Don’t Miss Important Dates!

If you are a parent, grandparent or a spouse, there are important dates. You don’t want to miss them. Birthdays, anniversaries, holidays, and appointments are all important. If you miss any of these you may find yourself facing disappointment and sometimes great sadness. For example, July 3 of every year is very significant. In fact, on July 3, 2026 Cindie and I will be celebrating our fiftieth wedding anniversary.

Departure dates also matter. Cindie, Noelle and I will be going to Costa Rica in March to celebrate a big day: Noelle’s graduation from high school. The date we fly from O’Hare airport is very important. If we aren’t at the United Airlines departure gate on the right date and at the right time, we may face lost or delayed opportunities. While we may find our calendars too full, there are some things we should not ignore.

Investing Dates for Your Monthly Checkup

It is not wise to miss important investment dates. There are a couple of dates that matter for the prudent investor. This includes those who invest in funds (ETFs and mutual funds), those who contribute to retirement accounts (traditional IRA and ROTH IRA accounts), and those who trade options. Investors in individual stocks like Amazon, Microsoft, Coca-Cola, Pfizer, Google, and Conagra would do well to pay attention to dividend and earnings dates.

Here is an important concept for all investors: Time in the market is far more important than timing the market. By that I mean a good strategy is to buy quality investments without too much focus on trying to time the best date or time to invest.

Even so, there are some important dates to remember. Key dates for investors include the ex-dividend date, which determines eligibility for dividend payments, and deadlines for contributions to retirement accounts like 401(k)s and IRAs, typically by December 31 each year. Additionally, important earnings report dates and tax-related deadlines can significantly impact investment strategies.

ROTH Conversions

Dates for ROTH conversions matter for at least two reasons. First of all, if the investment you convert pays a dividend, you move the income to the ROTH IRA. That income, when withdrawn, is not taxed. You pay the income tax in the year that you do the conversion.

In addition, if you complete the conversion before the end of the year, and if you have to take RMDs the following year, you are reducing the RMD dollar amount by the value of the assets you converted. For example, I converted 300 shares of CAG on December 12. That reduced my traditional IRA account balance by $5,325. I also converted 500 shares of GAIN, further reducing my IRA balance by $6,980. Future dividends from these shares are now tax-free. In addition, $12,305 of value was removed from my T-IRA and this will have an impact on my 2026 RMD.

An added benefit for each conversion for options traders is that those shares can now start to earn options income that will not face income taxes. The income from the options trades can grow exponentially. For example, I now have 2,600 shares of CAG in my ROTH IRA. That means I can create up to 26 options contracts on those shares. If one options contract can earn me $25, then 26 contracts can earn me $650. If I do that each month the amount of additional income can be significantly more than what I would get just from the dividends.

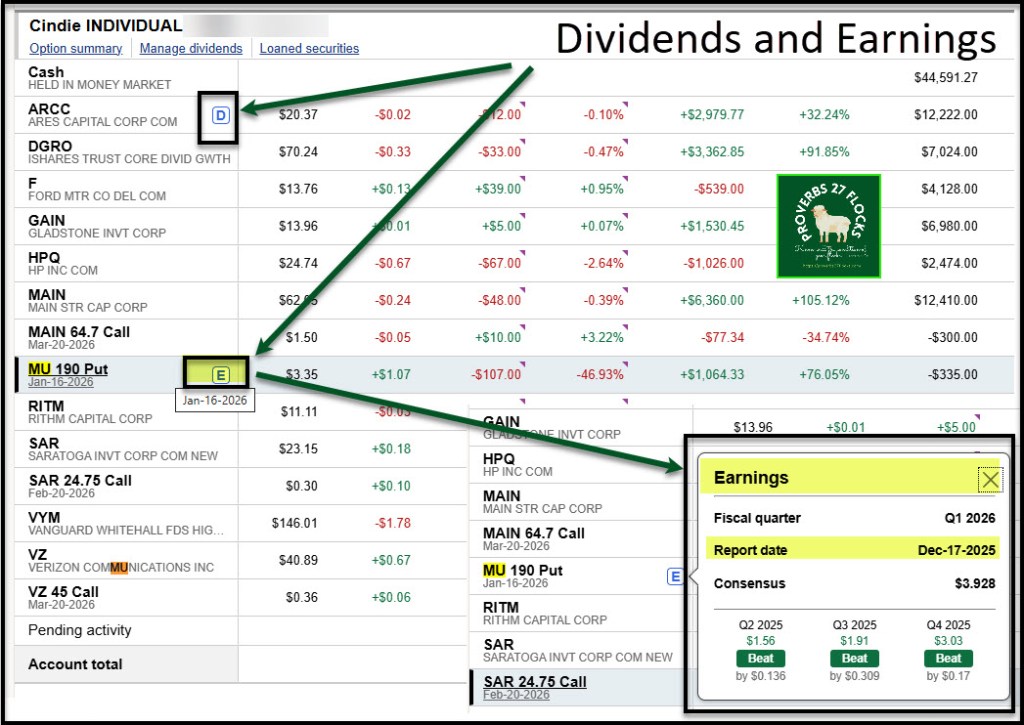

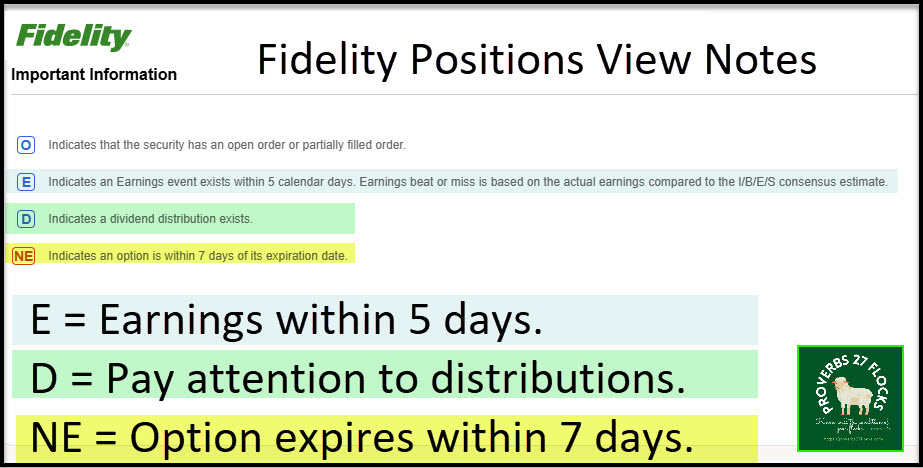

Earnings Dates

Long-term investors don’t need to spend a lot of time thinking about the next earnings date. However, for Fidelity investors, a quick review of your Positions page can quickly show you investments that have earnings dates in the next five calendar days. While it is rare that I buy an investment based on the earnings date, I do sometimes add shares before the earnings date if I believe the news will be positive. Even a positive earnings announcement is not a guarantee that the stock price will go up. If the company also expresses doubts about the next twelve months, investors could sell in a panic.

Think Strategically about Earnings Dates

Perhaps the best strategy may be this: if you want 100 shares of an investment, buy 50 shares just before the earnings are announced. Then buy another 50 after the announcement, especially if the shares drop in price.

For options traders (covered call and cash covered put options) knowing the earnings date can be helpful before you create an options contract. It really boils down to whether you think the share price might go up (this influences your price for covered call options) much higher than the contract price you pick. In general, I believe it is best to wait until after earnings are announced to enter into a new covered call options contract.

Dividend Distributions

Fidelity also flags positions with a “D” for dividends. If you click on the “D” you can see the Ex-dividend Date, the Pay Date, the dividend amount per share, and the Estimated Annual Income for that position. When I do this for BCSF in my ROTH IRA, I can see that BCSF has an Ex-Dividend Date of December 16, a Pay Date of December 30, a dividend of $0.42 per share, and an estimated annual income of $1,800 on my 1,000 shares.

While knowing this information helps me with options trading, it also keeps me from overreacting to market downturns or following others who are selling due to the latest panic. I certainly don’t want to sell a quality long-term investment before the dividend is mine. I also don’t want to enter into a covered call option contract just before the Ex-Dividend date.

Which Months Are Best for Buying?

According to a Fidelity Investments article, “Data shows November through April is the best 6-month period for stocks.” Mark Twain was a notoriously bad investor. He suggested that there are some months that are tough for investors. He wasn’t far from wrong. The problem with Twain’s investing strategy was that he chased big and risky home run wins instead of focusing on quality singles and doubles. I have found it best to gradually buy shares throughout the year, rather than to try to figure out what the market might do in any given month.

December 31 Reminders

A wise investing checkup in December involves four main activities.

- Tax Loss Harvesting: If you have a position in a taxable account that has lost value and you doubt that things will get better, it may be best to sell before the end of the year and take the loss. That may have some tax benefits if the loss is a long-term capital loss.

- RMD Withdrawals: If you are required to take RMDs, then don’t delay (or you will be penalized.) The deadline for taking your required minimum distribution (RMD) for 2025 is December 31, 2025. If you turned 73 in 2024, your first RMD can be delayed until April 1, 2025, but you must also take your second RMD by December 31, 2025.

- QCD Contributions: If you are 70.5 years old, then you have an opportunity to increase your charitable gifts from your T-IRA in 2025 up to $108,000. This can accomplish three things: It can reduce next year’s RMD, it can cover this year’s RMD (if you haven’t already done so, and it reduces your Adjusted Gross Income. That means those dollars, up to the annual limit, are not taxed. Be careful with this. If the charity delays cashing the check until 2026 it won’t count in 2025.

- RMD Reduction: Wise retired investors also maximize opportunities to reduce the next year’s RMD. This gives me more wiggle room for ROTH conversions the next year. After the RMD is satisfied I can restart the ROTH conversion efforts.

- IRA Contributions: Although the ROTH and IRA contribution deadline for 2025 is April 15, 2026, it can be beneficial to get that done in 2025. You probably already know what cash you have available. That cash could start growing as an investment in the IRA or ROTH.

Some Helpful Resources

Navigating Market Timing In 2026 – Russell Investments

“In today’s macro environment, we believe institutional investors are well served by understanding the trading dynamics that form around key market dates – insight that can help them prepare for more effective portfolio implementation.” – Seeking Alpha

Don’t Call It Market Timing. But These Are the Best Months to Invest.

By Mark Hulbert July 22, 2025

“The new study has a number of investment implications: The first is that jumping willy-nilly into the stock market anytime you find extra cash in your checking account is a far cry from investing according to a well-thought-out financial plan.” – Barrons

Some Useful Calendars for Investors

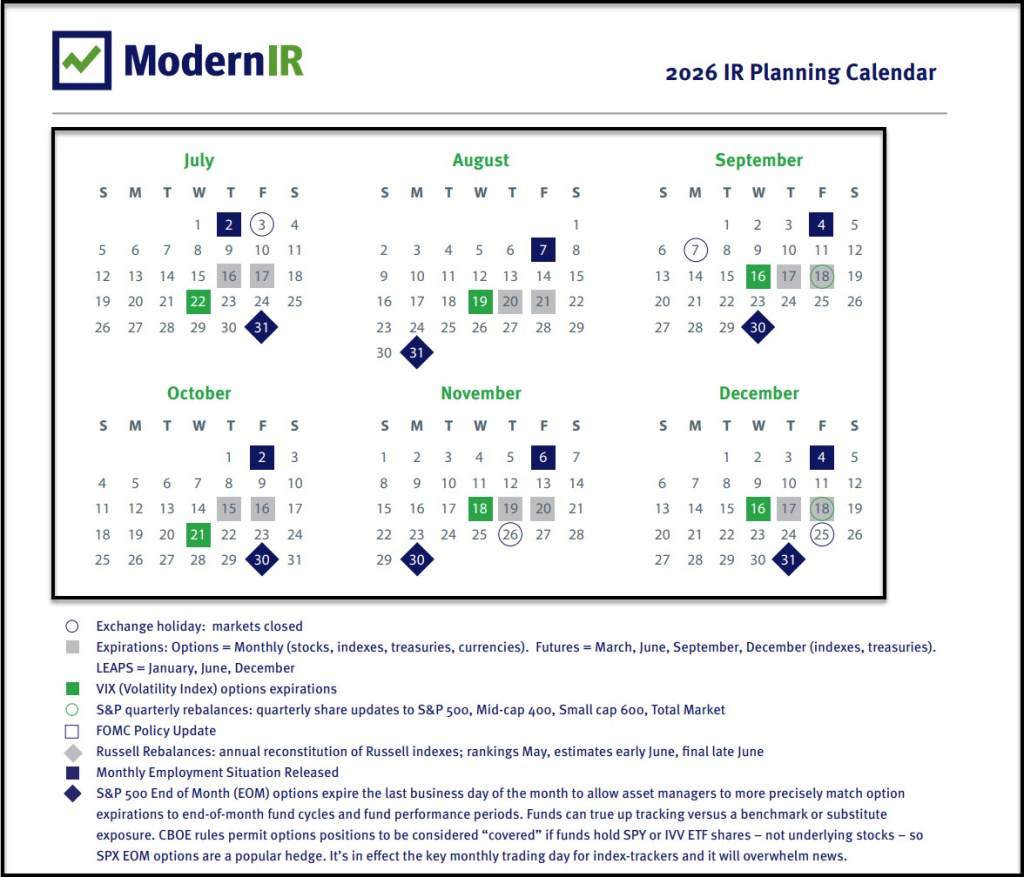

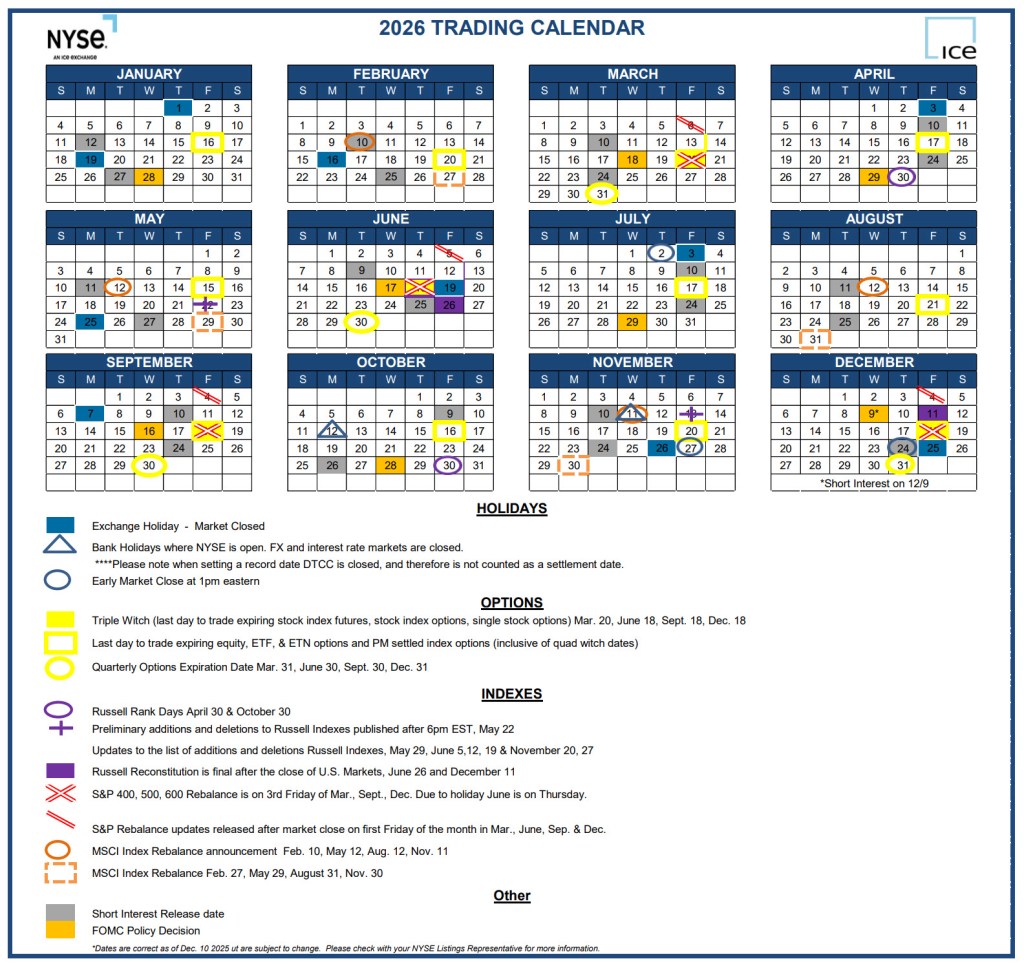

It is possible to trade weekly options on some stocks like The Coca-Cola Company (KO). Others, including stocks and ETFs only have monthly options. For example, VYM (Vanguard High Dividend Yield Index Fund ETF Shares.) only trades monthly options. The most important date for monthly options is the third Friday of the month. That will be the expiration date for any option trade for options that trade monthly.

Actionable Items

Do you have a retirement income strategy? If I had to guess, at least ninety percent of investors do not. You may be in the ninety percent. Perhaps you would do well to do a “Wise Investing Checkup” on your investment income.

Here are some questions you should ask yourself:

- Are my traditional IRA assets set up in such a way that when you must start taking RMDs you won’t have to sell assets during a down market? The goal is to cover the RMD and not sell assets during bear markets.

- If you qualify, do you have a giving strategy that can be leveraged to reduce your income taxes using QCD giving?

- Do you have a buy strategy that includes Ex-Dividend dates and earnings dates? It can help you to think about these dates when adding investments to your portfolio.

Conclusion to Chapter Six

When you reach the RMD age (when you must start withdrawals for a traditional IRA), it is imperative that you don’t neglect this task. If you do you will pay a penalty. Building a routine for charitable giving and investing throughout the year helps you set a rhythm that will keep you focused and minimize surprises and mistakes.

Footnotes and Definitions: The world of dividend investing.

- Ex-Dividend Date: The cutoff date to be eligible for the next dividend payment. Stocks purchased on or after this date do not receive the upcoming dividend.

- Record Date: The date on which a company identifies its shareholders eligible to receive the dividend.

- Earnings Date: The date the company reports on their quarterly earnings.

Final Thoughts

The best way to invest is to be consistent throughout the year. Don’t focus on dates unless you have a good reason to do so. The one exception as the year comes to an end is December 31. Don’t miss that date.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. Mutual funds do not have QUANT ratings. This makes them less likely for me to recommend as a part of your investment portfolio. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com