Was 2025 Successful?

I read more than the average investor. As a result, I believe I will learn more about investing and investments as time goes on. But I don’t want what I write to be cumbersome to read or have more than 1,500 words for most of my articles. The goal when I write is to communicate some key ideas or principles of investing.

When it comes to report cards, I want a summary to highlight what works and also give guidance for the investor who wants a simple plan. I also want those who invest to be able to get “easy income” with minimal time and effort. The reason for this isn’t so that you can sit on a beach living an unproductive life in retirement. Rather, the goal is for you to be able to use your talents, resources, and time in retirement for the good of your family, your church family, your community and the world.

Review: What is “Easy Income?”

Easy income is income that comes from making your investments work for you. The companies you invest in should be paying you when you are in retirement. The goal is to minimize the buying and selling of investments (stocks and ETFs) and to collect income from those investments by doing nothing. Most financial advisors do not structure retirement portfolios to do this. In fact, there is a subset of advisors who specialize in transitioning you from “growth” investments to “income” investments. I believe you can have both sooner rather than later.

Our Sources of Easy Income

My view is that our “easy income” comes from two sources. The first is Social Security. During 2025 Cindie and I received a total of $50,316 in Social Security benefits. However, the novice will assume that is what was deposited to our checking account. The reality is that we received $43,771.20. The reason we did not receive the full amount is due to Medicare Part B costs. The government deducts our required Medicare premium from our gross Social Security income. Said another way, $6,544.80 dollars of our Social Security was not delivered. It means the government gave and then took away 13%.

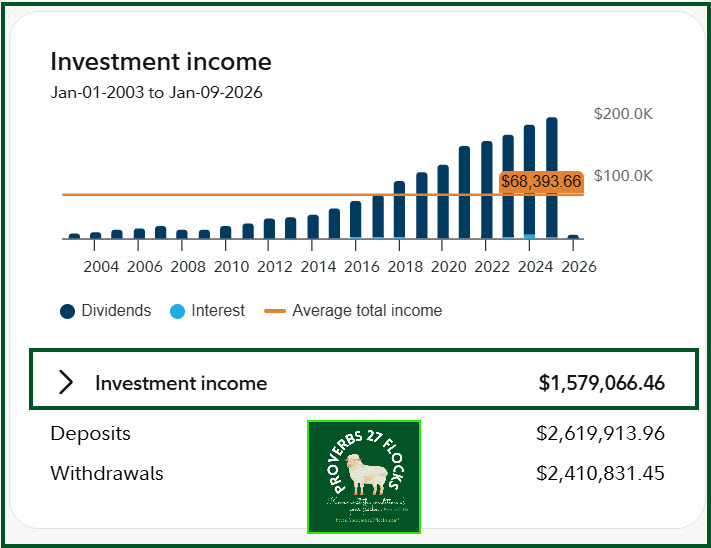

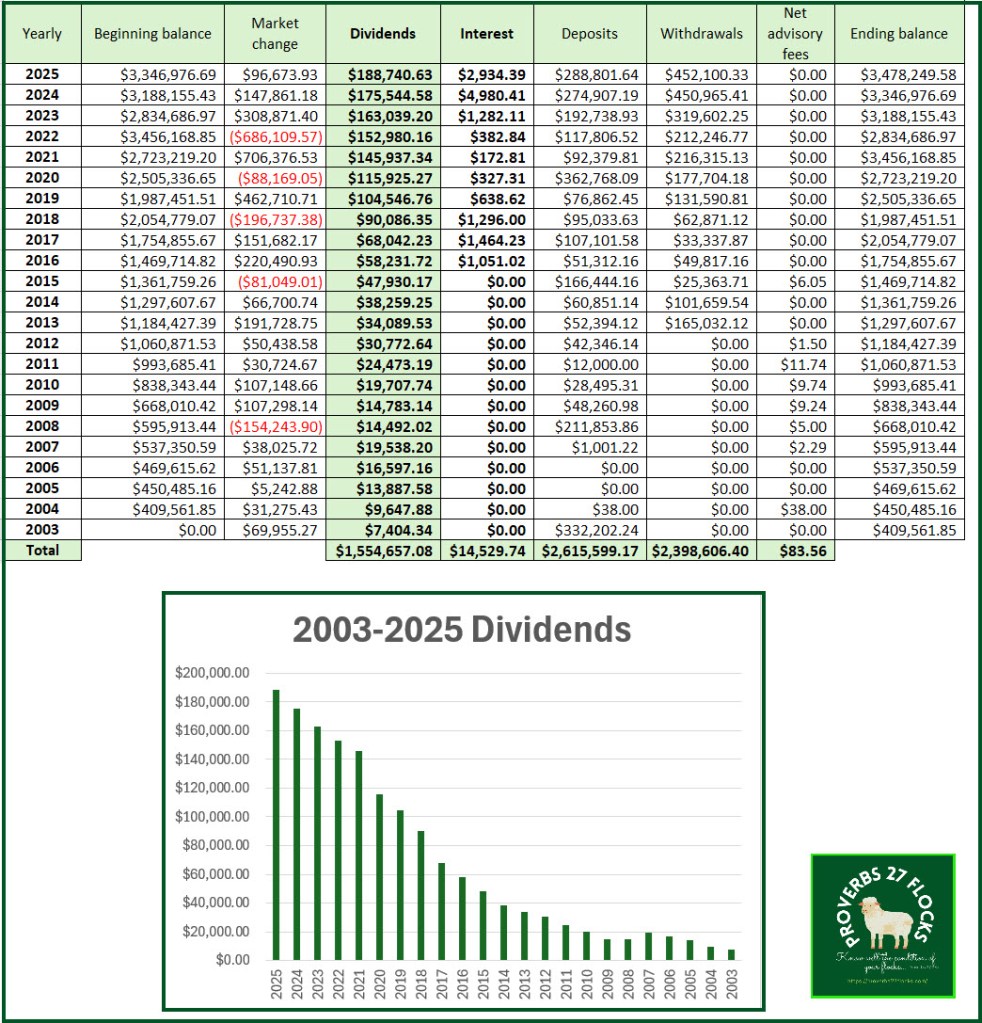

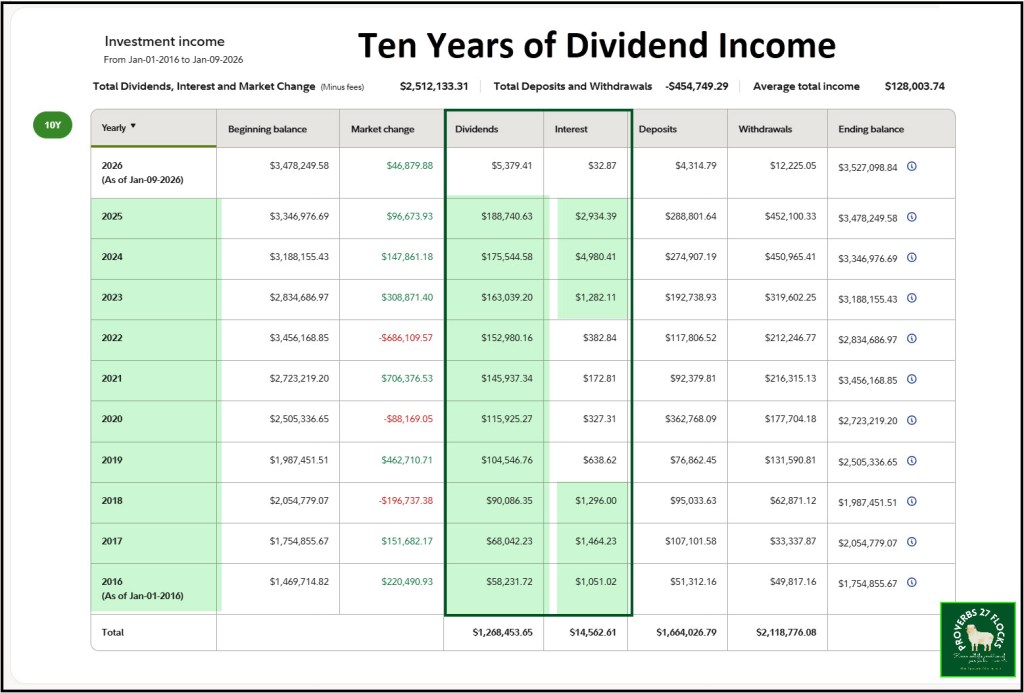

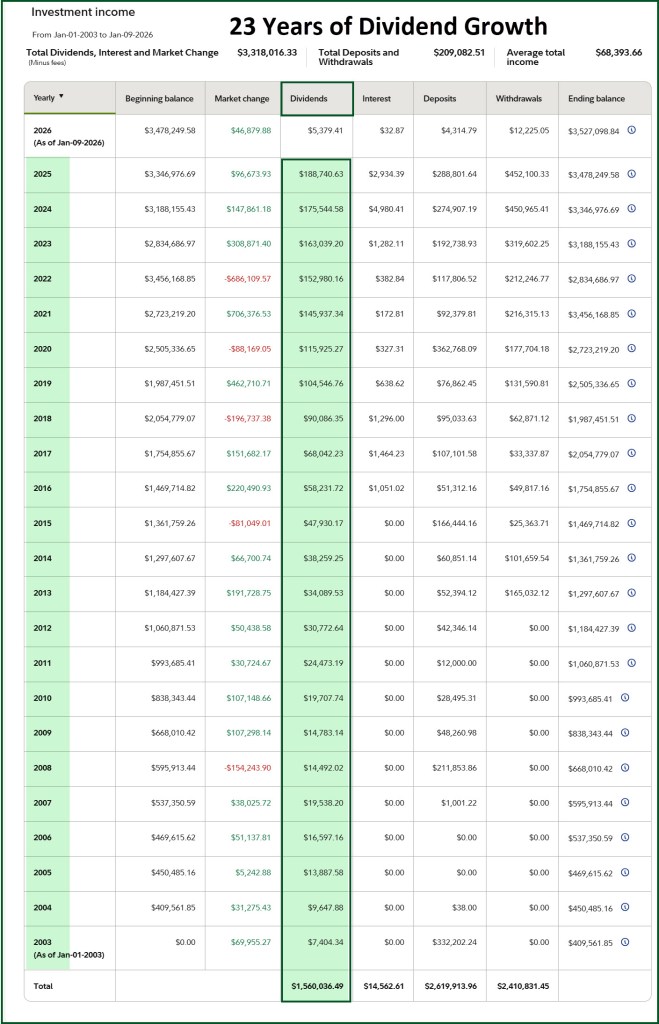

The second pipeline is far more lucrative and grows at a faster rate than Social Security’s measly 2% inflation bump. That pipeline is filled with dividend growth stocks and ETFs. One way to measure the success of a strategy is to see if it works. In 2023 our total dividends were just shy of $165K. At the end of 2024 our dividends increased to $180.5K. For the year that just ended, we reached a total of $191.7K in dividends (and interest.)

To put this in perspective, our income increased by 9.4% in 2024 and 6.2% in 2025. This was not done to sacrifice portfolio growth. The actual total balance of our investments did not grow significantly in 2025, but that is due to the withdrawals we made for various reasons, including QCD giving and the required minimum distributions we must take from our traditional IRA accounts.

One Other Income Stream

Believe it or not, there is one other income stream that is not part of “Easy Income.” That income stream comes from trading options contracts. The primary type of contract I trade is the “covered call option” on shares of stocks and ETFs we own. I will discuss those results in a future report card post.

Reminder to Obey the Rules

One of the key concepts I communicate to new investors is “The Rule of 72.” The reason easy income works is that I use this rule to pick investments. I believe it is important for you to understand the way our investment portfolio is structured. Here are three basics: 1) I believe the best “Rule of 72” investments are stocks. Bonds don’t cut it. 2) There are some sectors that will perform better than others over the long haul. They are better “72” investments. 3) Quality matters. If you have a lot of “SELL” investments, you may find it hard to keep the ”72” results in alignment with your long-term goals.

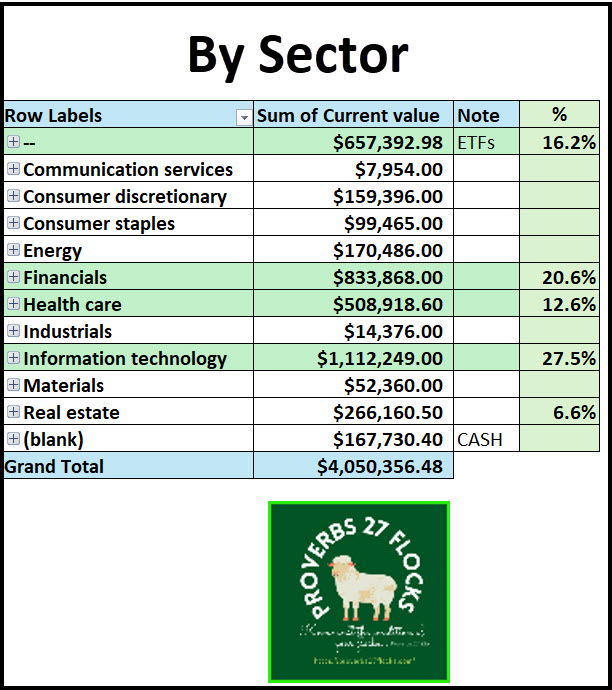

Our Investments By Sector

The vast majority of our investments are in three buckets: ETFs, technology, and financial stocks. The “Grand Total” on this image is misleading because it excludes the value of options contracts. The true total balance at this time is around $3.5M. However, the percentages give you a helpful review of where I focus.

Account Balances Matter

In the following images, I show a graph from Fidelity’s website that shows our balance activity from 2009 through 2025. In 2020 our balances were around 0% growth. Remember this was during the Covid-19 scare. Then in 2021 our account balances grew by almost 32%.

There are two scales on this image. On the left you can see the percentage return for each year and on the right you can see the changes in our account balances. The black line on the graph is the change in our account balances using a dividend growth strategy. On average, we gain about 9% each year. Using the rule of 72, that means our account can double every eight years.

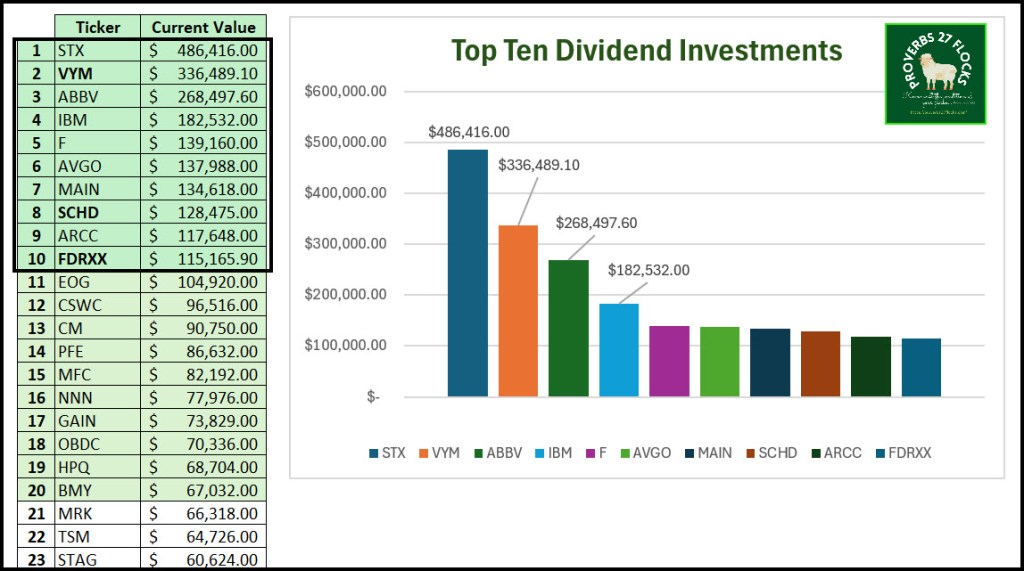

Top Ten Investments

Our top ten investments are STX, VYM, ABBV, IBM, F, AVGO, MAIN, SCHD, ARCC, and FDRXX. I am not recommending any of these for your portfolio, other than VYM and SCHD. Those two are dividend growth ETFs.

Looking at Dividend History

There are many different ways to look at dividend history and growth. The following gallery shows some of the different resources from Fidelity and some from a spreadsheet I created after downloading information from the Fidelity website. You can do the same for your accounts by going to the “More” tab and then click on “Performance.”

Future 2025 Q4 Year End Updates

There are other updates I plan to provide. These include dividend income results, interest income, Options income update, RMD results, a QCD charitable giving update, ROTH conversions completed, an EAI update showing easy income growth, the stocks I sold and those that I purchased, some new cryptocurrency ideas, and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Dividend Growth Investing Works

Even if you don’t trade options, there are good ways to grow your income simply by purchasing good dividend growth ETFs like VYM, DGRO, and SCHD. Bear in mind that I had growing dividend income before I started trading covered call options. This is easy income.

Closing Thoughts

If you are paying an advisor, find out the total cost of doing business with that advisor. I can almost guarantee you three things: the total will stun you and they probably won’t tell you what they hold in their own portfolio. They also won’t share their own personal investment results. In fairness, they probably cannot do that without getting into trouble with their company. I don’t have a company, so I can do what they cannot do.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.