Stocks and ETFs I Bought – QUANT Ratings

Before you read any further, please keep in mind that I am not always successful with every investment I make. When I first started investing I lost every dollar invested in two different companies, based on advice from an R.W. Baird broker. But his advice isn’t the only problem. Sometimes I have confidence in an investment that turns sour. One recent example includes Medical Properties Trust, Inc. (MPW). Therefore, before you buy anything in my third quarter list, there are three things I encourage everyone to do.

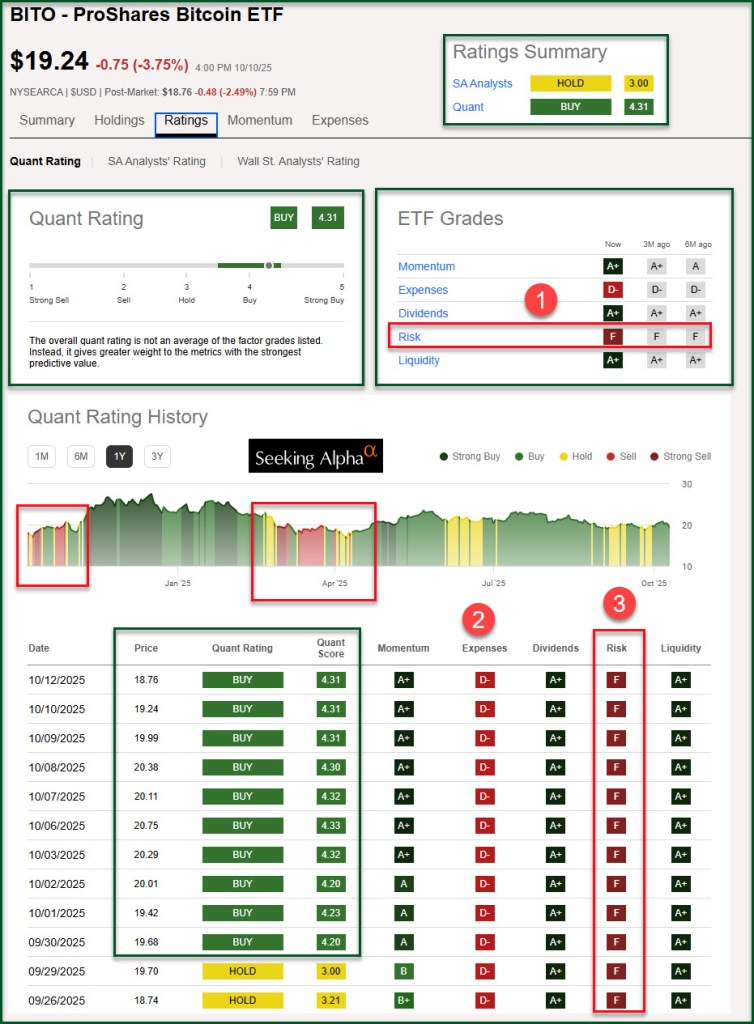

First ask, “Does the investment fit my goal statement and my investment criteria?” For example, I bought shares of BITO this past quarter. This ETF is the “ProShares Bitcoin ETF.” As long as you understand the risks in leveraged currency investing, then this might fit in with your portfolio. The fund invests in the currency markets. It invests through derivatives such as futures in bitcoin.

My investment in BITO is insignificant in total dollars. It ranks eighteenth out of the twenty-eight buys for the three months. If a cryptocurrency panic sets in, this investment could tank. In the meantime the TTM dividend yield is about 53% and the ETF pays monthly. In one month we received $113.41 in dividends for our shares.

Secondly, prudent investors use a tool like Seeking Alpha as a part of their research. I want to read what others are saying, and I always consider the QUANT ratio. In general, but not always, I want to see at least a “HOLD” QUANT rating on any stock or ETF I add to our portfolio. BITO currently has a buy QUANT rating of 4.31.

What many may not realize is that the QUANT rating varies over time. I purchased 100 shares for my ROTH IRA for $19.68 and 50 shares for Cindie’s ROTH IRA for $19.54 per share. It will not surprise me if the shares drop below $19 per share on Monday, October 13, 2025. (If you want to understand the QUANT ratings, here is a link: QUANT.)

The third piece of the puzzle has to do with diversification and the size of your total portfolio. If you are just starting out, then adding BITO to your portfolio is most likely not a wise long-term move. It might be, but BITO is highly speculative. Our current total retirement portfolio is $3.4M in value. That means our BITO investment is 0.087% of all investments. If your total portfolio is $40K, then owning 150 shares of BITO at my cost would make it 7.36% of your portfolio. That would not be prudent. I’d rather see you invest seven percent of your total investment dollars in VOO, DGRO, SCHD, VYM, or a similar more diversified ETF with hope of growing dividends.

What Was Added? How Were Shares Added?

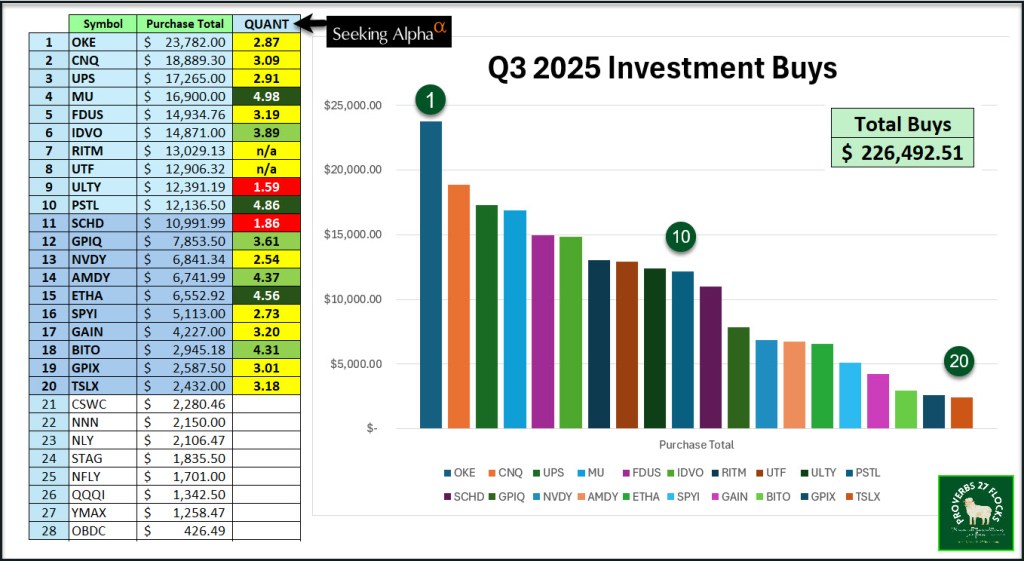

The total cash used for purchases was $226,493. This cash was raised from selling other investments and from substantial dividends that flow into our accounts each month. The buys were made with 84 separate buy limit orders. So, for example, when I bought shares of RITM, I did that in ten separate buy limit orders. The share purchases for ULTY were 15 different purchases totaling $12,391. ULTY (YieldMax Ultra Option Income Strategy ETF) is a very high-risk investment. Rithm Capital Corp is in the Mortgage REIT sector. This is also higher risk.

The thing new investors don’t always do well is buying shares of any investment with patience. I would rather buy 25 shares at a time than buy 100 shares in one block if the dollars involved over time will be significant. Dollar cost averaging is a wise approach for just about any investment.

The Top Twenty Buys

Here are the symbols for the top twenty: OKE, CNQ, UPS, MU, FDUS, IDVO, RITM, UTF, ULTY, PSTL, SCHD, GPIQ, NVDY, AMDY, ETHA, SPYI, GAIN, BITO, GPIX, and TSLX. However, I sold all of our TSLX shares on October 10th. Our TSLX (Sixth Street Specialty Lending, Inc.) shares were worth $61,302 at the sell limit prices I received.

Why did I do this? I wanted the cash for other investments. We have received $29,618 in dividends from this investment since 2017. The capital gain for the shares was $5,443. However, we did not buy all of the shares in 2017. I added shares over time in 2018, 2019, 2020, 2022, 2023, 2024 and 2025.

I share this because I don’t want you to think you should buy TSLX. In fact, perhaps none of the investments in my top twenty are right for you. Bear in mind that I trade covered call options on my shares of OKE, UPS and MU. If you aren’t ready to trade options contracts, then you might want to avoid my top four buys. So far in 2025 I have earned $449.65 in options income from UPS and I plan to enjoy the dividends from my 200 shares.

The time spent “buying” was minimal. Obviously most of the work involves a quick review of each investment before I buy. This is where my Seeking Alpha subscription helps. Within a couple of minutes I can determine if an investment I learned about is worth an allocation of our current cash dry powder.

NVDY and AMDY

AMDY (YieldMax AMD Option Income Strategy ETF) and NVDY (YieldMax NVDA Option Income Strategy ETF) are examples of ETFs that do options trades on company shares like AMD and NVDA. If you look at the yields for these two ETFs you should be very surprised. Both pay a ridiculously high dividend, and the dividend is paid monthly. Our total investment in these two is about $13.6K. Like other investments I made, these are also high risk.

Remember our total portfolio size? All of the Q3 investment buys make up 6.7% of our total portfolio. I’d rather have these investments than any bonds or bond funds. Most of them generate significant income because they engage in high-risk behaviors related to options trading or cryptocurrencies.

Recommendation

If you were to ask me, “What do you recommend?”, my answer would be to focus on investments like MU, PSTL, AMDY, and BITO. A small slice of each of these could prove beneficial to your income and growth. You would be investing in technology, office REITs (USPS facilities), and cryptocurrency income with these four.

Stay Tuned: More 2025 Q3 Updates to Come for Easy Income

Bear in mind that “easy” doesn’t mean there is no effort or time spent. Anything worth doing will take some time and effort. The goal is to focus on what is important and then move on.

The updates will include an Options income update, an EAI update showing easy income growth, and updates regarding the stocks and ETFs I sold. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Closing Thoughts

All investing has risks. I share my successes and my mistakes like MPW. The mistakes are reminders that you can lose money in more than one way when you invest. However, proper diversification can help prevent a real investment portfolio mess.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. It can help you find good growth and dividend growth investments. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.