How Do You Set Goals?

The vast majority of the people I have helped don’t set goals. Many of them don’t have a budget and don’t understand the purposes of a good budget. None of them had a plan for investing or even some goals. People, in general, don’t know how to and don’t set goals. That is not a wise model for any aspect of life. If the status quo is the best you can do or expect, then you have set your expectations far too low and you have a sad view of God’s desires for your life.

Some Basics for Christian Investors

Before I talk about goals for investors, let me suggest the following: If you are a Christian, you should trust God regarding your goals and plans. Proverbs 16:3 says, “Commit your work to the Lord, and your plans will be established.” Plans should start with a goal.

Jesus also made it clear that you should think about the details for decisions you make. In Luke 14:28 he said, “For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it?” The context of this was about counting the cost of being a disciple. While it is often costly to follow Jesus, I can say without reservation it is also the most rewarding way to live and to invest for eternity.

Jesus also said you should start with the number one priority: Matthew 6:33: “But seek first the kingdom of God and his righteousness, and all these things will be added to you.”

Our church in Verona Wisconsin is considering whether or not we should undertake a costly and significant building project. I think it is aligned with seeking God’s kingdom for the benefit of this generation and the generations to follow. The church was started in 1855, and hundreds of people sacrificed so that we would have resources today that many other churches do not have.

Good Investing Goals

Investing goals should be specific, measurable, achievable (but not easy), relevant, time-bound, and flexible.

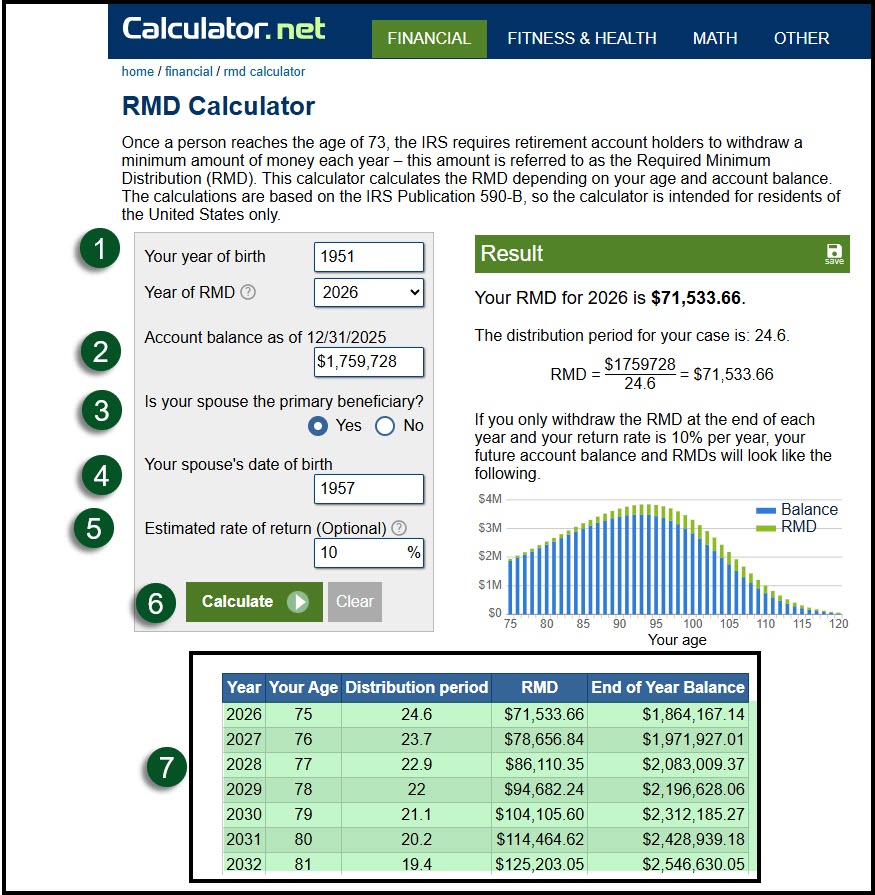

A good investment goal should be specific. Clearly defining what you want to achieve is the first step. Rather than stating a vague goal like “I want to have more money,” specify the amount and purpose, such as “I want to have growing dividend income that will cover my RMD each year without selling our investments.” That means the traditional IRA dividend income should be at least $70,000 per year.

Your goal should be measurable. You should track progress. For example, if I am aiming for $70K in dividend income ten years before retirement, and my current income from my IRA is $50K, then I need to examine my investments and think about how I will reinvest my dividends to reach the goal. Of course this also assume I will be picking quality dividend growth investments.

While it is wise to stretch yourself, your goal should be achievable. If you set a goal of 25% growth per year you aren’t likely to achieve your goal. However, it isn’t irrational to expect at least 10% returns on average over a ten-year period. Is your advisor doing that for you?

Goals should be relevant to your long-term objectives. The reason my goal statement says, “growing dividend income that will cover my RMD each year without selling our investments” is that I don’t want to have to sell any investments in a bear market or when one of my investments falls out of favor. This means I must be disciplined in my approach.

Too many people set “someday I will” goals. Those aren’t goals. Someday never comes for most people. Setting a specific timeframe for your goal is crucial. Your goals should contain as sense of urgency if you really believe in your goal. This will also help you budget carefully and spend prudently. It also helps you plan your investment strategy accordingly.

For example, “I want to build a retirement fund of $1.5 million by 2045” sets a clear time frame. My goal said it should cover my RMD. Well, RMDs are required minimum distributions when you reach a certain age (that depends on your birth year.) For me it was at age 73. For you if you were born after 1959 it would be age 75.

Finally, be flexible. The world is a crazy place. Market conditions can change, so it’s important to periodically reassess your goals and adjust them as needed. I found that my goal was too conservative, so five years into the plan I adjusted my dividend goal up from $60K to $80K.

Actionable Items

Do you like to live in a world of uncertainty? Then don’t think about goals or set them.

- What is your investment goal? Does this goal align with your purpose in life?

- Have you calculated your RMD based on your current traditional IRA or 401(k) balance? It isn’t hard to do.

Conclusion to Chapter Nine

A fool is sloppy and lazy in their dealings and plans. Proverbs 10:4 says, “A slack hand causes poverty, but the hand of the diligent makes rich.” Perhaps you aren’t lazy, but perhaps you need to change your goals or set some goals.

Helpful Resources

Seeking Alpha Subscription Information

Of all of the resources I use for long-term thinking related to investing, the most helpful is Seeking Alpha. Mutual funds do not have QUANT ratings. This makes them less likely for me to recommend as a part of your investment portfolio. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

All scripture passages are from the English Standard Version except as otherwise noted.

Cool pictures of your church, then and now !

LikeLike