What is Success?

There are many funny quotes about success. Baseball pitcher Earl Wilson said, “Success is a matter of luck. Ask any failure.” John Paul Getty said, “My formula for success is to rise early, work late, and strike oil.” Mark Twain said, “All you need in this life is ignorance and confidence, and then success is sure.”

When it comes to investing success, there are a few factors that, if you leverage them, can spare you from reacting to market downturns or “crashes.” Certainly understanding some basics like the Rule of 72 can help you make wise decisions. But when the market is going down, it feels like the Rule of 72 is a failure. Why is this? Because most people don’t measure success in ten-year increments. Rather, they look at investing success as what happened this month, this quarter or this year.

Two Primary Rules for “Flocks and Herds”

The first rule is that you don’t kill the momma. In your investment portfolio, the “momma” is any quality investment that is either going to deliver a rational capital gain in the future and/or that delivers babies (dividends; options income) on a regular basis. Those babies can turn into additional mommas that create more capital gains and dividends. Benjamin Franklin understood this principle and he used the breeding sow as an example.

He said, “Remember, that money is of the prolific, generating nature. Money can beget money, and its offspring can beget more, and so on. Five shillings turned is six, turned again it is seven and threepence, and so on, till it becomes a hundred pounds. The more there is of it, the more it produces every turning, so that the profits rise quicker and quicker. He that kills a breeding sow, destroys all her offspring to the thousandth generation. He that murders a crown, destroys all that it might have produced, even scores of pounds.” – Benjamin Franklin

We don’t talk about shillings, pence, pounds or crowns in our country. However, the principle applies to dollars and investing. (The crown was a gold coin introduced in the 16th century during the reign of King Henry VIII.)

Rule Number Two

The second rule is that you should have investments that allow you to eat while the herd or flock are growing. Some livestock produce things you can use to sustain life without killing momma. For example, you can have chickens that you don’t have to kill, but you can use some of the eggs the chickens produce. Some of the eggs can turn into more chickens. If your cow produces offspring, and the offspring is a bull, you might not need the bull. He can turn into steaks and other beef for the dinner table. Investing in the “stock” market is a similar exercise.

Reasons for Dividend Income Stocks and ETFs

Two of the reasons I focus on dividend growth stocks and ETFs (DGRO, VYM, SCHD) are simple: 1) Dividends are like eggs or extra bulls. They show up and I can use them for expenses without killing momma. Then, when the market goes down, I don’t have to wonder if it is “time to sell” based on fear or panic. Rather, I can ask a fundamental question: Is momma still producing dividends? Most of the time the answer will be yes. If the answer is no, then it may be time to send momma to the livestock auction or to the butcher.

2) The second is that dividend-focused investments are often less likely to drop as quickly as pure growth (non-dividend) investments in a market disturbance. (Even if they do, they will probably still pay the dividends.) This type of investment typically is more stable and resilient. Dividend-paying stocks provide regular income, which can help offset losses during downturns. Investors may be more inclined to hold onto these stocks for the income they generate. If they aren’t selling, then the demand may exceed the supply, reducing the overall impact of a decline in the market.

Investor sentiment plays a part in this. In a downturn, nervous investors often seek safer investments. Dividend stocks are perceived as more stable, leading to increased demand and potentially less severe price declines. Furthermore, investors like me view dividend stocks as long-term investments, which can lead to less panic selling during downturns.

Companies that consistently pay dividends often have strong fundamentals and cash flow, making them more likely to weather economic challenges. However, if a company faces significant financial difficulties, it may cut or suspend its dividend, which can negatively impact its stock price. That is why it is sometimes best to kill the momma and move on with a different investment. The goal is to always seek healthy mommas and avoid sick cows or dying chickens. If you buy the right stock to begin with, the number of times you will have to sell is dramatically reduced.

Historical performance shows that dividend-paying stocks have usually outperformed non-dividend-paying stocks over the long term, particularly during market downturns. This is partly due to the income they provide and the stability they offer.

Real Estate Can Help Meet the Need

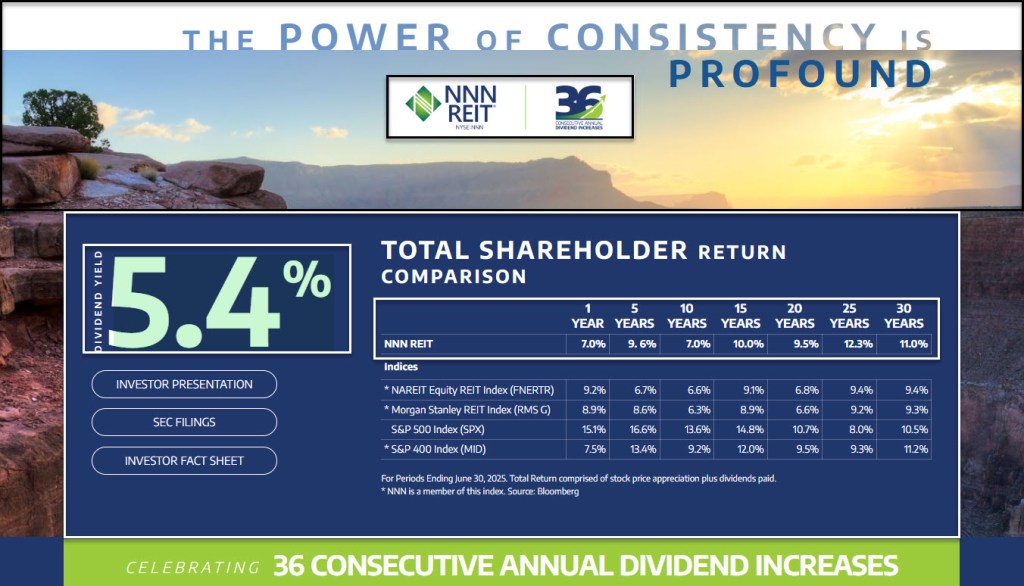

One example is a real estate investment trust: “NNN REIT is positioned for growth, as Fed rate cuts enhance its refinancing and acquisition opportunities, supporting capital appreciation and income. NNN’s robust Q2 results, high occupancy (98%), and disciplined acquisition strategy drive steady FFO and dividend growth, with a 34-year dividend increase streak.” – Steven Fiorillo, Seeking Alpha

NNN has had dividend growth for 34 years. The dividend yield is a respectable 5.70%. The dividend payout ratio is a sensible 69.19%. I own 900 shares of NNN in my ROTH IRA and another 700 shares in my traditional IRA. Cindie owns 150 shares in her ROTH IRA as well, making our total share count 1,750 shares.

NNN invests in high-quality properties subject generally to long-term, net leases with minimal ongoing capital expenditures. As of June 30, 2025, the Company owned 3,663 properties in 50 states with a gross leasable area of approximately 38.3 million square feet and a weighted average remaining lease term of 10 years. NNN is one of only three publicly traded real estate investment trusts to have increased annual dividends for 36 or more consecutive years.

Seeking Alpha Wisdom from Robert and Sam Kovacs

These two wrote a post on Seeking Alpha titled, “How To Survive A 30% Market Crash In Retirement.” They wisely suggest, “Dividend investing offers a powerful solution by providing steady cash flows that are largely independent of market volatility, neutralizing sequence risk.” Sequence risk is the potential for an investor to experience lower-than-expected returns due to the order in which investment returns occur. If you sell to raise cash or do a withdrawal from your account in retirement at the “wrong time” you can dramatically reduce your income in future years.

In retirement you don’t want to sell most of your cows. Here is how they put it: “The easiest way to nullify sequence risk is to invest in assets that have cash flows that match your cash flow needs. You have cash flow needs to pay for bills, groceries, and gas. Instead of liquidating chunks of your portfolio to fund these, it makes more operational sense to use cash flow from investments to finance these.” Because we own shares of NNN, and those shares create $2.40 per share in annual income. That is $4,200 in annual income. Much of this income is tax-free and some of it is tax-deferred.

Dividends change your goal from one of reactions to one of selecting good businesses. Robert and Sam said it well: “This shifts your goal as an investor from timing the market to picking good businesses with sustainable dividends.” Robert and Sam Kovacs

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.