Was Q3 Successful?

One thing that many (if not most) advisors don’t do is share their own results. They give recommendations and they do some work for you, and then they charge you for their services. They deserve to be paid, but do you ever wonder, “Does this person eat their own cooking?” Does the chef make food and then go across the street to get a meal at a competitor’s restaurant?

This chef eats his own cooking. I also share my menu and “preparation” and “cooking instructions” for the portfolio, including the menu items and ingredients that I will not use. The ingredients I avoid are the MSG and High Fructose Corn Syrup’s of the investment world.

Furthermore, although my father would have been appalled, I also share my results. I think that is only fair. Why should someone take my advice if they don’t know if I am really successful?

Training Session

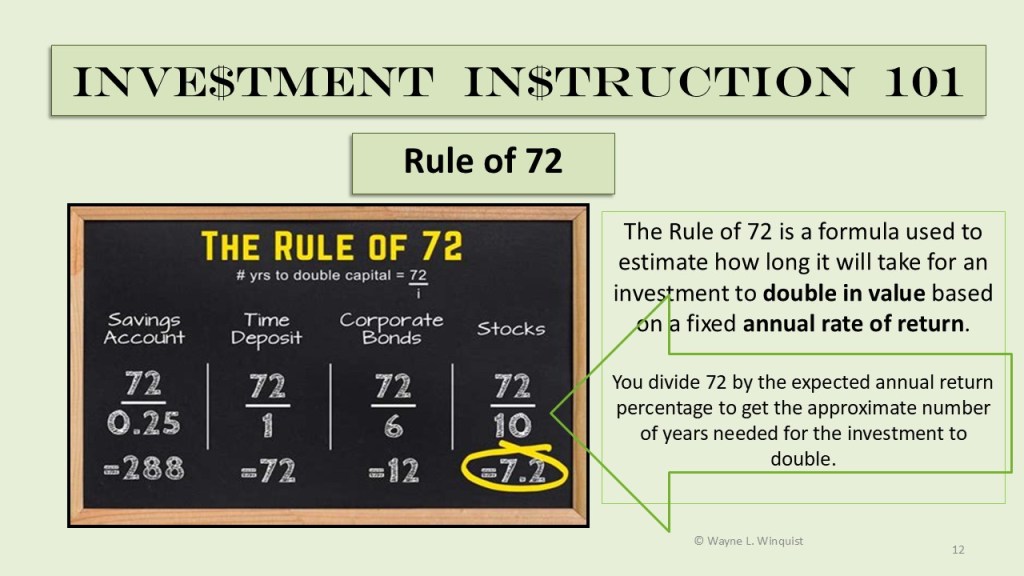

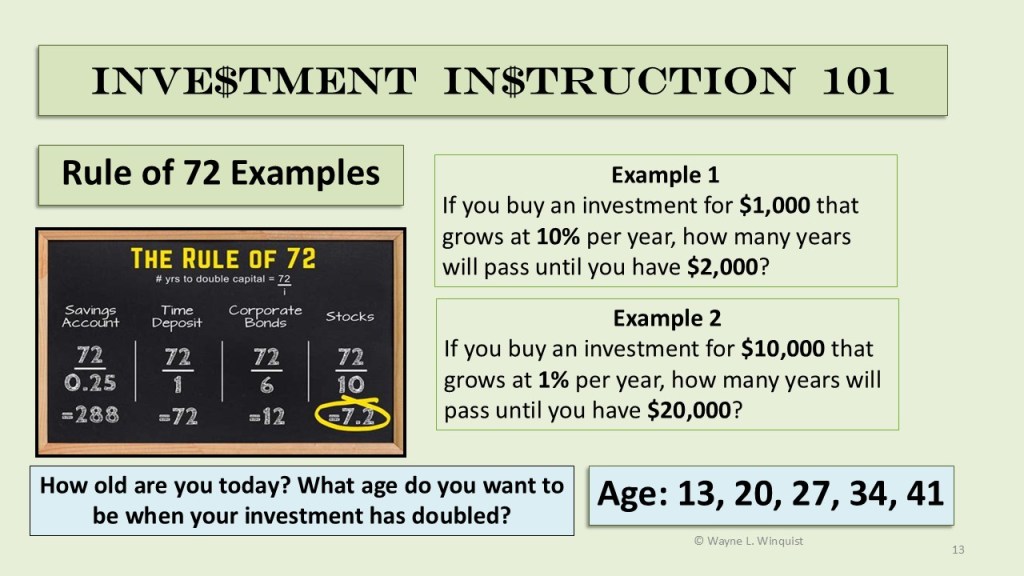

Last night I had the privilege to teach three teens and their parents some of the basics of investing. Our youngest grandson, who is now 13, participated. I loved hearing his answers when I asked questions. One of the key concepts I covered was “The Rule of 72.” Then I illustrated how that rule has benefited our investment portfolio results.

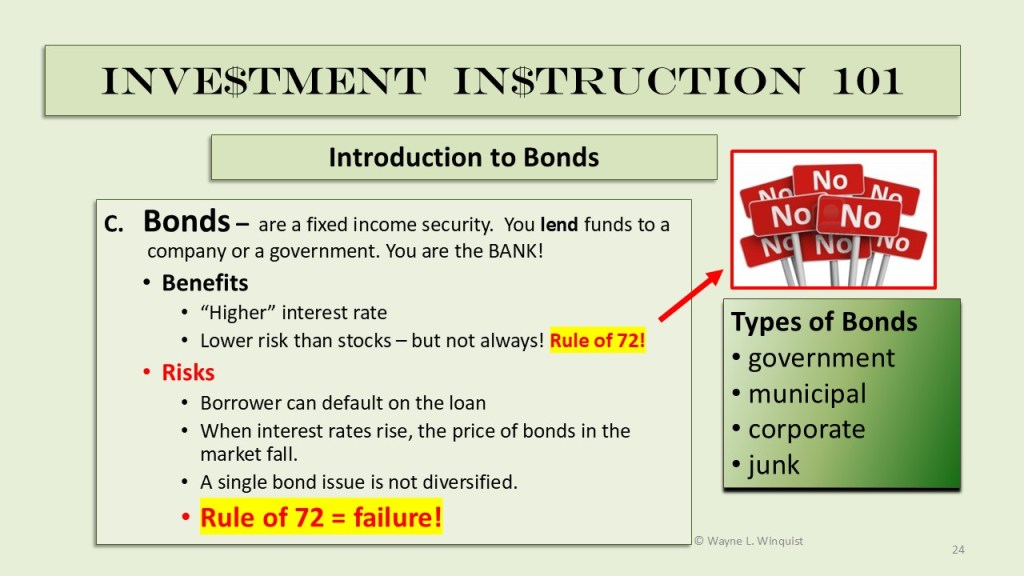

I also shared the investments that I avoid, and the ones I like based on the rule. Here are three slides from last night’s training. Notice that for each asset class (stocks, bonds, cash, CDs, ETFs, mutual funds) I talked about the benefits and risks of each investment type. This included an assessment of the investment when you consider the Rule of 72.

First Glance Update

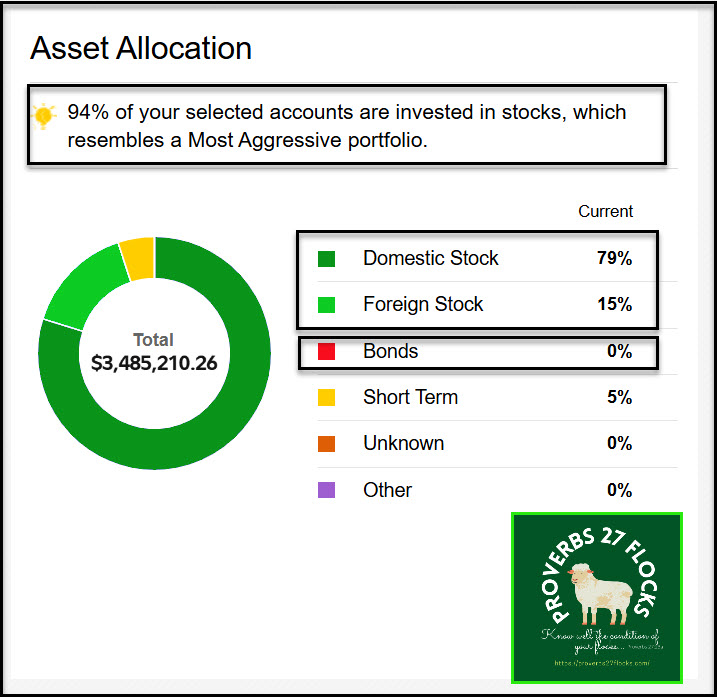

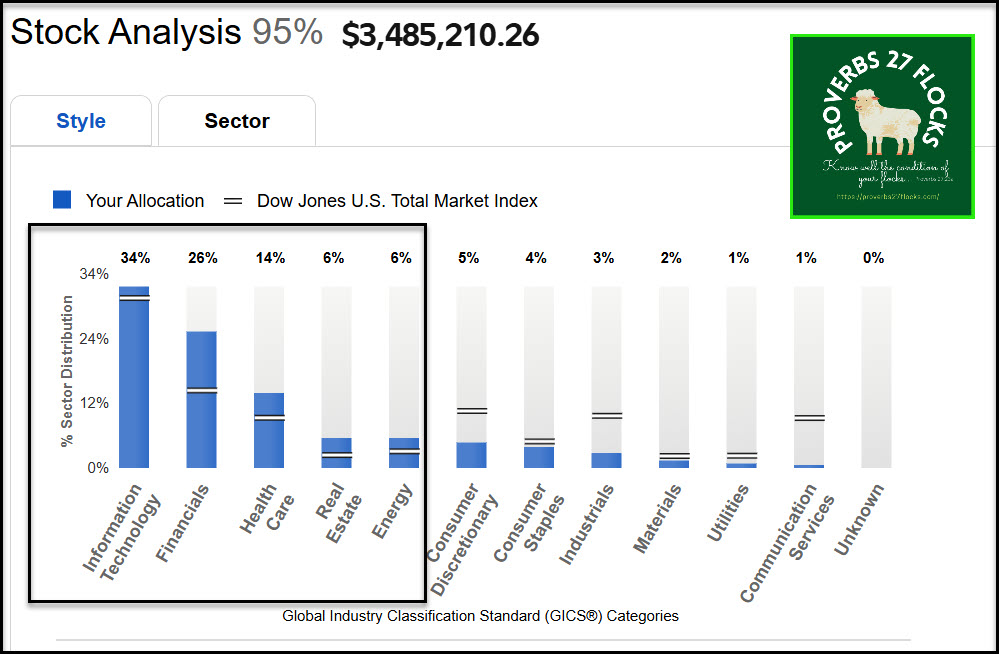

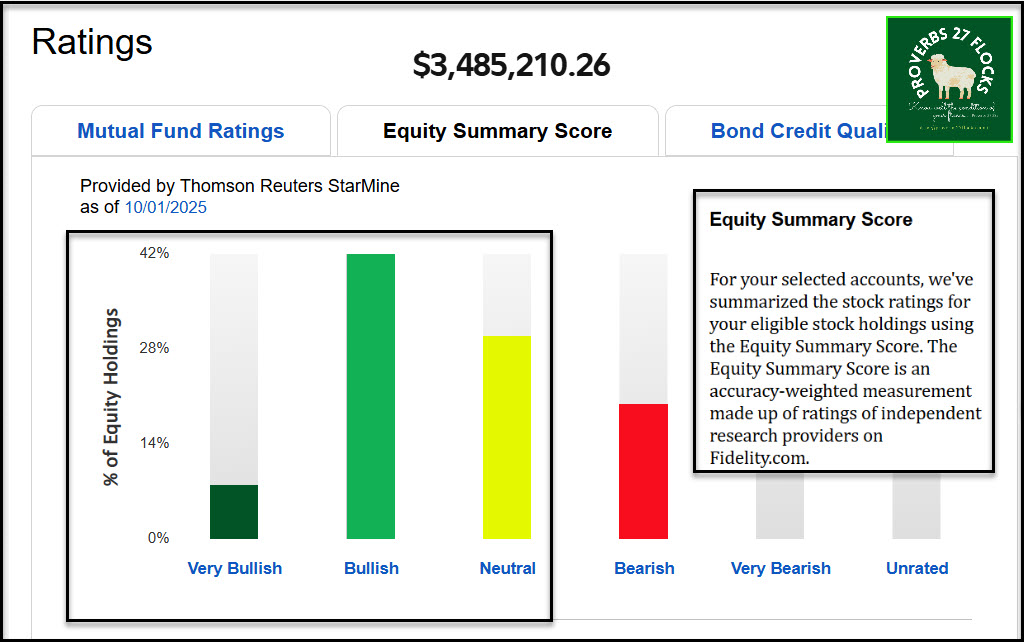

To better understand the next couple of posts, it is important for you to understand the way our investment portfolio is structured. The following three images communicate the following key factors: 1) I believe the best “Rule of 72” investments are stocks and low cost equity ETFs like SCHD and DGRO. Bonds don’t cut it. 2) There are some sectors that will perform better than others over the long haul. They are better “72” investments. 3) Quality matters. If you have a lot of “SELL” (bearish) investments, you may find it hard to keep the ”72” results in alignment with your long-term goals.

Future 2025 Q3 Updates

There are other updates I plan to provide. These include dividend income results, interest income, Options income update, RMD results, a QCD giving update, ROTH conversions completed, an EAI update showing easy income growth, the stocks I sold and those that I purchased, some new cryptocurrency ideas, and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Dividend Growth Investing Works

Even if you don’t trade options, there are good ways to grow your income simply by purchasing good dividend growth ETFs like VYM, DGRO, and SCHD. Bear in mind that I had growing dividend income before I started trading covered call options. This is easy income.

Closing Thoughts

If you are paying an advisor, find out the total cost of doing business with that advisor. I can almost guarantee you three things: the total will stun you and they probably won’t tell you what they hold in their own portfolio. They also won’t share their own personal investment results. In fairness, they probably cannot do that without getting into trouble with their company. I don’t have a company, so I can do what they cannot do.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser. We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.