Easy Income From Real Estate: NNN

A long time ago I used to buy tires for a 1964 Thunderbird. The year was probably around 1970. I don’t recall exactly what I paid for four tires, but I would not be surprised if I paid less than $150 for a set of four. I asked Duck.ai the following question: “How much, on average was the price per tire for passenger cars in 1970?”

The answer did not surprise me: “The average price for passenger car tires in 1970 was approximately $20 to $30 per tire. In summary, if someone were to buy a set of four tires in 1970, they could expect to pay between $80 to $120 total, which was a reasonable expense for that era.”

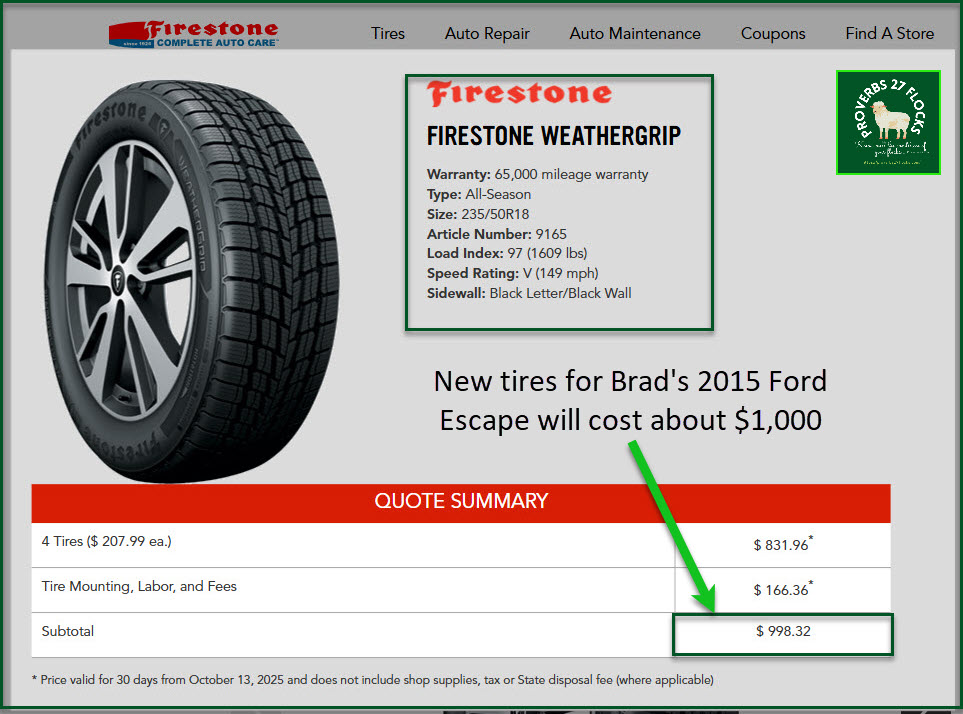

However, Duck.ai also noted that: “Adjusting for inflation, these figures indicate a significant increase in tire prices relative to today’s market.”

So I asked another question: “Adjusted for inflation, what should current tire prices be if they were $30 per tire in 1970?” The answer: “The equivalent price per tire today, adjusted for inflation, would be approximately $185.” Here is what tires will probably cost for the 2015 Ford Escape that Cindie drives:

Just sitting back and collecting the dividends is my idea of a good day’s work. Of course, I am not really sitting back very often. There are so many wonderful ways to devote my time. I just don’t want to spend time managing and repairing real estate. I also don’t want to pay property taxes or have to buy property insurance. In addition, I won’t want to have to evaluate tenants and then have to evict the ones who are a problem. NNN takes care of all of the details for me.

Our Ownership of NNN – it is a Real Estate REIT

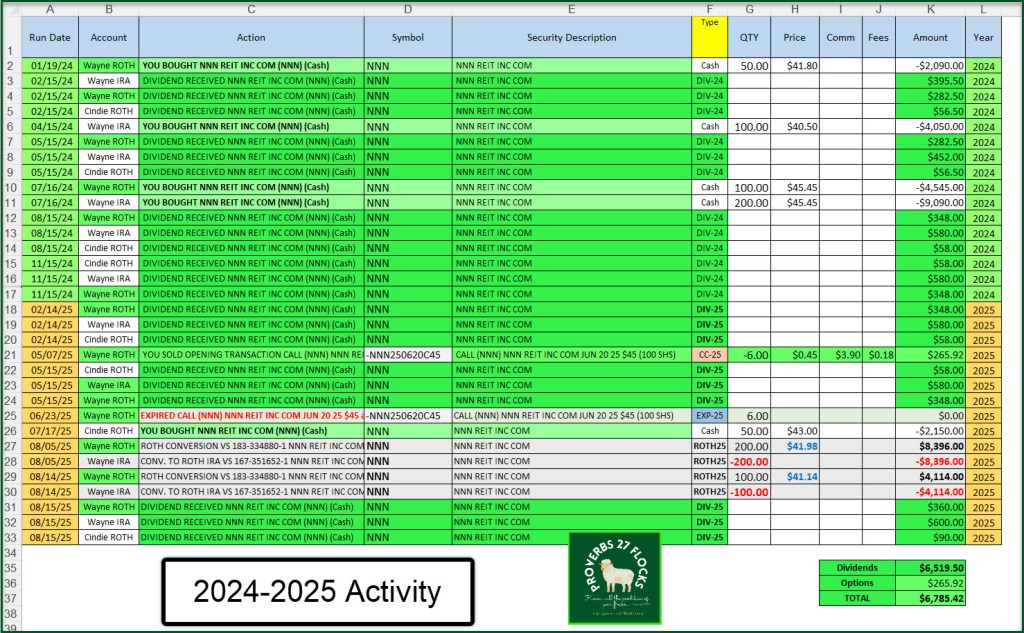

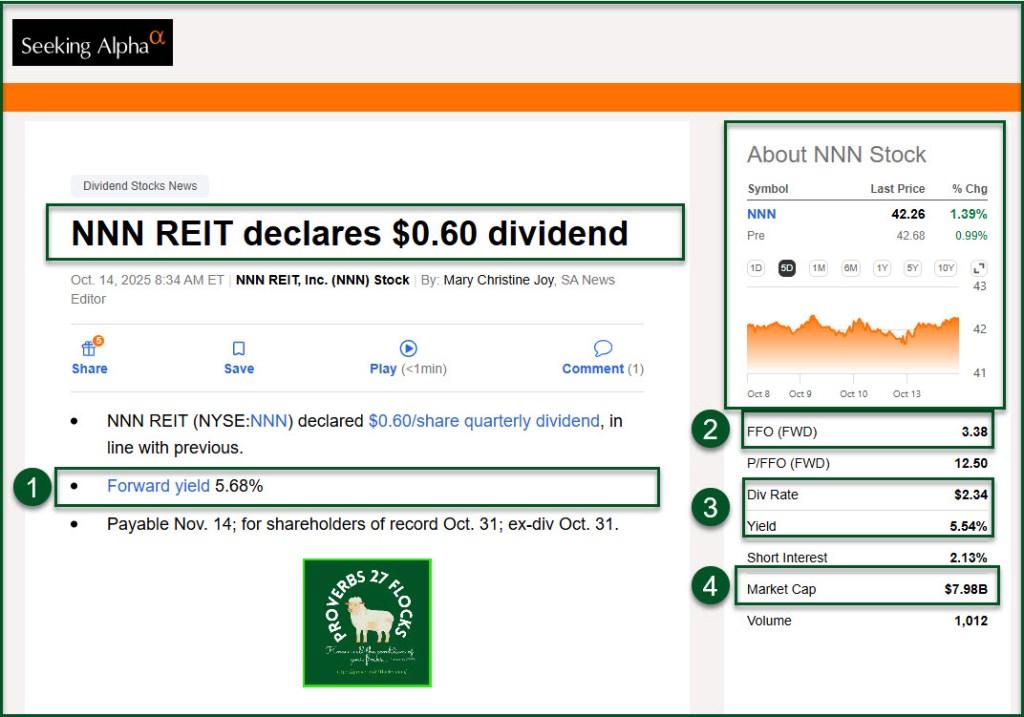

Cindie and I own 1,750 shares of NNN that are currently worth $74,138. With dividend at $0.60 per share, we will receive $1,050 on the dividend pay date. You have to own the shares by the Ex-Dividend date to reap the benefit of the next dividend. I also trade covered call options on my holdings for “synthetic” dividends. That income is small, but $265.92 will buy a month’s worth of groceries (and then some.) Because it is likely that the Ford Escape tires will cost about $1,000, the cost is covered just by the NNN dividend.

ROTH Conversions

One of the things you should notice in the following activity history I downloaded from Fidelity is the ROTH conversion of a total of 300 shares from my traditional IRA to my ROTH. Those share will now receive $180 in tax-free income. That is the best kind of easy income. You should also notice that I did the conversion at prices lower than today’s NNN price per share. The goal for ROTH conversions is to do them when the price drops.

If I convert more shares of NNN before October 31, which is the Ex-Dividend date, those dividends will also be tax-free. Cindie’s NNN dividends are already tax-free because she owns 150 shares in her ROTH IRA.

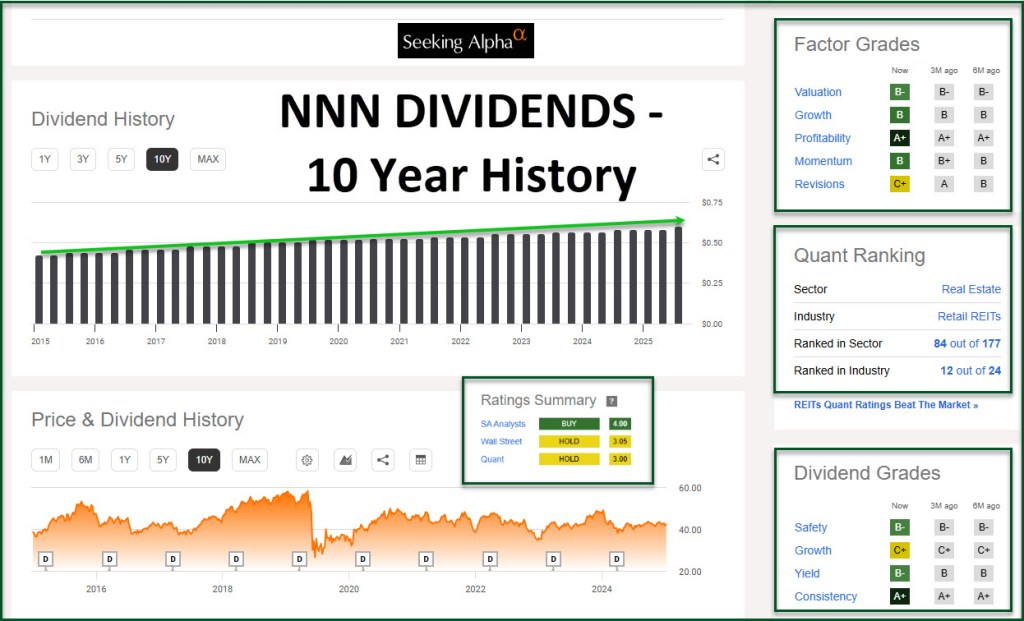

Another Opinion from Seeking Alpha

I like to read what others are thinking. I’m especially interested in analysis by other dividend-focused investors. Here is one viewpoint: “NNN REIT: Grab This Dividend Stalwart On The Cheap Now.” – Kody’s Dividends, Seeking Alpha

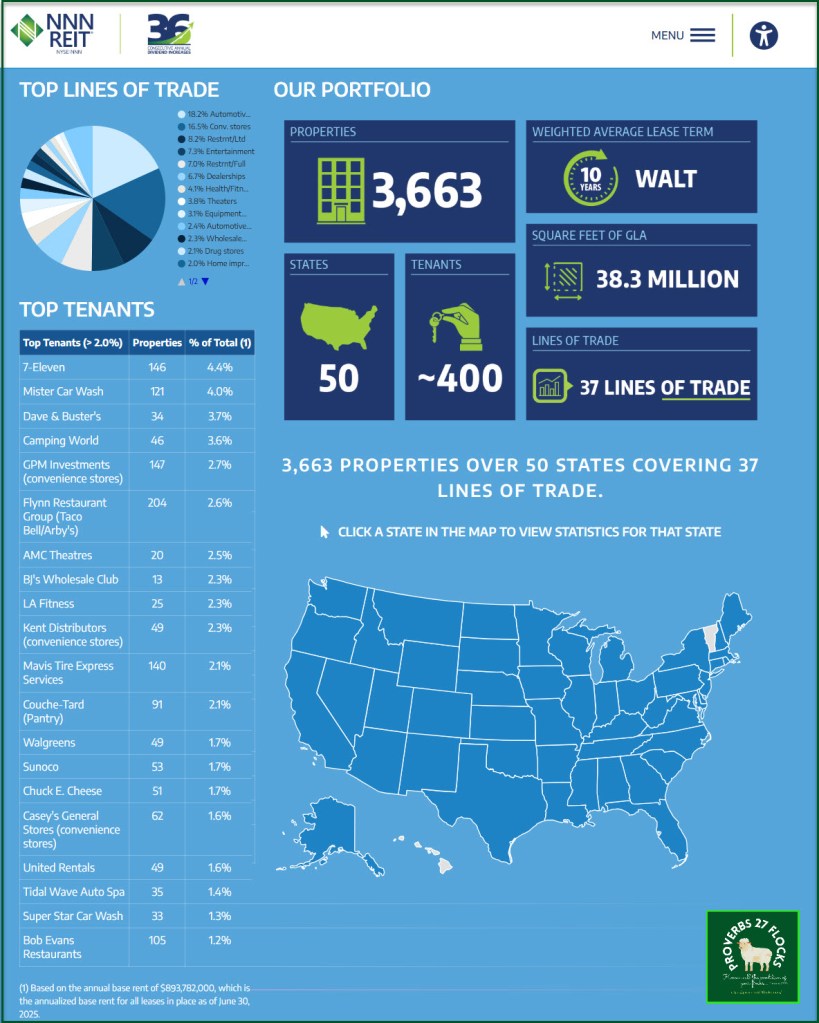

Business Profile

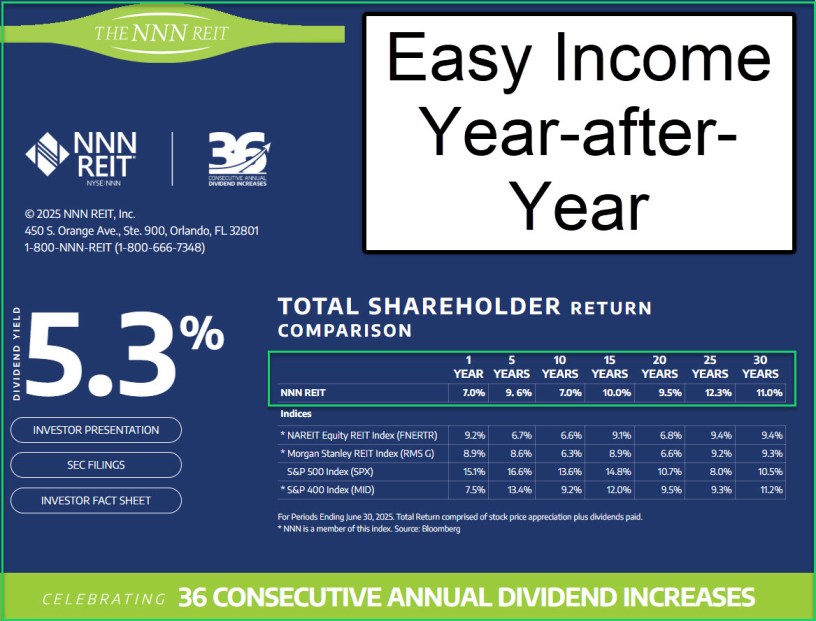

NNN invests in high-quality properties subject generally to long-term, net leases with minimal ongoing capital expenditures. As of June 30, 2025, the Company owned 3,641 properties in 50 states with a gross leasable area of approximately 38.3M square feet and a weighted average remaining lease term of 10 years. NNN is one of only three publicly traded real estate investment trusts to have increased annual dividends for 36 or more consecutive years.

Recommendation

If you don’t already own shares of NNN, I recommend that you consider adding this to your retirement portfolio. Don’t go crazy with your buys. One way to enter is to sell cash covered put options. The downside is that the current price is $42.41, so you would want the $40 put. The downside to this strategy is that you might not get the shares and you have to wait until November 21 to see if the shares fall to $40 or lower. Furthermore, the income from each contract with that expiration date would only be about $20 or $0.20/share. In my mind it makes more sense just to buy shares now.

Seeking Alpha Highlights

Finally, as you would expect, I look at Seeking Alpha before buying or selling an investment. NNN has a very, very long history of paying increasing dividends. The payout ratio is perfect: 69.50%, and the yield is a decent 5.68%. Bear in mind that my “yield” is greater than that due to options trades.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.