What Are Your 2025 Income Taxes?

Some of my readers probably have a professional prepare their Federal and State income tax returns. That is certainly understandable given the complexities of the tables and forms. It is also more complicated for a small business owner to handle the complexities of the tax system. However, I think most can accomplish this task at a far lower cost using software like TurboTax.

But I believe there is a bigger issue. Most don’t have a plan for income taxes. Even if you do let someone else do the work, it pays for you to think about income taxes proactively and to take action to minimize your tax burden. You can do that this year. You don’t have to wait until a month before your income tax filing is due. There are good reasons to do this.

The retired investor is often surprised by their total income tax bill. That is due to the complexities that are associated with IRA withdrawals and the various types of income that are the result of selling investments and receiving various kinds of dividends. You can make it much harder on yourself (or the tax professional) by ignoring taxes until the last week before they are due. This chapter will take you through some of the things I have seen as I help others and as I prepare for our own income taxes.

You Should Have a Tax Strategy

I think most investors miss several critical considerations regarding income taxes and their investments. Understanding these elements can significantly impact overall investment strategy, your true investment returns and the financial outcomes. For example, it helps to understand capital gains tax and dividend taxes for taxable accounts. There are also special considerations for long-term capital gains versus short-term capital gains.

Knowing your tax bracket can help you plan wisely for this year’s income taxes and future taxes. As you get older, the importance of this is often neglected to the investor’s harm. For example, if you don’t know your “AGI” (Adjusted Gross Income) when you are on Medicare, you may be surprised to see that your Medicare Part B tax will increase. That can decrease your Social Security income.

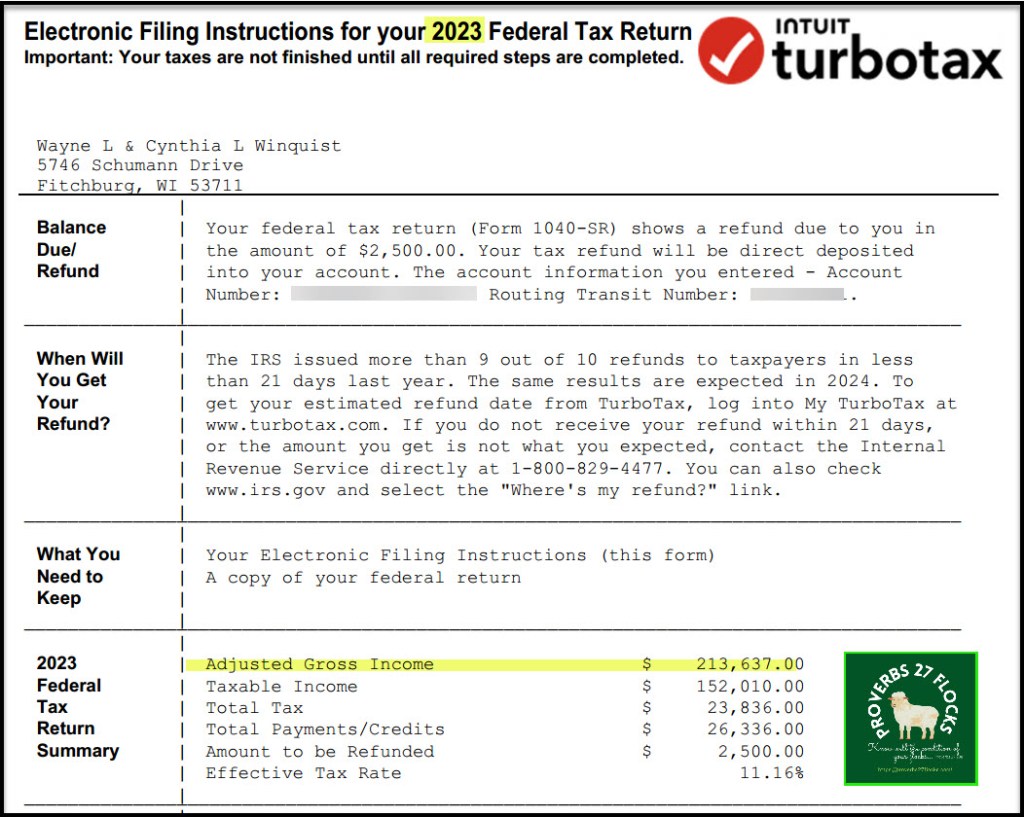

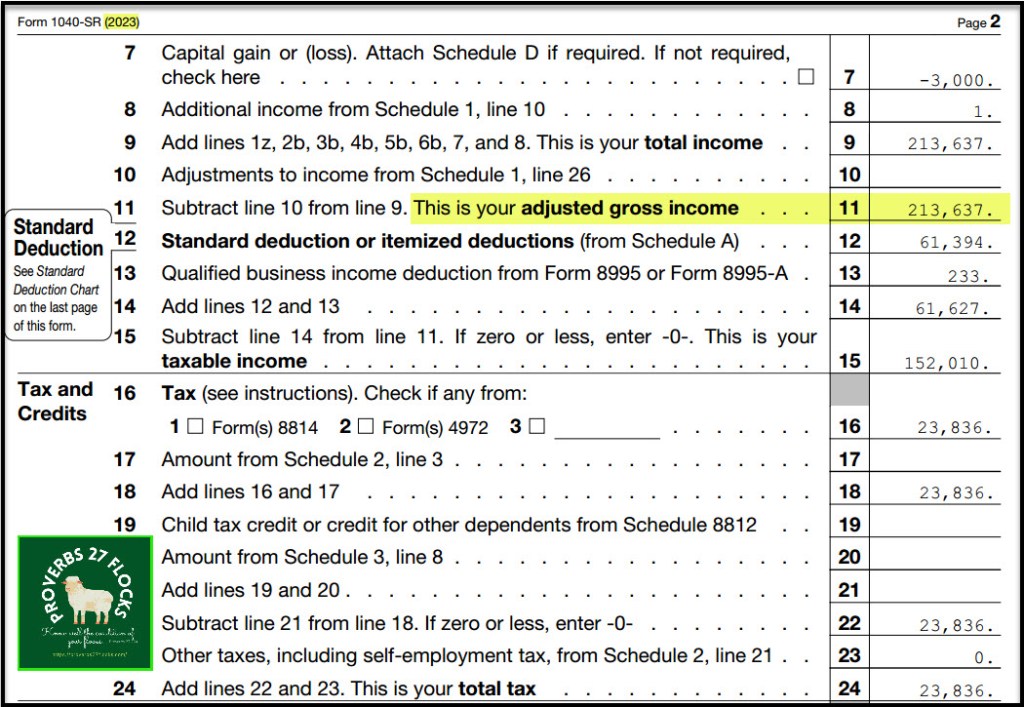

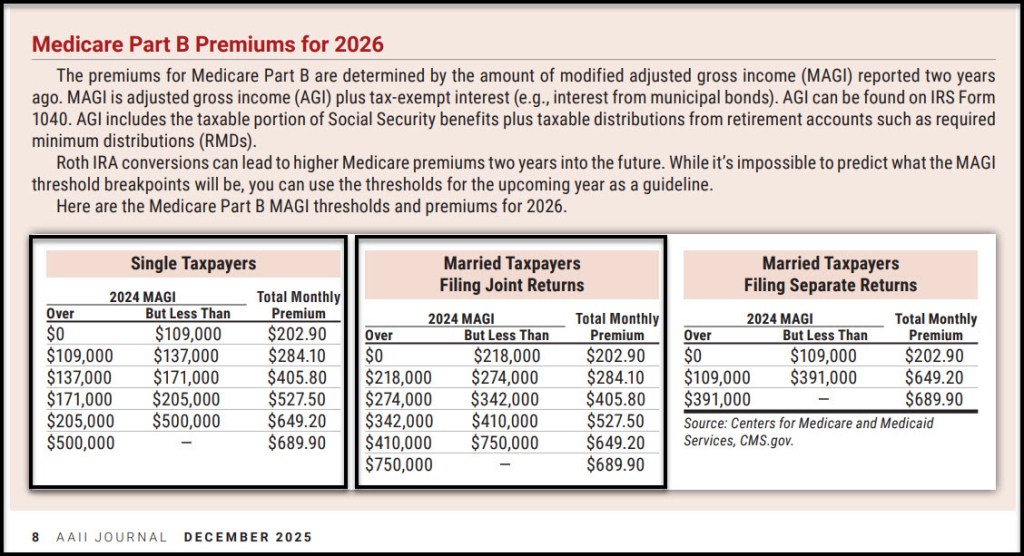

In 2025, the Income-Related Monthly Adjustment Amount (IRMAA) impacts Medicare Part B premiums based on your modified adjusted gross income (MAGI) reported two years prior. This means your 2025 premiums will be based on the income from your 2023 tax return. That sounds complicated, but it really isn’t. If you look at your 2023 income tax return you can find the AGI as a quick way to see where you fall. If you are married, filing a joint income tax return, you can avoid the extra Medicare tax by ensuring your MAGI is less than or equal to $212,000.

If your MAGI falls between $212,001 – $266,000, you will pay an additional $74 per month per person receiving Medicare. For Cindie and me, that means we pay $148 per month more than if we kept our income below the $212,001 level. You may quickly be surprised to see that the required minimum distributions, income from taxable accounts, and Social Security can easily push many over the base MAGI level. While you may not see it as an issue when you are in your first twenty years of working, this will creep up on many taxpayers who are uninformed and it certainly will be felt when you enter your retirement years.

Reducing Future Income Tax Pain Using ROTH Conversions

This is where prudent and strategic conversions of investments from a traditional IRA to a ROTH come into play. It should be obvious that a ROTH conversion is a taxable event. If you do a ROTH conversion, it increases your current year income taxes (most of the time) in the same way that an RMD from a tax-deferred IRA increases your income and income taxes. What most don’t realize is that as your IRA account grows in value (if you bought the right investments), your RMD increases as do your income taxes. To make matters more complicated, the RMD percentage also increases each year, compounding the income tax problem.

For example, my 2025 RMD was $71,425.50. This was based on my age and the balance in my traditional IRA on December 31, 2024. This year I have been continuing ROTH conversions after satisfying my RMD requirement. Because of this, my 2026 RMD is likely to be about $72,000. If I had not done the conversions, my 2026 RMD would have been at least $76,000. That is something I want to avoid. To save on income taxes, I used QCD giving to meet my RMD requirement.

Beneficiary Advantages of the ROTH Conversion

Roth IRAs can be advantageous for heirs, as they can inherit the accounts tax-free and won’t have to take RMDs during the original owner’s lifetime. If you love your family, then you should be thinking about how your investments might be taxed when they inherit your remaining assets in a traditional IRA or 401(k).

Think Two, Five and Ten Years Out

With that knowledge, the decisions you make should be for the next five years or even the next ten years. In addition, you should think two years out when it comes to the Medicare Part B premium costs. Remember, your Income-Related Monthly Adjustment Amount (IRMAA) impacts Medicare Part B premiums based on your modified adjusted gross income (MAGI) reported two years prior.

Therefore, your MAGI for 2025 can have an impact on your Medicare Part B premiums in 2027. In the same way, your 2026 MAGI will impact your 2028 Medicare Part B premiums. These add up. Having a ROTH conversion strategy can make a huge difference for both future RMDs and income taxes and for Medicare Part B premiums.

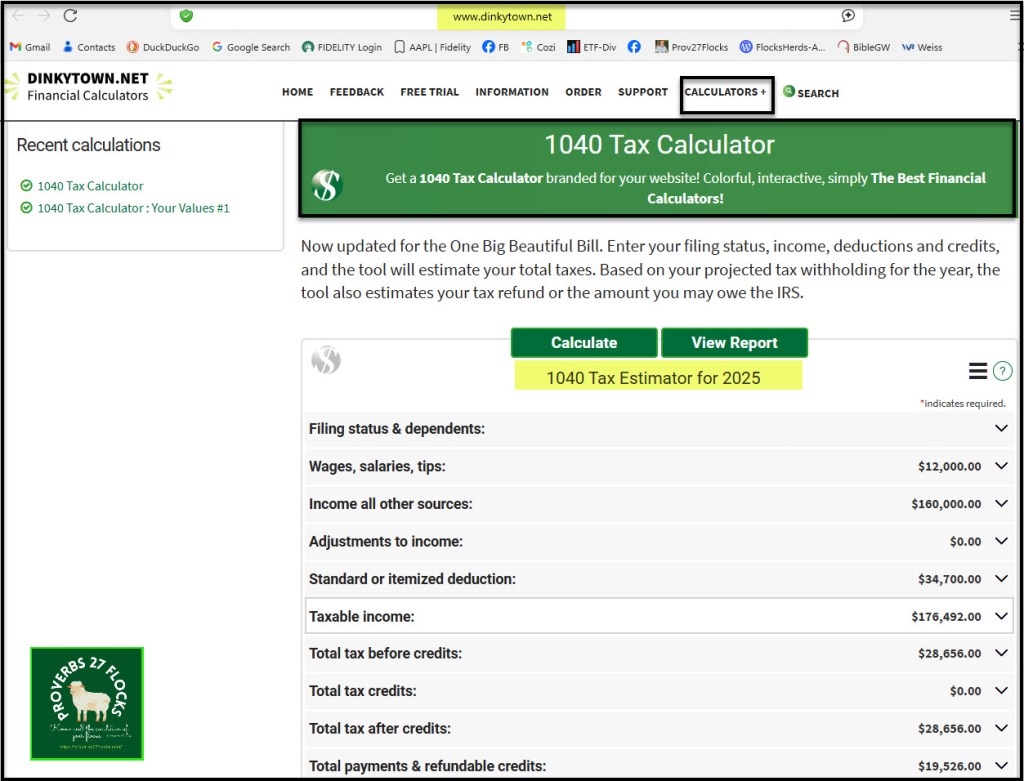

A Tool That Helps – DinkyTown

If you go to the Dinkytown website you can find a calculator that helps you prepare for your income taxes. This morning I helped a lady work through her expected 2025 total Federal income tax liability. We used the DinkyTown website to determine if her estimated tax payments and withholding from her pension were sufficient for her total income tax bill.

To get the answers we needed to know her total Social Security income (before the Medicare Part B premium deduction), her total pension income and income tax withholding from her pension, her capital gains on her taxable brokerage account, her dividends and interest from that account and any other income like the gains and dividends from her previous broker.

Because she is single, her MAGI maximum to avoid paying a higher Medicare premium is $106,000. We could quickly see that she should fall below that amount.

Key Points to Remember

- Two-Year Lag: Your 2025 IRMAA is based on the MAGI from your 2023 tax return. Therefore, your 2026 IRMAA will be based on your 2024 return, and your 2027 IRMAA will be based on your MAGI for 2025. (Aren’t taxes so much fun?)

- Sliding Scale: The surcharges are calculated on a sliding scale, meaning that even a minor increase in income can trigger a higher premium. If you go over the bracket by $1 you can wind up paying quite a bit more in Medicare premiums two years down the road.

- Medicare Part D: Similar IRMAA thresholds apply for Medicare Part D, affecting your prescription drug coverage premiums as well. (The government gives you an inflation adjustment for your Social Security and then quickly grabs it back in the form of Medicare premiums.)

Actionable Items

Learning more about your income taxes before you retire is a prudent use of your time. I suspect most income tax preparation services fail to deliver meaningful advice for future income taxes. I can say this with reasonable certainty given the people I have helped with their income taxes, including family members.

Here are the questions you should ask yourself:

- What will this year’s AGI amount look like? How does it compare to the 2024 amount?

- What can you do before December 31 to reduce your income tax liability or to minimize future income taxes when you must take RMDs from a traditional IRA or traditional 401(k)?

- What will my total income taxes be like when I start taking RMDs?

- If you are married, and you die before your spouse, what will his/her income tax situation look like when filing as a single person?

- Are you willing to pay more taxes this year to save taxes in the next ten years?

Like most things in life where big dollars are involved, procrastination is not a good idea.

Conclusion to Chapter Four

If you don’t have an investment strategy, then you are in a boat that might drift into dangerous retirement waters. In the same way, if you have no interest in your income taxes and don’t have a tax strategy, you may find future income tax payments and Medicare premiums rather frightening.

Footnotes and Definitions: you need to think about the big picture of the costs of your investments.

- AGI: AGI is your total gross income minus specific deductions, known as above-the-line deductions. These may include educator expenses, student loan interest, IRA contributions and tuition and fees.

- MAGI: Modified AGI is calculated by adding specific items back to your AGI. This figure is often used to determine eligibility for various tax benefits.

- IRMAA: Income-Related Monthly Adjustment Amount (IRMAA) impacts Medicare Part B premiums based on your modified adjusted gross income (MAGI) reported two years prior.

- RMD: Required Minimum Distributions are the mandatory withdrawals that individuals must begin taking from certain retirement accounts, such as traditional IRAs and 401(k)s, once they reach a specific age. These rules are established to ensure that retirees eventually pay taxes on the funds that have been tax-deferred during their accumulation phase.

- Long-Term Capital Gain: Long-term capital gains refer to the profits realized from the sale of an asset that has been held for more than one year. The treatment of these gains is particularly favorable under U.S. tax law compared to short-term capital gains, which apply to assets sold within a year of acquisition.

- Short-Term Capital Gain: Short-term capital gains are the profits generated from the sale of an asset that has been held for one year or less. These gains are treated less favorably under U.S. tax law compared to long-term capital gains, which apply to assets held for over a year.

- Qualified Dividends: are dividends paid by domestic or certain foreign corporations that meet specific criteria established by the IRS. These dividends qualify for lower tax rates, providing a tax advantage compared to ordinary dividends. Dividends from REITs (Real Estate Investment Trusts) and MLPs (Master Limited Partnerships) are typically not considered qualified dividends. Therefore, it is best to hold REITS in your ROTH IRA or Traditional IRA accounts. To be considered qualified, you must hold the stock for a specific period: Generally, the stock must be held for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date.

- ROTH Conversion: A Roth conversion refers to the process of transferring funds from a traditional retirement account, such as a Traditional IRA or 401(k), into a Roth IRA. This strategy can provide significant tax advantages, especially in retirement.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. Mutual funds do not have QUANT ratings. This makes them less likely for me to recommend as a part of your investment portfolio. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com