ROTH Conversions and Answering Shawn’s Questions

One of my readers asked some ROTH conversion questions, and these questions often are on the minds of others I help. Therefore, rather than just answering Shawn via email, I think my answers may help others navigate the maze of ROTH conversions.

Before I answer his questions, I want to share the conversions I completed in 2025 and what I plan to do in 2026. I am already seeing the benefits of the conversions I completed, because some of the positions I converted have reversed course and are heading back up. However, there are also others, like HPQ which have not fared as well. In the end, however, the benefits of the conversions will play out well with a long-term perspective. This has happened in the past as well with excellent results.

The Scope of the Conversions

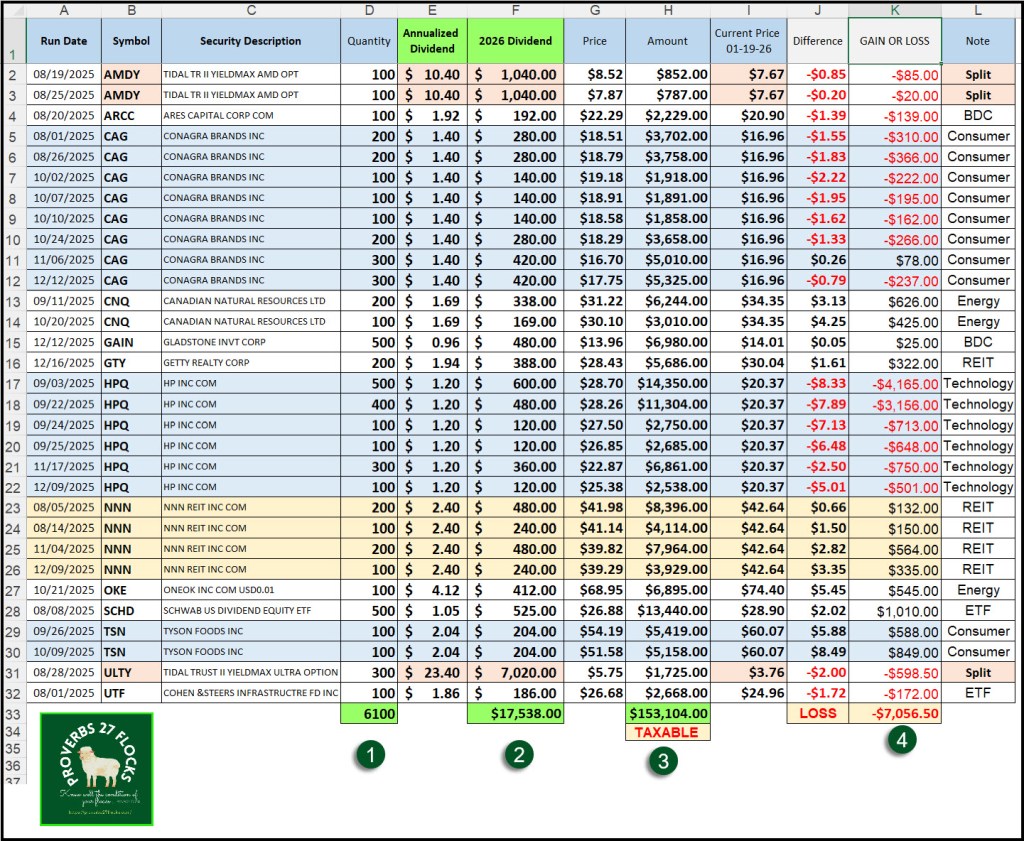

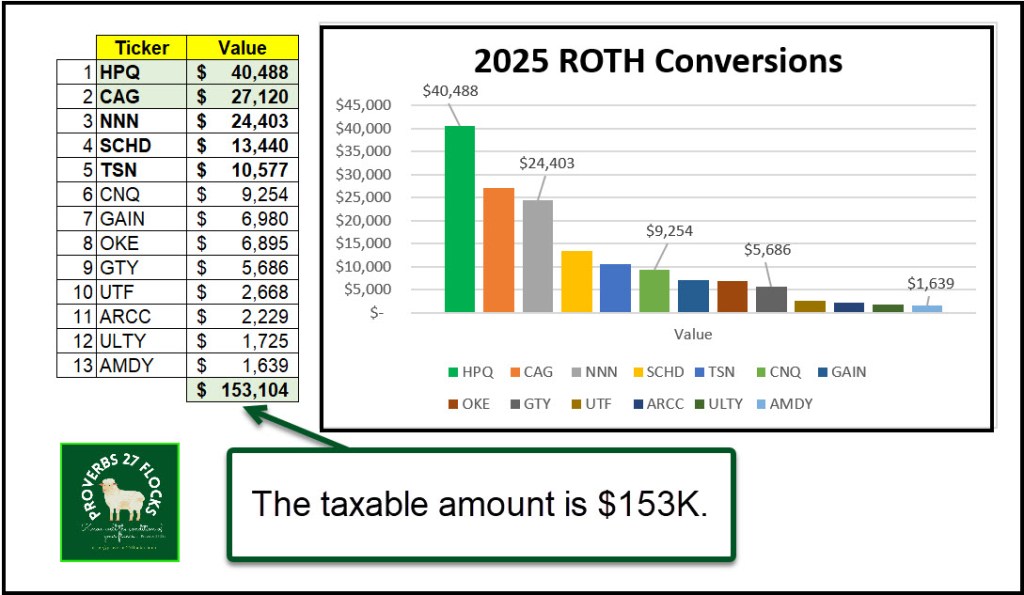

I converted 6,100 shares of my traditional IRA holdings. The positions included ETFs, consumer stocks, technology, REITs, energy and BDCs. The goal was to transfer assets gradually from August through December. The following are the ticker symbols of the investments: AMDY, ARCC, CAG, CNQ, GAIN, GTY, HPQ, NNN, OKE, SCHD, TSN, ULTY, and UTF. The total value of the assets converted was $153,104. This is the taxable amount. I was most aggressive in converting HPQ and CAG shares because I believe the market is undervaluing those assets on a long-term basis.

The Impact of the Conversions

There are at least three desirable outcomes from the conversions. They are a reduced 2026 RMD, increased dividend income in my ROTH, and more options trading opportunities in my ROTH.

The conversions reduced the balance of my traditional IRA. This is helpful because it reduces the 2026 RMD. I like this because I can more quickly convert more IRA shares to my ROTH this year after I meet the RMD requirement for the year. (My RMD will be satisfied with QCD charitable giving. This is tax-free too!)

A second desirable outcome is the movement of dividends from these assets to the ROTH. Those dividends are now tax-free. Currently the combined estimated annual income from my traditional IRA and my ROTH is $180.9K. My ROTH now makes up $91.3K of the total. This has another desirable impact: I can now reinvest the dividends in the ROTH, further growing the ROTH’s account balance and dividends.

A third desirable outcome is that I can now trade covered call options on most of the shares I converted. So, for example, I moved 1,500 shares of CAG and 1,500 shares of HPQ. I can trade up to 15 covered call contracts on each of those stocks, further enhancing my tax-free income in 2026 and beyond.

Four Significant Totals

The following spreadsheet shows both the details and four significant totals.

Number 1: This is the number of shares converted to the ROTH. Why is this important? Because 6,100 shares are now 61 potential covered call options contracts. Therefore, during 2026 I will look at options contracts on these shares.

Number 2: The $17.5K is a good estimate of the potential tax-free dividends I will see in my ROTH this year and (hopefully) in the next ten years.

Number 3: I do have to pay taxes on the $153.1K. Bear in mind however, that someday the taxes have to be paid anyway. When we can no longer file a joint income tax return (one of us will likely die before the other) taxes will skyrocket.

Number 4: The value of the shares in total has dropped by about $7K. I view this as a short-term disappointment. I really doubt that CAG and HPQ will fail to perform in the future. In any case, the dividends going forward help dull the pain of the current paper loss.

Now it is time to address my reader’s questions.

Shawn’s Comments and Questions

His questions are good ones. The first and second have to do with “the process” for doing a conversion and any requirements for the holdings that are converted. The second is focused on the timing of tax payments. The last one is about the strategy for paying the income taxes.

He has roughly $275K in his traditional IRA. He is still relatively young: 53 years old. He is also aware of his current income tax bracket, so he understands the potential tax implications of each conversion. He notes, “The biggest hurdle would be making the tax payments on this conversion.”

Question One: Process

What is the actual process to make a conversion?

Do I need to sell stocks, ETF’s, etc. in the IRA, withdraw the money and then deposit into a Roth?

You never need to sell the traditional IRA assets to move them to the ROTH. I don’t think that is a good idea, but you can do that. Instead, you can move stocks and ETFs directly from the T-IRA to the ROTH. The best time to do this is on a day when the price of the asset is down. Sometimes it is best to just move some shares in one month and wait to see if they continue to drop. That is what I did in 2025.

Fidelity lets the client do their own transfers. You simply click on “Transfer” and select the traditional IRA as the “From” account and the ROTH IRA as the “To” account. You then select the specific investments you want to move from the T-IRA to the ROTH. If you have 500 shares of company XYZ, you can transfer any number of those shares to the ROTH. Bear in mind that the tax will be based on the closing price of the shares on the day you make the transfer. The Fidelity site estimates the value of the transfer based on the current price of the shares. The transfer must be started before the market closes.

He goes on to say: “Let’s say I wanted to do $50,000. Based on current tax rates I would be in between the 22% to 24% bracket so let’s assume 23% for federal and then I would have 5.3% for state taxes for a total of 28.3%. This would be $14,150 that I would need to pay. To make this payment would be really hard.” Yes, you have to be ready to pay the tax. Therefore, don’t rush to do a certain dollar amount within the year. Make the transfer sensible so that you can cover the income taxes from funds you receive from other sources.

Question Two: Income Taxes

“Let’s assume I make this conversion here sometime in the 1st quarter. Would I need to pay the taxes immediately or would I be able to make quarterly payments for this money?”

First of all, don’t rush to try to do the conversion in the first quarter. I understand why you might want to do that (for options trading and dividend income) but there is no need to rush. You do not have to pay the taxes immediately. However, it is prudent to do estimated tax payments for both the state and federal income taxes on the websites for Wisconsin and the IRS. The IRS publishes the due dates for each quarter. So, for 2026, the first quarter estimated income tax deadline is April 15. (Estimated tax payments for 2026 are due on April 15, 2026, June 15, 2026, September 15, 2026, and January 15, 2027.

He should be very careful about making withdrawals from his ROTH IRA before he reaches age 59.5 years old. Once you reach 59½ and meet the five-year rule, all withdrawals are tax-free and penalty-free. Here is one window for investors younger than the age 59.5: You can always withdraw the principal amount you contributed, regardless of your age or how long the account has been open.

Question Three: Sources for Income Taxes

“Let’s assume that I currently don’t have the amount to cover the taxes and move the $50,000 to a Roth IRA. Once this conversion happens, I start to trade options and start to earn option/dividend income in this account. During the year, let’s assume that I could make $15,000 in options/dividend income in this account. Assuming I am able to withdrawal any portion of my contribution (Original $50,000), couldn’t I withdraw the roughly $14K+/- from my initial contribution to cover the taxes?”

There are too many assumptions in this approach. First, I don’t think it is wise to do withdrawals from the ROTH to pay income taxes. The goal is to increase your tax-free income, and you can seriously harm that by taking withdrawals at your young age. The best approach is to find ways to pay the taxes with money in savings or a taxable brokerage account. That means doing smaller conversions at this stage would be prudent. You want to pay taxes without significant ROTH withdrawals.

In addition, it is unwise to assume you can pay the income tax with options income. If we head into a bear market you don’t want to trade options on assets that are falling in value. First of all, you won’t find many buyers for those options, and secondly you risk losing your shares at undesirable prices.

Future 2025 Q4 Year End Updates

Next time I will continue the 2025 Easy Income Strategy review. I can explore RMD results, a QCD charitable giving update, a 2026 EAI update showing easy income growth, the stocks I sold and those that I purchased in 2025, some new cryptocurrency ideas, and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Closing Thoughts

ROTH conversions are a good strategy for increasing tax-free income in retirement. It also helps plan for your spouse if/when they need to file income taxes as a single person. However, you must consider the up-front income tax costs and look at how soon you will recoup the taxes from dividends and options income. I do not recommend ROTH withdrawals to pay income taxes. That is messy and costly.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha (SA). If you decide to explore a SA subscription, please use the following link to receive a $30 discount for your first year. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Hi Wayne, other than the yield, what are the factors that make CAG a more attractive option than GIS or TSN?

LikeLiked by 1 person

The quick answer (but I will do a longer blog post on this one) is that I like TSN better than CAG and I hold shares of both.

There are other contenders to consider as well, so rather that skim the surface, I will discuss my thinking in a new post. Thanks for asking the question.

LikeLike