Stealth Wealth Termites

Advisors and Termites

Most investment advisors or financial advisors really don’t want their clients to think about the fees they charge year-after-year. They also don’t want them to see how the fees actually grow over the decades as their client balances grow. Of course, some advisors cause account balances to decline, but most have a desire to help and to grow their client’s investments. This is certainly in the advisor’s best interest. What is not obvious to most clients is the total cost keeps increasing while the work that is being done is often decreasing. This causes hidden wealth destruction. It is akin to the damage done by termites (or carpenter ants) on homes.

“One of the reasons termites are so destructive is their ability to remain undetected for long periods. Unlike other pests, termites often invade a structure from underground, entering through the foundation. As they slowly munch away at wooden structures, a homeowner may remain unaware until the damage becomes substantial. This stealthy nature allows termites ample time to consume and weaken wood structures from the inside out.” Source: Why a Termite Infestation Is So Destructive

Do you have termites eating away at your investments? How many termites do you have?

A Quick Review of Chapters 1-2

This is the third chapter of my wise investing checkup series. In the first chapter the focus was on mutual fund costs and the different share classes. There are viable lower-cost alternatives to just about every type of fund I have considered. Furthermore, the results offered by high-cost actively managed funds rarely beat the results you can achieve with low-cost funds. Most investors do not pay attention to these costs and even fewer really understand how the costs compound over time.

In the second chapter the focus was on broker fees. Management fees and account maintenance fees are common. The bottom line when it comes to fees is that they reduce your bottom line. I would argue that most of the fees are unnecessary. They reduce your potential total income. Some might argue that the advice they receive is necessary because they believe they don’t know enough or cannot easily know enough to make investment decisions on their own.

There are many benefits that come from knowing more about just about anything in life. One of the reasons there are various mathematics classes is that those classes equip individuals with tools and strategies for effective problem-solving and critical thinking. For example, algebra is useful in finance, science, construction, and engineering. Geometry is helpful for architecture and construction. Trigonometry can be useful in physics, navigation and engineering.

It saddens me that so much time is spent on these helpful and essential tools in our high school curriculums and very little is done to teach some of the “mathematic” basics of investing. Rarely do I find an adult who understands the “Rule of 72” or other key mathematical realities of the investing world.

A Real-Life Example

In January 2020 I met with someone I will call “Bob.” Bob had an investment advisor at a bank who was costing him far more than Bob was receiving in results. His advisor at the time was a major banking firm that shall remain nameless. I remember that when Bob tried to move his $250,000 retirement account from the big bank to Fidelity Investments the bank did everything they could to stop and delay the transfer. It was frustrating and it was a peek into the world of the big bank.

I spent quite a few hours providing Bob with the basics he needed for moving forward without the high costs. He sold the bad investments and added in low-cost ETFs with the potential for growing dividends. Then, about two years later, Bob called me to tell me he was considering moving his accounts from Fidelity Investments to a Big Insurance Company (BIC). Many alarm bells rang in my head. The reason for this is quite simple. There are some types of businesses (banks and insurance companies come to mind) that have high investment costs and deliver mediocre returns. They make a lot of promises and the promises sound sweet and “easy” for the naïve investor.

My Recommendation for Bob

Hoping to protect Bob, I had only one request. I asked Bob to ask the BIC insurance guy to send him a list of all of their fees. It was my hope that when Bob saw he was returning to the world of termites he would put a stop to the move to the big insurance company (BIC).

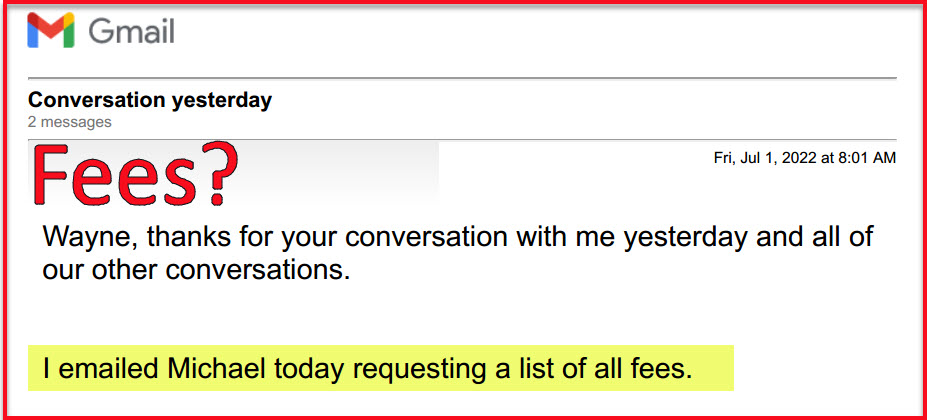

Sadly, he did not appreciate the high costs and moved forward to doing business with the insurance company. I saved portions of the insurance provider’s email for future reference. These responses are not atypical. I’ve seen this multiple times with various individuals and their advisors. I want to talk about the following four images from Michael at “big insurance company.”

Image One: The Total Extra Cost

The cost was 1.25% or $2,500 per year on the $250,000 Bob would transfer to “BIC.” One of the “benefits” the insurance guy offered was “tax loss harvesting.” That is a polite way of saying “we will probably buy some investments that will lose money, but we can always sell them and that will help you cut your income taxes.”

Michael also offered to move the traditional IRA holdings to a ROTH for lifetime tax-free income. That type of service is easily done by any investor on the Fidelity Investments website. I’ve done it multiple times. It costs nothing to do and can be done in less than five minutes.

The third piece was “daily active management of the majority of the portfolio.” If you really believe this, you are a chump or dupe. Advisors who are worthy of their client’s trust don’t actively manage anyone’s portfolio on a daily basis. Then, to add “significantly increased diversification” to the equation is another nonvalue add to explain the $2,500 annual fee. Any good set of low-cost ETFs can easily meet this requirement.

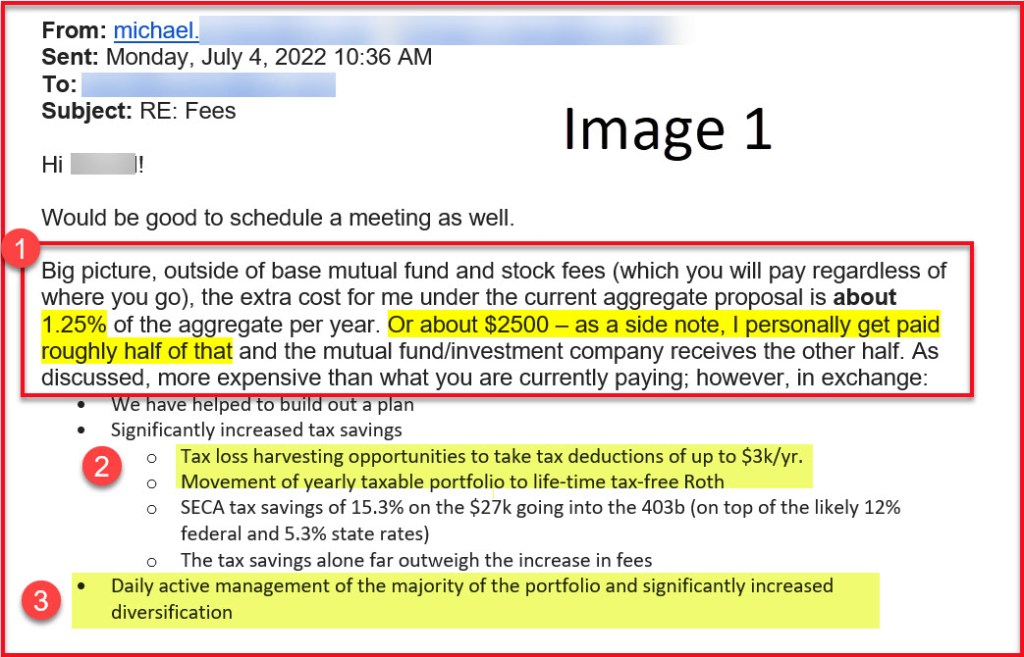

Image Two: Brokerage Accounts

BIC Michael says brokerage accounts will be for “buy and hold.” He wasn’t going to be watching this account, so he has selective oversight and not a view for the big picture. Note that he does not specify the actual costs of the “non-institutional mutual funds” but does acknowledge that there are fees and commissions which he discusses later in the email. This is how “the advisor gets paid.” Sadly, the advisor is already receiving income from the account management piece of $2,500 per year. This type of double-billing is quite common, and it adds up over time.

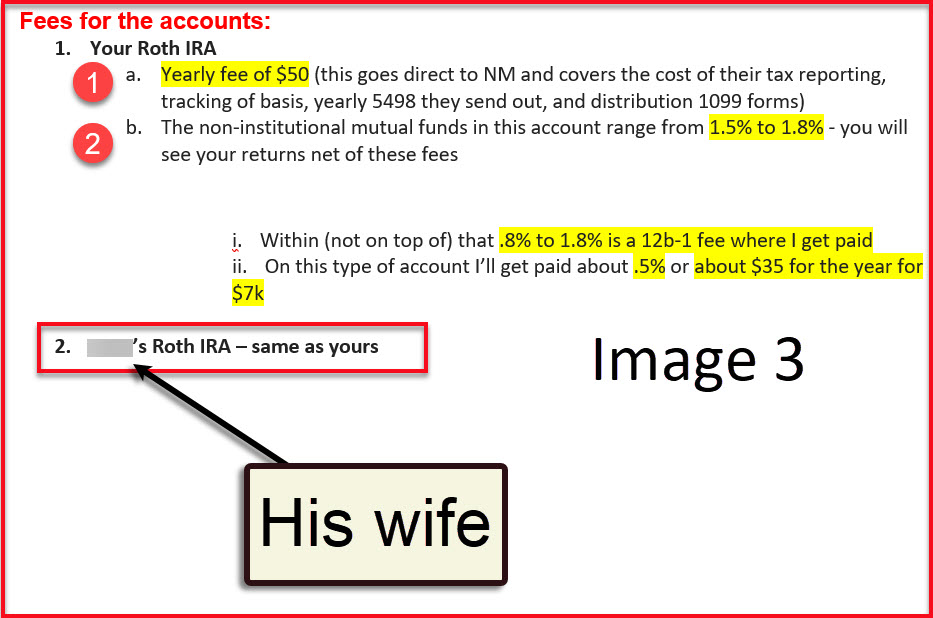

Image Three: Fees for the Accounts

There is a $50 per year fee for Bob’s Roth IRA and then another $50 per year fee for his wife’s ROTH IRA. This “fee” supposedly covers tax reporting and the distribution of tax forms.

Stop and think about this. These forms are provided by Fidelity Investments at no cost. Therefore, after ten years, at $100 per year, Bob and his wife are paying $1,200 to receive income tax forms that are computer generated and require, at the most, some paper and postage to send to Bob and millions of other clients. It is no wonder they love to charge Bob for this “service.” Most of these forms are now a PDF download, so there is no need for postage, paper and an envelop.

To add insult to injury, there is another $35 per year fee for $7,000 invested. The same is true for Bob’s wife. Therefore, the total is $70 per year or at least $700 for ten years. This assumes, of course, that the balances in the ROTH IRAs stay at $7,000. If they do that, why is Bob paying almost $2,000 over ten years for these services?

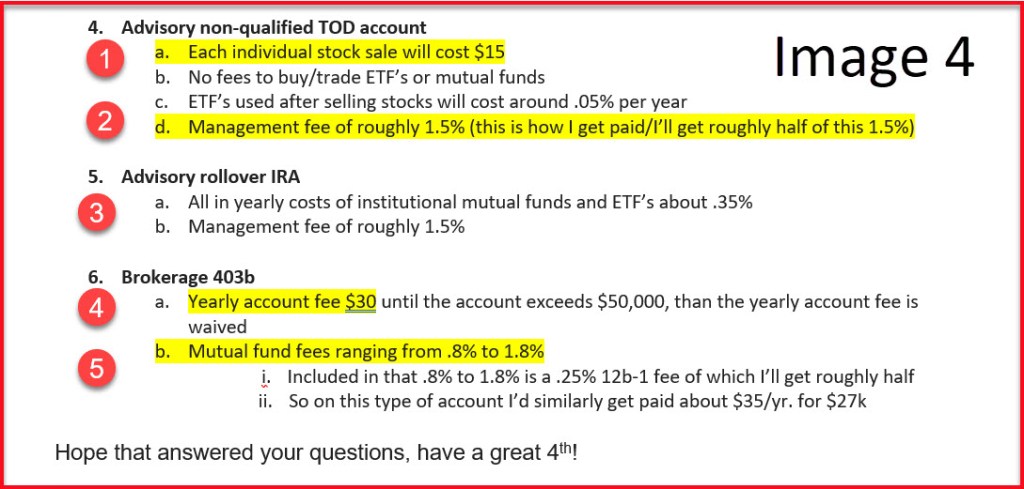

Image Four: Fees and More Fees

I don’t want to spend much time on this one, other than to say that charging $15 to sell (or buy) a stock is not only irrational, but also an open door for too much trade activity for multiple $15 commissions. Fidelity charges nothing to buy or sell any stock if you enter the buy or sell order on your own. This is not hard to do.

While it is still hard to know the total fees and commissions Bob and his wife will pay during the years the BIC takes care of them, rest assured it is a very big number. That is the reason Michael broke out the details so that most of the numbers didn’t look like a big deal. If I had to guess, Bob would pay at least $30,000 for these services over ten years. It will be much more if their investments grow at an average rate of 8-10% per year. (I find that highly unlikely, as their advisor probably put at least 40% of their assets in bond mutual funds.)

Now ask yourself a practical question or two. How many nice trips could you take with $30,000 in ten years? Would you like to spend $2,500 on a trip this year instead of giving the money to someone else? Wouldn’t it be nice to be able to donate $30,000 to a charity that you support? Do you think you could buy some nice transportation for $30,000? Don’t forget the time value of money. The $30,000 was earning interest and/or dividends for each $3,000 you saved each year.

If you don’t care about advisory fees and having money for vacations and large purchases, then you can ignore this chapter. If you do care about them, then I suggest the following action items.

Actionable Items

I suspect you will have a hard time getting your advisor to come clean about total costs. Note that Michael did not, in his email, total up the costs Bob had to pay. This is by design. Michael doesn’t want you to know the total. However, if you have an investment advisor, ask the following questions:

- What is the total cost of your advisory fees?

- What are the annual account management fees?

- What do you charge for stock, ETF, and mutual fund transactions?

- Is there a front end or back-end load on any of the mutual funds you will recommend? What are the loads? What will that cost?

- If my account doubles in value in seven years due to the Rule of 72 and 10% annual returns, what will I pay in total for all of the previous fees and commissions?

When you get the answer (if you get the answer) be prepared to be shocked. It isn’t uncommon for these costs to grow each year without a corresponding change in the effort your advisor puts on your account. Remember this: he or she is doing this for hundreds of clients. In all likelihood he is doing the same thing for all of you.

Conclusion to Chapter Three

Many of you took algebra in high school. You devoted hours to understanding the different formulas and then apply them in word problems designed to get you to think critically and carefully when solving problems. Perhaps you should do a bit of math when it comes to the costs of investing. You need to be able to understand the return you receive for the dollars you invest with the help of an advisor. If they don’t deliver more than what you can get from a broad stock market index fund, then why pay the $2,500?

Footnotes and Definitions: you need to think about the big picture of the costs of your investments.

- Commissions: Charges for executing buy or sell orders. This can be a flat fee or a percentage of the trade amount.

- Management Fees: Ongoing fees charged for managing investment portfolios, often calculated as a percentage of assets under management (AUM).

- Account Maintenance Fees: Regular fees for maintaining the brokerage account, sometimes waived if minimum balance requirements are met.

- Load Fees: Fees associated with mutual funds, usually taken from the investment amount upfront (front-end load) or at sale (back-end load).

- Transaction Fees: Charges for specific transactions, such as options trades or international trades.

- Inactivity Fees: Fees for accounts that remain inactive for a set period.

- Withdrawal Fees: Charges for withdrawing funds from the account, particularly for wire transfers or checks.

- Margin Fees: Interest charges on borrowed funds used for margin trading, usually calculated daily. Avoid using margin for your investing. Don’t sign margin agreements under any circumstances.

- Research and Data Fees: Costs for accessing premium research, market data, and analytical tools. Some brokers offer free resources, while others charge for advanced information.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. Mutual funds do not have QUANT ratings. This makes them less likely for me to recommend as a part of your investment portfolio. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com