What About RMD’s, QCD’s, Roth Conversions and Income Taxes?

This is part two of the Q3 update. The goal of this post is to get you started with thinking about what retirement looks like when it comes to minimizing income taxes and maximizing charitable giving. RMD’s are taxable income. Wise investors prepare for income taxes and pay them quarterly. QCDs (Qualified Charitable Giving) can help minimize your income tax burden and maximize the dollars that reach the charity.

2025 RMD for Cindie and Wayne

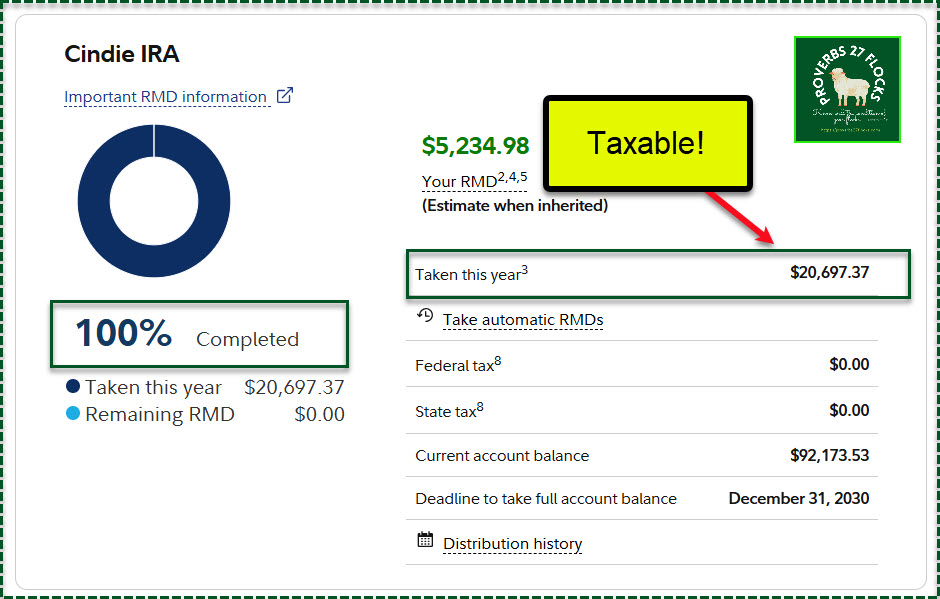

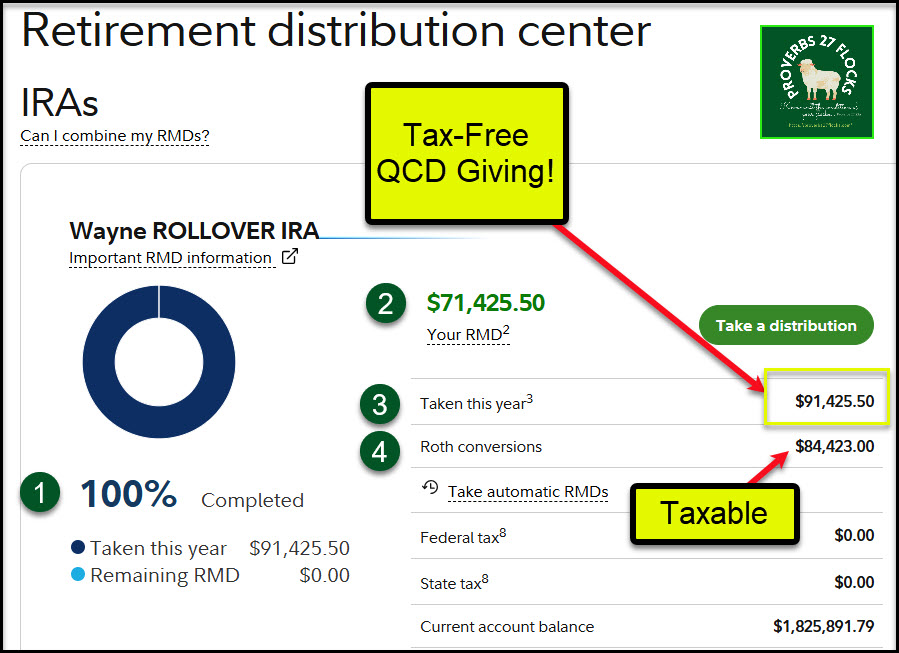

Both of us have satisfied the government’s requirement for Required Minimum Distributions. Cindie’s 2025 RMD is taxable income. Only a portion of mine are taxable due to QCD giving.

This image shows Cindie’s 2025 RMD withdrawals, as captured from Fidelity’s website. She must withdraw the entire balance by the end of 2030 because this is an inherited IRA.

This is the same image from my account. Notice four things: 1) I have satisfied my RMD for 2025. This is good, as it gives me an opportunity to do ROTH conversions. 2) My RMD for 2025 is about $71.4K. This number is calculated by Fidelity using my age and the IRA account balance at the end of 2024. 3) I have taken about $91.4K in withdrawals. All of this is a QCD non-taxable withdrawal. Therefore, I have satisfied my required RMD using QCDs to various non-profits, including our local church. 4) The taxable amount is the total YTD ROTH conversions.

ROTH Conversions

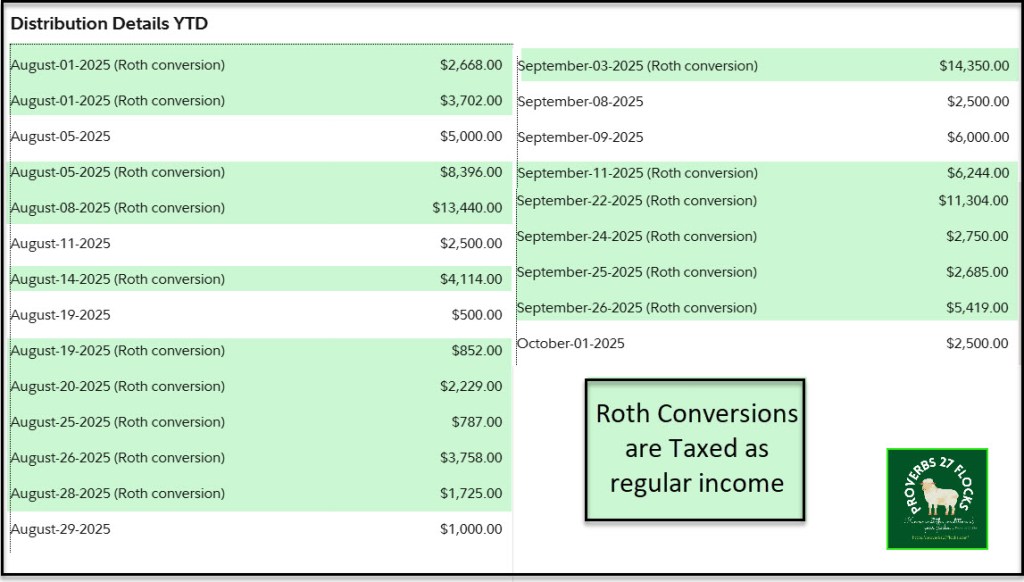

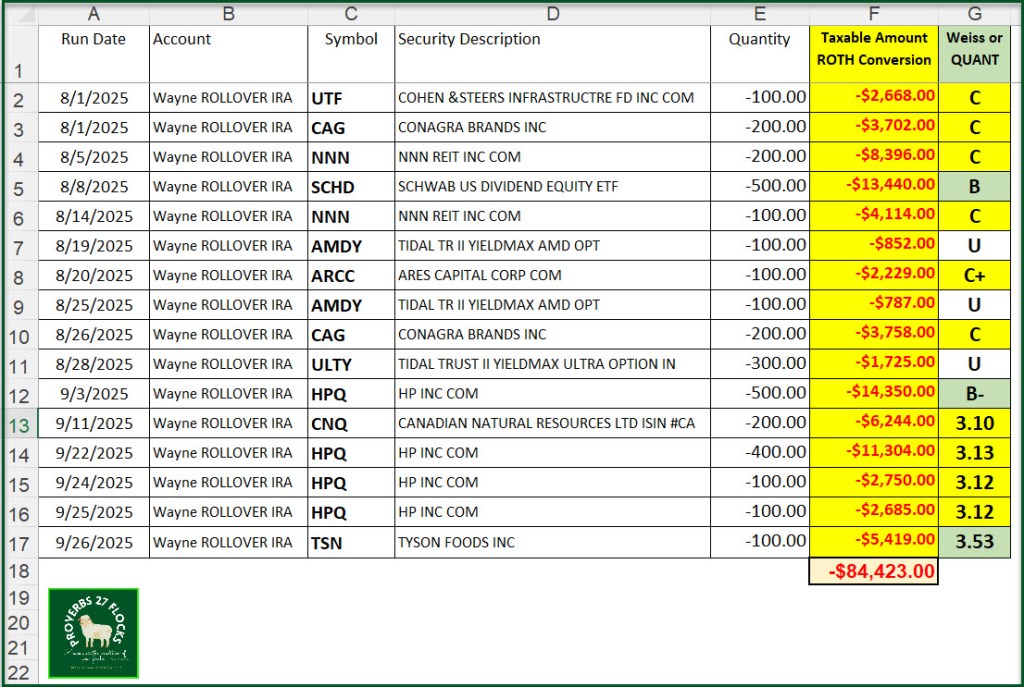

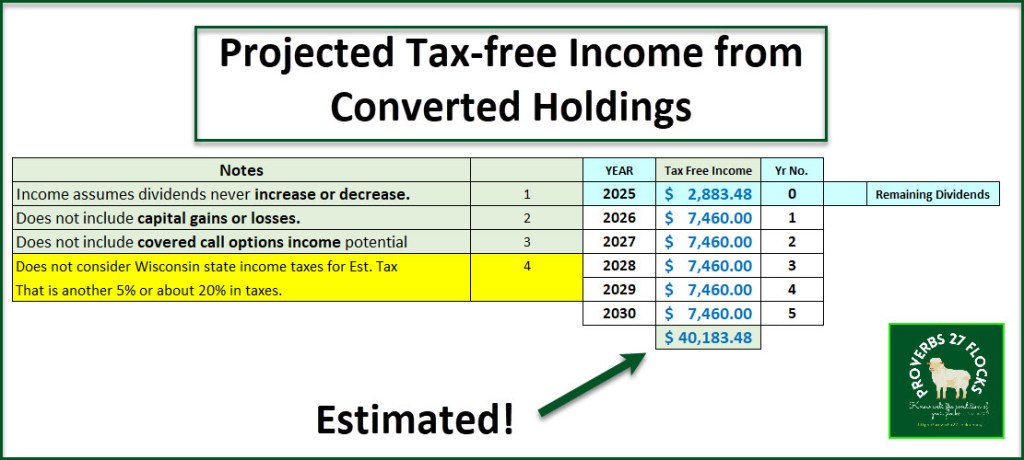

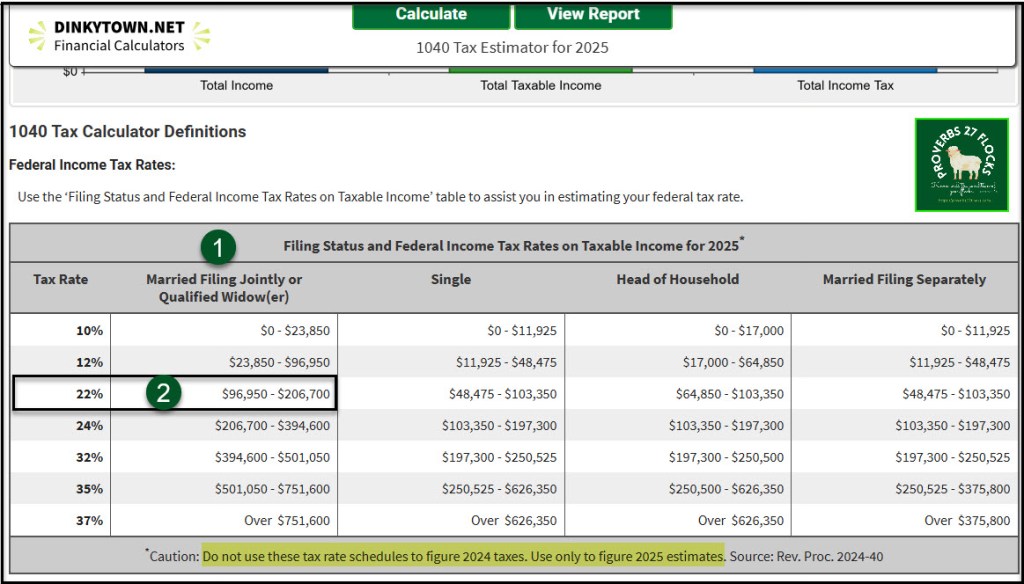

There are two ways to see the ROTH conversions. The first image is a partial extract from the Fidelity website. I highlighted the ROTH conversion amounts. These are taxable events, so I need to include the $84.4K as taxable income. The second image shows the positions I have converted year-to-date. You should notice that I don’t do all of the conversions in one block. My strategy is this: I look for days when the market is down, and particularly when the position I want to convert is down. This leverages the value and reduces the tax burden.

All of these stocks and ETFs pay a dividend. Therefore, it is helpful to see what the tax-free income will look like for the next five years. That makes paying the income tax less painful.

I also keep track of the quality of the investments I convert. The best tool for this purpose is Seeking Alpha.

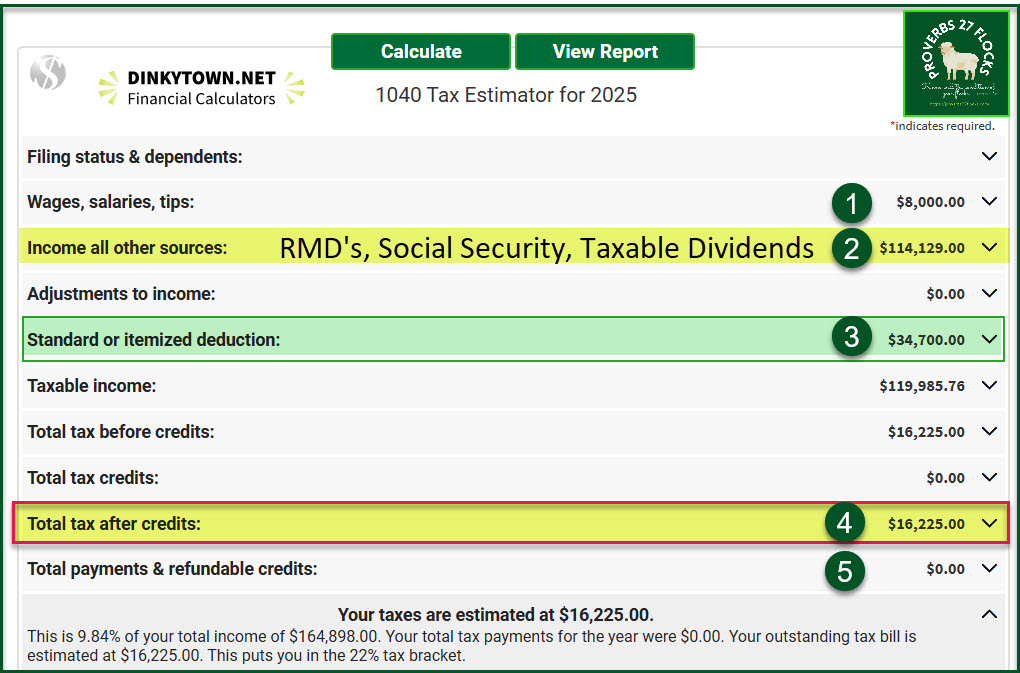

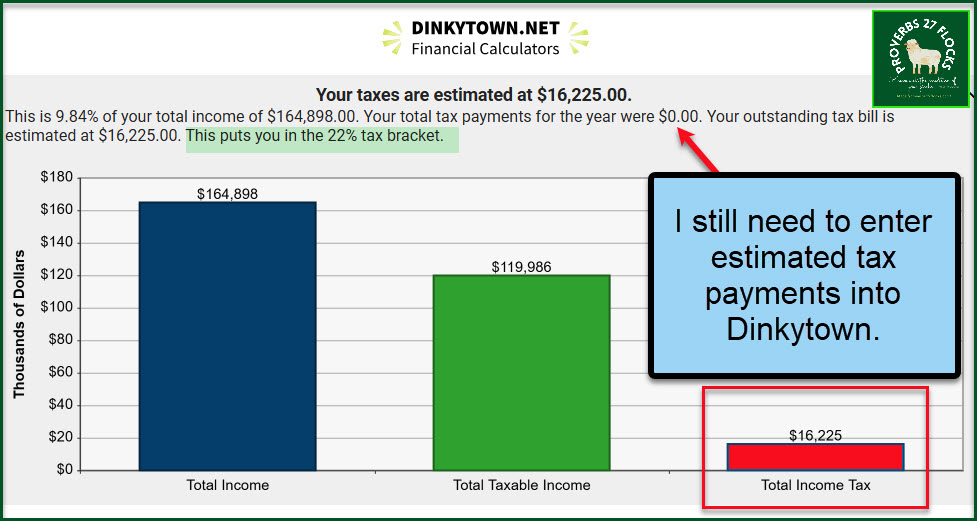

Dinkytown Tax Estimates

Dinkytown offers a great tool for 1040 tax calculations. I entered the YTD ROTH conversions, Cindie’s YTD Beehive gross pay, our total expected Social Security income for the year, Cindie’s RMD withdrawals, and an estimate for the taxable qualified dividends from the taxable brokerage accounts.

Although I have not yet entered taxes paid YTD into Dinkytown, I have already paid $19,526 in estimated quarterly Federal income taxes for 2025. If this trend continues, we will get a Federal refund. I hope that the refund is very small because I don’t like loaning money to the government. They already have enough trouble keeping their own budget and paying their bills and interest on the national debt.

Stay Tuned: More 2025 Q3 Updates to Come

The updates will include dividend income results, interest income, Options income update, an EAI update showing easy income growth, the stocks I sold and those that I purchased, some new cryptocurrency ideas, and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Closing Thoughts

If you have income from multiple sources, using Excel to keep track of your income can help you estimate your income tax liability. This is especially important in retirement because none of our income sources has automatic income tax deductions except for Cindie’s pay from Beehive Homes of Oregon. I recommend using Dinkytown. It is simple to use and can help you with income tax planning. However, it does not calculate Wisconsin income taxes. I have to do that using a spreadsheet.

Here is a link to the DINKYTOWN website: LINK

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.