Why Do I Own CAG?

A reader asked an excellent question. Matt M. wondered why I was investing in shares of Conagra (CAG) over TNS or GIS. He asked, “Other than the yield, what are the factors that make CAG a more attractive option than GIS or TSN?” This is worthy of some further explanation. My short answer is “I like TSN better than CAG and I hold shares of both.” It is true that there are some reasons to be concerned about the potential for growth for Conagra Brands, Inc.

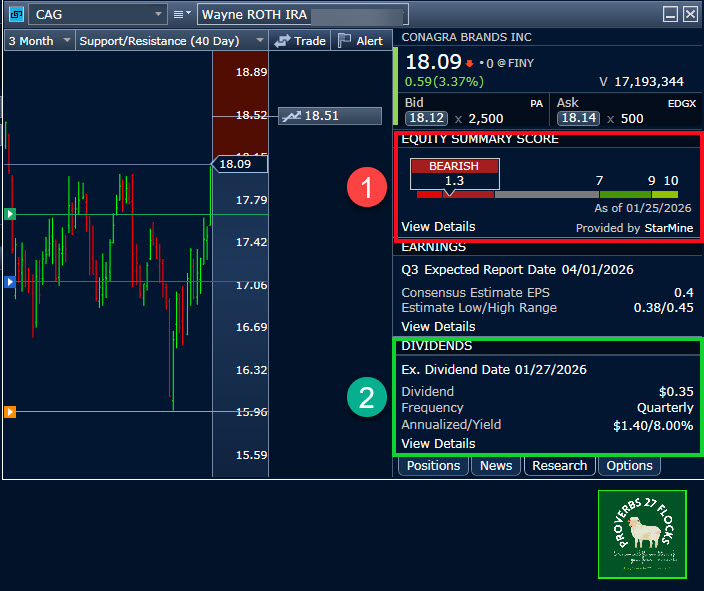

During 2025 I converted 1,500 shares of CAG from my traditional IRA to my ROTH IRA. The total transfer was worth $27,140 because I did eight conversions from August through December. As a result, my average cost basis for the transferred shares is $18.08. The question I had to ask myself was “were the shares worth more than that transfer cost?” Time will only tell, but I think the shares are undervalued by the market.

In fact, as I type this paragraph the shares are trading for $18.09. That means they went up 3.37% from Friday’s close. I believe there is an obvious reason for this that may not be rational. The Ex-Dividend date for CAG is tomorrow, so some investors are trying to get the $0.35 per share dividend.

Total CAG Quarterly Dividend

Because I moved the shares to my ROTH the dividends for the 1,500 shares are now tax-free. That means I will receive $525 for those shares on the dividend pay date: 02/26/2026. However, I already had 1,200 shares of CAG in my ROTH, so my total holdings are going to pay $945 of tax-free income.

During 2026 I expect the Annual Payout (FWD) of $1.40 to be maintained. This means I will receive $3,780 in tax-free dividends during the year. To put this in perspective, we spent about $5,500 on groceries in 2025. In other words, the CAG dividend will pay for eight months of groceries. However, this still doesn’t fully answer the question.

Covered Call Options and CAG

For many investors this might not be a factor, but I can also trade weekly covered call options on my CAG shares. For example, I could enter 27 contracts to sell my shares at $19 per share with a contract expiration date of February 27 and potentially receive $256.50 (after Fidelity’s commission) for the contract. The probability that the shares will reach $19.00 by that date is currently about 27%. In other words, it is unlikely that I would lose my shares.

If I was able to repeat this trade over the course of 52 weeks, at least 24 times, I could potentially receive another $6,000 in synthetic dividends that are also tax-free. Again, this doesn’t really fully answer my reader’s question, but perhaps it is easier to see why I am not in a rush to sell my CAG shares.

What Factors Make CAG a BETTER Option than GIS or TSN?

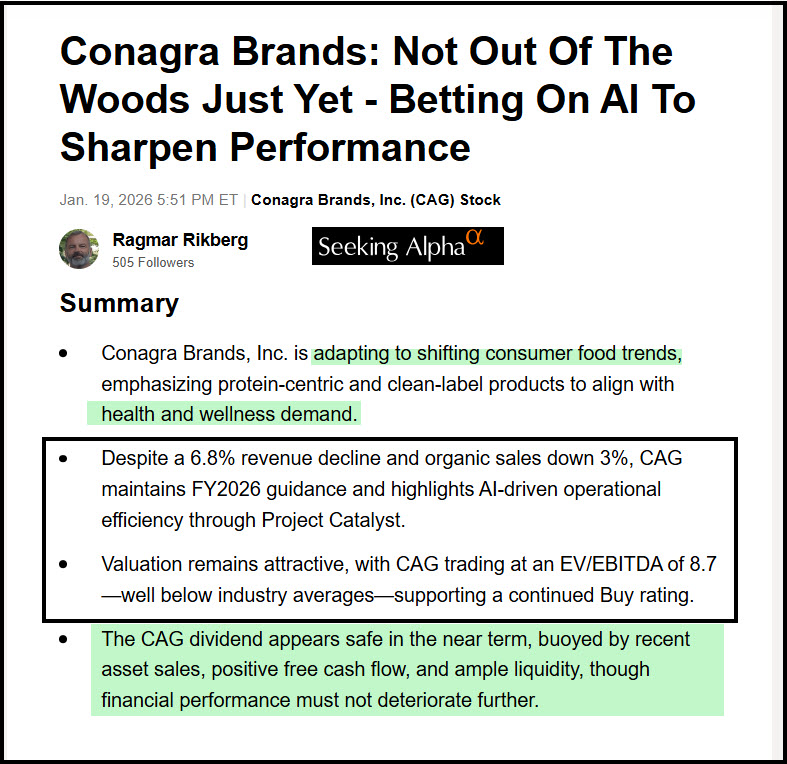

While not “better” I think there is too much pessimism in the market regarding CAG. I tend to agree with Ragmar Rikberg who said “If I had to choose from the stocks I cover, the safest candidates in my view would be Verizon (VZ), Conagra Brands (CAG), Tyson Foods (TSN), and Archer-Daniels-Midland (ADM). Communication remains essential in any environment—people will always use phones and the internet. Food stocks that are attractively valued also make a lot of sense, since people need to eat under all circumstances, and during recessions they tend to cook more at home. That said, companies with a high exposure to sugar‑rich and ultra‑processed foods are better to avoid, as GLP‑1 drugs continue to reshape consumer eating habits.”

Rikberg is “betting on AI to sharpen performance.” I also think that the dividend is safe if CAG executes on its strategy. The question remaining is “will Conagra turn their ship around and have a tail wind that creates increasing value?” I’m willing to risk the converted $27,140 to say “yes.”

TSN is Better

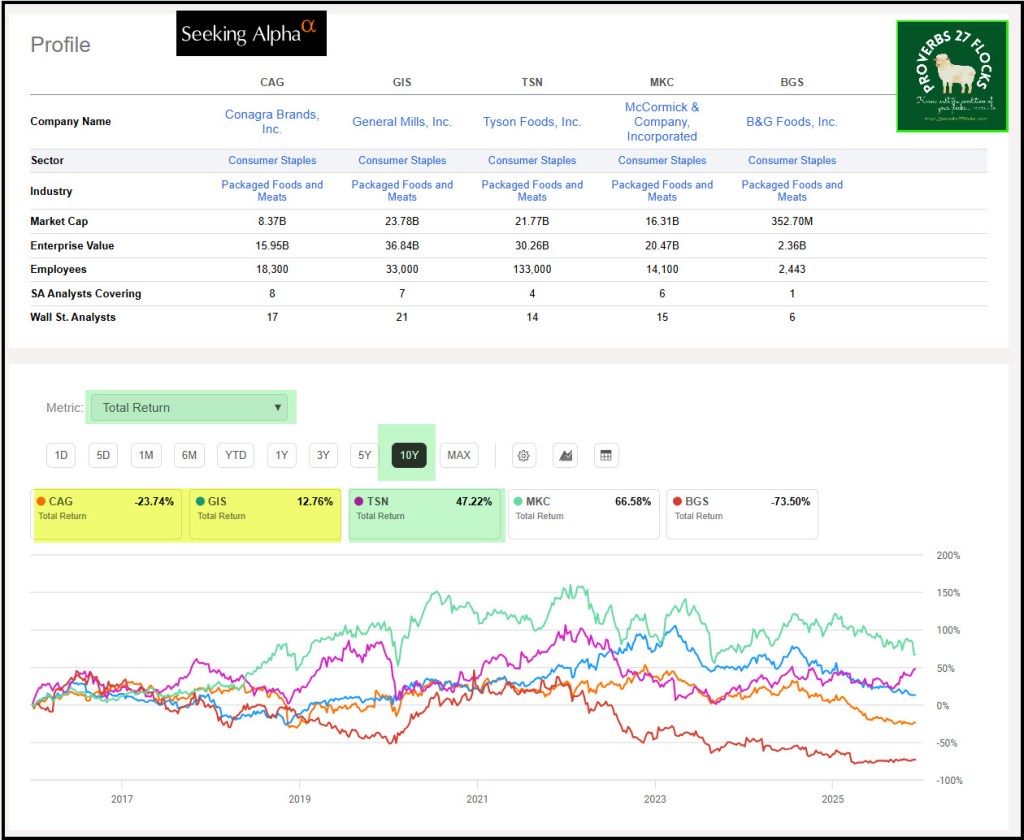

TSN clearly has better metrics, and I own shares of TSN as well. I have 500 shares in my ROTH and another 100 in my traditional IRA. During 2025 I converted 200 of my TSN shares from my traditional IRA to my ROTH. The total taxable cost of this conversion was $10,577, so my average cost basis for this conversion was $52.89. The shares closed today at $63.73, so this is far more encouraging than my CAG conversions.

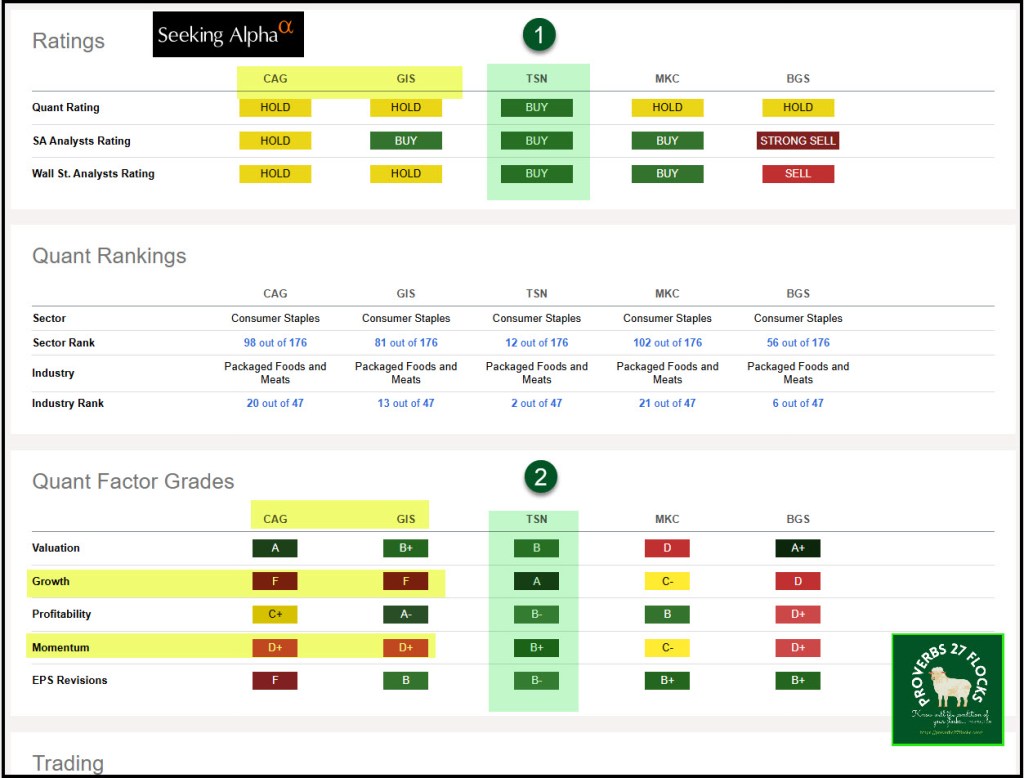

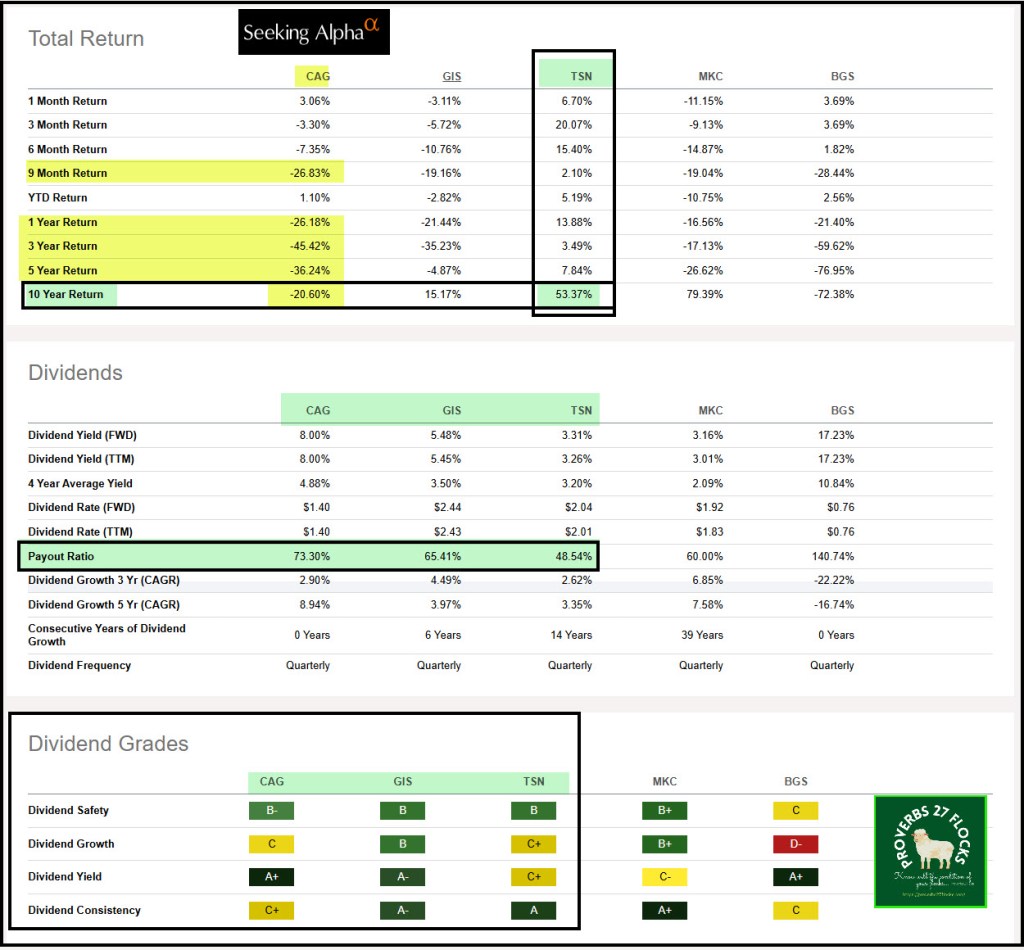

Although Tyson’s dividend yield is only 3.31%, it has a far less risky dividend payout ratio of 48.5% compared to CAG’s payout ratio of 73.30%. Having said that, I think payout ratios between 30-70% are ideal for established consumer staples stocks. The thing that makes TSN more attractive is the potential for earnings per share (EPS) growth. CAG should have EPS growth, but not at the same pace as TSN.

The New USDA Recommendations May Cause Consumer Behavior Changes

The new Guidelines emphasize simple, flexible guidance rooted in modern nutrition science: Prioritize protein at every meal, consume full-fat dairy with no added sugars, eat vegetables and fruits throughout the day, focusing on whole forms, Incorporate healthy fats from whole foods such as meats, seafood, eggs, nuts, seeds, olives, and avocados, Focus on whole grains, while sharply reducing refined carbohydrates, Limit highly processed foods, added sugars, and artificial additives, eat the right amount for you, based on age, sex, size, and activity level, choose water and unsweetened beverages to support hydration, and limit alcohol consumption for better overall health. – SOURCE: USDA

GIS is Better Than CAG on Several Fronts But Not All

General Mills is better than CAG, but not quite as good as TSN. The yield for GIS is 5.48%, which is very nice, and the dividend payout ratio is a rational 65.41%. Earnings should also grow, but not as fast as TSN. The one point of concern for me is their heavy focus on cereals like Cheerios, Chex, Cinnamon Toast Crunch, Cocoa Puffs, Fiber One, Lucky Charms, Wheaties, and Cookie Crisp. I could not find a breakout of their sales across their different business lines in their December 2025 investor presentation. Clearly some of their business lines are struggling especially those related to grains.

Tyson’s Product Mix is Encouraging and Meaty

I think given the focus of Tyson’s product lines, it has a better long-term growth perspective. Tyson Foods, Inc., operates through four segments: Beef, Pork, Chicken, and Prepared Foods. The company processes live fed cattle and hogs; fabricates dressed beef and pork carcasses into primal and sub-primal meat cuts, as well as case ready beef and pork, and fully cooked meats; raises and processes chickens into fresh, frozen, and value-added chicken products, including breaded chicken strips, nuggets, patties, and other ready-to-fix or fully cooked chicken parts; and supplies poultry breeding stock. It also manufactures and markets frozen and refrigerated food products, including ready-to-eat sandwiches, flame-grilled hamburgers, Philly steaks, pepperoni, bacon, breakfast sausage, turkey, lunchmeat, hot dogs, flour and corn tortilla products, appetizers, snacks, prepared meals, ethnic foods, side dishes, meat dishes, breadsticks, and processed meats under the Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, and State Fair brands.

Conagra’s Business Has Potential

Conagra Brands, Inc., operates in four segments: Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice. The Grocery & Snacks segment primarily offers shelf stable food products through various retail channels. The Refrigerated & Frozen segment provides temperature-controlled food products through various retail channels. The International segment offers food products in various temperature states through retail and foodservice channels outside of the United States. The Foodservice segment offers branded and customized food products, including meals, entrees, sauces, and various custom-manufactured culinary products packaged for restaurants and other foodservice establishments. The company sells its products under the Birds Eye, Marie Callender’s, Duncan Hines, Healthy Choice, Slim Jim, Reddi-wip, Angie’s, BOOMCHICKAPOP brands.

General Mills Is Complicated but Diversified

Like I said earlier, I’m concerned about GIS from a carbohydrate and sugars perspective. General Mills, Inc. manufactures and markets branded consumer foods worldwide and operates through four segments: North America Retail; International; Pet; and North America Foodservice. It offers grain, ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and savory snacks, ice cream and frozen desserts, unbaked and fully baked frozen dough products, frozen hot snacks, ethnic meals, side dish mixes, frozen breakfast and entrees, nutrition bars, and frozen and shelf-stable vegetables. The company also manufactures and markets pet food products, including dog and cat food; and operates ice cream parlors. It markets its products under the Annies, Betty Crocker, Bisquick, Blue Buffalo, Bugles, Cascadian Farm, Cheerios, Chex, Cinnamon Toast Crunch, Cocoa Puffs, Cookie Crisp, Dunkaroos, Edgard & Cooper, Fiber One, By The Foot, Gushers, Roll-Ups, Gardettos, Gold Medal, Golden Grahams, Häagen-Dazs, Kitano, Kix, Lärabar, Latina, Lucky Charms, As Well As Muir Glen, Nature Valley, Nudges, Oatmeal Crisp, Old El Paso, Pillsbury, Progresso, Tastefuls, Tiki Pets, Total, Totinos, Trix, True Chews, True Solutions, Wanchai Ferry, Wheaties, Wilderness, and Yoki brands.

Options Trading for GIS, TSN, and CAG

GIS only offers monthly options. That is not a negative for the average investor, but it doesn’t entice me. TSN is the same. Only CAG has the potential for weekly options trades at this time.

Conclusion

For the average investor with a long-term perspective, TSN is the best of the three. While the yield is lower, that is a function of the market’s view of the potential for growth. Obviously TSN’s 10-year total returns far exceed those of GIS and CAG. GIS is number two in my view. CAG is not for the risk-averse investor. However, the old adage of “buy low and sell high” might make buying CAG shares using cash covered put options a viable strategy. The following images help me analyze the relative strengths and weaknesses of the three. It is easy to see that TSN is the clear winner at this point.

That, however, doesn’t mean I plan to sell CAG. I think there are some strong reasons to continue to hold my shares for the dividends and options income stream.

It should be noted that I have never found a good consumer staples ETF, but if I did I would recommend that for the average investor.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha, especially the QUANT ratings. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

Thanks Wayne, that’s very helpful. I share your concerns about the sugar and high processing related to several GIS food products, although that may already be baked (ha) into the price. I’m hoping that will be offset by an upside to other areas like the pet lines. Time will tell!

LikeLike