Easy Income from Real Estate

I don’t want to hire staff, figure out how to take care of employee health care benefits, deal with disagreeable customers, or be on-call at just about any hour of the day to deal with a problem at my convenience store, automotive services location, or even at a quick service restaurant. Having said that, I don’t mind “collecting the rent” and raising the rent. Of course, I don’t really have to do that either. I can just eat a donut and drink a cup of coffee and let Getty Realty do all of the stuff for the rentals.

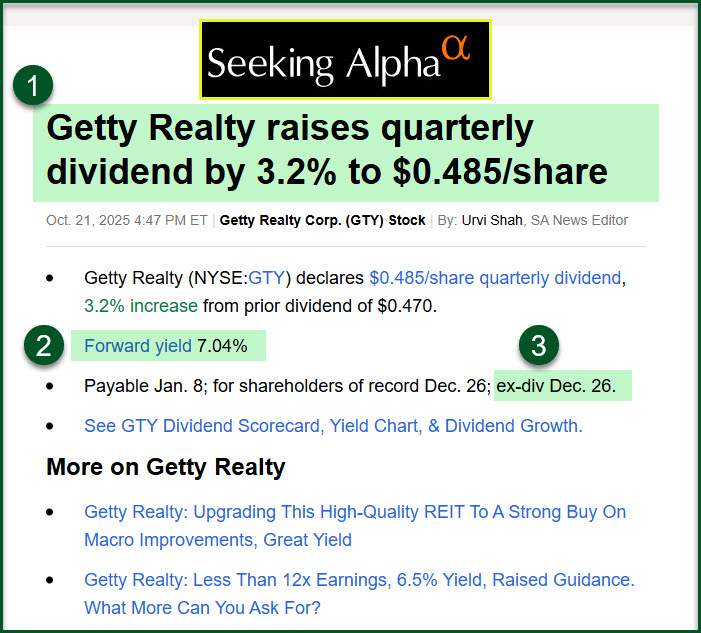

One way to do this is to own shares of GTY. Here is a snapshot of our holdings. As a result, we will be paid more rent because GTY increased their dividend.

GTY’s Major Tenants

When I look at the list of tenants I don’t get nervous. Most of them are consumer-focused and are usually high-traffic businesses. Here is a partial list: Convenience Stores: 7-Eleven, Circle K, BP, Automotive Services: Valvoline, Jiffy Lube, Midas and Quick Service Restaurants: Dunkin’, Subway, Starbucks.

Getty Realty Corp. is a publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single-tenant retail real estate. As of March 31, 2025, the Company’s portfolio included 1,119 freestanding properties located in 42 states across the United States and Washington, D.C.

Seeking Alpha also makes it possible to graph total returns. Total returns are the price increase (or decrease) and the dividends paid during that period of time. GTY’s total returns are more than adequate. It doesn’t hurt to buy on the dips.

Resources for Investors

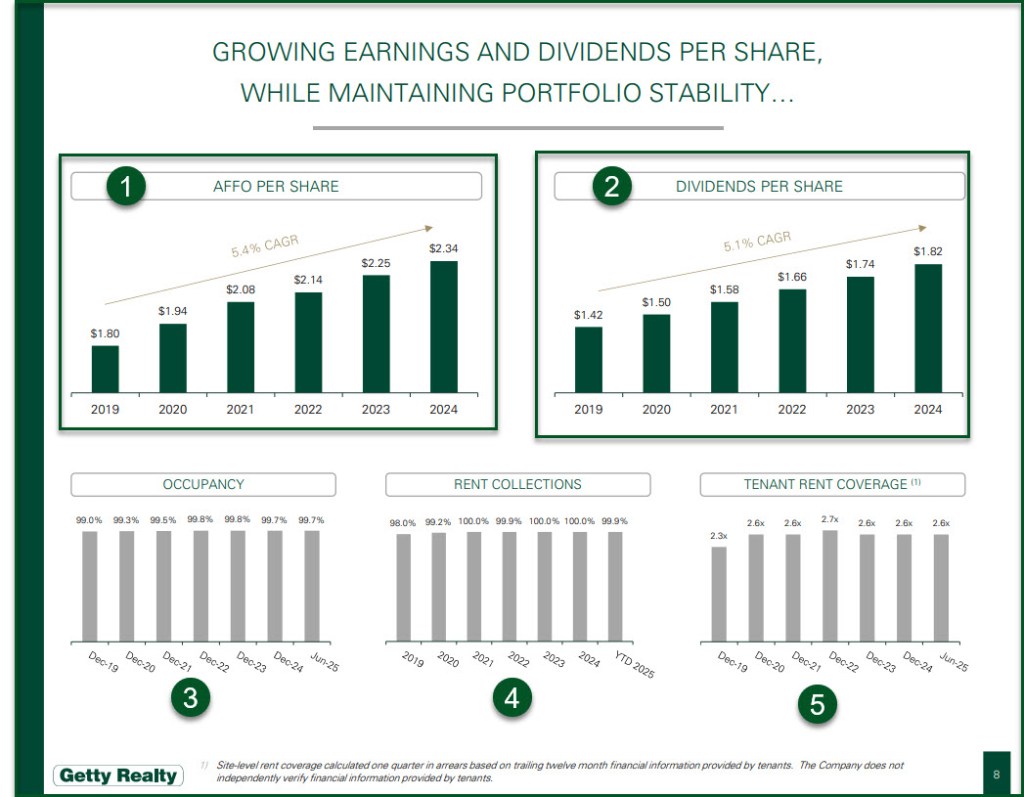

It never hurts to look at investor reports. Getty does a nice job of doing this. To see their resources for investors, go to this link: GETTY INVESTORS

If you want to review the July 2025 Report Presentation: here is a link: REPORT

Seeking Alpha QUANT Evaluation

A good mix of investments continues to make sense for a reliable income stream. I usually like to know the status of the QUANT ratings for our investments. They are usually “HOLD” sometimes I buy more even if the rating is HOLD. I do trade covered call options on some positions. In January I made about $800 trading options on our GTY shares. Since then I pressed the pause button for options trades and just collect the dividends. So far this year we have received $3,783.50 in dividends from Getty.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com