Chapter 1: Think About Total Costs

This Costs You Tens of Thousands

What does it cost to live in your home, condo, or apartment? The average person has absolutely no idea. Perhaps the first thought is the monthly rent for apartment dwellers and the monthly mortgage payment for those who own a home or condominium. That falls dreadfully short of the mark. There are other ongoing costs, not the least of which is homeowner’s insurance and in many cases, property taxes. Renters may think they only pay the landlord, but the reality is that the landlord is charging them for the property taxes and insurance for the building as a part of the rent payment. Other costs for homeowners may include replacing a new roof, the furnace and air conditioner, or repairing a host of other expensive things.

These all add up. The problem is that most don’t add them up. The same thing happens in the life of the investor saving for retirement. We will start by looking at the ongoing costs of mutual funds and ETFs. The goal is to help you think about really counting the costs.

Understanding Mutual Fund Ownership Costs

Some of these costs may not hit you and rarely will you actually see the costs that do apply to your investments in your statement. In fact, even the “expense ratio” is rarely shown on many statements I have seen.

Some of the ownership costs include the expense ratio, load fees, transaction fees, account maintenance feeds, fund performance fees, and for taxable accounts, capital gains and dividend taxes based on the fund’s activities. If you knew the costs you would be appalled and probably want to find ways to cut the costs. This is possible.

Why You Should Care

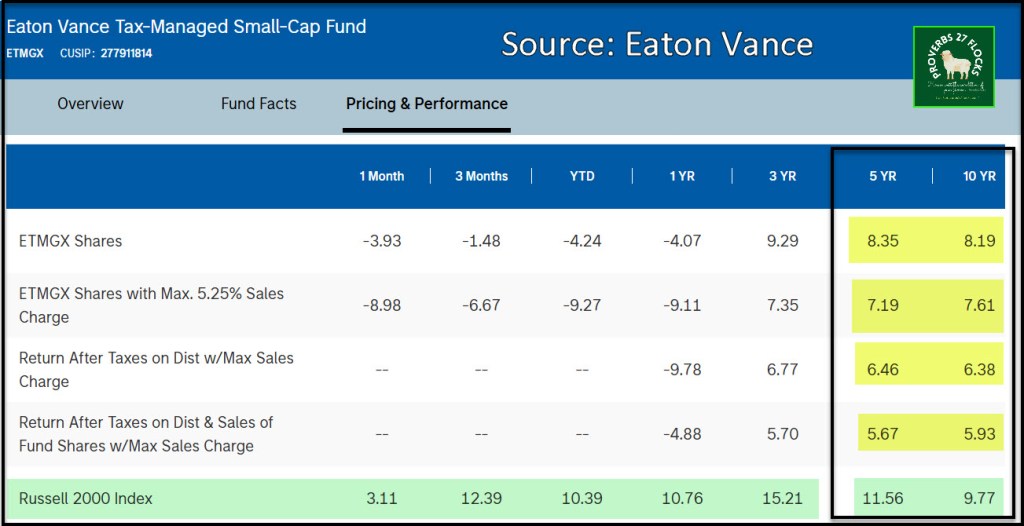

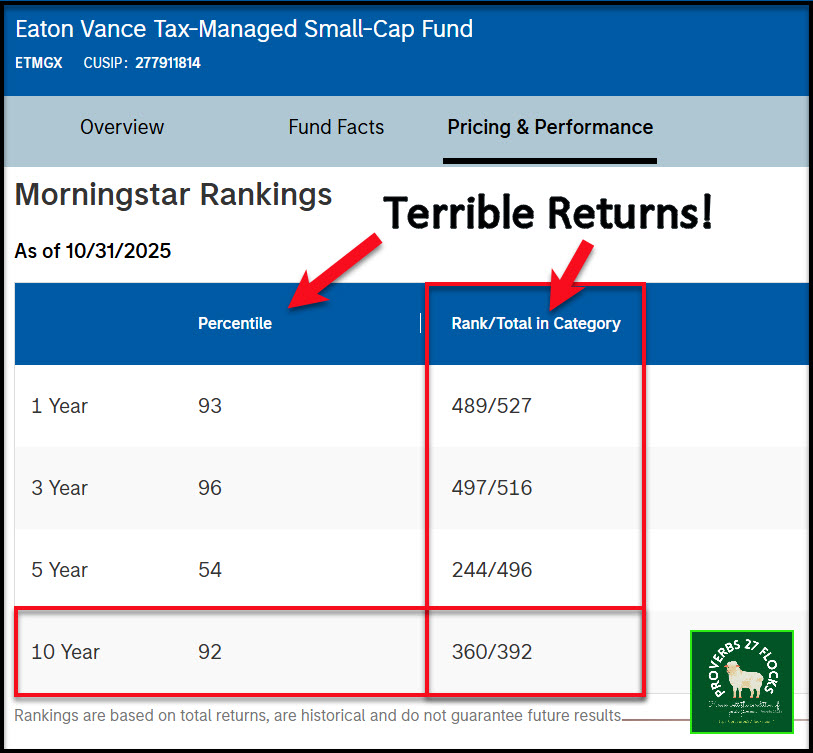

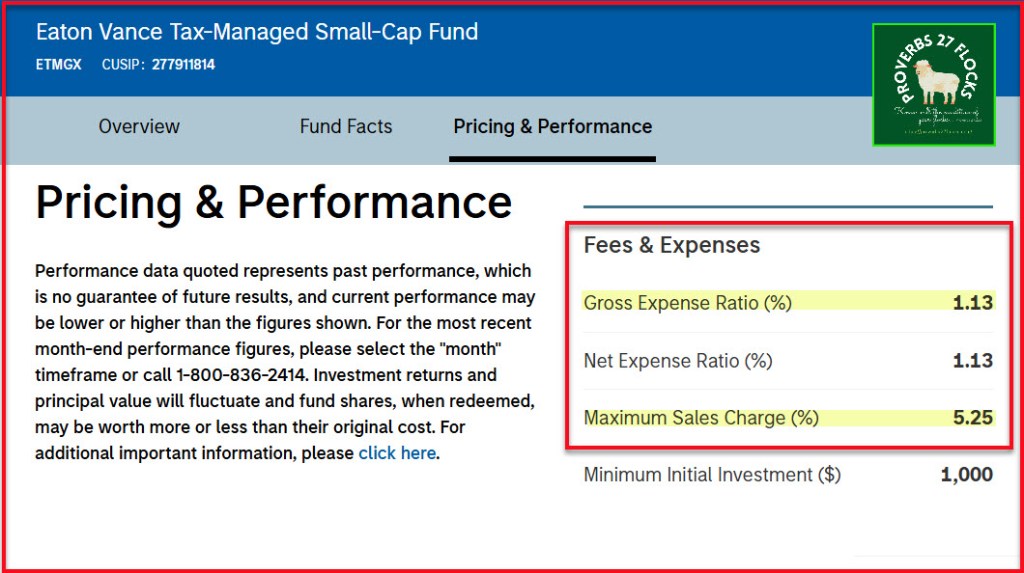

Some might conclude this doesn’t matter because the overall fund performance is adequate. Let’s consider just one fund I picked at random: Eaton Vance Tax-Managed Small-Cap Fund Class A (ETMGX). This fund has an expense ratio of 1.13%. According to Seeking Alpha, the ten-year price returns on this fund are 19.76%. If we look at total returns the value is 100.10%.

This fund far underperforms the S&P 500 – which has total returns of 215%. So, for performance that seriously underperforms, you pay one percent of your total investment to the fund manager in fees.

If you look at the CAGR (Compound Annual Growth Rate) for an investment that returned 100% over ten years, you will discover that the average annual return of the mutual fund over the ten years is approximately 7.18%. That isn’t terrible, but you are paying 1.13% for “that isn’t terrible” returns.

If you have a $10,000 investment in fund that has a 1.13% expense ratio, and the balance remains unchanged, how much will you pay the fund manager over ten years? The math is simple. Multiply the $10,000 by 1.13. You are paying $1,130 in total. Those $1,130 are no longer earning you anything. Those dollars are in the pocket of the fund manager.

But the problem is far greater. Because the fund is growing in value, you are paying more in expenses each year the value of the fund shares increases. Also, let’s assume that you have a $500K portfolio and you decide to allocate 10% of your total assets to ETMGX. That means you invested $50K and you are now paying $5,650 over ten years to own this fund.

Again, this assumes the fund never grows in value above $50K. Why would you even buy a fund that never grows in value? Bear in mind that the value of the dollars subtracted from your account cannot help grow your assets. They are growing the mutual fund manager’s assets instead of your assets.

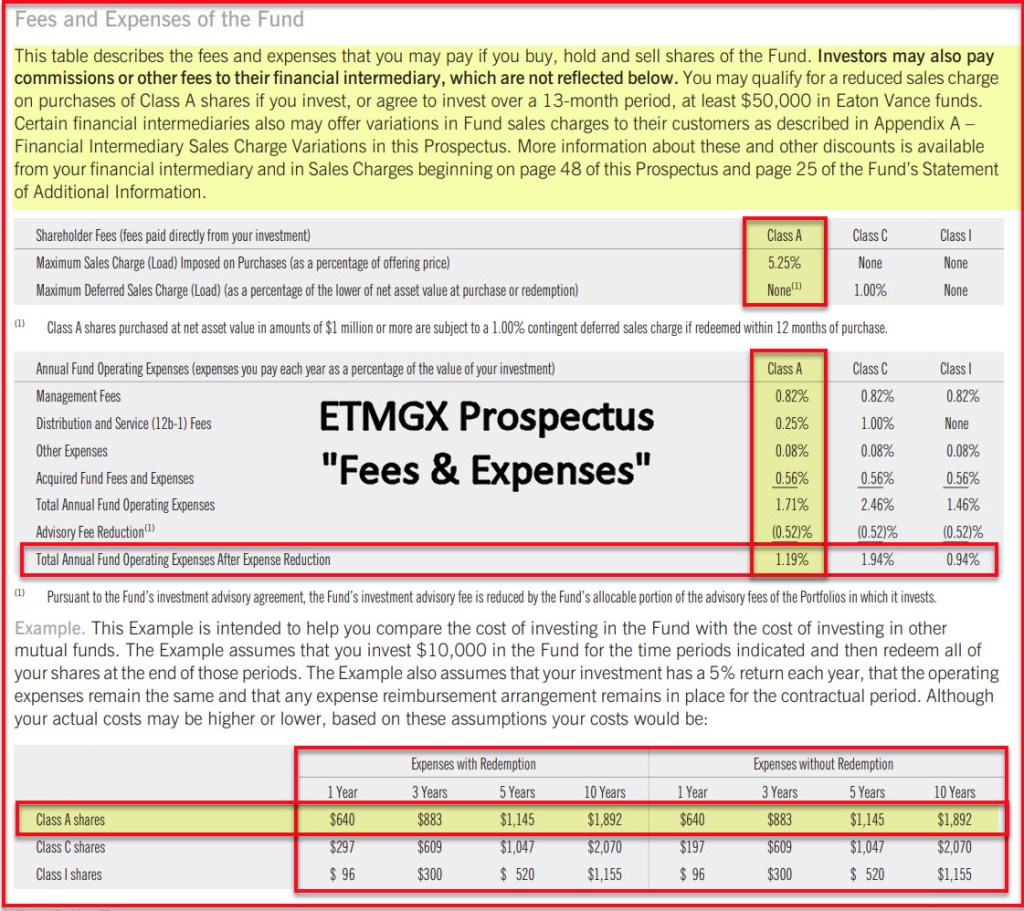

Bad News Followed by Terrible News: Sales Charges

However, for this “Class A” fund it is even worse than that. There is another potential 5.25% that is skimmed off of the dollars before they even start working for you. This is called the “sales charge.” The sales charge, also known as a load, is a fee that investors pay when purchasing or selling shares of a mutual fund. This charge is intended to compensate the broker or financial advisor for their services in selling the fund. I have seen statements that show investments in this type of fund.

Think of it this way: You give your advisor $50,000 and the fund takes away $2,625 and invests the balance of your dollars in the fund. That $2,625 is the “sales charge” or upfront “tax” on your deposit. There are different kinds of sales charges, known as loads. Here is an image that breaks them down. Only the last one is worth the allocation your investing dollars.

Types of Sales Charges

- Front-End Load

- This charge is deducted from the initial investment amount.

- For example, if you invest $1,000 in a mutual fund with a 5% front-end load, $950 will be invested in the fund, and $50 will go toward the sales charge.

- Back-End Load (Deferred Sales Charge)

- This charge is applied when you sell your shares.

- It typically decreases the longer you hold the investment, often disappearing completely after a certain period (e.g., several years).

- Level Load

- This is a continuous charge that may be assessed annually.

- It is usually a percentage of the investment and allows for no sale fees at the time of purchase or redemption.

- No-Load Funds

- These mutual funds do not have any sales charges, allowing investors to buy and sell without incurring additional fees.

Importance of Knowing Sales Charges

Understanding sales charges (if a fund charges them) is crucial for investors, as these “loads” will significantly impact overall returns. Comparing funds based on their load structure, expense ratios, and performance can help you make an informed decision about where to invest your money. Always look at both the sales charge and ongoing fees when evaluating mutual funds to ensure they align with your investment goals.

What does the pickpocket cost?

I’m 99% certain that my readers have never calculated their total investment costs. This is ignoring a real drain on your retirement accounts. It is like being pickpocketed every year by the same pickpocket and never saying “STOP!”

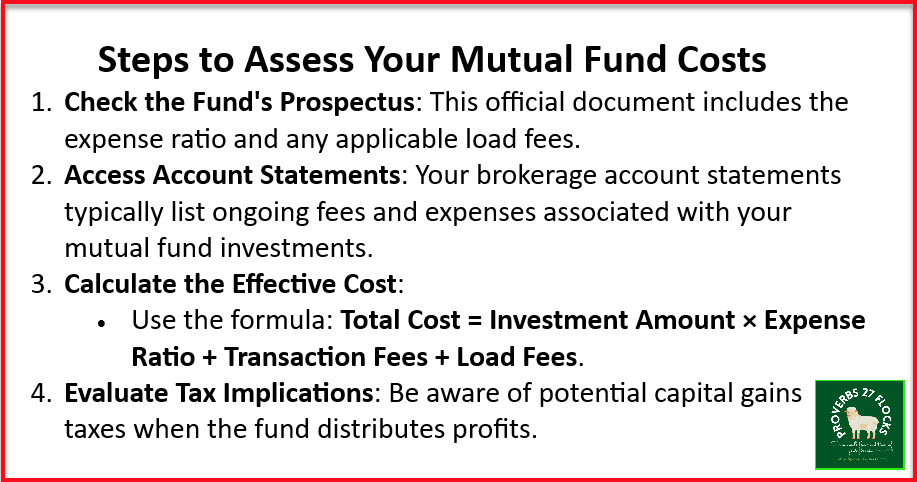

Steps to Assess Your Mutual Fund Costs

You might grow weary trying to calculate these costs. It is best accomplished using a spreadsheet and by using the data from Seeking Alpha to build a “portfolio” of your mutual fund assets. You can also take a more clumsy and time-consuming approach as follows:

- Check the Fund’s Prospectus: This official document includes the expense ratio and any applicable load fees.

- Access Account Statements: Your brokerage account statements may list ongoing fees and expenses associated with your mutual fund investments. Not all of them do because they don’t want you to have a heart attack.

- Calculate the Effective Cost: Use the formula: Total Cost = Investment Amount × Expense Ratio + Transaction Fees + Load Fees.

- Evaluate Tax Implications: Be aware of potential capital gains taxes when the fund distributes profits. The mutual fund decides when to sell assets to lock in gains. You do not and if your mutual fund is in a taxable account the income taxes can be a terrible yearend “surprise!”

Viable Alternatives Reduce Your Costs

There are viable alternatives. So, for example, if you want a small-cap fund that performs well and doesn’t charge you a king’s ransom, consider iShares S&P Small-Cap 600 Value ETF (IJS). The expense ratio for ETF IJS is 0.18%, almost a full percentage less than ETMGX.

In addition, the ten-year total returns of this fund are almost 121% and there is no front-end or back-end sales charge. You also don’t have to invest a minimum of $1,000 to buy shares and you won’t be surprised by capital gains at the end of the year. You decide when to sell your IJS shares to lock in your gains (or losses).

Even better is VIOV. Vanguard S&P Small-Cap 600 Value Index Fund ETF Shares has a 0.10% expense ratio, no loads, and a ten-year total return of about 130%. Why would anyone want to invest in ETMGX? Actually, most people don’t. ETMGX only has $116M in total assets. Most investors avoid it like the bubonic plague. One way to determine if a fund is a rational choice (mutual fund or ETF) is the total assets under management (AUM). If the number is less than a billion dollars, it probably is a fund to avoid.

Mutual Fund Share Classes

According to artificial intelligence, “About 45% of mutual funds currently have a sales charge or load. This reflects a trend where many mutual funds offer different share classes, including some that are no-load, meaning they do not carry an upfront sales charge.” Buyers should beware of A, B, and C class shares because of loads. You should be able to see this in the name of the mutual fund. For example, ETMGX clearly says it is Eaton Vance Tax-Managed Small-Cap Fund Class A.

There are several different types of “share classes.” They include A, B, and C. These all have a load. I and N shares usually have no loads, so if you have a choice between A, B, C, and I shares, choose “I”. F shares typically don’t have a load either. However, these are available through fee-based advisory accounts and while there is usually no commission, the advisor fees can be killers.

Actionable Items

- Look at your account statement for the names of your funds. Are any of them in the A, B, or C classes. If so, you are probably paying too much for the fund.

- Ask your broker or financial advisor to give you a total of all of the annual expenses for all of your mutual funds and ETFs. Then also ask them for the total ten-year returns of those funds. Are you getting the best value for your investing dollar? (Hold off on asking them the total amount they are charging you to manage your accounts. That will be discussed in another chapter.)

- Double-check what you are told. It won’t take much time if you use Seeking Alpha and a spreadsheet. What are the total mutual fund fees you paid in 2025?

Conclusion to Chapter One

Just about every person I have helped with reviewing their investment portfolio and investment statement has not understood the true cost of ownership. When they do they want changes and they want them today.

There is an even bigger non-ending cost many miscalculate. Mark 8:36 says, “For what does it profit a man to gain the whole world and forfeit his soul?” Don’t leave life without considering that truth from the Savior of the world.

Footnotes and Definitions: you need to think about the big picture of the costs of your investments.

- Expense Ratio: A yearly fee expressed as a percentage of your investment, covering management and operational costs.

- Load Fees: Sales charges paid when you buy (front-end load) or sell (back-end load) shares of the fund.

- Transaction Fees: Costs associated with buying or selling fund shares, which may vary based on the broker.

- Account Maintenance Fees: Annual fees charged by some brokers for maintaining your account.

- Fund Performance Fees : Additional fees based on the fund’s performance, usually in hedge funds rather than traditional mutual funds.

- Taxes: Capital gains distributions and dividend taxes that may be incurred based on fund activity.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. Mutual funds do not have QUANT ratings. This makes them less likely for me to recommend as a part of your investment portfolio. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

All scripture passages are from the English Standard Version except as otherwise noted.