Bill’s Helpful Comments for Tax Firewalls

One of my readers made some excellent observations and comments regarding my previous “Rule of 72” post. I think what he says about ROTH conversions and a tax firewall merits sharing in this update. First a quick review about this rule.

The Rule of 72 and Doubling of Your Assets

Just about every person will retire from their work. Some will retire to do other things including spending more time using their skills and resources to help others. The rule is quite simple and takes less than a minute to help clarify how your investment harvest can look when it is time to harvest and engage in post-retirement activities. The rule of 72 has great value if you are 20 years old, significant value if you are 50 years old, and I still consider it valuable at age 74. What is the rule?

“The rule of 72 calculation is a quick way to estimate how long it will take for an investment to double in value.” – Investopedia

Rule of 72 and ROTH Conversions

Here is where Bill’s comments are helpful because they use an illustration of a firewall. He talks about a tax firewall. A firewall can be materials a builder uses between the attached garage and the living space to slow the spread of a fire. The reality in our home is that there is a “firewall”, but it probably has minimal effectiveness. Having said that, the door to the garage is steel, and the wall itself provides a bit of a buffer to keep the fire out for a limited amount of time.

Firewalls in computer networks are barriers to help protect the network. Therefore, the idea of a “tax firewall” is a helpful way to think about the spread and growth of income taxes that can harm or sabotage your retirement income.

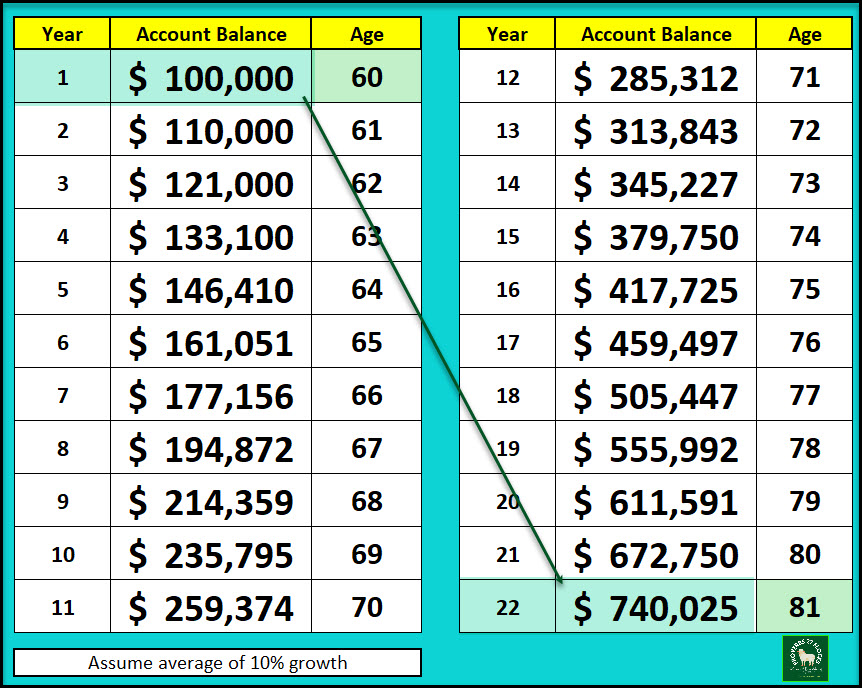

Tax Firewall + Doubling Your Clarity

Bill said, “One thought I’d add on the ROTH conversion front: the real power of converting early isn’t just avoiding RMDs—it’s locking in a tax bracket before the harvest gets too big. If someone converts $100K at age 60 in a 22% bracket, that seed could grow to ~$800K by age 81 (assuming 10% annual growth). That’s $778K of tax-free gain. The pain isn’t the $22K tax bill—it’s the tax firewall you build for the future.” Here is my spreadsheet that illustrates the concept with numbers I verified using AI.

Bill goes on to say, “One often says, ‘I don’t want to pay all these taxes,’ and the pain of those higher taxes is real. Yet, if you sketch it out on paper, you realize that paying now helps you sidestep the consequences of future tax policy changes—Federal, State, IRMAA, and NII. Over 15 years, your tax burden might be cut in half, even if it never feels like it in the here and now.”

Finally, if you are younger than me, then Bill adds another insight: “And timing matters. Early conversions sidestep IRMAA, bracket creep, and the widow’s penalty that can double the tax rate on the same income. It’s not just about doubling your money—it’s about doubling your clarity.”

Bill, I think you gave some thoughtful and helpful additional insights. Thanks for sharing them!

In Real Retirement Life

The number 72 is an important number. One thing that it can do is increase your income tax liability. That should be a consideration if you have assets in a traditional IRA or 401(k). Remember this: the RMD increases as you get older. Even though the new numbers for calculating the RMD are better, the end result can be much more than you thought you would pay in taxes as you get older.

RECOMMENDATION REPEATED

The book of Proverbs offers sound advice: You need to pay attention to what you buy for your investment mix. Proverbs 27:23-24 says, “Know well the condition of your flocks, and give attention to your herds, for riches do not last forever; and does a crown endure to all generations?”

Don’t get so caught up in “doubling” your money without thinking about why you are doing it. Someday someone else will own your fields and crops. Your flocks and herds won’t matter any more because you won’t need them. However, those you love can benefit from your wise stewardship of those assets.

Next Time – We will continue looking at the seven Investing Rules: 3, 4, 5, 10, 22, 72, and 100. The rule that remains is the “100.”

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.