But Be Careful About Your Thinking

One of the most dangerous and debilitating things you can do is to convince yourself of something that is not true and then act on that conviction. A key to good investing is truthful knowledge or facts (because there are tons of falsehoods available from multiple sources) that is then applied with wisdom.

Wisdom in the investing world is in very short supply. Part of this is due to human nature and is fueled by pride, greed, fear, and worry. To be proud is not wise. To be greedy is foolish. To be fearful of what is not worthy of fear is unfounded. To worry or be anxious is disobedience to Jesus’s command not to be anxious – assuming of course that your father is the Father in heaven. Can you change tomorrow by worrying about tomorrow? Not really.

What I need to do every day is talk to myself. But I need to have a serious and wise talking-to. There is a Spanish Proverb that says, “Wise men talk because they have something to say. Fools talk because they have to say something.” I need to confirm that my thinking is informed by truth. Only then can I talk to my brain. Sometimes I need to tell my brain “shut up.” (Mom would not appreciate me saying that out loud to someone else!)

Bad Investing Decisions

Bill Murray offers a humorous thought: “Everything happens for a reason. But sometimes the reason is that you’re stupid and you make bad decisions.” Bad decisions are the result of pride, greed, fear, and worry. When your brain is being led by those characteristics, you need to tell your brain to “shut up.”

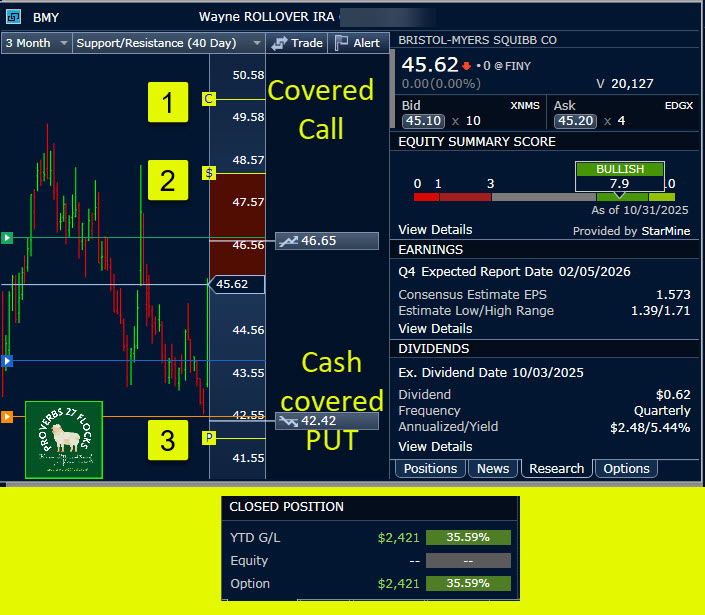

There is a recent AAII article that is helpful, written by Charles Rotblut. The title of the article is “Shut Up, Brain: Why Investing Is a Marathon, Not a Sprint.” Far too many investors think investing is a sprint. Many of them are day traders. They evaluate their results based on one day’s market behaviors. Recently our shares of BMY kept going down, down, down. Yesterday BMY’s share price went up 7.08%.

Why did I stay on the course? I told my brain to keep quiet about the things that don’t matter and focus on the things that do matter. Here are three things that do matter for a dividend growth investor. BMY has the following attributes: Payout Ratio 36.55%; 5-Year Dividend Growth Rate is 6.62%; and the Dividend Growth has been ongoing for 17 Years.

Dividends, Cash Covered PUTs, Covered Calls

Not only is the dividend yield at current prices 5.44%, but I can also trade options: both CALLs and PUTs. As a result in my traditional IRA I have received $2,421 in YTD options income on these contracts. When share prices drop, I tell my brain to “shut up” and trade options. I say “be quiet” and collect the dividends.

Shut Up, Brain: Why Investing Is a Marathon, Not a Sprint

Rotblut suggests five things for the marathon: 1) A good plan; 2) Discipline; 3) Patience; 4) A willingness to accept uncertainty; and 5) Knowing Thyself.

I like how he compares running a marathon with investing and a willingness to accept uncertainty: “As runners, we don’t get to choose the weather we will have on race day. We can only adjust our strategy based on the conditions, whether it’s rain, wind or heat. The prospect of injury or illness is always present, even with our best efforts to avoid both.”

He goes on to say, “Investors don’t get to choose the conditions that will exist over their time horizon. Corrections will occur at inopportune times. Bear markets will interrupt portfolio growth. Life events will challenge the ability to save.” With this in mind, it is often very helpful to talk to yourself about your investments. Most of the time you should just say “shut up” and then learn how to trade options and collect the dividends while you run towards the finish line.

Suggestions

Proverbs 14:15 “The simple believes everything, but the prudent gives thought to his steps.” The corollary to this is that the wise is careful about what they believe, and the sensible person gives thought to avoiding worry, fear, greed, and pride. Those four lead to missteps or false steps.

If you want to avoid overreacting to short-term market noise, then I suggest Seeking Alpha as a source for measuring what matters over the long-term.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

All scripture passages are from the English Standard Version except as otherwise noted.