Stocks and ETFs I Sold (QUANT Ratings)

Wise investors have a buy strategy. They obviously want to buy investments they think will go up in value and/or produce steading income. Another factor to consider is whether or not the investment is offering growing dividends.

However, most investors don’t have a sell strategy. They are eternally optimistic about every investment, regardless of the success of that investment. They hope against hope that a losing investment will rebound.

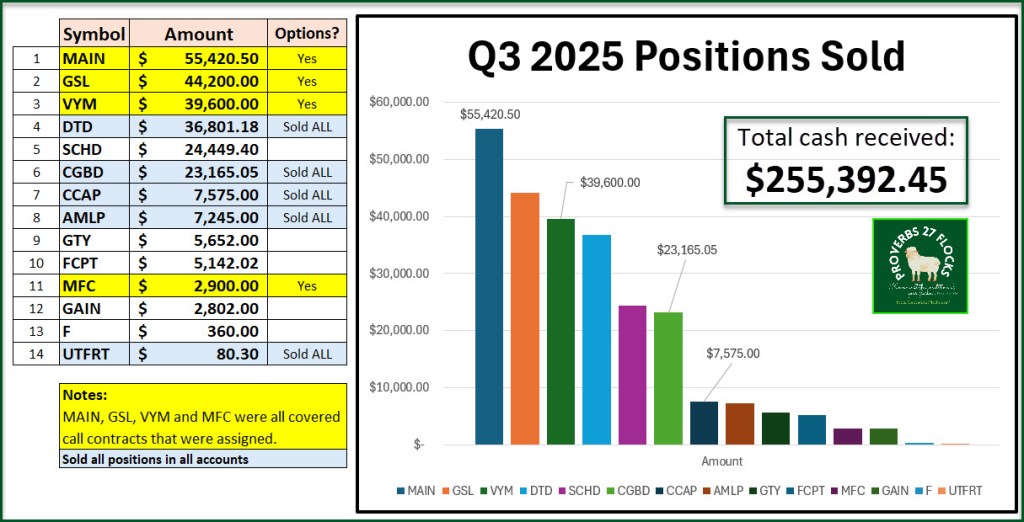

Let me share my thoughts about the investments I sold. Here is the list of ticker symbols: MAIN, GSL, VYM, DTD, SCHD, CGBD, CCAP, AMLP, GTY, FCPT, MFC, GAIN, F, and UTFRT.

One Reason for Selling – Shares Called Away

There are certainly many different reasons to consider selling an investment. During the third quarter I sold portions of, or all our shares of fourteen different stocks and ETFs. In the image provided the shares in yellow were called away or “assigned.” This means that I had a covered call option (or multiple options contracts) that resulted in having my shares called away. The ones sold included MAIN, GSL, VYM, and MFC. To be honest, I was disappointed in the loss of all of the shares. However, that is the “risk” associated with selling covered call options. The truth is that I received what I considered a fair price for our shares.

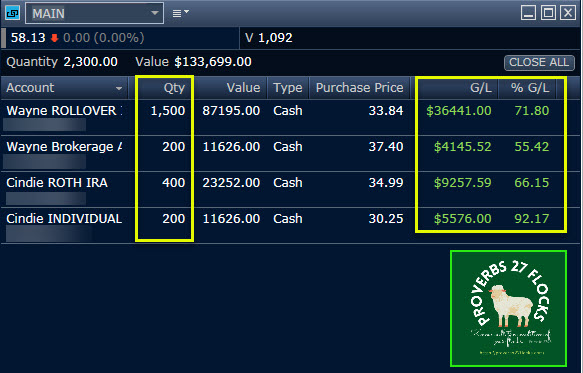

It is important to note that we still own a very significant amount of MAIN (2,300 shares) and VYM (2,285). Cindie and I also have a very large share count of MFC (2,200 shares) and still have a small 200 share allocation of GSL.

The assigned shares resulted in profits from the sales. The total cash we received was about $142K. In a previous post I mentioned that cash from sales made it possible to buy other investments or to enter cash covered PUT options for other investments.

Reason Number Two

It was time to say goodbye to our holdings in the following investments: DTD, CGBD, CCAP, AMLP, and UTFRT. The UTFRT decision was easy. UTFRT stands for the Cohen & Steers Infrastructure Fund, which is designed to invest primarily in infrastructure-related assets. I received shares of this ETF as a result of owning the main fund: UTF. We still own 1,400 shares of UTF. I just did not want the UTFRT investment, and it was practically worthless anyway.

Reason Number Three – DTD ETF Shares

The reason I sold our DTD shares was different. I felt that DTD (WisdomTree U.S. Total Dividend Fund ETF) had become overvalued and that it was time to lock in profits. For example, in my traditional IRA I made a nice profit of $4,503 (22%) in about one-and-a-half years. The $36.8K of cash could be put to work elsewhere.

Reason Number Four – CGBD, CCAP, and AMLP

Both CGBD and CCAP are business development companies (BDCs) and I would rather focus our attention on a smaller set of BDCs including ARCC. The investment in AMLP was relatively insignificant and I didn’t feel like buying more shares, so I sold mine at a slight profit of $223.

Reason Number Five – SCHD, GTY, FCPT, GAIN, and F

The reason for the sale of Ford was just to free up some cash in our cash account. I made a 30% profit, so the extra cash could be used to pay some bills.

For SCHD, you may wonder why I sold 900 shares. I still like SCHD, but I wanted some additional cash in my ROTH IRA for some other investments that looked like they had more potential and for the ability to do more cash covered PUT options contracts. I still have 2,500 shares of SCHD in my ROTH and another 1,000 shares in my traditional IRA. Cindie also owns 1,000 shares in her ROTH.

Recommendation

If you hold shares of SCHD, I don’t think you should sell. The same is true for MAIN, GSL, and VYM. If you have shares of DTD you might want to sell and buy something else with the cash. If you don’t trade cash covered PUT options the cash from the sale of DTD could get you started with that investing adventure.

Stay Tuned: More Q3 Updates to Come for Easy Income

There are still a couple of Q3 updates remaining: an Options income update and an EAI update showing easy income growth.

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. It can help you find good growth and dividend growth investments. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.