When Does Probability Matter?

There are many everyday activities where we think about probability without thinking about probability. For example, if the chance of snow is 5%, we think differently about the day’s activities than if the probability is 100%. If the traffic is terrible at 2 AM going through Chicago, the probability that it will be worse than terrible at 8 AM is greater.

We also think about this when we buy insurance: health coverage, auto insurance, homeowners insurance, and even pet insurance (I think pet insurance is a terrible waste of money). Social Security deals in probabilities. That is one reason they will pay you more at age 70 than they will pay you at age 62. They know you are closer to death’s door at age 70.

Gamblers also think about probability when they play the slot machines. Actually, they don’t. If they did they wouldn’t play them. The same is true of buying a lottery ticket. The chances that you will win the Powerball lottery is approximately 1 in 292.2 million. As of November 2025, the estimated population of the United States is approximately 342 million. Think about how many losers there are before you play the lottery.

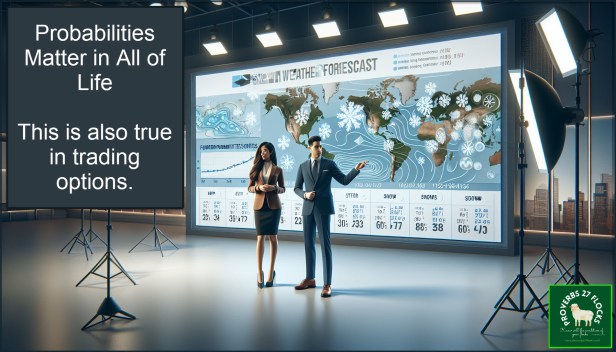

Probability Affects the Price of Stock Options

Probability plays a crucial role in determining the price of stock options. Understanding this relationship can help traders make informed decisions regarding options trading. For example, consider the impact of Volatility. Volatility is the price swing, both up and down, and the degree of the change in the price, especially during the short-term. Higher volatility increases the potential for large price swings, raising the probability of options finishing in-the-money. This often leads to higher option premiums. In other words, you might earn more on a stock that is highly volatile, but you also risk losing your shares if you are trading covered call options.

Fidelity’s Active Trader Pro (ATP)

When I teach others how to trade covered call options (or cash covered put options), one of the important considerations is the likelihood that your shares will be called. In general, if you like your investment, then you don’t want your shares called. This is especially true of dividend growth investments. As a rule of thumb, if an option expires at the end of the week, and there is no earnings announcement during the week, a reasonably safe probability rating is 20-30%.

Fidelity’s ATP made it easy to see this information. The following illustration was captured from ATP on Friday. If I were to roll the pending December 12, 2025 $52 option contracts (eight contracts = 800 shares) to $55 with an expiration date of February 20, 2026, I could receive about $248 in options income. The “Probability Above 55 at Expiration” is just under 12%. This falls well within my personal risk profile.

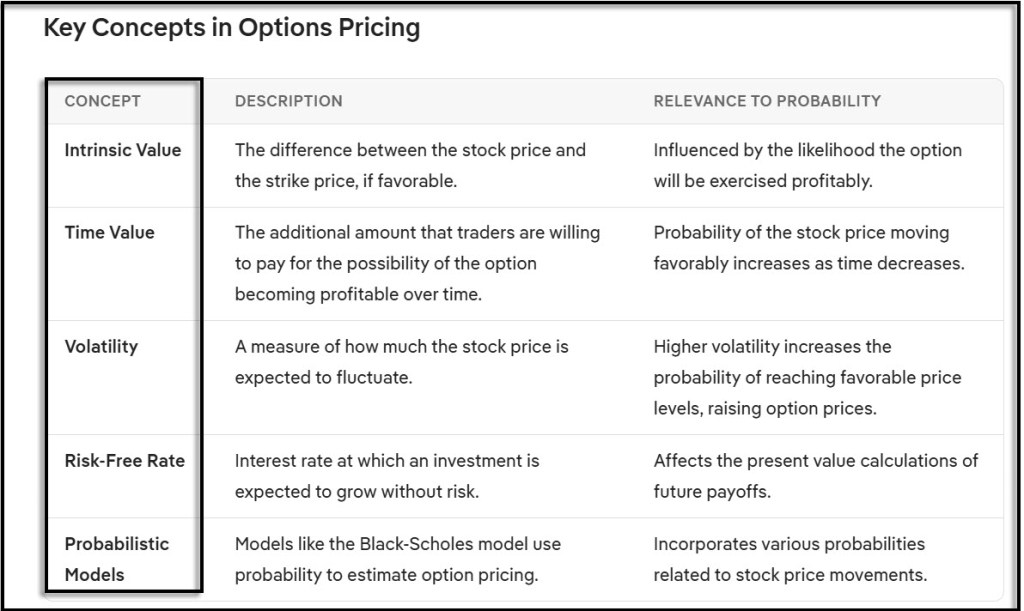

Fidelity’s New Trader + (T+)

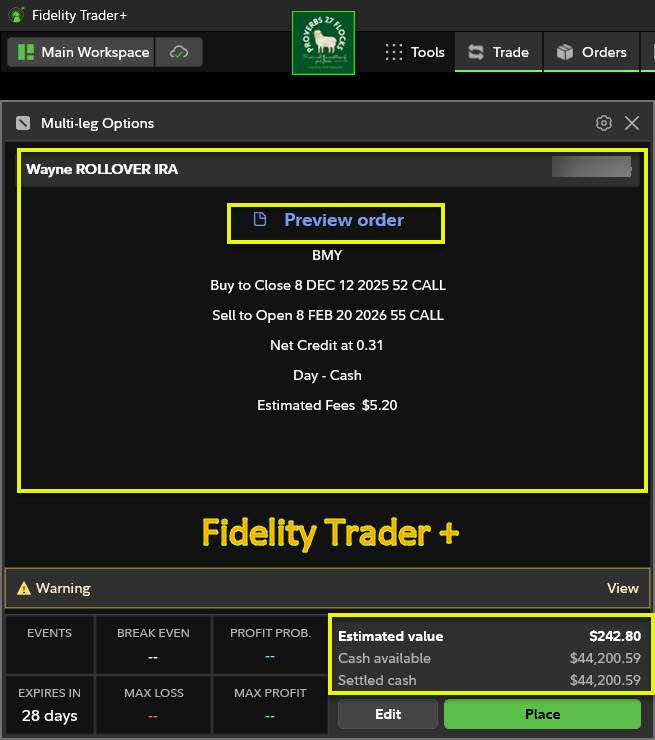

This week I started to experiment with Fidelity’s new trading software, running it alongside ATP. I wanted to compare the two trading platforms. I quickly saw that there were two missing pieces. My biggest concern was that there is no Probability Above 55 at Expiration. Furthermore, the net income was not displayed in T+. T+ shows a net credit of $0.31 per share, so I would have to multiply 800 shares by $0.31 to get the $240. Here is a screenshot from T+.

I called Fidelity to ask about these missing pieces. The rep I spoke with indicated that others were calling to express disappointment with the lack of “Trade Armor” due to several factors. I added my voice to the mix. The representative said I should look for more updates, as the product is still being enhanced with input from users.

The final screen I will share in this post is T+’s “Preview Order.” As you can see it shows what contract I am closing, what I want to open, the net credit, the cost of the trade ($5.20) and the “Estimated value” of $242.80.

How Does Fidelity Calculate Options Probability?

I don’t know, but I suspect it has something to do with the Black-Scholes Model. The Black-Scholes Model is a mathematical model used for pricing European-style options. Developed by Fischer Black, Myron Scholes, and Robert Merton in the early 1970s, it provides a theoretical framework to value options based on various parameters.

The key components of the Black-Scholes Model are the current market price of the asset, the “strike price” (the price at which you are willing to have your shares called, the time to expiration in days or years (portion of a year), the current “risk-free interest rate” that you could get if you just left the money in a CD (like 4%), and Volatility – the measure of the price fluctuations of the underlying asset over time.

In a future post I might talk more about this model. The reason it is important is that most options traders don’t want to sell their shares. What they want are the synthetic dividends from trading options.

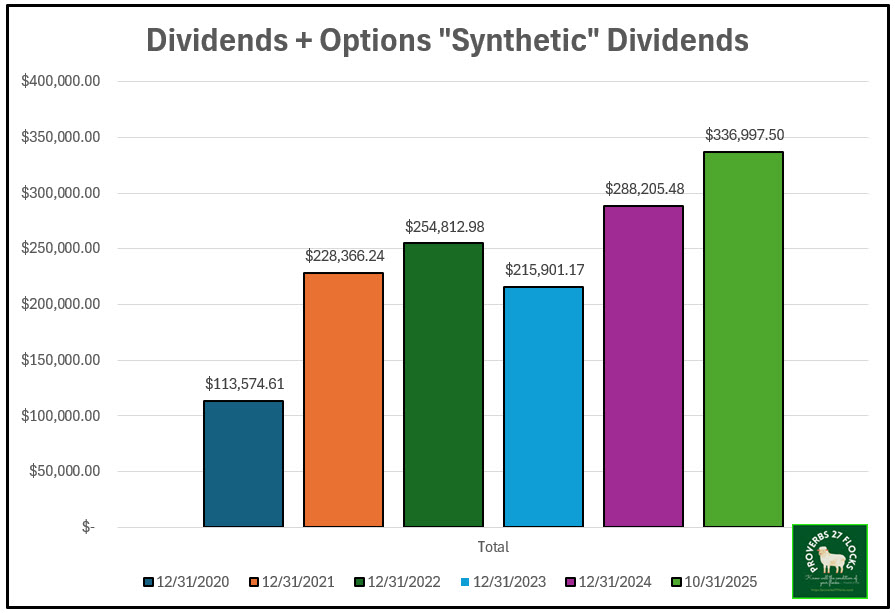

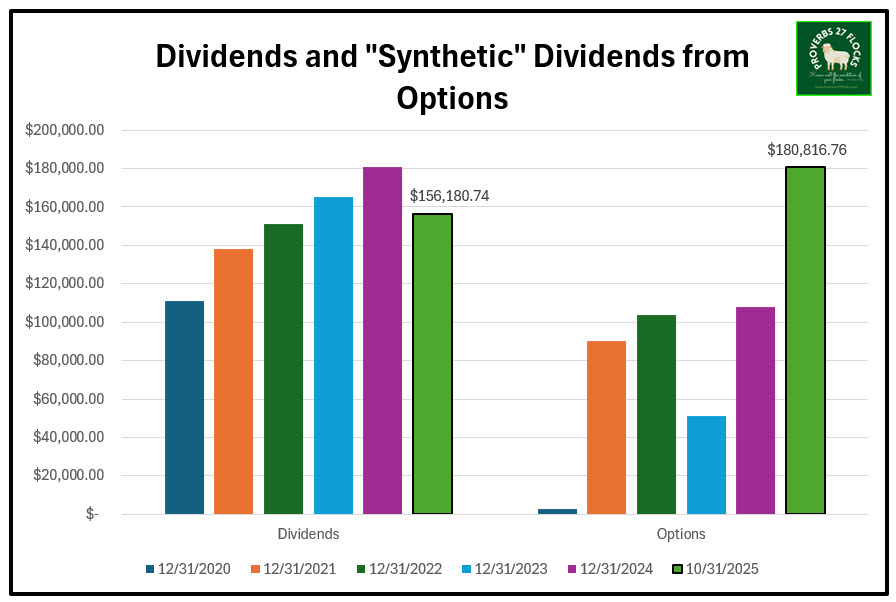

These images show the combined power of regular increasing dividends plus the “synthetic” dividends from trading options.

In Summary

One thing that is more important than probability or the Black-Scholes Model, is the quality of the assets you buy to trade options. If you like high-risk investments, you might be able to earn sufficient options income to reduce the overall risk. However, I believe it is best to use Seeking Alpha to find good stocks and ETFs and then trade options on those shares. It is even better to have a stock or ETF that is already paying dividends. If you can earn the regular dividend and the synthetic dividend, you greatly increase your income stream.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com