What You Don’t See Hurts – Taxes and Fees

Most adults quickly learn that various governments look for creative ways to fund municipal, county, state and Federal programs. Of course there is the income tax. Then many have to pay property taxes on top of that. What renters don’t realize is that they are paying property taxes with their rent payments. The same is true of investing. You don’t see all of the costs because providers would prefer that you not really see the total cost of investing.

Government Sets the Example

The Federal government is the master of adding in costs. Tariffs, Medicare and Social Security and a host of other taxes. When you fill your tank you are paying Federal and state taxes. The United States federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel.

Wisconsin is also the master tax magician, grabbing cash from you at every stop along life’s path. In addition to income taxes, we pay taxes on purchases. Five percent of every dollar is really just handing money to the state. The minimum combined sales tax rate for Dane County (where we live), Wisconsin, in 2025 is 5.5%, which includes a state sales tax of 5.0% and a county tax of 0.5%.

If you want to drive your vehicle on the public roads you pay an annual tax to have your vehicle licensed. Even your pet is not immune to taxes. There are fees to pay for dogs and cats (but not my tropical fish.) In Fitchburg dog owners pay $26.00 for spayed or neutered dogs and $36.00 for “intact dogs.” Cats cost less: $6.00 for spayed or neutered cats and $8.00 for intact cats.

There is also a fee to pick up our trash and our recycled items, even though we already pay over $8,500 in annual property taxes.

Then there is the hotel tax. This tax is typically applied as a percentage of the room rate, which can vary by location. In the U.S., state hotel tax rates generally range from 2% to 6%, but local jurisdictions may add their own taxes on top of that, leading to higher overall rates in some areas.

Total Taxes

Most of us don’t want to know the total tax and fee bill. For 2024 our Federal income tax bill was $40,767. This includes taxes on income, Social Security income, Cindie’s part-time income, dividends, and capital gains. Our Wisconsin state income tax was $11,253. Our property tax for that year was $8,745. The total, just from these three is $60,765.

A quick look at just our credit card purchases (excluding groceries as Wisconsin does not tax them) shows we spent over $73,000 during 2024. 5.5% of those dollars were tax payments. That would be about $3,600 in sales taxes. This ignores the fuel tax, but it gives you a taste.

Investments Face the Same Insidious “Taxes”

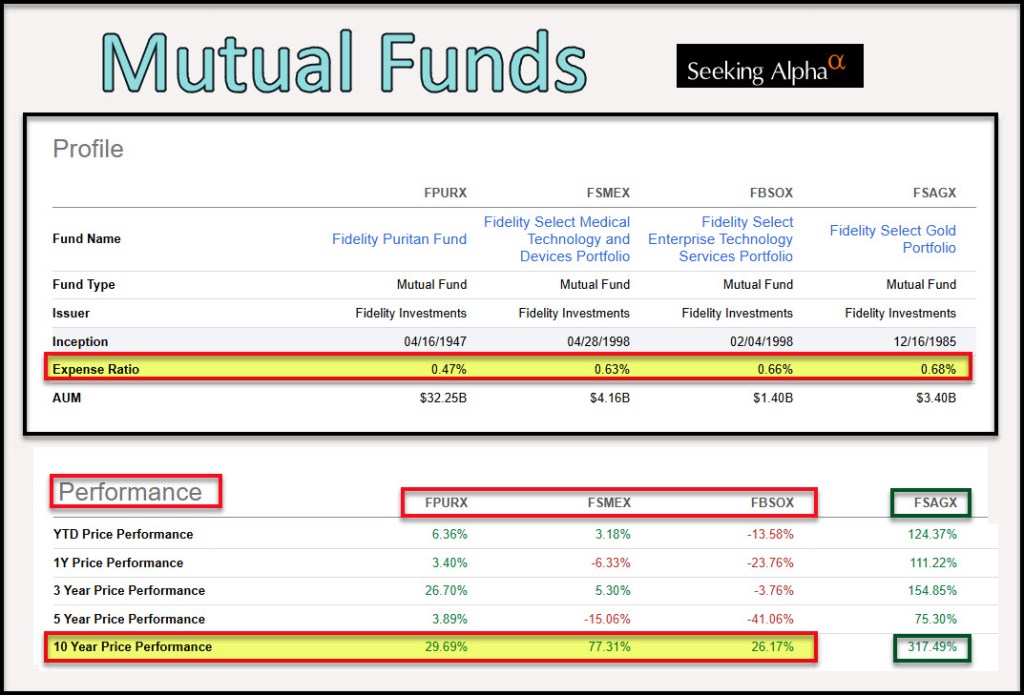

There are expenses charged by mutual funds and ETFs. It isn’t uncommon for a mutual fund to charge between 0.50% and 1.00% or more based on the dollars invested. If you have $50,000 invested in a fund that charges 1.00%, you are paying $500 per year as long as you own the fund and the balance is $50K. If the balance goes up, you pay more. If your total investments are $500,000 and your average expense ratio is 0.75%, then you are paying $3,750 annually for the help you are receiving.

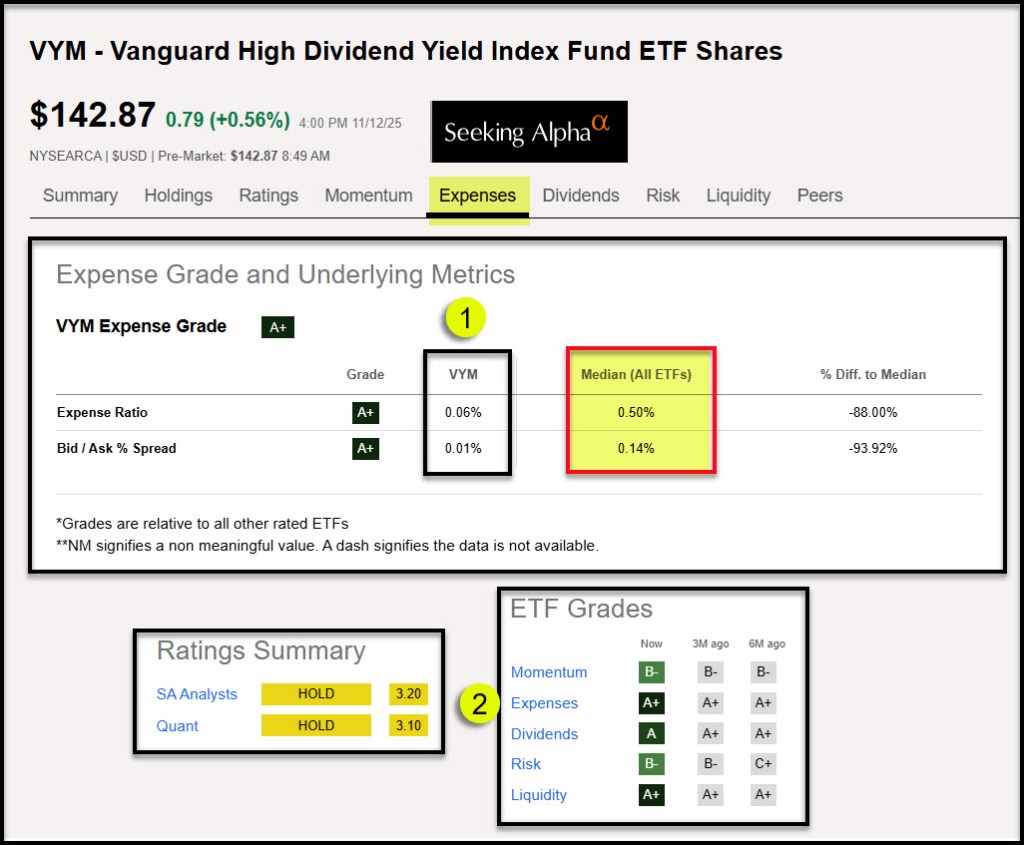

ETFs tend to charge a lower rate. Most of the ETFs in our portfolio have expense ratios less than 0.10%. There are a few with higher ratios, but the dollars invested in those funds is much less than in the lower cost funds.

Advisory and Account Fees

It is not uncommon for me to see people paying $5,000 per year for professional investment advice and services. I usually ask them if the one or two hours their advisor spent helping them is worth that much to them. They are stunned. To make matters worse, the advisor is sometimes also paid for buying and selling investments and they tend to pick investments with higher expense ratios.

“Advisory fees: Managed accounts typically charge 0.25%–1.00% annually for professional portfolio management.” (Fidelity Viewpoint)

“Account maintenance/platform fees: Some accounts charge periodic fees for access or services. Fidelity has no maintenance fees or account service charges.” (Fidelity Viewpoint)

Mutual Funds

If you want to learn more about mutual funds, this is a helpful article: How Mutual Funds Make Money (Seeking Alpha)

Want to Learn More?

Fidelity provided a good summary of the fees that eat away at your investment portfolio. The Viewpoints article was “Beat hidden investment fees.” (Viewpoints)

They wisely state: “You’ve done everything right: Saved, invested, stayed the course. But what if the fees you didn’t notice have been holding you back? Even small costs can add up over time, reducing the money you have working toward your goals. The good news: Spotting and reducing excessive fees doesn’t have to be complicated—and it can make a real difference for your future.” (Viewpoints)

Want Some Help?

While I cannot meet everyone’s needs, one thing I try to do is provide advice. You can actually do the work yourself. Ask this question of your advisor: “How much am I paying you every year in total dollars for your advice?” Then ask this question: “What are the total fees (expenses) for the mutual funds and ETFs in my portfolio?”

Don’t be surprised if they try to dance around that question and just give you percentages. I’ve seen this most often when I go with a friend to talk to their advisor. They really don’t want you to know the totals.

You should also use a tool like Seeking Alpha to look up the expense ratios for your mutual funds and ETFs. Here is an ETF example to show how I compare ETFs. This is not hard to do on Seeking Alpha. Of course it is important to look at price performance and total returns when you evaluate ETFs. The expense ratio is just one of a couple markers to consider. I want easy income and income growth when I buy most ETFs.

When comparing mutual funds, don’t neglect looking at performance. Obviously, if you are getting better returns than an S&P 500 index fund with a low expense ratio, paying more for a fund might make sense. Consider these four funds picked at random: FPURX, FSMEX, FBSOX, and FSAGX. Three of the four have terrible 10-Year Price Performance returns. If total returns are equally bad, then you are overpaying to own these funds.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com