Proverbs27Flocks

The Old Testament book of Proverbs is packed with investment guidance. The reason I named my blog Proverbs27Flocks is simple: most people do not “know well the condition of (their) flocks” and they don’t give “attention to (their) herds.” As a result, their cattle die slow deaths or don’t produce milk or calves, and their sheep wander off never to be found. There are wolves in the investing world and you need to watch for them.

Proverbs 27 not only has “investing” advice, but this portion of Proverbs also talks about the uncertainty of every day: “Do not boast about tomorrow, for you do not know what a day may bring.” (27:1) and the benefit of hearing from others: “Better is open rebuke than hidden love. Faithful are the wounds of a friend; profuse are the kisses of an enemy.” (27:5-6) It also says, “Iron sharpens iron, and one man sharpens another.” (27:17)

Don’t read the following too quickly. It not only talks about investing, but about perspective. Notice, if you didn’t already see it, that “riches do not last forever.” How do we know this? Consider lottery winners and what happens to most of them. Better yet, consider your current age and wealth and then look at the tables that talk about your life expectancy. Not many make it to 100 years old. Those that do also come to realize that “riches do not last forever.”

“Know well the condition of your flocks, and give attention to your herds, for riches do not last forever; and does a crown endure to all generations? When the grass is gone and the new growth appears and the vegetation of the mountains is gathered, the lambs will provide your clothing, and the goats the price of a field. There will be enough goats’ milk for your food, for the food of your household and maintenance for your girls.” – Proverbs 27:23-27 ESV

These realities should not cause us to become dispirited, discouraged or depressed. Rather, they should be helpful reminders about how to be thoughtful about life and life’s priorities.

Tips For Giving Attention to Your Herds and Knowing Your Flock Condition

There are several ways to do this, and none of them need to be overly time-consuming. Of course, you could hire a shepherd or cowboy to do this work for you. That might make sense as long as you are getting value for the dollars you spend. Many have investment advisors that are more like wolves than shepherds, or cattle rustlers than cowboys. At the very least, even if you use an advisor, you should walk out into the pasture once each month to see how things are going.

Read Your Statement with a Critical Eye

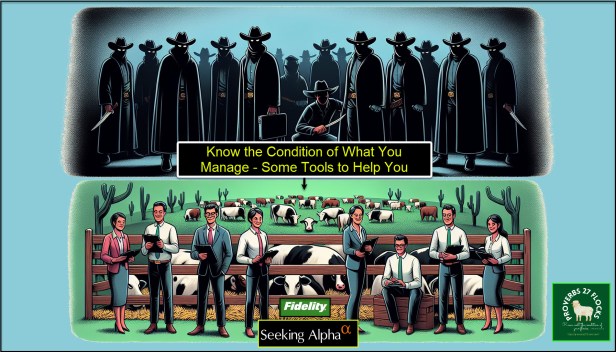

The first basic is always to read you monthly statement. If you are getting multiple statements from multiple providers you have just complicated herd management. Consider rolling old 401(k) accounts to your own self-directed IRA or ROTH accounts. There are only a couple of pages that should capture you attention, and I have written about this before. If you do a search on my blog using this string: “Fidelity Statement.”

One of my most popular posts was called “How AND Why I Read My Monthly 80-Page Fidelity Statement.” It explains the basics of reading the Fidelity Investments monthly statement. That page has 1,398 readers in the time since it went to press. The only other pages that score higher are the home page and my contact information page.

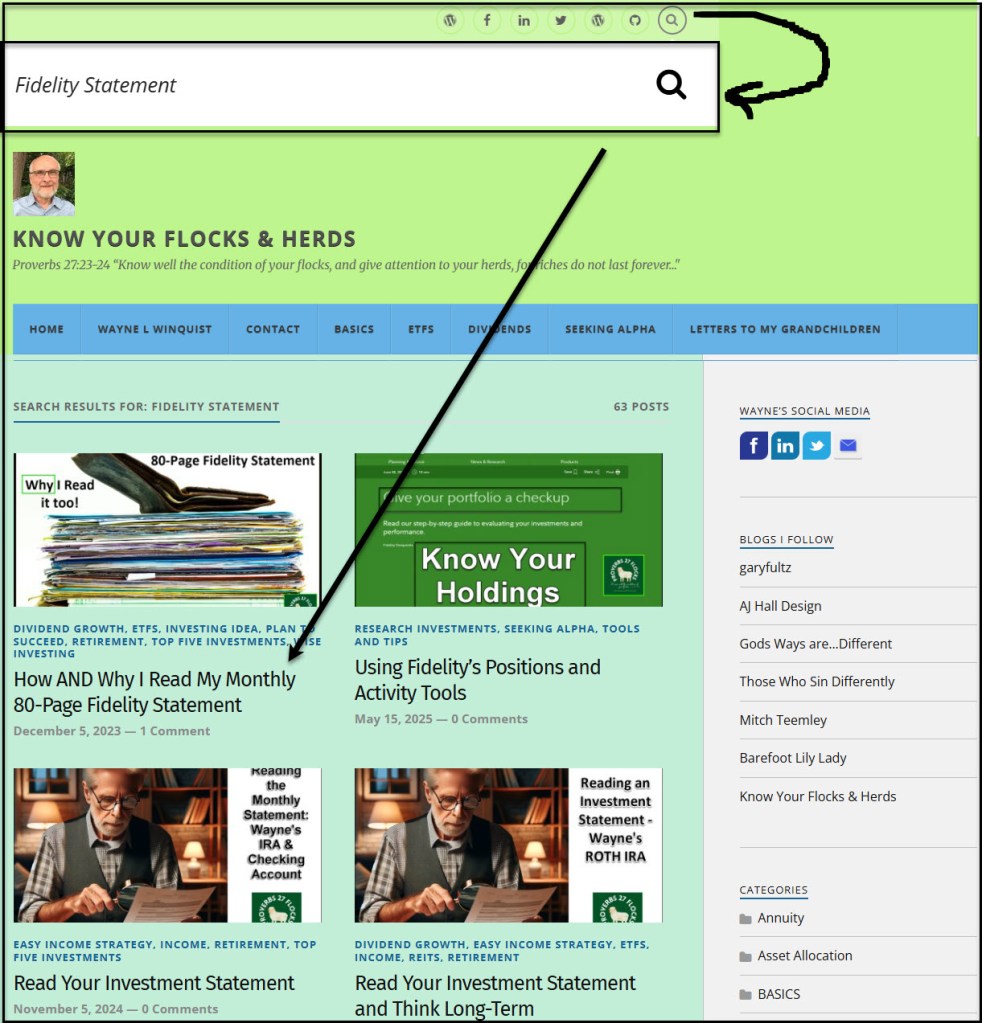

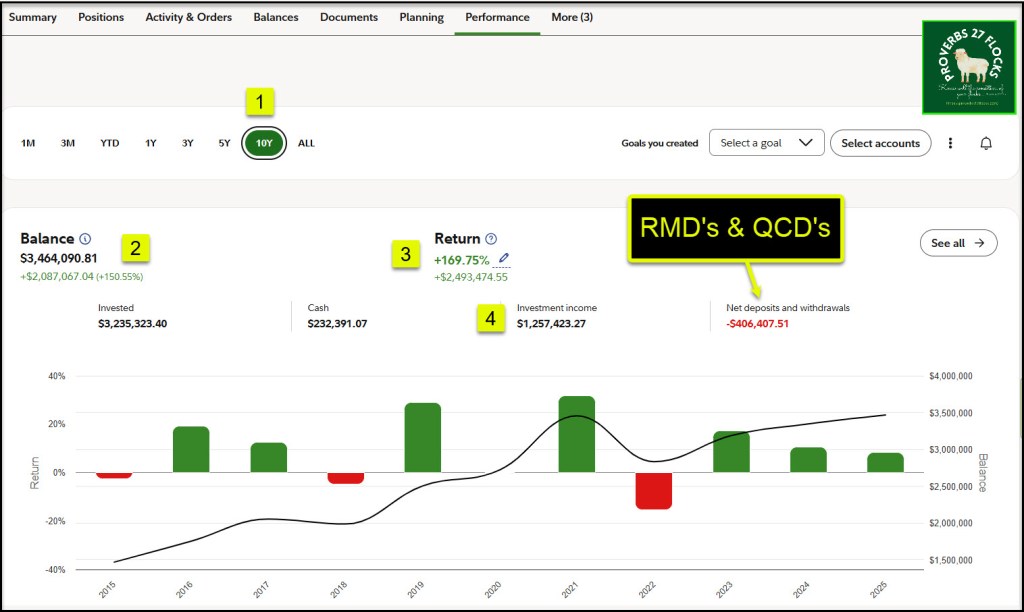

Use Fidelity’s Performance Tool

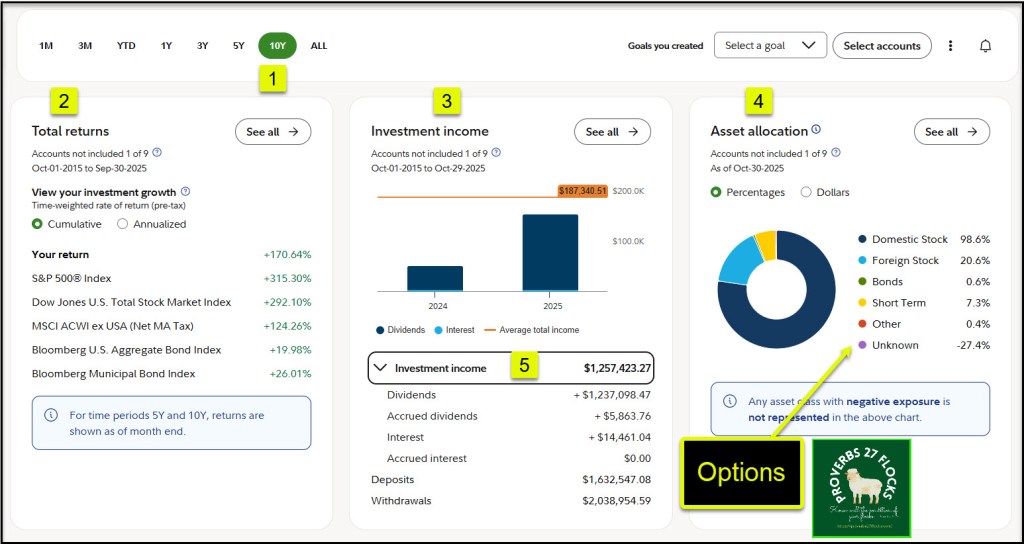

If you use the tool, be concerned about long-term results. If you have ten years of history, that is ideal, but don’t wait until you have ten years of history. The performance tool gives you insight into your “Time-weighted rate of return (pre-tax)” Fidelity says, “This measures your cumulative investment performance for the time period specified. It reflects any growth and income generated by your investments, net of fees. It does not reflect the impact of cash flows, such as deposits and withdrawals. Please see important disclosures below for additional details on our methodology.”

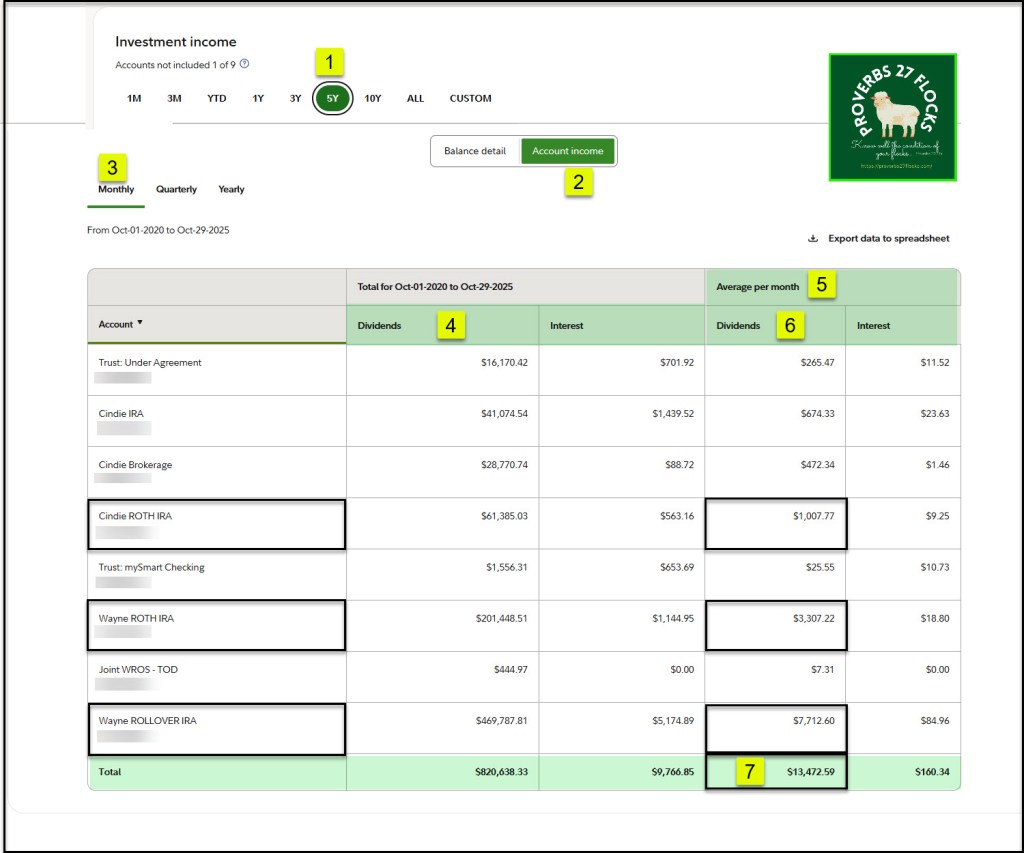

The tool also displays your total returns and your investment income and investment income trends. It reveals your asset allocations and some helpful analysis of your investment flocks and herds. Here are just a couple of samples. You can drill into the details as well.

Here is a drill down into the income portion of the tool. Ask yourself, “Is my income increasing or decreasing?” If it is decreasing, ask “why?”

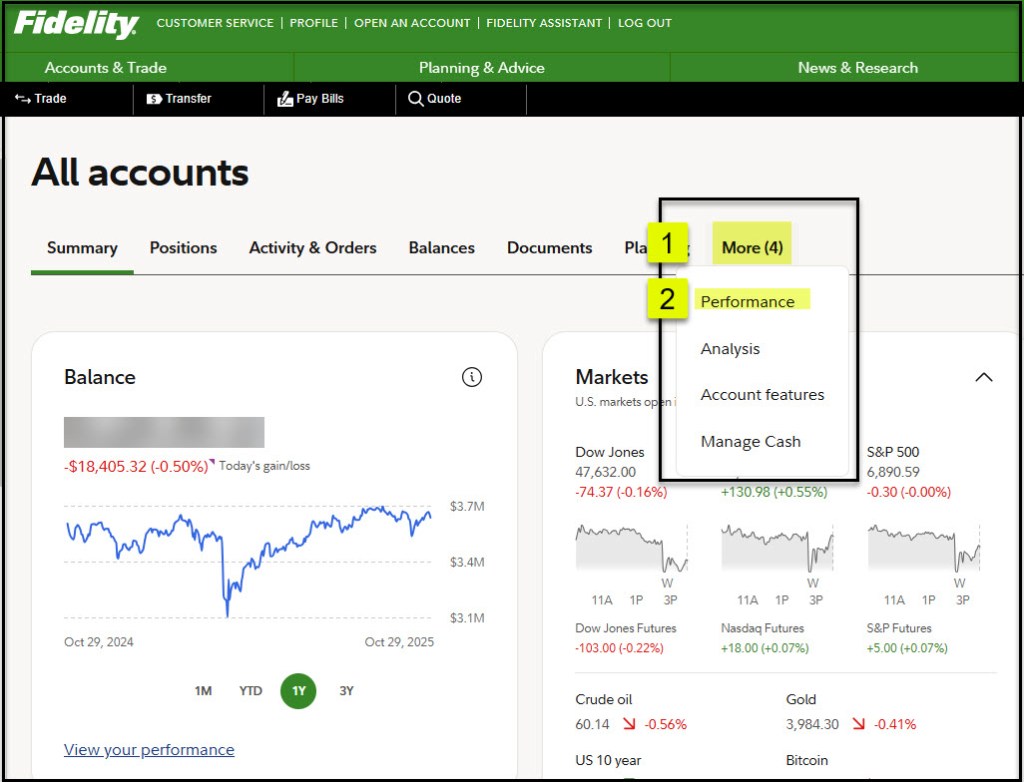

Use Seeking Alpha’s Health Score Tool

If you are comfortable with linking your brokerage account with Seeking Alpha, then you can get a nice high-level view of the quality of your investment herd and flock. This tool (1) reveals the following: 2) How Healthy is Your Portfolio; 3) How You Compare with others (my portfolio is in the top 20% of all portfolios on Seeking Alpha; 4) What Do The Analysts Think (I have 38 stocks rated highly in my traditional IRA account.); 5) Your Dividend Safety Score (This alerts me to both the good, the bad, and the potentially ugly income streams); and 6) What Are The Strengths And Weaknesses Of Your Portfolio.

Note: “The ratings are being provided for information purposes only. Valuation, Growth, Profitability, Momentum, EPS Revision ratings ranging from A-F do not constitute a specific call to action or advice for any individual to buy, hold, or sell a certain stock.” – Seeking Alpha

Even though the analysis is “for information purposes only” it is a helpful way to see if your portfolio is going to be eaten by wolves or potentially hijacked by rustlers.

Summary

Spend a bit of time thinking about what your statement tells you, how your investments have performed over the last ten years (or more) and the quality of the mix of investments in your portfolio. Bear in mind that the Seeking Alpha tool for the “Health Score” won’t be worth much if you focus your investments on mutual funds. That is another reason I am not a fan of that type of investment. It is a very muddy stream.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

All scripture passages are from the English Standard Version except as otherwise noted.