Mixed Emotions – Excitement and “Regrets”

I have several mixed emotions when I see a good earnings report that drives the price of shares higher. I own 200 shares of UPS in my ROTH IRA that I purchased on August 27 for $87.50 per share and on September 3 for $85.15 per share. Therefore, my average cost is $86.33 per share. The premarket price for the shares was running just slightly above $100 per share when I started typing this paragraph. (Update: the shares are now down to $97.40 because some sanity returned to the price per share!)

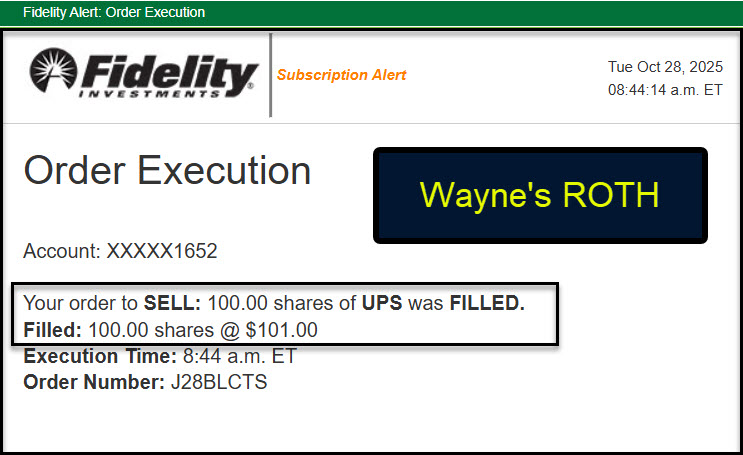

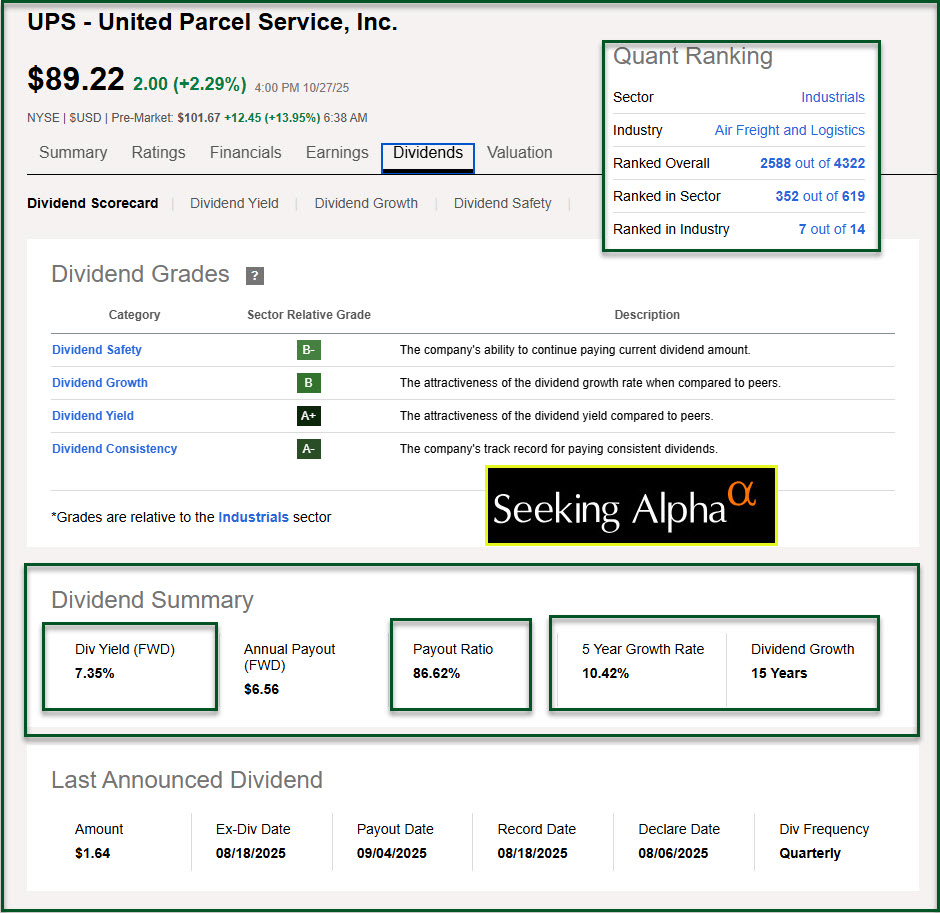

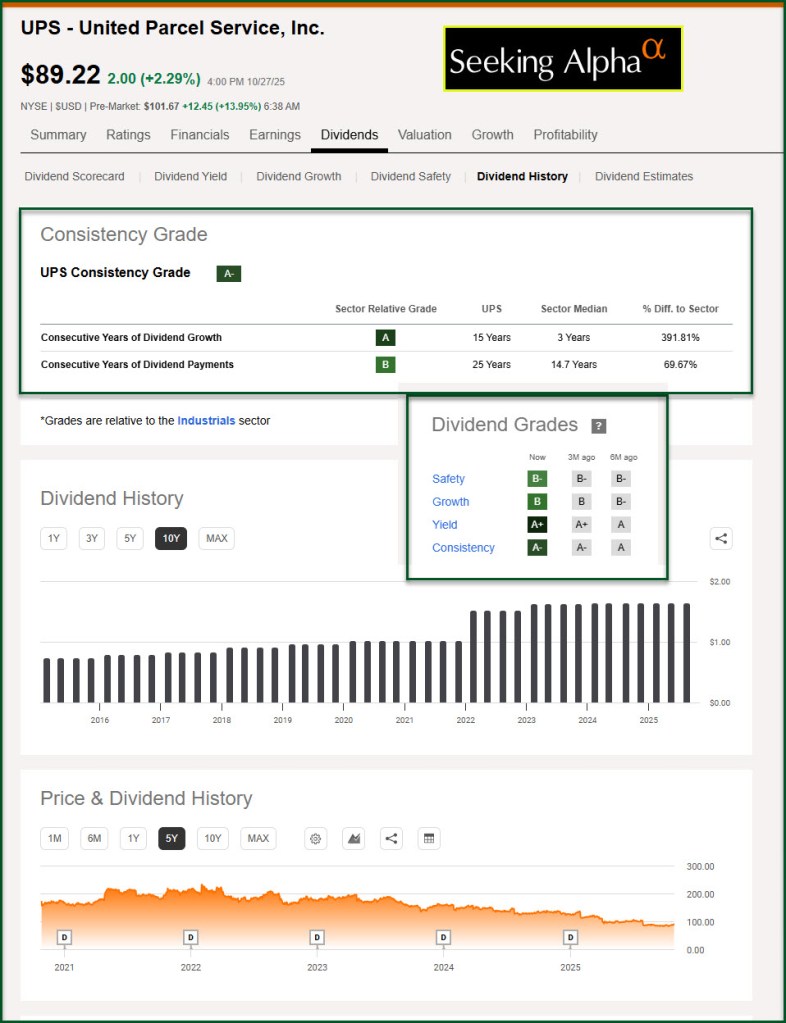

The dividend yield on UPS is currently just north of 7.5%, so that is an attractive yield. However, to lock in a profit now certainly seems like the right decision. These market behaviors can be temporary due to day trading activities. To lock in a profit on 100 shares would give me a profit of about $1,400. Given how long I have owned the shares, that is a very nice ROI.

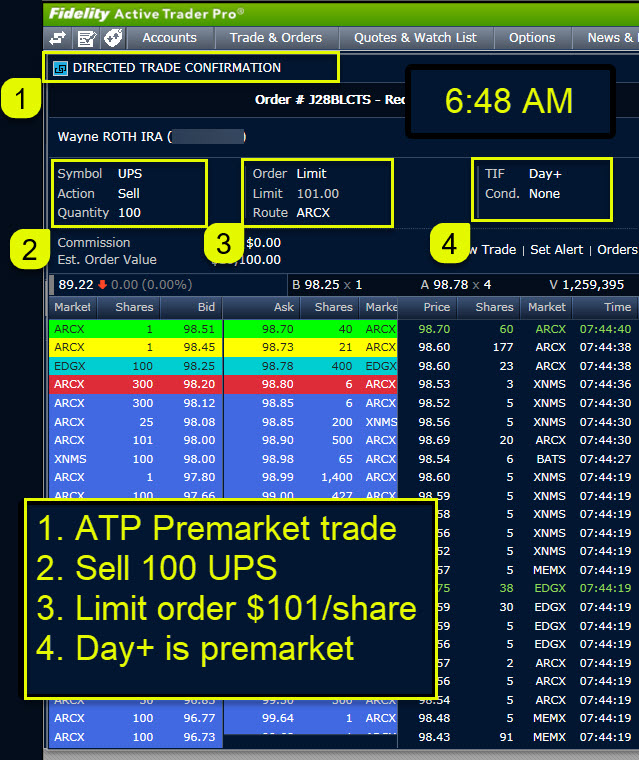

At 6:10 AM I entered a sell limit order for $101 in the premarket trading euphoria. There is no way to know which direction the price will go, but I would be more than satisfied to sell at $101 per share.

Patient Waiting Results in a Nice Profit

The ATP (Active Trader Pro) screen shots show why my patience was rewarded. There were a couple of times when I thought about lowering my sell limit price to $100 or even $97 per share. However, I was hoping that as more investors saw the good news they would bid up the price. They did and I sold 100 of my UPS shares before the market opened.

The Other Side of the Coin is “Regret”

There is a slight problem. One hundred of my shares are allocated to a covered call contract. The contract obligates me to sell one hundred shares for $90 per share. That would give me a profit, but the profit isn’t as good as it would have been if I had not entered into the contract.

That is the “risk” associated with this type of option. However, bear in mind that I will still make a nice profit if my shares are called away on November 21. Of course, I can attempt to roll the contract up to $100 for an expiration date farther into the future. I have not decided if that makes sense or not.

My profit isn’t limited to the $90 price. I have already received $185 from the options contracts I entered for UPS since I bought the first 100 shares. This includes a cash covered put that expired. If I can hold onto the shares in the covered call contract I can potentially earn even more options income from covered calls.

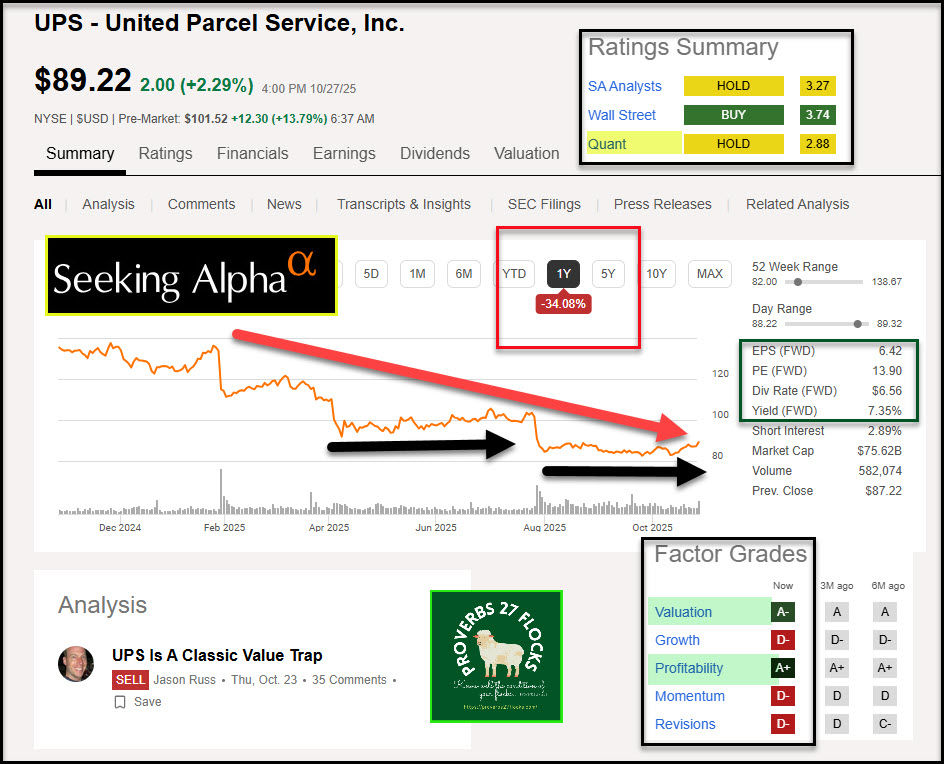

Why the sudden upward price surge? Sometimes it is just the “news” that drives investors to buy like crazy or sell like crazy. Both types of behaviors provide opportunities for profits. I am willing to take a short-term profit to add cash to my cash covered put ammunition.

News From Seeking Alpha

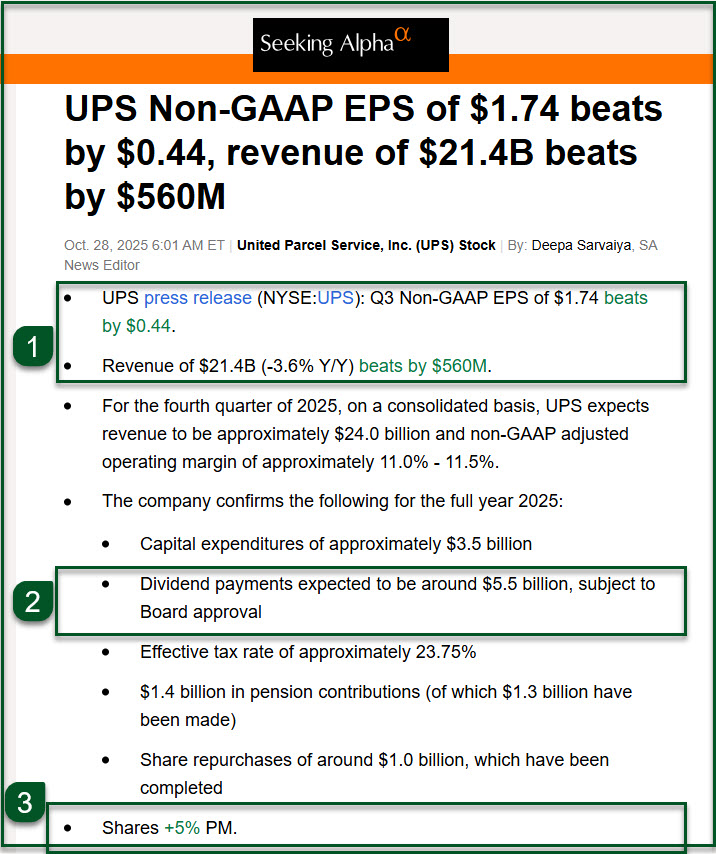

UPS Non-GAAP EPS of $1.74 beats by $0.44, revenue of $21.4B beats by $560M By: Deepa Sarvaiya, SA News Editor

Because the news is good, and the forecast is good, UPS shares are up 12.3% as I write this paragraph. That is a sell opportunity.

“Revenue of $21.4B (-3.6% Y/Y) beats by $560M. For the fourth quarter of 2025, on a consolidated basis, UPS expects revenue to be approximately $24.0 billion and non-GAAP adjusted operating margin of approximately 11.0% – 11.5%.”

“Dividend payments expected to be around $5.5 billion, subject to Board approval.”

“Share repurchases of around $1.0 billion, which have been completed.”

Company Profile

United Parcel Service, Inc., a package delivery and logistics provider, offers transportation and delivery services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery services for express letters, documents, packages and palletized freight through air and ground services in the United States. The International Package segment provides small package operations in Europe, the Indian sub-continent, the Middle East and Africa, Canada and Latin America, and Asia. The company offers a range of guaranteed day- and time-definite international shipping services; day-definite services; cross-border ground package delivery; contract-only, e-commerce solutions for non-urgent, and cross-border shipments; and international service for urgent and palletized shipments. It also provides international air and ocean freight forwarding, contract logistics, custom brokerage and insurance, mail services, healthcare logistics, distribution, and post-sales services. United Parcel Service, Inc. was founded in 1907 and is headquartered in Atlanta, Georgia.

Recommendation

If you see a good company with the potential for upwards price movement, it doesn’t hurt to buy shares. However, I think it is wise to have a few criteria: 1) The company must be profitable. 2) The dividend should be attractive, and the payout ratio should be rational. 3) You can trade covered call options on the shares for additional income while you wait for good news. 4) The Seeking Alpha QUANT rating should be at least a HOLD. The BUY or STRONG BUY ratings are usually even better. 5) You are patient. In fact, patience is sorely lacking on the part of most investors. We must think long-term but not be greedy. That means we must be willing to sell for handsome short-term profits.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com