Utility, Energy, and Real Estate Stocks in One “ETF” – Actually a Closed End Fund

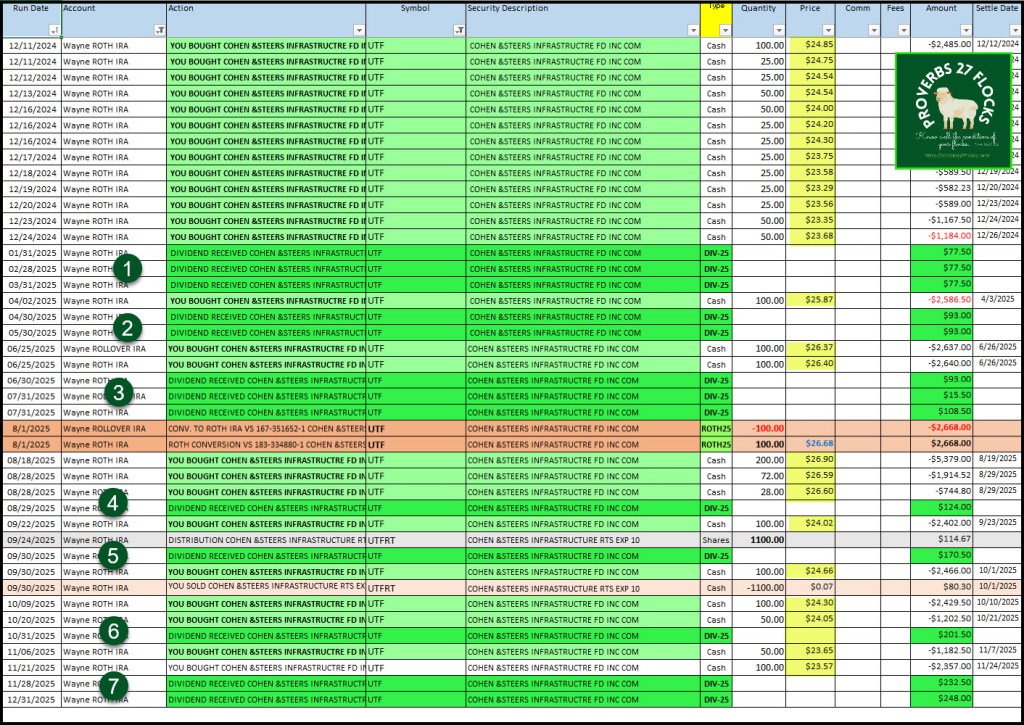

Most of the time I am not a proponent of utility stocks. They do exhibit some positive characteristics, but they tend to lack dividend growth. However, for predictable monthly income a utility “ETF” is a better choice over most bonds and bond funds. One CEF I have been adding to my ROTH IRA is UTF. This is not a pure utility play. Rather, it is an “infrastructure” opportunity.

Also, UTF is not really an ETF. It is a closed end fund (CEF). More on that later in this post.

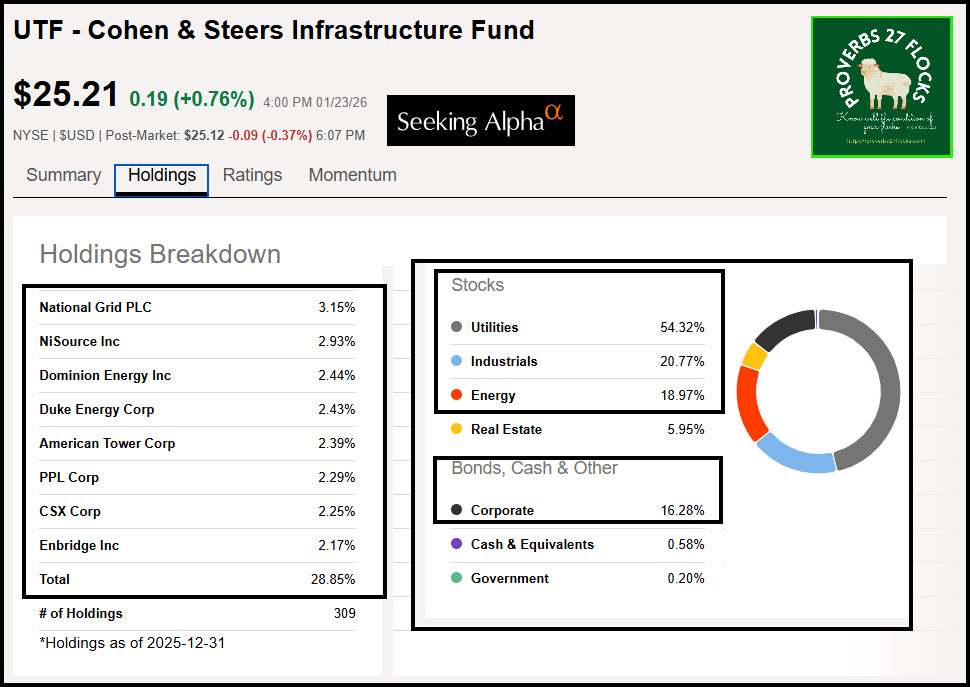

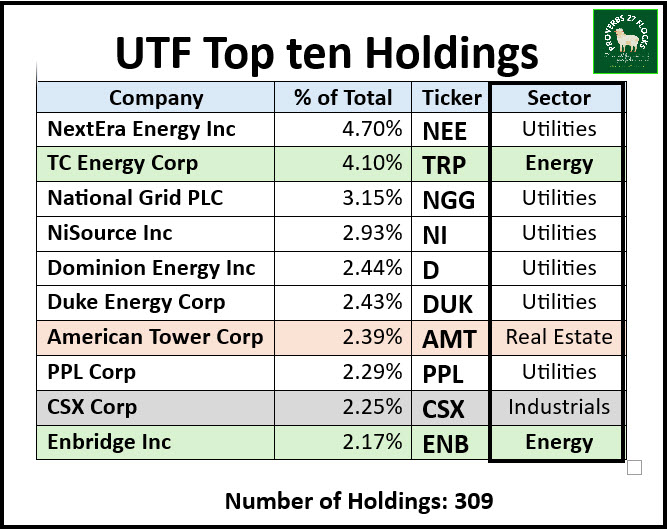

I currently hold 1,600 shares of UTF in my ROTH IRA that I started to acquire in late 2024. The most recent dividend was added to my ROTH on 12/31/25 for $248. This income comes from three main sectors: utilities, energy, and real estate.

What are some advantages of investing in stocks and ETFs in the utility sector?

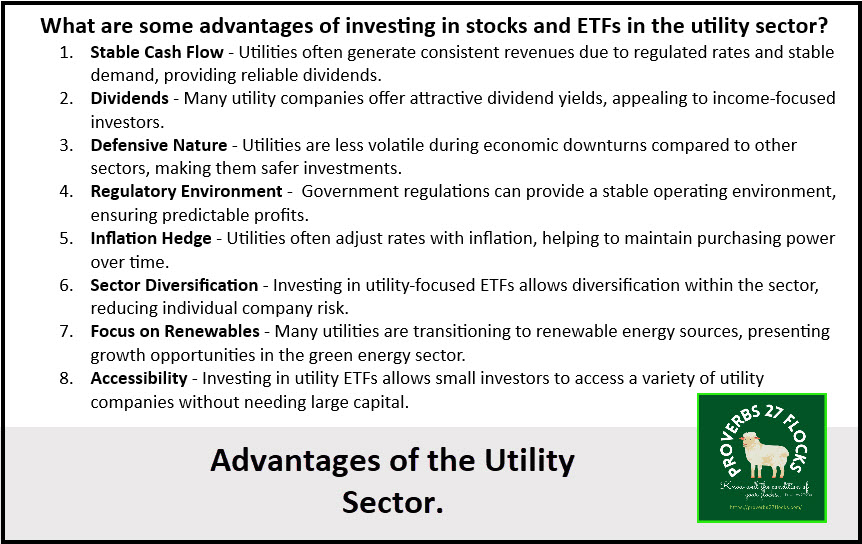

- Stable Cash Flow – Utilities often generate consistent revenues due to regulated rates and stable demand, providing reliable dividends.

- Dividends – Many utility companies offer attractive dividend yields, appealing to income-focused investors.

- Defensive Nature – Utilities are less volatile during economic downturns compared to other sectors, making them safer investments.

- Regulatory Environment – Government regulations can provide a stable operating environment, ensuring predictable profits.

- Inflation Hedge – Utilities often adjust rates with inflation, helping to maintain purchasing power over time.

- Sector Diversification – Investing in utility-focused ETFs allows diversification within the sector, reducing individual company risk.

- Focus on Renewables – Many utilities are transitioning to renewable energy sources, presenting growth opportunities in the green energy sector.

- Accessibility – Investing in utility ETFs allows small investors to access a variety of utility companies without needing large capital.

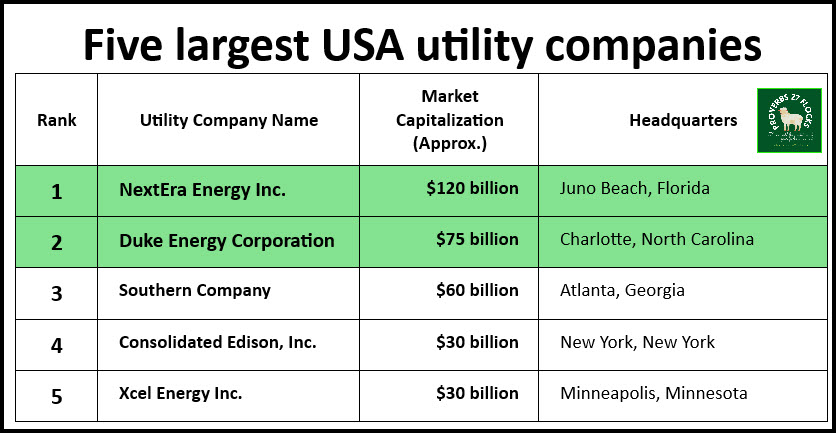

Five largest USA utility companies

Of the five largest utility companies, two appear in the top ten of the UTF investments. They are NextEra Energy Inc. and Duke Energy Corporation. However, it should be noted that Southern Company, Consolidated Edison Inc, and Xcel Energy Inc are in the top twenty UTF investments.

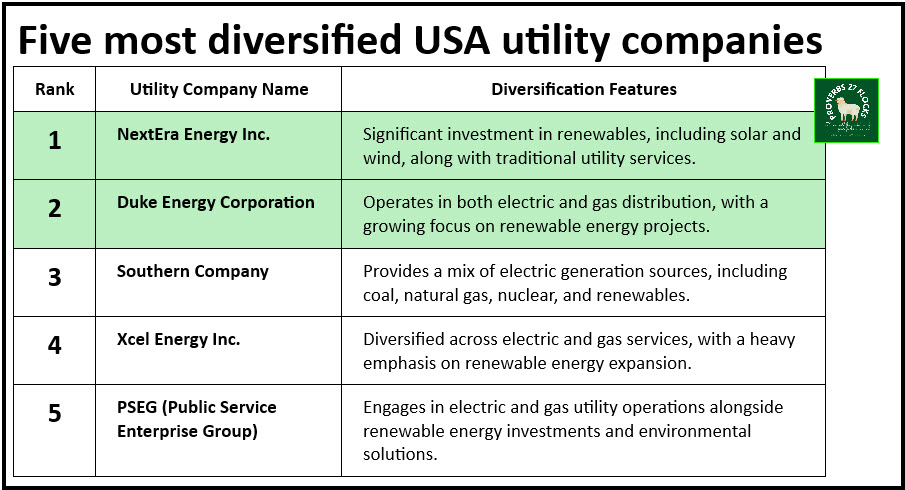

Five most diversified USA utility companies

A similar pattern, of course, is seen in diversification of types of utility resources. The following rank in the top five for diversified assets: NextEra Energy Inc, Duke Energy Corporation, Southern Company, Xcel Energy Inc, and PSEG (Public Service Enterprise Group).

Overview of Four Diversified Utility Companies

NextEra Energy Inc is heavily invested in renewable energy, including solar and wind projects, while also providing traditional utility services. Its commitment to sustainability makes it a leader in diversifying energy sources.

Duke Energy Corporation operates in both electric and gas distribution. It has various initiatives focused on renewable energy sources, enhancing its portfolio and contributing to environmental sustainability.

The Southern Company is known for its diverse range of electric generation sources, including coal, natural gas, nuclear, and growing investments in renewable energy.

Xcel Energy Inc. offers both electric and natural gas services and is recognized for its strong focus on expanding renewable energy options, significantly investing in wind and solar power.

Which utility ETF has the lowest expense ratio?

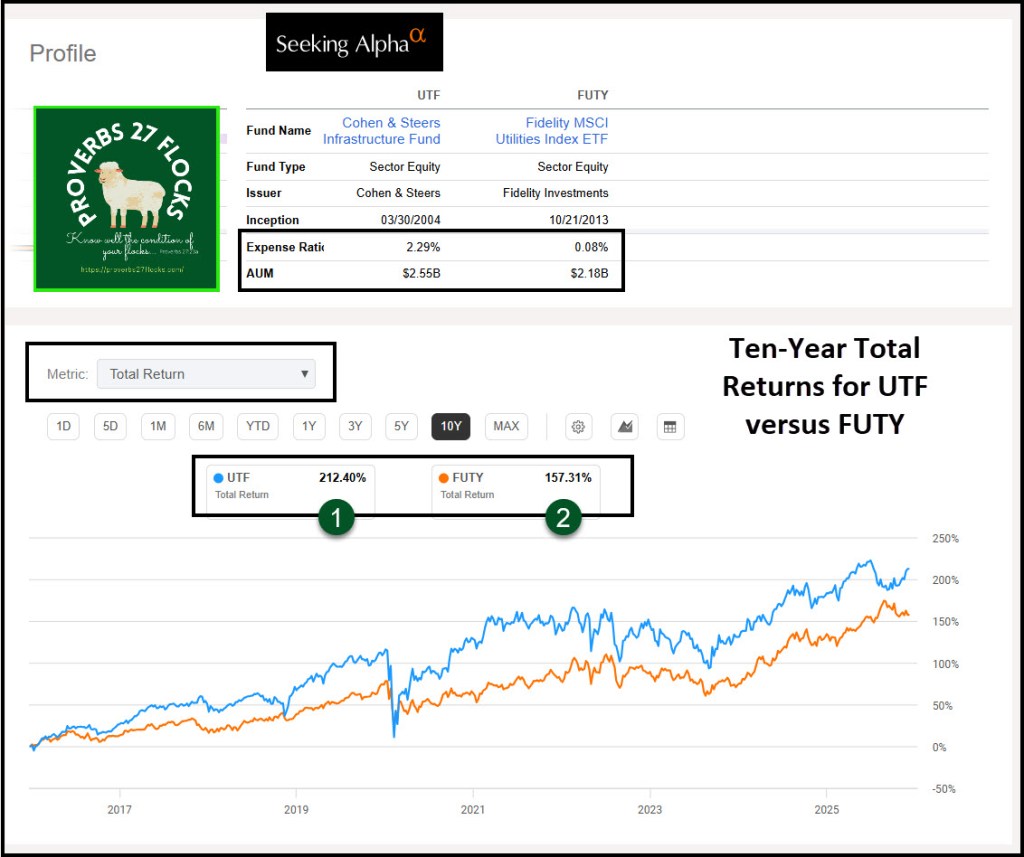

The utility ETF with the lowest expense ratio is the Fidelity MSCI Utilities Index ETF (FUTY), which has an expense ratio of 0.08%. This low cost makes it an attractive option for investors seeking to minimize expenses while gaining exposure to the utility sector. However, FUTY has underperformed UTF in total returns when you look at the past ten years. In addition, FUTY’s dividend yield is a paltry 2.66% due to its focus on just the utility sector.

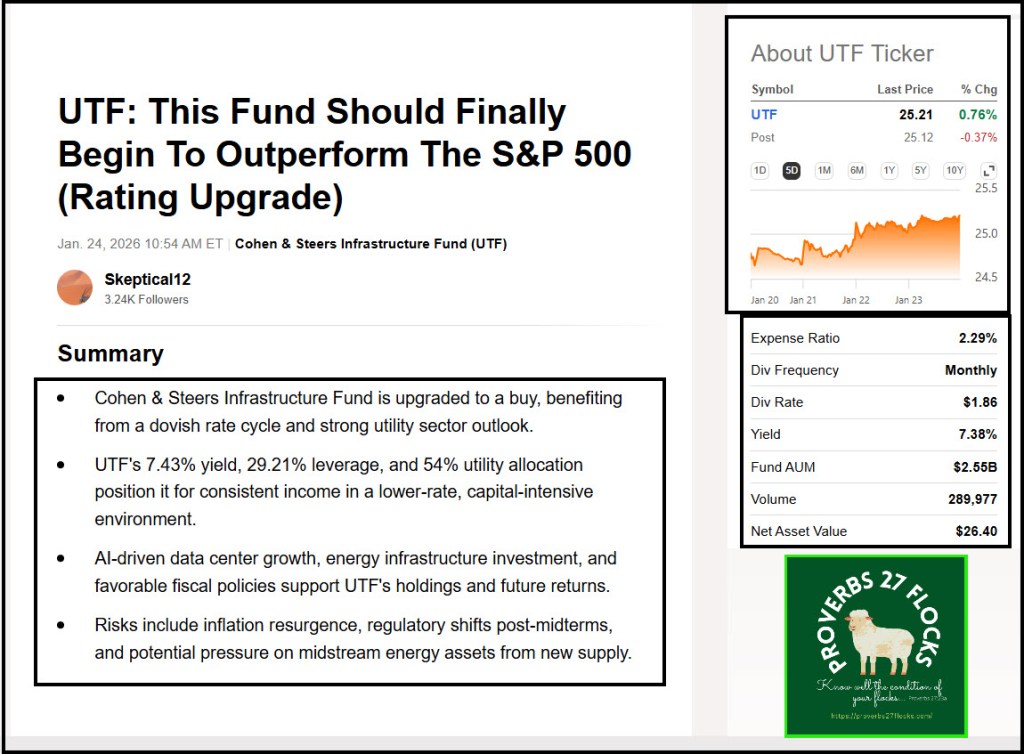

UTF’s Dividend Characteristics

While investors are not wise to chase yield, UTF also beats FUTY on a couple of fronts. The first is dividend yield: 7.38%. The second is that FUTY pays quarterly, but UTF offers monthly dividends. Because our utility bill expense is monthly, I like to have cash coming into my ROTH that can help pay our growing utility bill. Bear in mind that this income is also income tax-free.

In other words, my ROTH IRA will receive $2,976 from UTF during 2026, assuming there are no changes in UTF’s dividend distribution. To put this in perspective, our total utility bills for 2025 were $2,891. So UTF is providing enough cash to pay for our electricity and gas.

Fund Profile

Cohen & Steers Infrastructure Fund, Inc. is a closed-end equity fund launched by Cohen & Steers, Inc. The fund is managed by Cohen & Steers Capital Management, Inc. It invests in public equity markets of the United States. The fund invests primarily in value stocks of infrastructure companies across all market capitalizations. It employs fundamental analysis to make its investments.

The fund benchmarks the performance of its portfolio against a composite index of 80% FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) and 20% BofA Merrill Lynch Fixed-Rate Preferred Securities Index. It was formerly known as Cohen & Steers Select Utility Fund, Inc. Cohen & Steers Infrastructure Fund, Inc. was formed on January 8, 2004 and is domiciled in the United States. The Fund’s objective is to achieve total return, with an emphasis on income.

What is a closed end equity fund?

A closed-end equity fund is a type of investment fund that pools money from multiple investors to invest primarily in stocks or equities. Unlike mutual funds and exchange-traded funds (ETFs), closed-end funds (CEFs) have a fixed number of shares that are issued during an initial public offering (IPO). After this, the shares trade on stock exchanges similar to individual stocks. FUTY is not a CEF.

Another Question to be Answered

One of my readers posed an excellent question that I hope to address soon. “Other than the yield, what are the factors that make CAG a more attractive option than GIS or TSN?” This is worthy of some further explanation. My short answer is “I like TSN better than CAG and I hold shares of both.” But there are some reasons to be concerned about the potential for growth for Conagra Brands, Inc.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com