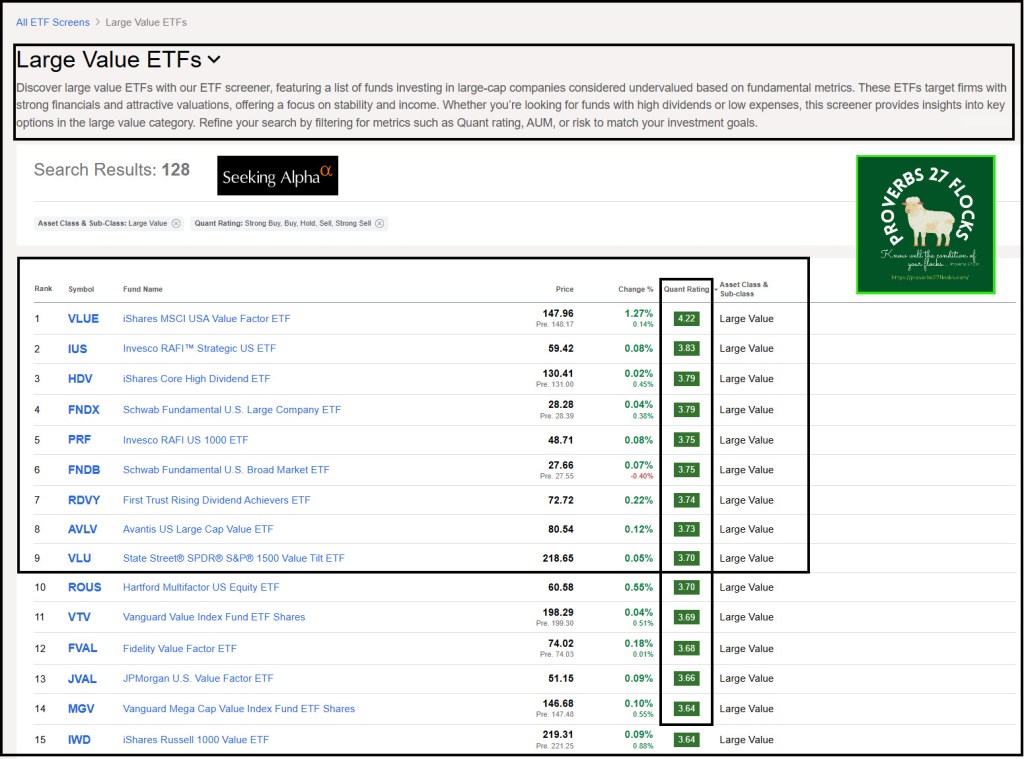

The same can be done with ETFs. For example, we own shares of VYM, SCHD, and DGRO. If I look at the summary page for SCHD I will see “Peers” as well. If I select that option Seeking Alpha displays VYM, VIG, DGRO, HDV, and DVY. You can also use the “ETF Screener” tool.

“Seeking Alpha’s ETF screener helps you discover and analyze ETFs for any investment strategy. Tailor your search by Quant Ratings, analyst recommendations, or key financial metrics. You can build a custom screen or use any of our top-rated presets to quickly discover new ideas.”

All Stocks Screener

Although I don’t use it, there is also another tool called the “All Stocks Screener.” Using this tool you can filter investments to your preferences. Seeking Alpha says, “Discover a comprehensive selection of all stocks with Seeking Alpha’s All Stocks screener, designed to give you access to the entire stock market landscape. This powerful tool offers a broad range of stocks across various sectors, market capitalizations, and investment styles, from high-growth tech companies to reliable dividend-paying blue chips. Whether you’re searching for potential growth opportunities or solid income-generating investments, our screener provides an all-encompassing view of stocks backed by in-depth analysis. Filter by metrics like valuation, momentum, and profitability to tailor your stock search to fit your investment strategy and objectives.”

So What CRDO?

In the last five days CRDO has been trending down. The five-day loss is 3.42%. The one-month loss is about 9%. However, the six-month results clock in at 20%. The shares had been trading at about $108 per share on July 28, 2025. In recent days the stock has been hovering between $128 per share and $132.40. Doing a cash covered put at $130 for just one week of exposure doesn’t strike me as ridiculous. Given the QUANT rating of 4.87 (Strong Buy) I’m willing to invest $13K to see if I can leverage CRDO during 2026 for options income.

The other thing I always consider is the “Earnings Estimates” for 2026, 2027, and 2028. This information is available on both the Summary page for CRDO (you have to scroll down to see it) or via this hyperlink: CRDO Consensus EPS Estimates.

Seeking Alpha Emails “Strong Buy Favorites”

On Tuesday, January 27, 2026, I received a message from Seeking Alpha that said, “Top quant picks for earnings week: CLS, VLO among strong buy favorites.” This included the following “Strong Buy” possibilities:

Celestica (CLS), Quant Rating 4.86 – Strong Buy.

Valero Energy (VLO), Quant Rating 4.86 – Strong Buy.

Sanmina (SANM), Quant Rating 4.83 – Strong Buy.

Invesco (IVZ), Quant Rating 4.82 – Strong Buy.

Enova International (ENVA), Quant Rating 4.81 – Strong Buy.

Viavi Solutions (VIAV), Quant Rating 4.77 – Strong Buy.

Valley National Bancorp (VLY), Quant Rating 4.77 – Strong Buy.

Deluxe (DLX), Quant Rating 4.73 – Strong Buy.

Chevron (CVX), Quant Rating 4.72 – Strong Buy.

Conclusion

I just checked the pre-market price for CRDO. The shares might trade up to $133 per share today. If they stay above $130 I won’t be obligated to buy the shares. Only today and tomorrow will really tell if I will or won’t own CRDO. Either way I view it as a win. I can either do another cash covered put or, if I own the shares, I can do a covered call option. Both add dollars to my traditional IRA.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com