Is the Easy Income Growing?

This is part three of the Q3 update. There is nothing wrong with “growth” investing. Growth investing is generally defined as investing in assets that will grow. In general, this means you will be buying and holding stocks (and stock mutual funds or ETFs) that are expected to grow at an above-average rate compared to their industry. So, for example, there are many pharmaceutical companies. But not all of them will grow in value due to growth in sales, profits, margins, and other factors. So the focus is capital appreciation with immediate income as a secondary concern.

This makes sense, especially if you are young. However, in retirement it is necessary to start consuming the value of your investments. There are two primary ways to do this. The first would be to sell your growth investments and use the proceeds to pay for your living expenses. The second is to own dividend-paying stocks and ETFs that give you sufficient cash each quarter to fund your retirement. Of course, there is a mix of the two. You can own both types of investments.

The reality is that we own both types of investments. However, the primary focus is on dividend income that grows. I want easy income but if it doesn’t grow it isn’t a very sustainable model when you remember the monster called inflation. Therefore I don’t want to have to think about what to sell and when to sell it to generate growing income.

Wise Investors Read the Monthly Statement

Many people never look at their statements. They miss a lot of important information when they fail to read a couple of pages. Three things should be of importance: 1) What is your advisor charging you for their advice? Are you getting above average market returns as a result of their work and guidance? If not, what exactly are you paying for if you could just invest in a total market ETF? 2) What is the income you are receiving from your investments? Where is that income going? Are you reinvesting it? Are you expanding your holdings with more diversification? 3) What are your largest holdings? Are they appropriate and do they increase your overall risk if one of those top holdings drops significantly in value?

What the Q3 2025 Fidelity Statements Tell Me

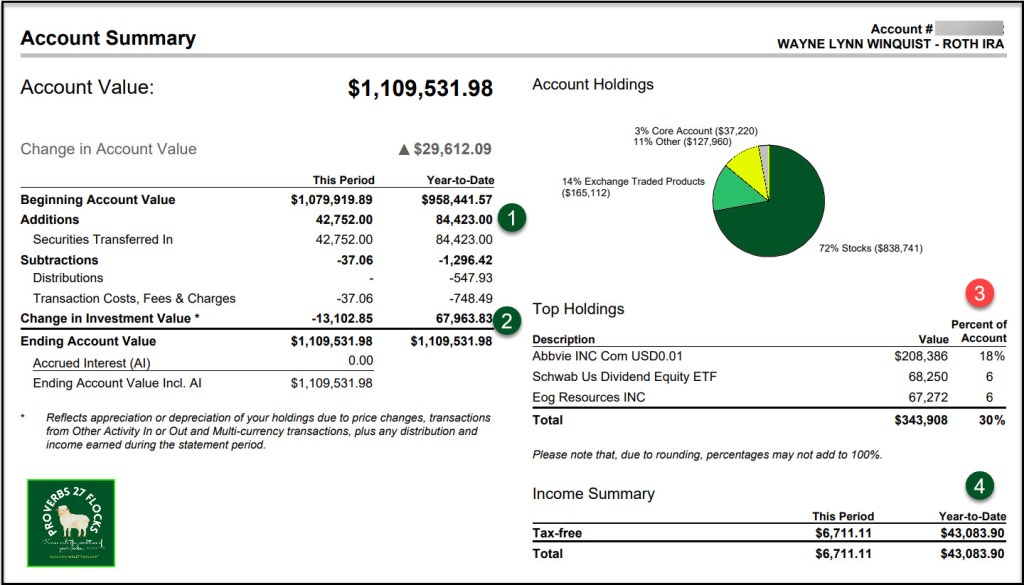

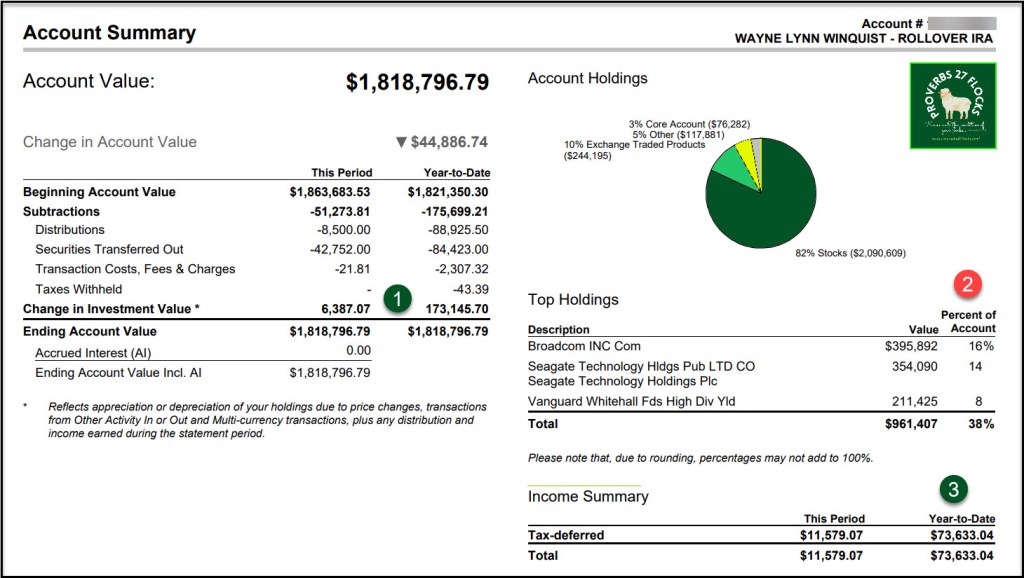

Our two largest accounts are my traditional IRA and my ROTH IRA. Over time, due to ROTH conversions, my ROTH is finally above the $1M mark. Therefore, the tax-free income we receive from that account (dividends and covered call options) is significant. Easy income should be tax free whenever possible. Here are two significant pages from our September 2025 statement. Pay particular attention to the top holdings.

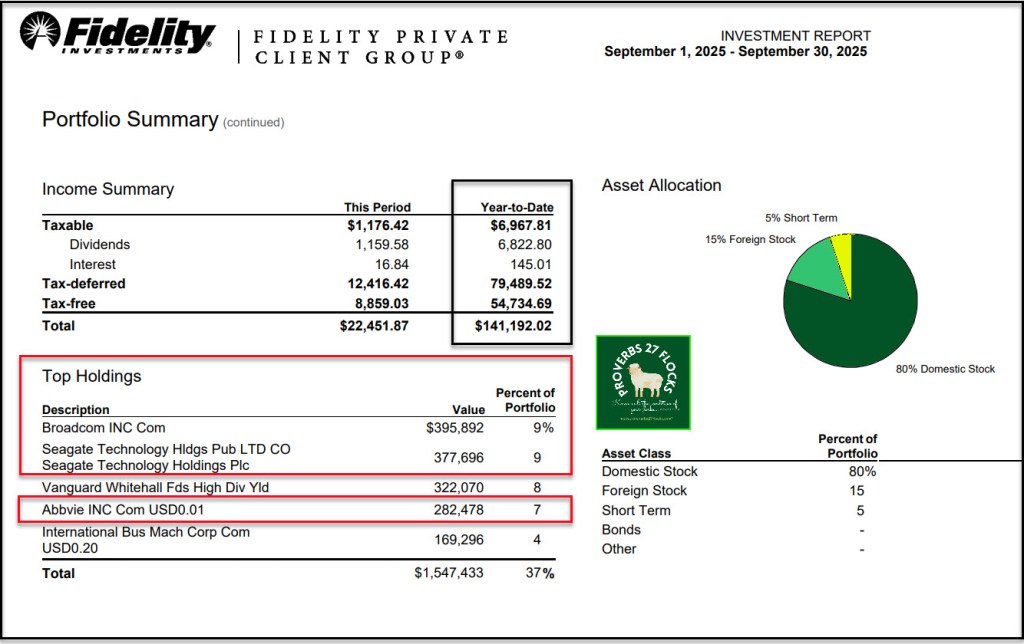

There is some additional risk in my portfolio due to our large “Top Holdings” investments in ABBV, EOG Resources (EOG), Broadcom (AVGO), and Seagate (STX). Bear in mind that I trade covered call options on these shares, and I anticipate that some of my AVGO and ABBV shares will be sold on or before the contract expiration dates. I expect all of my STX shares to be called and some of the EOG shares may be called as well.

Any non-ETF holding that is greater than 5% should be a yellow caution flag. Do not forget that you might be introducing risk simply by buying ETFs that all focus on the top ten investments in the S&P 500 index. I see this just about every time I review someone’s holdings.

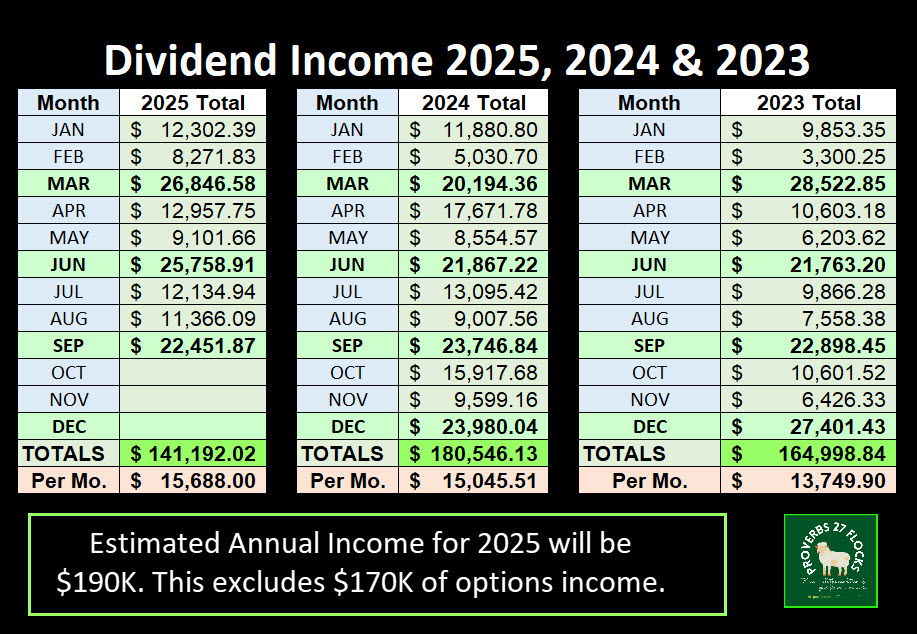

Here is the summary page from our September 2025 Fidelity Statement. Notice that our YTD income is $141K. This does not include options income. $54.7K of this income is TAX FREE.

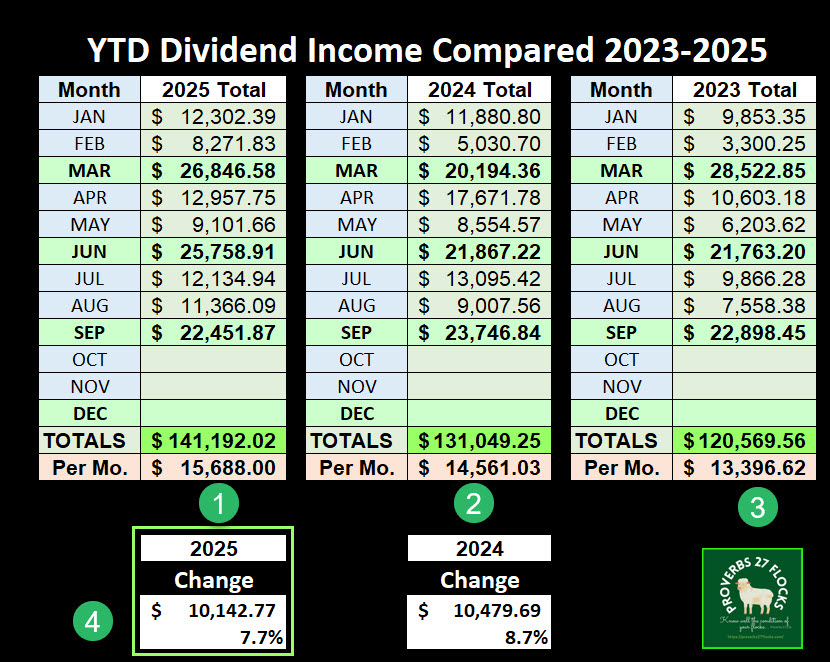

Comparing 2023-2024-2025 for Growth

The trend is being maintained. For the most part our portfolio is unchanged year-after-year. That isn’t to say that I never buy or sell investments. However, my turnover is minimal. That is by design. I don’t want my life to be a slave to the stock market. These two images illustrate the reality of the growth.

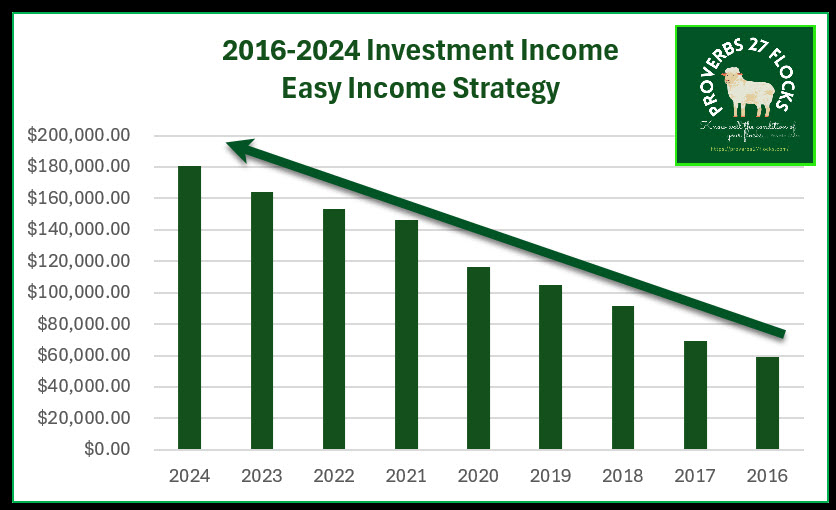

The Easy Income Trend 2016-2024

In 2016 our dividend income was just under $60K. In 2024 it was about $180K. Notice that Covid-19 did not have an impact on our income growth. Also notice that our income has more than doubled in eight years. The question you need to ask is, “what has happened to my income from investing for the last 5-10 years?” You don’t know? Then take some time to determine if you will have sufficient income to fund your retirement years.

Stay Tuned: More 2025 Q3 Updates to Come

The updates will include an Options income update, an EAI update showing easy income growth, the stocks I sold and those that I purchased, some new cryptocurrency ideas, and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Closing Thoughts

Remember the need to do some tax planning. The investment choices you make today, including converting assets from traditional IRAs (401k) to ROTH accounts can have a significant impact on your real income in retirement. In my last post I mentioned DINKYTOWN’s website. There is a link to Dinkytown in that post.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. It can help you find good growth and dividend growth investments. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.