When the Bubble Bursts and the Bear Market Comes

In general, I am an optimist. An optimist can be wrong, as can a pessimist. The difference is probably that the optimist tends to be happy and hopeful while the pessimist is woeful and worried. I already know that being a worried person is anti-Biblical and essentially says “God can’t or won’t take care of me.” Being woeful for the wrong reasons is also counterproductive and makes for miserable company.

One of the “secrets” of investing is to do what the majority does until the majority is wrong. When the market is going up, it is because the majority are optimists and they are buying investments and cannot get enough of the most recent craze, be it technology, artificial “intelligence”, energy, weight-loss drugs, or cryptocurrency. So doing what they are doing can make sense, if you are buying the right assets

When the market is going down, it means the majority are pessimists who are selling investments because they fear the bubble will burst. In reality, most of the time assets don’t burst, they deflate.

Is the Stock Market Bankrupt Now?

Recent gyrations of the stock market and the value of many assets have exposed the pessimists. A bursting bubble can be bankruptcy for any individual stock or business sector. In contrast, a bear market is the bubble being reduced to a smaller bubble. Selling when the market is going down is only rational if you know your assets are junk. If the bubble is gone, you are bankrupt. If the bubble is smaller, just wait and watch because history does repeat itself.

Before I share some optimist thinking, enjoy some humorous quotes:

“A lot of people become pessimists from financing optimists.” – anon

“Always borrow money from a pessimist. He won’t expect it back.” – Oscar Wilde (I might add, buy stocks from pessimists. They have a short-term focus most of the time.)

“A stockbroker urged me to buy a stock that would triple its value every year. I told him, ‘At my age I don’t even buy green bananas.’” – Claude Pepper

Reminders for Optimists

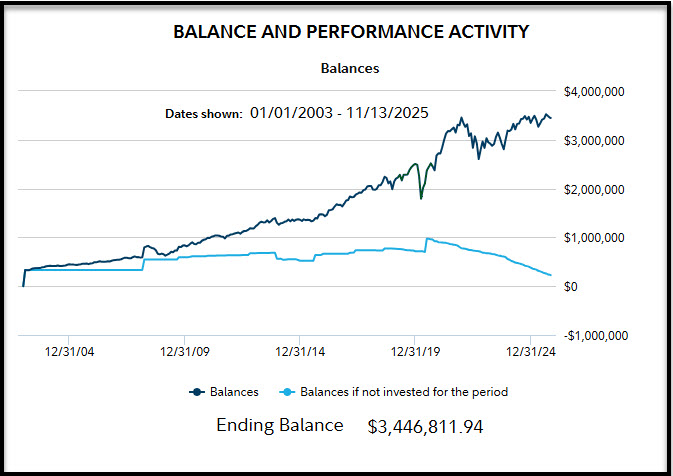

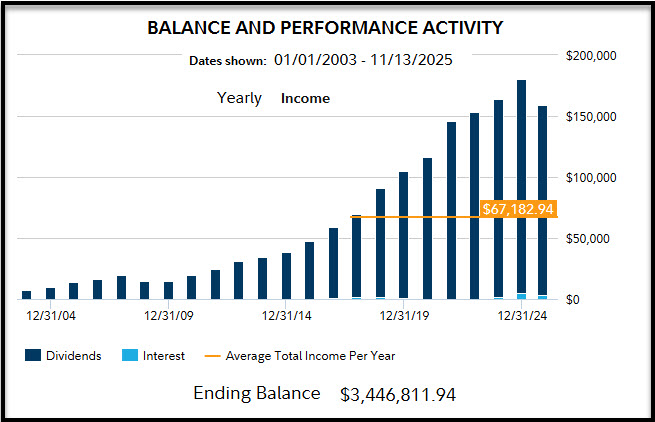

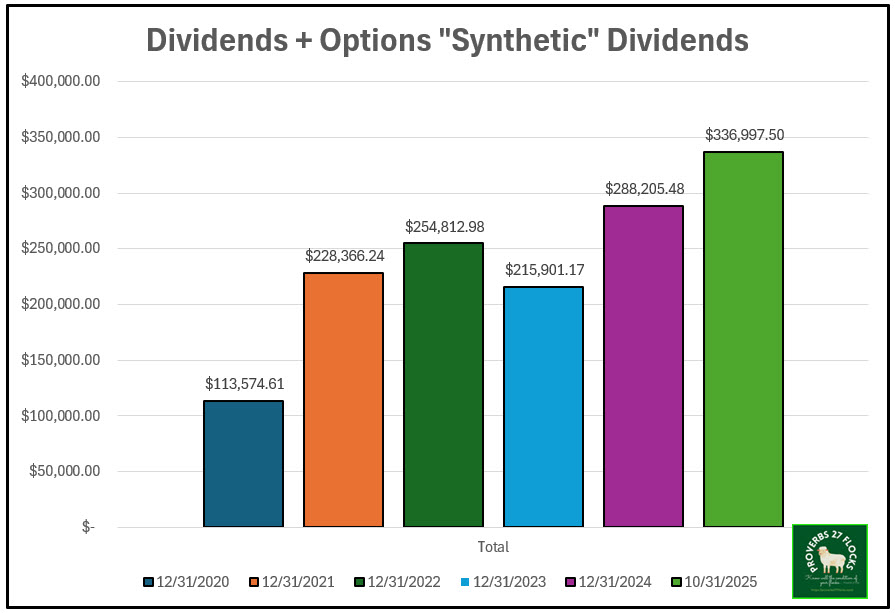

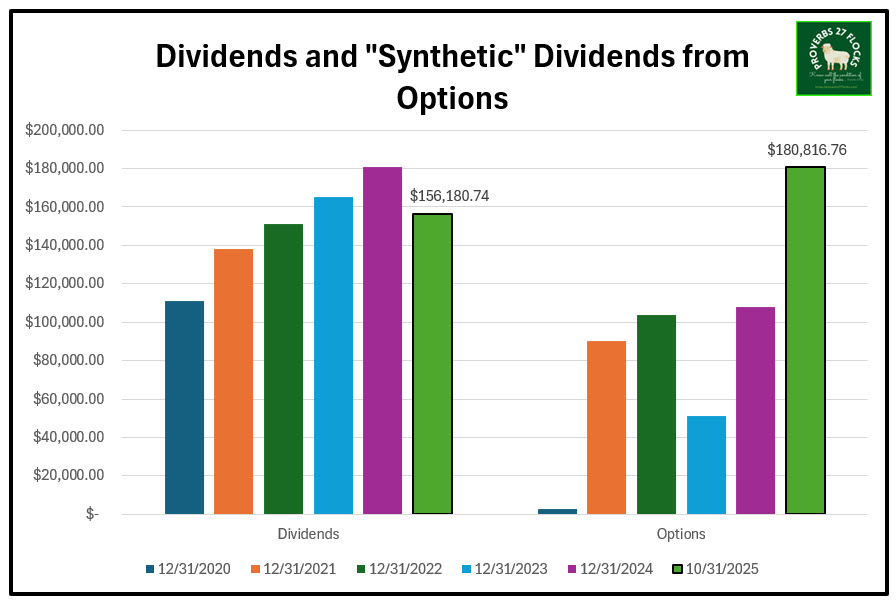

I like graphs, because you can quickly see trends. What I like to see is two-fold: 1) The value of the assets should increase over time and 2) Dividend income (and options income) can and should increase over time. After considering these seven reminders, I will show four images that show results over time.

- OPPORTUNITIES: Down stock markets provide buying opportunities. Don’t rush to buy but be grateful for the pessimists. Do this by gradually adding shares from the dividends you should be receiving at least quarterly.

- RESEARCH: Always try to buy good assets on days when the price of the asset is down due to temporary “bad” news. One day’s doom and gloom is not the same as “this is a shipwreck.” I use Seeking Alpha extensively to validate the reality of an investment.

- RMD JOY: If you are in retirement and have to take RMDs, rejoice that the required minimum distribution will be lower next year if the overall value of your IRA is lower on the last day of the calendar year.

- INCREASING DIVIDENDS: Always look to see if your dividend income is increasing. Dividends can be used to buy groceries, pay utilities, fund vacations, or give to charities. My personal history shows that bear markets do not interrupt the dividends from quality ETFs and stocks. If, for example, a company has been paying an increasing dividend for ten or more years, then they paid an increasing dividend during the 2019 Covid downturn and panic.

- DIVIDEND YIELDS: When the prices of an asset go down, if the dividend is not suspended or reduced, the dividend yield goes up. What matters more than the current dollar value of your shares is the yield from that investment. Of course, if the yield is high because the company is failing, then you should sell.

- SELL RULES: Have good rules for why you would sell. Don’t neglect to keep your rules.

- SELL LIMIT ORDERS: Avoid entering sell limit orders. That type of order is saying “if the price drops to this price, just sell my shares.” It is far better to set email or text alerts and then determine if the current price is an overreaction or the beginning of the end for your particular investment.

Sluggards and Pessimists in Proverbs and the Scriptures

A bit of wisdom is indispensable when investing for the future. Sluggards have excuses for their bad choices and behaviors. Pessimists also tend to have similar issues.

Proverbs 22:13 (ESV) “The sluggard says, ‘There is a lion outside! I shall be killed in the streets!’”

Proverbs 26:13 (ESV) “The sluggard says, ‘There is a lion in the road! There is a lion in the streets!’”

The Bible doesn’t use the word “pessimistic” but there are eternal truths to be gained from reading the Bible. This is a helpful reminder: “Another way to think of pessimism is faithlessness. It is impossible to have faith while being pessimistic. Pessimists preview a future without God in it—or maybe a God who doesn’t care—but Jesus showed God’s love and offers a bright future (Romans 5:8; Titus 2:13).” Got Questions

My future is bright from an eternal perspective. I also think the future is bright to be able to be generous from the temporary assets placed in my care. I would encourage you to consider your future in light of who God is and what he has promised.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com