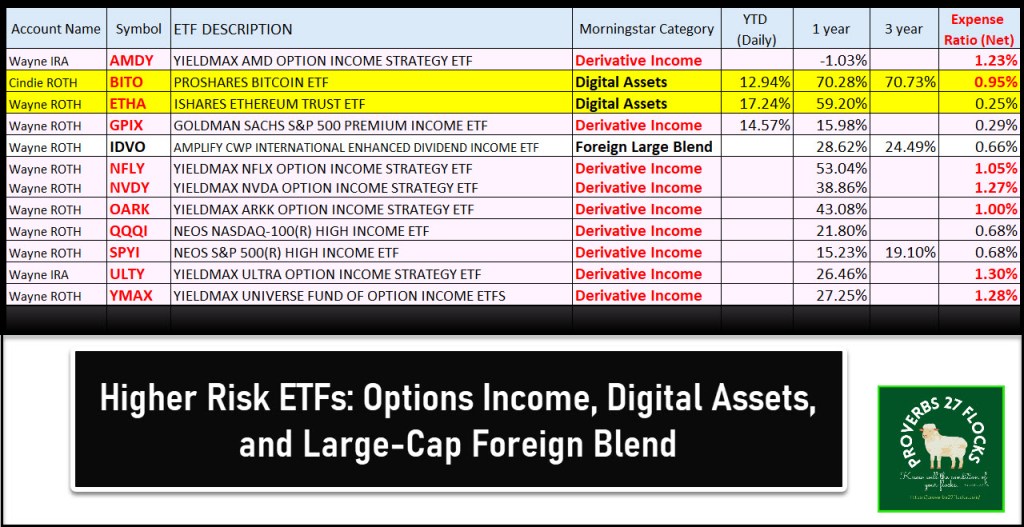

Digital Assets and Derivative Income

BITO is the ProShares Bitcoin ETF. If you are one of my loyal readers, this edition of my “Easy Income Strategy” is definitely not the norm. In fact, my fear in sharing this information is that novice investors with very few assets will rush to buy some or all of these.

Please understand that this post is one of transparency so that you know what we own, but it certainly shouldn’t be understood to be a recommendation. Consider this to be educational and only trade in these ETF assets if you know what you might lose.

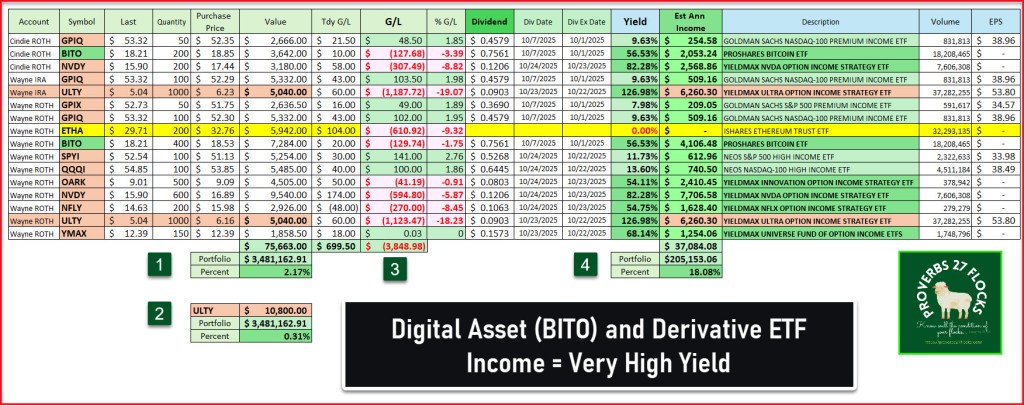

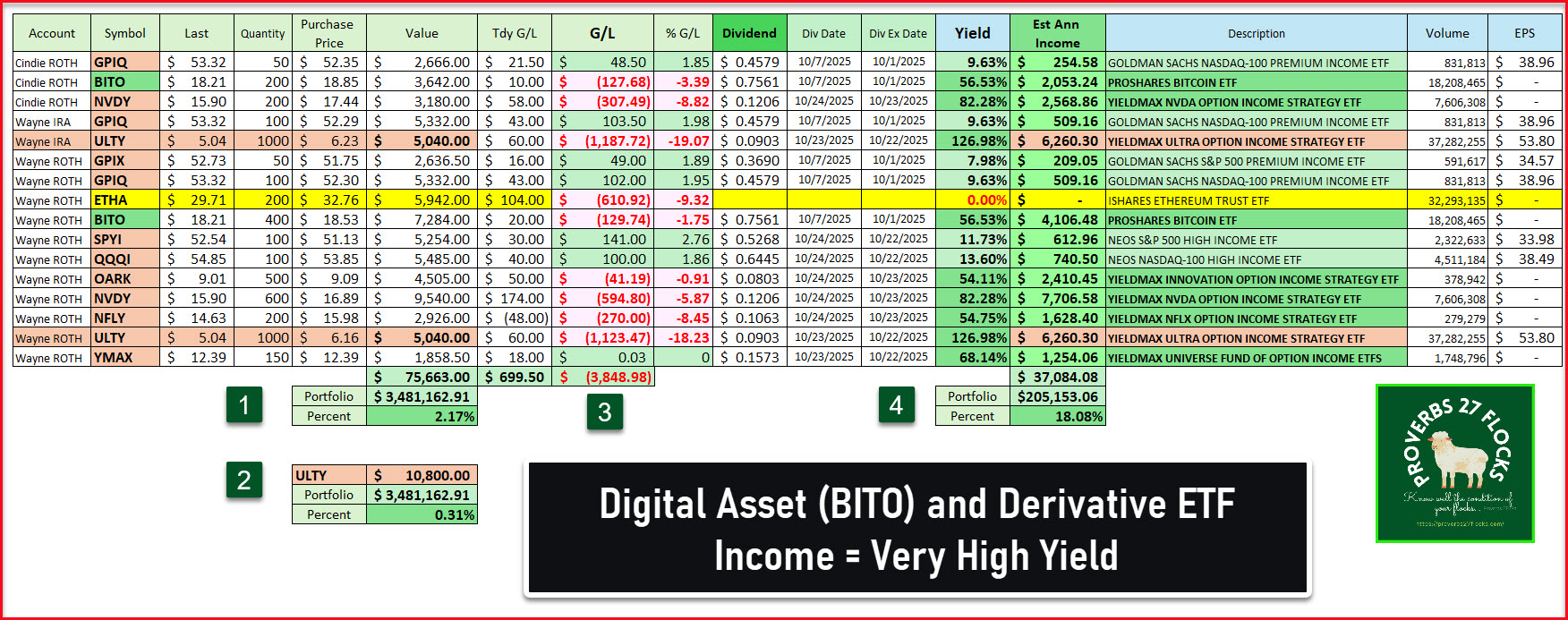

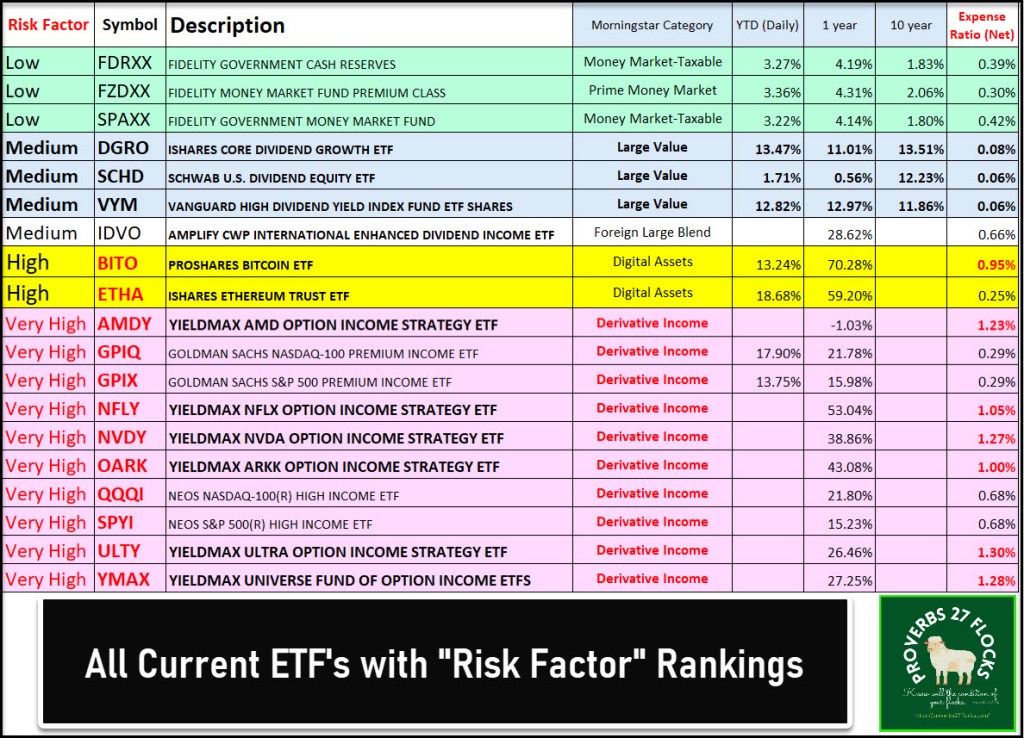

Before I dive into the details, let me explain the amazing dividends of this class of investment. The yields range from 8% to almost 127%. The current value of this set of investments in our portfolio is about $75.6K or only 2.17% of our total investment dollars. What is amazing is that the potential annual dividend income from just these ETFs is $37K. That is 18% of the dividends we are likely to receive from all of our investments in more conservative ETFs and stocks.

Types of Income-Producing Assets

There are three types of income-producing ETF assets I have added to our portfolio in the last couple of months. The first type is “digital assets.” Digital assets are assets that you cannot see, touch, or print. They are electronic assets like the Bitcoin. If you know me then you know that I would not want to own Bitcoins or cryptocurrency. In general I dislike all currency investments.

The second type are classified as “derivative income” ETFs. Derivative Income ETFs are exchange-traded funds that use derivatives like options contracts to achieve their investment objectives. Their primarily focus is generating income. These ETFs usually invest in a mix of equities, fixed income, and derivative instruments like options, futures, and swaps to maximize returns while attempting to manage risk. Because there is a lot of guesswork involved with trading options and futures to generate quick monthly income, the investments are by their very nature high risk.

The third type of ETF investment is a foreign large blend ETF: Amplify CWP International Enhanced Dividend Income ETF. In general, while I like some international stocks and own international investments for both income and options trading, I’m generally not a big fan of international ETFs. IDVO is an exception for a couple of reasons. First, it pays a monthly dividend. Second, the dividend yield is a nice 5.26%. Finally, the current QUANT rating is a BUY.

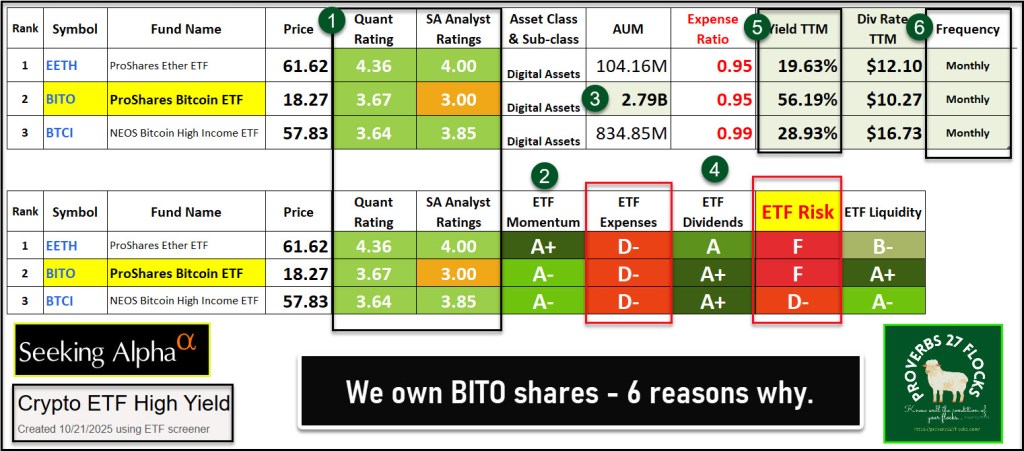

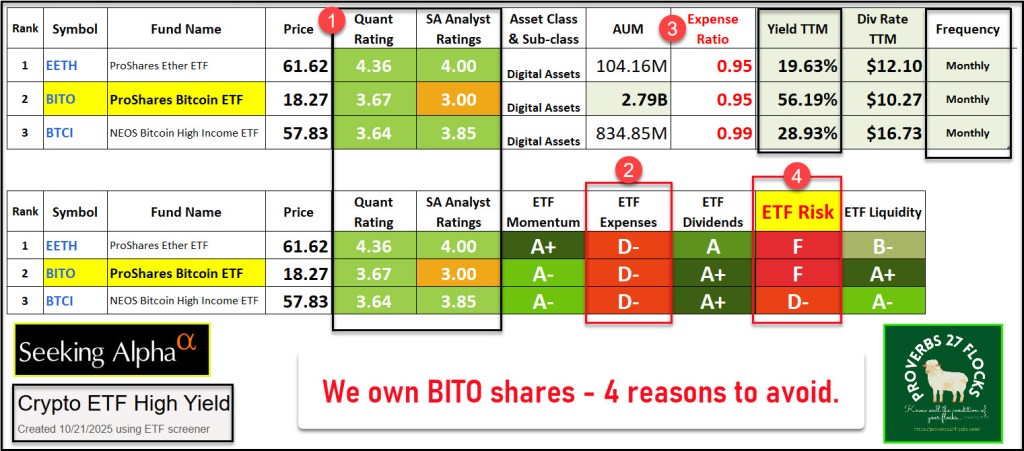

Looking For Digital Assets

One of the easy ways to do this is to “create” a portfolio that selects this type of asset in Seeking Alpha. I did this using the Seeking Alpha ETF screening tool and created a screen I called “Crypto ETF High Yield.” I only wanted to see a subset of the digital asset universe, hoping to find assets with QUANT ratings of BUY or HOLD.

BITO was of interest to me, and I have been gradually adding shares of this ETF on days when the price of the ETF shares falls.

Derivative Income ETFs

I trade covered call options contracts and cash covered puts. The number of ETFs that do this for you has increased dramatically. I have been adding some of these ETFs into our mix of investments. Of the eight we hold, some a very focused and specialized. If the underlying stock were to take a nosedive, then the ETF would likely suffer greatly. Once you get used to how these ETFs are named, you can spot the underlying stock.

For example, AMDY is focused on the stock with the ticker symbol AMD. NFLY is focused on Netflix. NVDY is an ETF with NVDA as the options base.

Crazy ULTY – YieldMax Ultra Option Income Strategy ETF

ULTY has a much broader base, but it is also a crazy high-risk ETF. The cool thing is that this ETF pays a weekly dividend and get this: the current yield is 127%. It is very much like trading options every week. I have been receiving weekly income from this ETF since July 8 in my ROTH IRA. YTD my income from the ULTY shares is $1,147.

To put this in perspective, my total ROTH investment is ULTY is a paltry $10,080. That is about 0.31% of our total investment capital, but it has the potential to pay $12,500 in dividends during the next twelve months. Please note the word “potential.” There is significant risk associated with the fund and the sustainability of the dividend.

If you pay attention to the images I am sharing, you will see that I have a loss of $2,311 on my ULTY shares, so the dividends have not risen enough to cover the current overall loss. Be careful about this ETF. It might work out over the long haul, but it might not.

ULTY Fund Profile

Tidal Trust II – YieldMax Ultra Option Income Strategy ETF is an exchange traded fund launched and managed by Tidal Investments LLC. The fund invests in public equity and fixed income markets of the United States. For its equity portion, it invests through derivatives in stocks of companies operating across diversified sectors. The fund uses derivatives such as options to create its portfolio. It invests in growth and value stocks of companies across diversified market capitalization. For its fixed income portion, the fund invests in short-term U.S. treasury securities. The fund employs quantitative analysis to create its portfolio. Tidal Trust II – YieldMax Ultra Option Income Strategy ETF was formed on February 28, 2024 and is domiciled in the United States.

Seeking Alpha – BITO: An Income Generating Machine

On Oct 22, 2025, Gary Bourgeault had this to say about BITO: “ProShares Bitcoin Strategy ETF (BITO) offers consistent income by investing in Bitcoin futures, without the upside cap of covered call ETFs. BITO’s performance closely tracks Bitcoin, with minimal NAV erosion, making it resilient to price downturns and quick to recover alongside BTC. Investors should focus on income generation, not growth, when holding BITO, and avoid panic selling during temporary price declines. BITO is ideal for those confident in Bitcoin’s long-term growth, but new investors should start small and understand its income-focused strategy.” (LINK)

Summary

Digital Assets and Derivative Income ETFs are only a sprinkle of salt on the beef roast of our total portfolio. I look at these as just a bit more diversification. Because I trade options, but some weeks I don’t trade options, I prefer to let some experts generate some income from trading options on my behalf.

My Recommendation and CAUTION

I agree with Gary Bourgeault regarding BITO. Although ULTY has a current dividend yield of 124.21% and pays a weekly dividend, don’t buy too many shares. BITO’s digital asset TTM yield is small by comparison: 56.38%. Again, this means that there is considerable risk. However, if you understand how options trading and cryptocurrency trading works, these yields are not that bizarre.

Let me repeat the CAUTION AND WARNING: all of the investments in this group are certainly much higher risk than VYM, DGRO, and SCHD. Therefore, it is far better to focus on those three stalwart dividend growth ETFs than to get to crazy with ULTY and BITO.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

Ticker Symbols in our portfolio include the following digital assets and derivative ETFs: AMDY, BITO, ETHA, GPIX, NFLY, NVDY, OARK, QQQI, SPYI, ULTY, and YMAX.