Dividend Income Progress

There is a common misconception that a focus on dividends is not possible without sacrificing total returns and the growth of your investment portfolio. Part of the problem, I believe, is that the power of using those dividends to expand and increase your investment portfolio is not appreciated. If, for example, you purchase investments with growing dividends, those additional dividends create opportunities to buy more of the same or of other investments with growing dividends.

If you accept the premise that you might get too old or too weak or sickly to work in the future, then you must be thinking about where you will find income. There are a few ways to gain income. They include selling investments to raise cash (be sure to sell in a bull market), dividends from investments, Social Security, and (for some) a pension. You can also have income from your business or from real estate. Some of these are “easy” and some of these continue to require a lot of work and good timing. Bear in mind that when you are my age or older, your stamina and ability to think clearly may diminish.

Does Dividend Growth Investing Really Work?

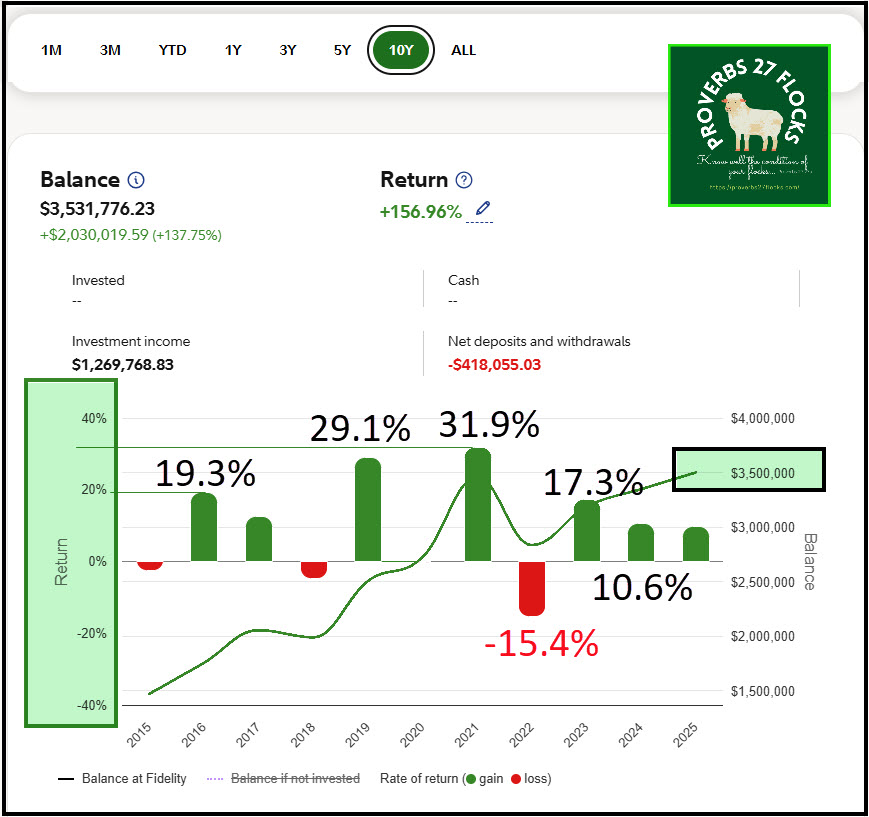

The following image from Fidelity illustrates my point about a dividend growth approach. The last ten years (plus YTD 2025) have had peaks and valleys. In four of the years our returns exceeded 17%. Three of the remaining years had acceptable returns of about or a bit more than 10%. The worst year was 2022 at a negative 15.4%. 2015, 2018, and 2020 were all slightly down. This is to be expected. The stock market is characterized by ups and downs.

What Work Can Dividends Do?

The goal I propose is “easy income.” I like to think of this as an income strategy, so I call it the Easy Income Strategy. Dividends can be used in several ways to greatly increase your income before and during retirement and to grow your giving and portfolio at the same time.

Dividend Reinvestment

There are a couple of ways a prudent investor can invest incoming dividends. The first is to turn on automatic dividend reinvestment. This may be prudent if you want more shares of any or all of your investments. I prefer to have the cash arrive into the SPAXX money market fund so that it can be used in several different ways.

First of all, it can be withdrawn for spending or charitable giving. The other two favorite ways are to 1) buy more shares of the same or a different investment using buy limit orders or 2) to trade cash covered put options on stocks or ETFs that could be added if the price drops to the contract price.

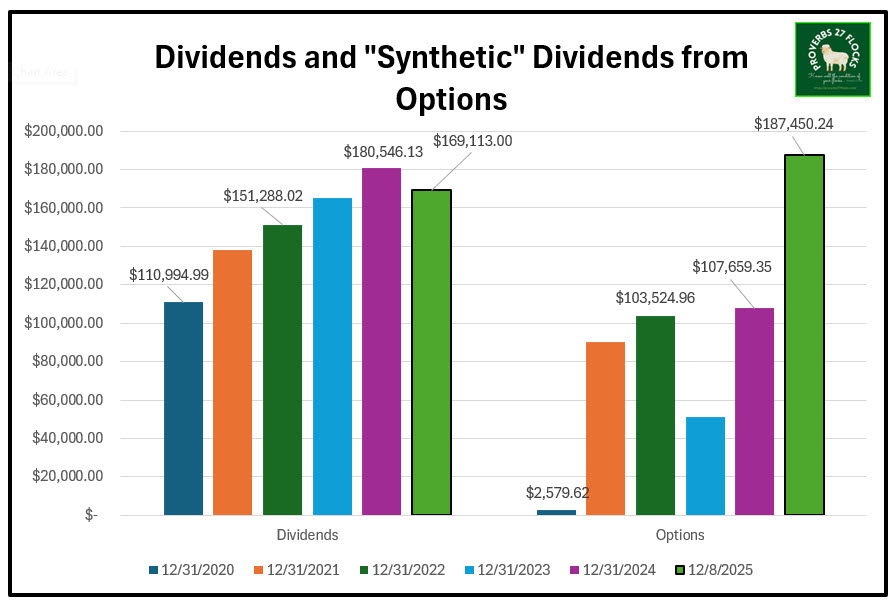

Dividend reinvestment creates a snowball of increasing dividends each quarter that builds a bigger dividend snowman. As the new shares are added they start to contribute to the next quarter’s dividend income. If the dividend increases, that increases the dollars available to continue to roll into even more income. Notice that in the down market the dividends still increased in 2022.

Portfolio Example: Cindie’s ROTH IRA

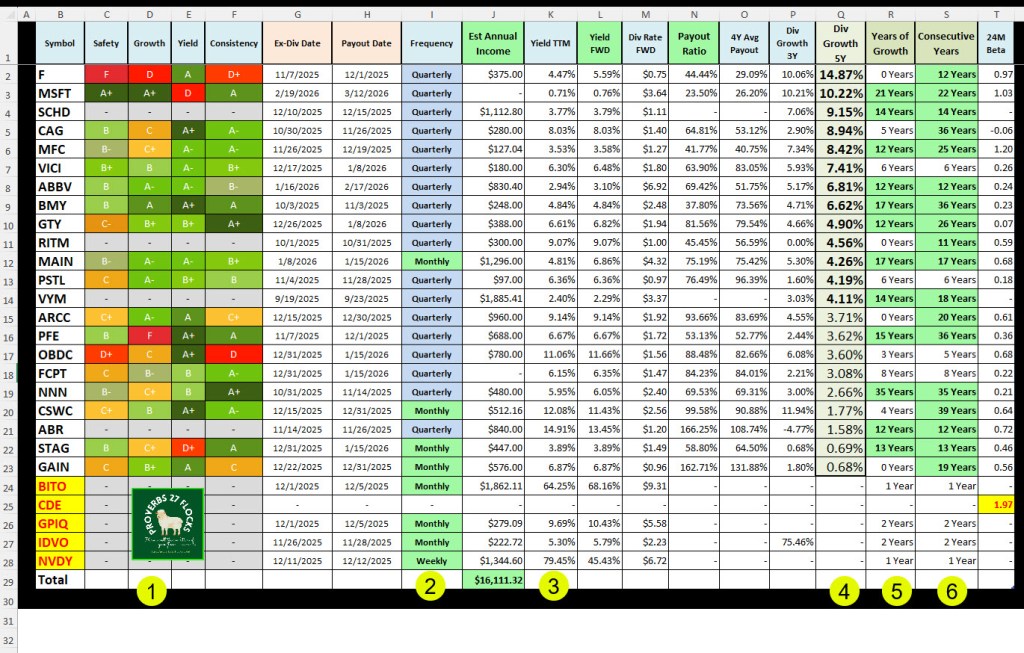

There are two ways I created income in my wife’s ROTH IRA account. The first is easy: dividends arrive monthly for some investments and quarterly for others. MAIN, GAIN, CSWC, and STAG all pay monthly. If you look at the columns labeled 1, 2, 3, 4, 5, and 6, you can learn quite a bit about her investments. First of all (1), the Seeking Alpha dividends ratings help me know if the dividend is “safe”, growing, has a decent yield and pays the dividend consistently.

I also want to know the frequency of the dividend (2) and the yield (3). Although I did not label column N, the Payout Ratio, that value is also an important consideration. However, for the purposes of this chapter, the 5-year dividend growth rate is most helpful (4). Thirteen of her holdings have a growth rate of at least four percent. Remember: inflation eats into your spending power, so having a growth rate that exceeds inflation helps maintain your buying power.

The years of dividend growth (5) and the consecutive years the dividend has been paid (6) are also worth considering. You may want to avoid buying investments that don’t have history that suggest dividend consistency and growth.

A Closer Look at Her Holdings

There are five holdings displayed with a bright yellow background: BITO, CDE, GPIQ, IDVO, and NVDY. These are certainly much higher risk cryptocurrency or leveraged ETFs, but they are a relatively small percentage of the total investments Cindie owns.

The investments paying a dividend are F, MSFT, SCHD, CAG, MFC, VICI, ABBV, BMY, GTY, RITM, MAIN, PSTL, VYM, ARCC, PFE, OBDC, FCPT, NNN, CSWC, ABR, STAG, and GAIN. In this list there are technology stocks, ETFs, BDCs, health care companies, REITs, consumer, and financial stocks. Diversification is important. Cindie’s largest ROTH investment is VYM, which is 26% of her total account. MSFT is second with 15% of the total. SCHD, ABBV, and MAIN are also a large portion of her investments.

There are two pieces of income in Cindie’s ROTH: dividends and options income. $13,917 has been paid in dividends in 2025 YTD. The other piece is the “synthetic dividend” which comes from options trades. YTD options income is $4,850. Bear in mind that this income is all tax-free. $18,767 is a nice chunk of change for Cindie. This equals a “yield” on the total value of her account of about 6.3%.

Three Helpful Resources for Exploring Dividend Investing

If you are interested in a better understanding of the world of dividends, here are some additional resources. The first is from Kiplinger: “What is Dividend Investing.” The second is from Forbes: “Dividend Investing for Beginners.” The third is from Investopedia: “The Dividend Portfolio You Need.”

A Tool That Helps – Seeking Alpha

Seeking Alpha contains a wealth of information. You can link your brokerage or retirement accounts to Seeking Alpha to get a comprehensive view of the quality and nature of your holdings. That is how I created the spreadsheet for Cindie’s ROTH IRA. There are links at the end of the post for receiving a subscription discount.

Actionable Items

Do you have a retirement income strategy? If I had to guess, at least ninety percent of investors do not. You may be in the ninety percent. Perhaps you would do well to do a “Wise Investing Checkup” on your investment income.

Here are some questions you should ask yourself:

- What are my total dividends for the last five-to-ten years? Are they growing?

- Which of your investments do not pay a dividend? Do you have a strategic reason for those investments? When you enter retirement, how will those investments provide income?

- Do you have automatic dividend reinvestment turned on? Is this the best tactic for all of your investments?

- Can your dividends cover the RMD you will have to take in retirement from tax-deferred IRA and 401(k) accounts? Do you understand why this may be prudent?

- Do you have the right dividend investments in taxable accounts? Do you know which ones might not be good in a taxable account?

- What income can you expect from a pension or Social Security? Will that cover your expenses in retirement? Will that income grow at least to cover inflation?

Like most things in life where big dollars are involved, procrastination is not a good idea.

Conclusion to Chapter Five

If you don’t have a dividend investment strategy, then you may not be ready for retirement. Perhaps you should at least review your strategy if you are 55 or older.

Footnotes and Definitions: The world of dividend investing.

- Qualified Dividends: are dividends paid by domestic or certain foreign corporations that meet specific criteria established by the IRS. These dividends qualify for lower tax rates, providing a tax advantage compared to ordinary dividends. Dividends from REITs (Real Estate Investment Trusts) and MLPs (Master Limited Partnerships) are typically not considered qualified dividends. Therefore, it is best to hold REITS in your ROTH IRA or Traditional IRA accounts. To be considered qualified, you must hold the stock for a specific period: Generally, the stock must be held for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date.

- Dividend Yield: Measures the annual dividend payment relative to the stock price, typically expressed as a percentage. A higher yield may indicate a good income-generating opportunity but can also signal risk.

- Payout Ratio: Represents the percentage of earnings paid out as dividends to shareholders. A lower ratio can indicate room for growth, while a higher ratio may suggest potential sustainability issues.

- Dividend Growth Rate: Indicates how much a company’s dividend has increased over time, usually expressed annually. Consistent growth can be a sign of a healthy company.

- Ex-Dividend Date: The cutoff date to be eligible for the next dividend payment. Stocks purchased on or after this date do not receive the upcoming dividend.

- Record Date: The date on which a company identifies its shareholders eligible to receive the dividend.

- Dividend Reinvestment Plans (DRIPs): Allows investors to reinvest dividends to purchase additional shares automatically, compounding growth over time.

- Types of Dividends: Includes cash dividends, stock dividends, and special dividends, each with different implications for investors.

- Tax Implications: Dividends can be taxed differently depending on local tax laws and whether they are considered qualified or ordinary dividends.

- Dividend Aristocrats: Companies that have consistently increased their dividends for at least 25 consecutive years, indicating stability and reliability.

- Sustainable Dividends: Assess whether dividends can be maintained. Look for consistent cash flow, profitability, and solid financial ratios as indicators.

Final Thoughts

The best way to invest dividends is to reinvest them into additional shares of dividend-paying stocks or funds, which can compound your returns over time. Additionally, consider diversifying your investments across different sectors to reduce risk while focusing on companies with a strong history of increasing dividends.

Understanding Dividend Investing

Investing dividends can be a smart strategy for generating income and building wealth. Here are some key points to consider:

What Are Dividends?

- Definition: Dividends are payments made by companies to their shareholders, typically from profits.

- Forms: They can be issued in cash or as additional shares of stock.

Risks and Considerations

- Market Volatility: Dividend stocks can still be affected by market fluctuations.

- Discretionary Payments: Companies can reduce or eliminate dividends based on financial performance.

- Tax Implications: Be aware of how dividends are taxed, as this can affect your overall returns.

Investing dividends wisely can provide a steady income stream and contribute to long-term financial growth.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. Mutual funds do not have QUANT ratings. This makes them less likely for me to recommend as a part of your investment portfolio. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com