Does Your Advisor Teach You?

Education and Training

What would you think of a doctor who examined, and found something wrong, and prescribed a medicine that you have to take for the rest of your life, but did not tell you the probable causes of the malady? I trust you would not be pleased. How about if your mechanic charged you $4,000 to fix a problem with your SUV, but did not give you recommendations for preventative maintenance for the future? I suspect some of you would be disappointed. (Maybe I am overly optimistic on that point!)

I believe the same is true for every area of life. You usually don’t want just the “fix” a problem or take care of a need, but you also want to be better informed and have wisdom for choices going forward. Along that same line, I don’t have much respect for investment or financial advisors who prescribe solutions, charge high fees, and never teach me anything. I think my readers deserve something more. I’m not opposed to using a good advisor, but good ones may be hard to find.

During 2025 I have had the opportunity to train several teens, some college students, some middle-aged adults, and some seniors with some important investing truths and skills. One granddaughter even brought a friend from college and asked me to teach her the basics of investing. What impressed me about this granddaughter is that she also wanted a refresher course of the things I taught her when she was a teen.

One of my “classes” has been individual stock options (and ETF options) training. I can think of at least six people who took the training and started trading options. One of them is my pastor, another is my son, one is a friend I have never met in person, and another is a friend of a friend. I even taught a couple, who learned so quickly that they started to make an amazing amount of money trading options with just some basic knowledge. Here is what they paid for the training: nothing.

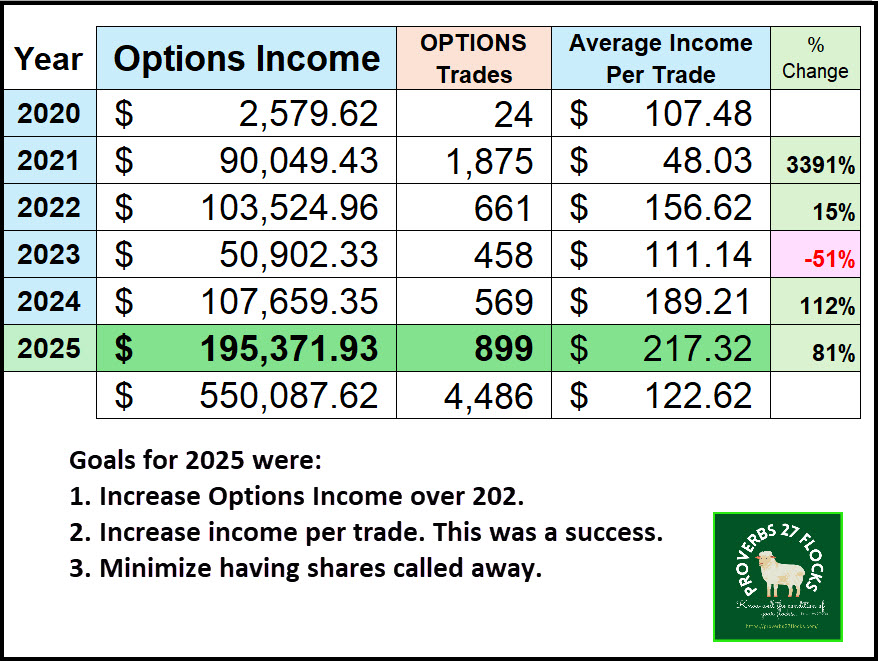

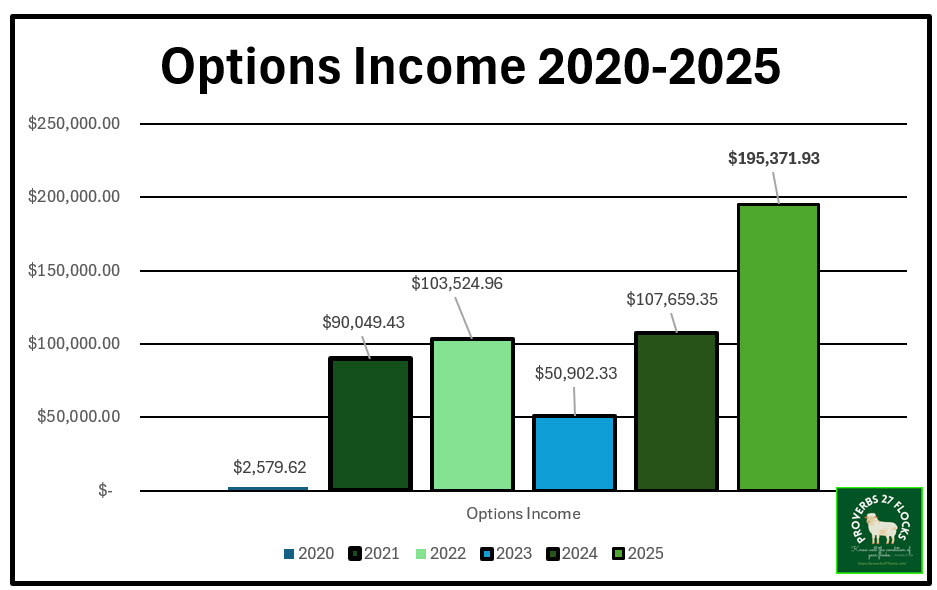

Tax-free Options Income

During 2025 Cindie and I earned tax-free options income in their ROTH IRA investments to the tune of $55.0K. Those are dollars that can be withdrawn, and the IRS and the state of Wisconsin don’t get a cut. Because Wayne’s ROTH is significantly larger than Cindie’s, my tax-free income was $50.0K. You can give a lot of gifts, travel, and buy a decent used car with that type of income.

Tax-free Dividend Income

During 2025 Cindie and I earned tax-free dividend income in their ROTH IRA investments of $77.9K. Those are dollars that can be withdrawn, and the IRS and the state of Wisconsin don’t get a cut. Because Wayne’s ROTH is significantly larger than Cindie’s, my tax-free income was $62.3K. You can give a lot of gifts, travel, and buy a decent used car with that type of income.

Total Tax-free Dividend and Options Income

If you add the $55.0K and the $77.9K, the total tax-free income for 2025 was $132.9K. How did this begin? Many years ago I started saving and investing. Cindie and I both took advantage of workplace retirement accounts. We were disciplined to add the maximum amounts to our ROTH IRA and 401(k) accounts when those became available. Our total options income since 2020 has been $550,087.62.

Expired Options 2025

During 2025 1,506 contracts (calls and puts) expired. That means I kept the related 146,700 shares of stocks and ETFs that were in the covered calls and did not have to purchase the 4,500 shares that were cash covered put contracts. However, I did not have to do 1,506 trades to get these results because some of the trades were for more than 100 shares. Some were for 3,000 shares or even, in the case of Ford, 6,500 shares.

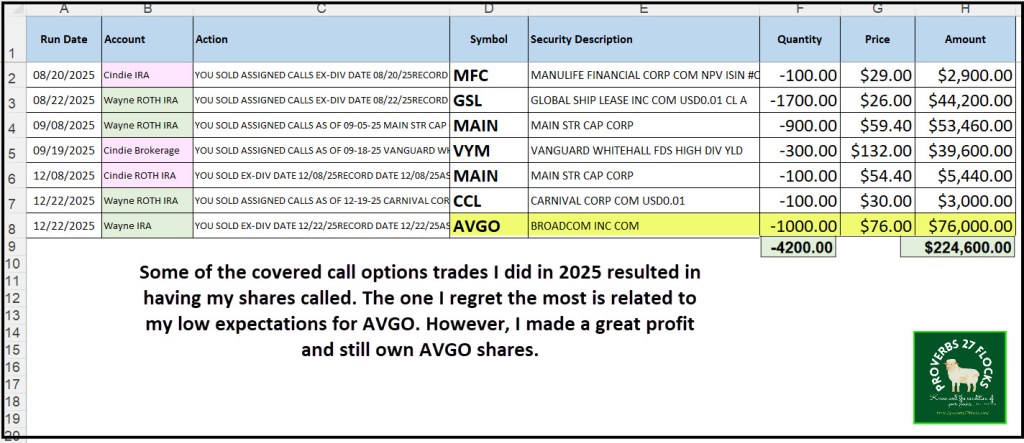

There were some options contracts that did get called. They included shares of MFC, GSL, MAIN, VYM, CCL, and AVGO. The called shares totaled 4.2K. This was a mere fraction of the total 146.7K that I kept. That is an acceptable ratio.

There were very few cash covered puts I had to purchase. The only two were for 100 shares of TSN and 200 shares of AVXL. However, the income I received from PUT was small compared to the income from CALL options. PUTs only accounted for $3,342 of the $195.4 in options income. Nevertheless, $3.3K in income from stocks I did not own is a sweet topping for overall income.

What is needed to start trading options?

There are four basics that can get you started in trading covered call options. You need some training, an account (IRA, ROTH, or brokerage), some existing investments, and a sliver of time.

1. Basic training. There are good books on the topic, and you can search YouTube and Investopedia to learn more about options and trading options. However, I think spending some time with me is also an option for learning to trade options.

2. Apply for options trading on accounts. This can be done online with Fidelity Investments.

3. Own at least 100 shares of a stock or ETF with options available. It is best to start with a low-cost stock like Ford (F).

4. You should be willing to spend fifteen minutes of time when the market is open to enter a grade. This does not have to be weekly, but I recommend doing at least one trade every other week to cement the process in your mind.

Future 2025 Q4 Year End Updates

Next time I will continue the 2025 Easy Income Strategy review. I can explore RMD results, a QCD charitable giving update, ROTH conversions completed, a 2026 EAI update showing easy income growth, the stocks I sold and those that I purchased in 2025, some new cryptocurrency ideas, and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Closing Thoughts

It is not unusual for investors to pay $5,000 or more for the help from a stockbroker or investment advisor. If all you are getting is market returns (or less) then you are overpaying for their help. Furthermore, if you are not learning anything when you speak to your advisor, then perhaps they don’t want you to be educated. Ask yourself why that might be.

Options trading requires knowledge and time. If you don’t have the knowledge, you can get it. Everyone has time. You get to choose what you do with it.

Always start with a goal, including your options trading adventure. Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income and options income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Options trading is so valuable and a great way to boost income. I’m grateful for the basic lessons you’ve taught me and have continued to grow with my learning and trading.

LikeLike