Read the Fine Print and Then Make Money Now

When you see the bank offers to open a checking account to receive $400 or up to $600, do you pay attention to the fine print? Do you know how much of your time you will spend to open the account? What about the time to make changes to your direct deposit from your employer or Social Security? If you have bills you pay from your current checking account, how much time will you spend moving those to the new account? After you get the “free” money, do you know what interest rate the bank will pay you for the next five years? Did you read the fine print about the monthly service charges you might incur if you don’t follow all of the bank’s requirements?

If you think the bank is your friend, then perhaps you have low expectations of friends. There is a far easier way to make $400-$600 in less than five minutes of work. The solution is to learn how to trade cash covered put options on stocks like CRDO (Credo Technology Group Holding Ltd).

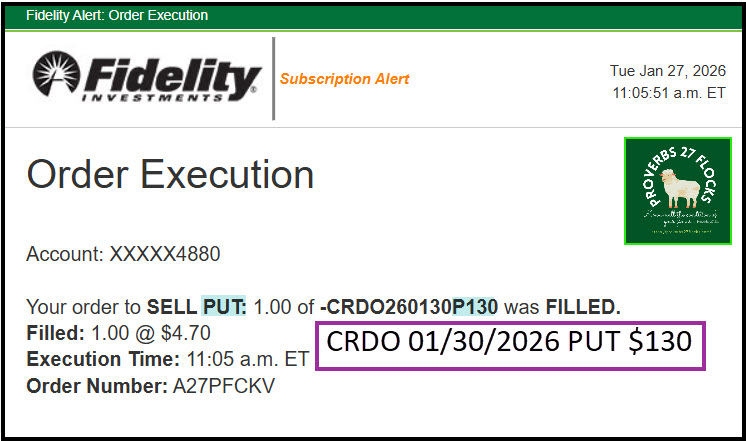

Yesterday I did a single trade in less than five minutes that added $469.35 to my traditional IRA (T-IRA) account. The strategy behind this will likely earn me far more doing the same things over-and-over again. A mix of cash covered put option trades and/or covered call options can create sizable income during the year. I started with $13,000 that was sitting in my T-IRA. That cash was earning interest and is still earning that same interest on the $13K. The strategy is fairly simple.

Strategy Summarized

When I buy an investment it helps if the investment pays a dividend. However, there is nothing inherently wrong with non-dividend investments. In fact, many of them can be used to generate weekly income without even buying shares of the stock. Here is a short list of possible choices and outcomes:

- Attempt to buy 100 shares in a company for less than the current market price. This is done using a cash covered PUT option.

- If shares are not purchased, because the price of the shares does not drop to the contract price, consider another cash covered PUT option trade next week.

- If shares are purchased because the shares dropped to or below the contract price, sell a covered call option on the 100 shares the next week.

- Repeat as necessary. This could be done as often as once per week. If you start at the beginning of the year you could receive income fifty-two times during the year from the 100 shares of stock or from not owning anything at all.

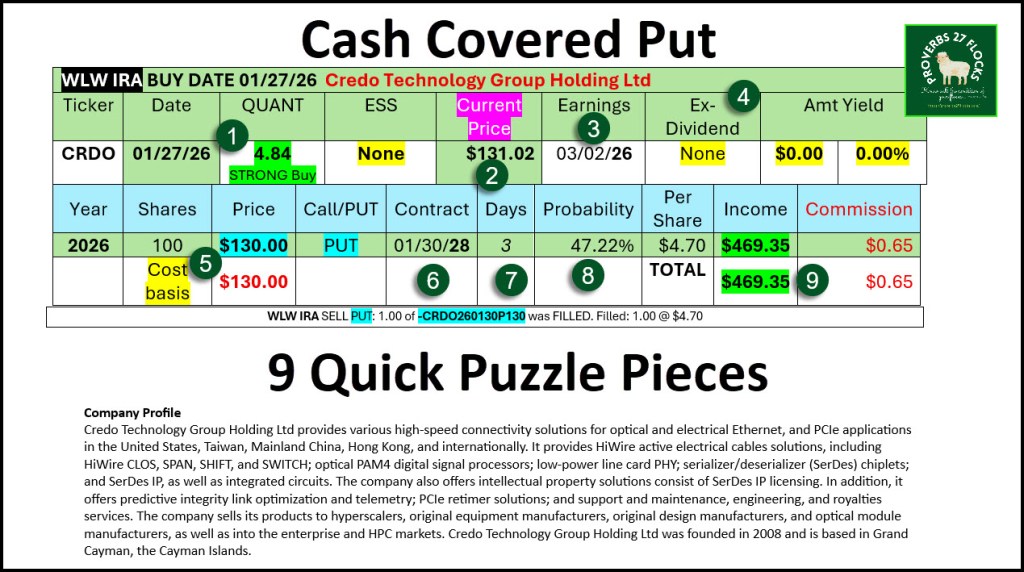

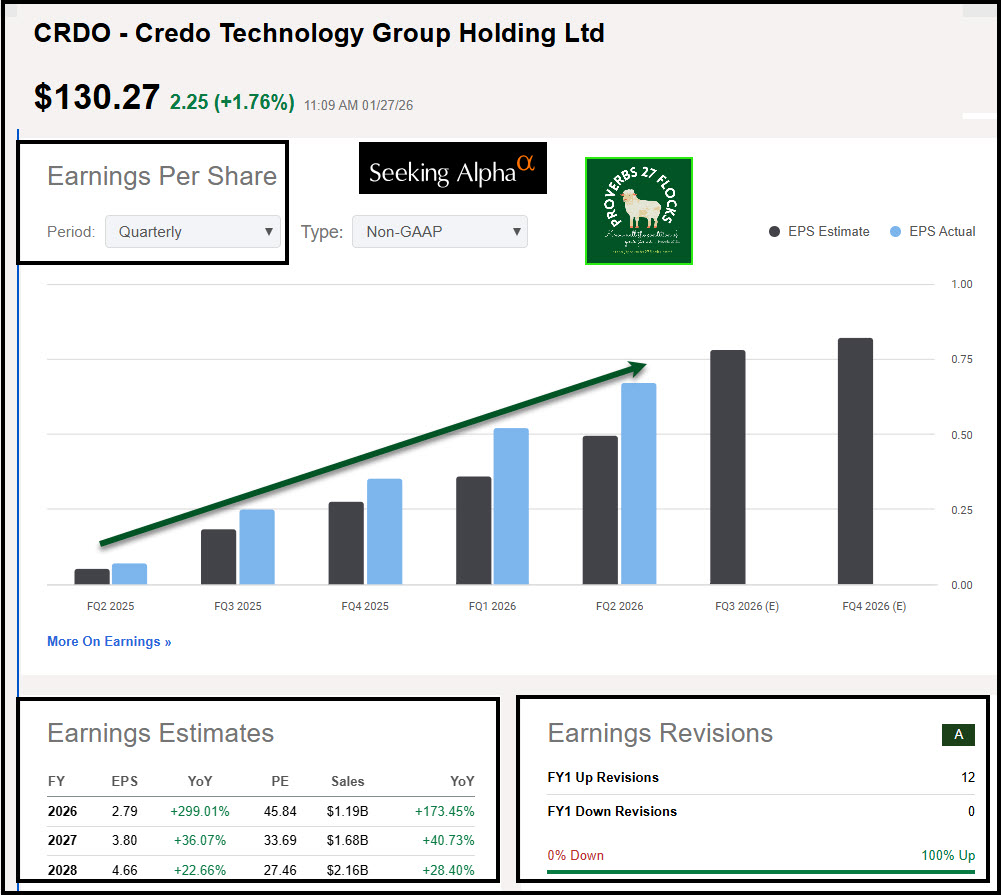

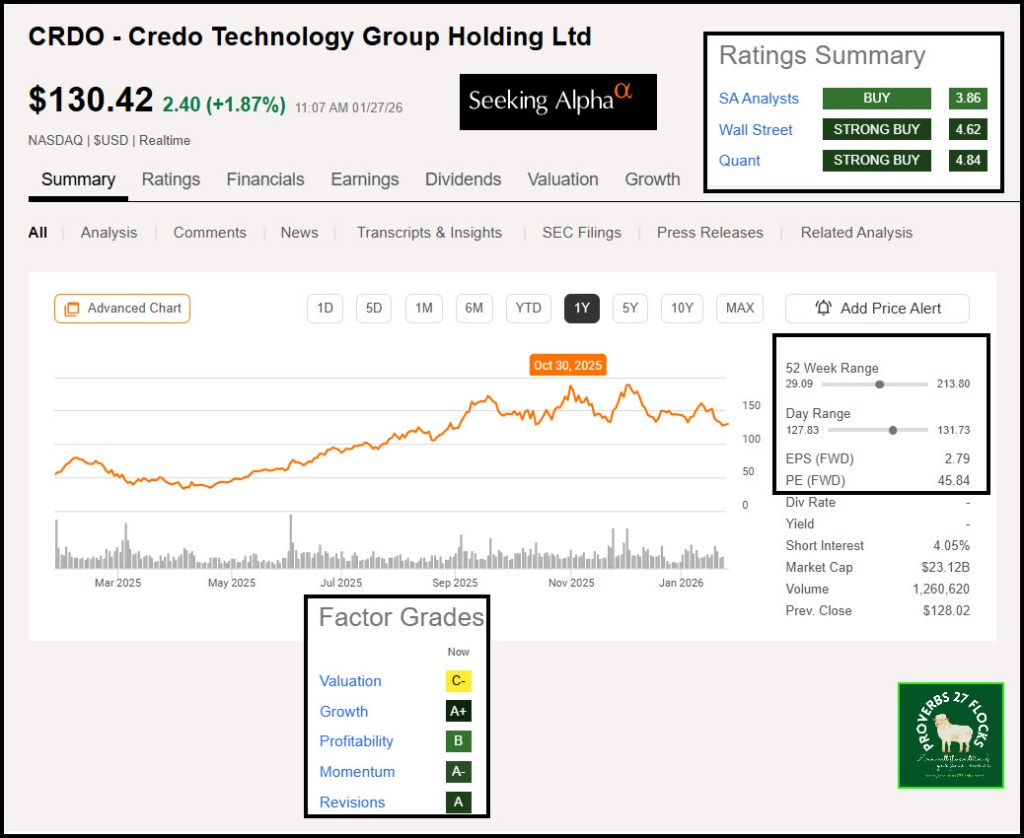

The First Four Minutes of the Trade

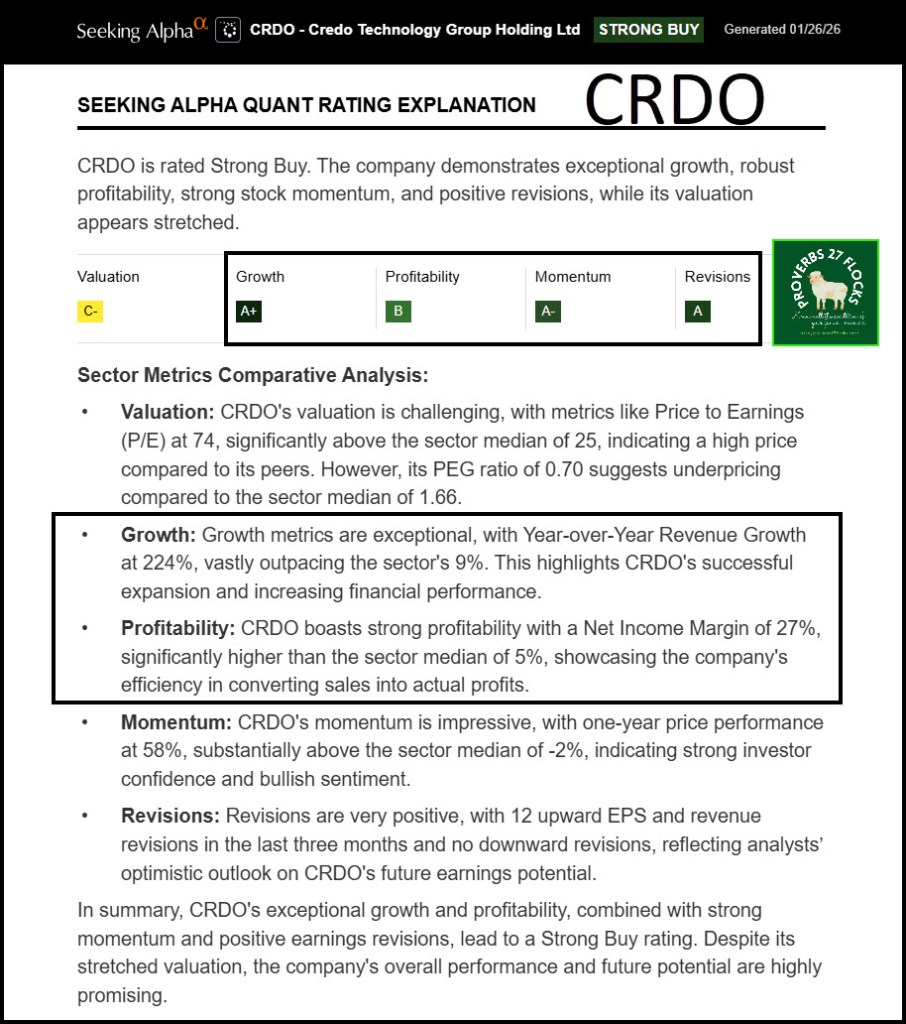

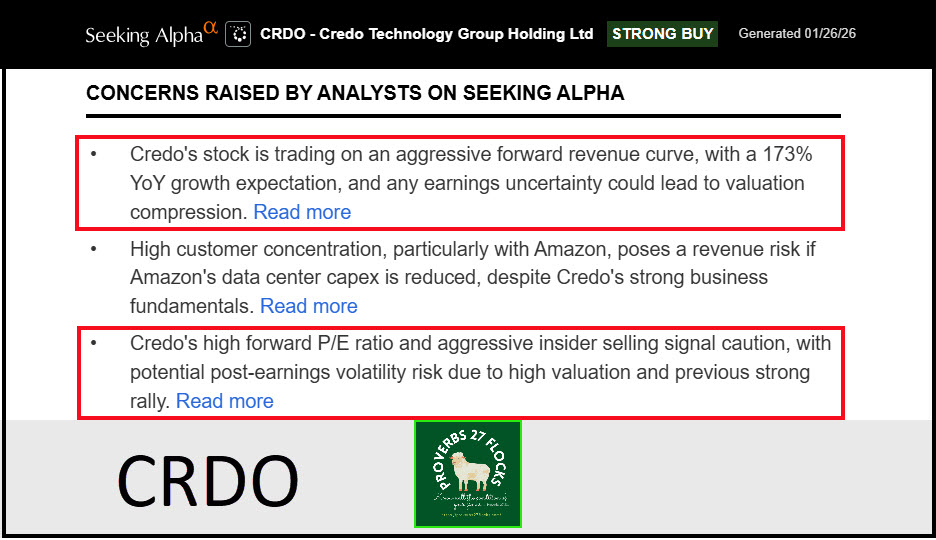

The first four minutes are spent looking at CRDO. The questions I ask are, 1) What is the Seeking Alpha QUANT rating? The higher the better. 2) What is the current price per share? Can I afford to buy 100 shares? 3) When will earnings be announced? I don’t want to do an options trade that falls beyond that date. 4) Does the stock pay a dividend, and if so, when is the Ex-Dividend Date? 5) If I set the contract price for the cash covered put at $130, do I have $13,000 to buy the shares on the agreed contract end date? 6) When does the contract I am considering expire? The sooner the better. 7) How many days until the contract expires? Less than five days is ideal. 8) What is the probability that I might have to buy the shares by the end of the contract? Less than 50% is ideal but below 30% is even better. 9) What profit can I realize from the trade?

When I do a “class” on options trading I usually start with covered call options. However, the next logical step is the cash covered PUT.

If I have to buy the shares then the cost basis of my shares is actually less than $130 per share. The reason is simple. Because I received $469 already, the true “cost” basis of the CRDO shares is now $4.69 less, or $125.31 per share. No one would have sold me their shares for that price yesterday.

2026 YTD Total Options Income is $6,017.61

For 2026 I have already received $6,017.61 in options income from covered calls and cash covered put options trades. I would have to open a lot of checking accounts at different banks to receive that kind of money.

The vast majority of the options trades were covered call options. That means I am willing to sell my shares if the price reaches the contract price by the end of the contract. The only “risk” is that someone will buy my shares at the price we agree on when we enter the contract. Of course, if the shares are called away I now have additional cash I could use for buying shares of something else and/or doing a cash covered put contract on the shares I sold.

Company Profile

Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally. It provides HiWire active electrical cables solutions, including HiWire CLOS, SPAN, SHIFT, and SWITCH; optical PAM4 digital signal processors; low-power line card PHY; serializer/deserializer (SerDes) chiplets; and SerDes IP, as well as integrated circuits. The company also offers intellectual property solutions consist of SerDes IP licensing. In addition, it offers predictive integrity link optimization and telemetry; PCIe retimer solutions; and support and maintenance, engineering, and royalties services. The company sells its products to hyperscalers, original equipment manufacturers, original design manufacturers, and optical module manufacturers, as well as into the enterprise and HPC markets. Credo Technology Group Holding Ltd was founded in 2008 and is based in Grand Cayman, the Cayman Islands.

Competitors and Unique Value

Credo Technology Group competes with several prominent companies in the high-speed connectivity market. Notable competitors include Broadcom Ltd.

- Credo delivered a remarkable 272% YoY revenue growth in Q2 FY26, with management projecting continued gross margin expansion and a $10B+ addressable market driven by five growth pillars. Read more

- Credo’s AECs have become the de facto standard for AI inter-rack connectivity, validating the company’s AI interconnect thesis with triple-digit revenue growth and robust profitability. Read more

Conclusion

Just about any bank will take your money and leverage it to their advantage. I highly recommend that you open a checking account with Fidelity instead. Then, when you have cash available in your ROTH or T-IRA, start learning how to leverage that cash for options trades. Don’t jump through hoops to earn $400 when you can take a short walk in less than five minutes and do the same thing without any fine print.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha, especially the QUANT rating for stocks and ETFs. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com