Are You Focused on the Tree or the Forest?

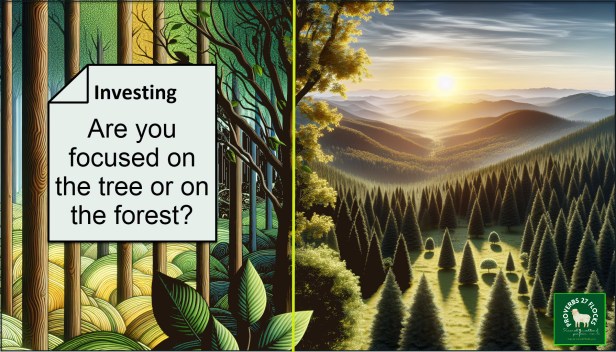

When the market drops like it did yesterday, probably due in part to President Trump’s 100% tariffs on Chinese goods, different people view the drop differently. There are those who see what happened as a single tree that is losing its leaves and seems to be dying. They lack hope and perspective.

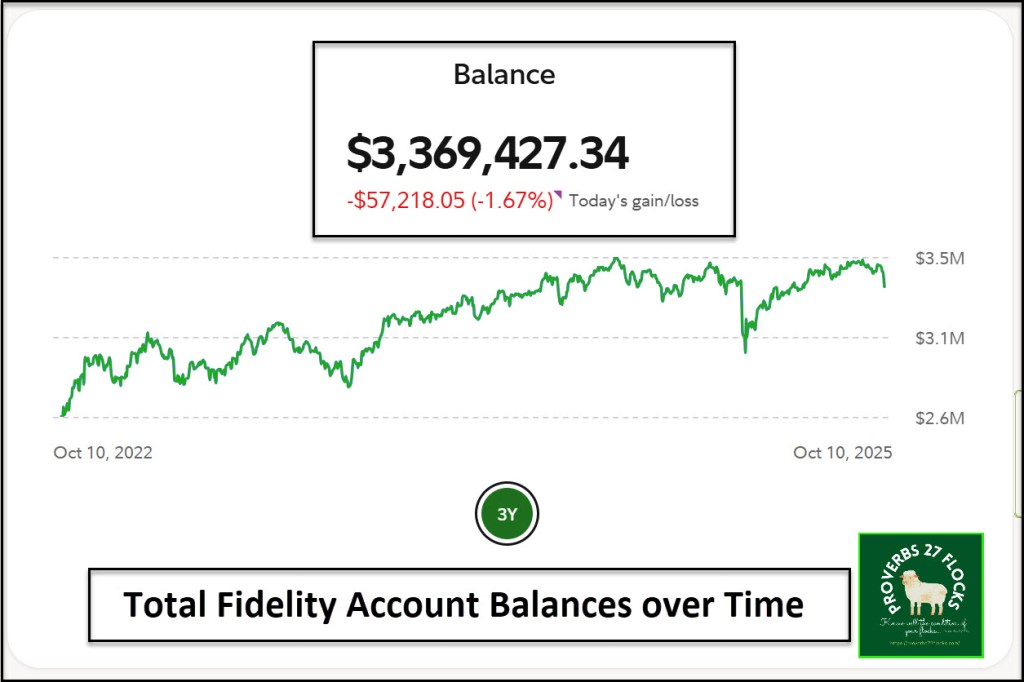

There are others, like me, who continue to look at the forest of investments and long-term growth from both dividends and ten-year market trends. Yesterday our Fidelity accounts went down 1.67%. That translates to over $57K in “lost” value. In fact, the week itself was a disaster for our investments as a whole. Why am I still optimistic and not fearful? Where is “hope” to be found?

Why I have Hope

There are two types of hope. One is “hope so” hope that lacks assurance or certainty. The other type of hope is based on promises that are made by someone who has great character, the ability to fulfill their promises, and a history of fulfilling their promises. When it comes to this life, history shows that calamity can come quickly. The Great Depression comes to mind, as do the other more recent events. But my true hope is not built on investments.

The author of the book of Lamentations lived during a stressful time in the life of the nation of Israel. Lamentations 3:21-24 says “But this I call to mind, and therefore I have hope: The steadfast love of the Lord never ceases; his mercies never come to an end; they are new every morning; great is your faithfulness. ‘The Lord is my portion,’ says my soul, ‘therefore I will hope in him.’”

The reason I have hope is not because of our assets. I have hope because there is a God with steadfast love. He sees sparrows fall and knows we have needs. He is a good heavenly Father. That is true for believers during all of history, and certainly for the last 100 years.

Learning From 100 Years of History

Can or will bad times come? Certainly. Most of the time there is a relatively short time between the beginning of the “disaster” and the recovery. Sometimes, however, the disaster can stretch out over a decade or more.

The “Great Depression” was a part of life when my parents were children (1929–1939). The stock market crashed on October 29, 1929 (Black Tuesday). This downturn led to massive unemployment, bank failures, and a severe economic decline that lasted throughout the 1930s.

Another October comes to mind: Black Monday in 1987. On October 19, 1987, stock markets around the world crashed, with the Dow Jones Industrial Average falling 22% in a single day. The crash was attributed to factors like computer program trading and widespread panic.

Sometimes it takes greed to create a mess. In the “Dot-Com Bubble” (2000–2002) there was a surge in technology stock valuations caused by nonstop euphoria, leading to a bubble. When the bubble burst in 2000, major indices suffered significant losses, with the NASDAQ dropping 78% from its peak. Do you see some parallels with the current AI-fueled exuberance of 2025?

It wasn’t that many years ago that there was a “Global Financial Crisis” (2007–2009.) The crisis was sparked by the collapse of the housing market and risky mortgage-backed securities. This downturn led to a nearly 57% drop in stock prices from their previous highs and resulted in major financial institutions failing or requiring bailouts. Our granddaughter Violet was a toddler when this one started.

You don’t have to be very old to remember the COVID-19 Market Crash (2020.) Bad policy decisions drove an economic shutdown, causing a rapid market downturn. Markets fell by about 34% in a matter of weeks.

Could Friday be the start of a major market crisis. Yes, it could. The point to remember is that you should not pin your hope to things that are not certain. Life is uncertain by its very nature. Therefore, temporary investments are temporary and subject to crazy peaks and valleys.

The Proper Response to Friday’s Market

The proper response will continue to be from a forest perspective. Don’t focus on the tree of October 10, 2025. Your forest view can and should include a right view of God, a right view of the temporary reality of life and wealth, and a reasonable long-term approach to investing. When one tree falls in the forest it doesn’t usually mean the forest is doomed.

All scripture passages are from the English Standard Version except as otherwise noted.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.