22 Times Rule: Your Retirement Investment Balance

After you understand the previous four “rules” that are for the numbers 3, 4, 5, and 10, you would do well to examine Rule 22. Now, this rule is somewhat movable. By that I mean different advisors suggest slightly different numbers. For example, some suggest 25 is the right number. What you need to know is that as the number you pick increases, the more you need to save to hit that goal. I think 22 is the minimum number, so I will use that one for today’s discussion.

Why Begin to Use Rule 22?

When I use the term FIRE, I am referring to a common abbreviation. FIRE means “Financially Independent, Retire Early.” Even if you don’t want to retire early, you need to think about retirement.

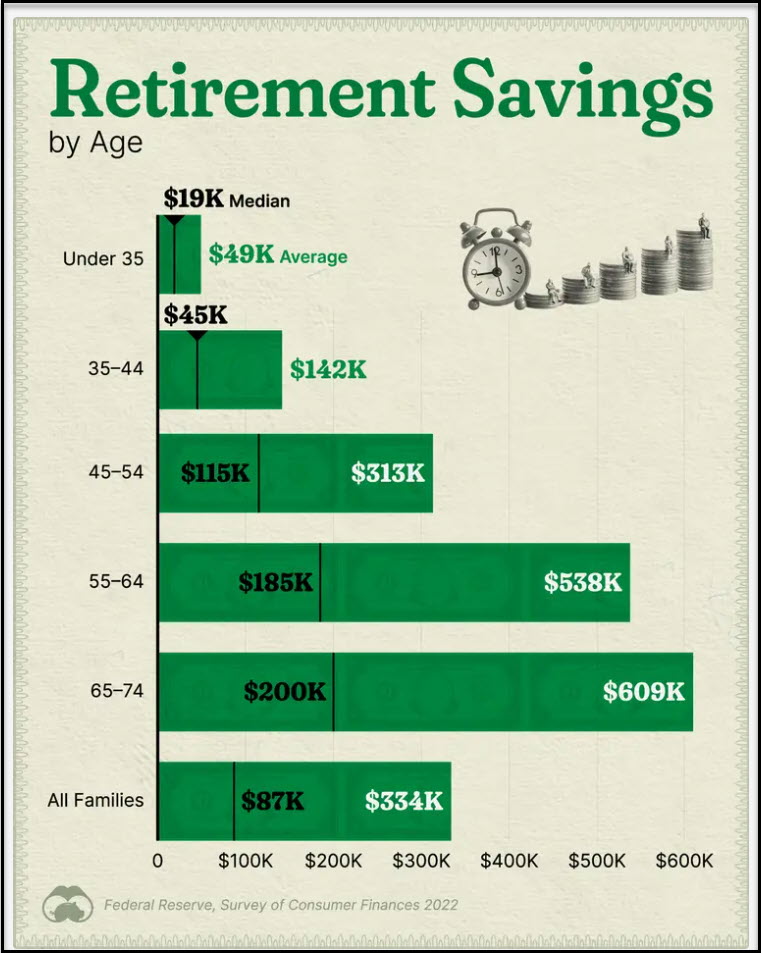

The average person is dreadful at saving money. Rather, they love to spend and go into debt to get stuff that will depreciate in value. In the following FIRE illustration one would do well to consider the Median retirement savings of those in the 55-64 age group. They are heading for a difficult time in the years following their first Social Security deposit. Those that are in the 65-74 age group probably already regret their poor financial decisions and their lack of decision-making in their 30’s and 40’s.

Where to Begin

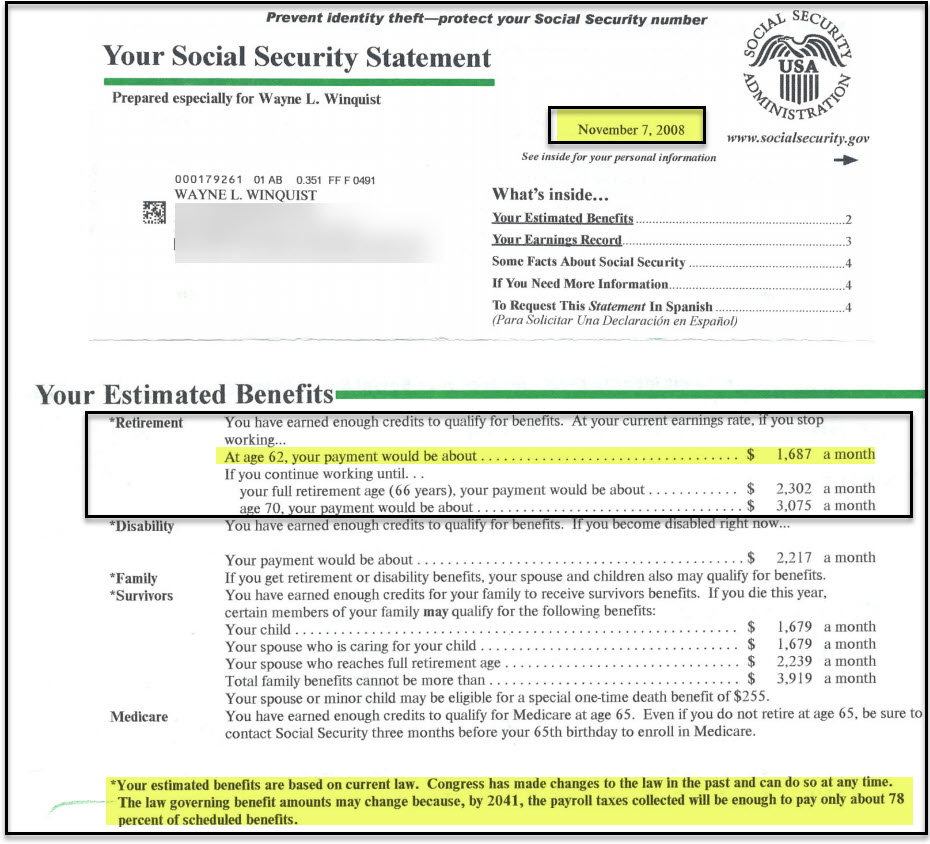

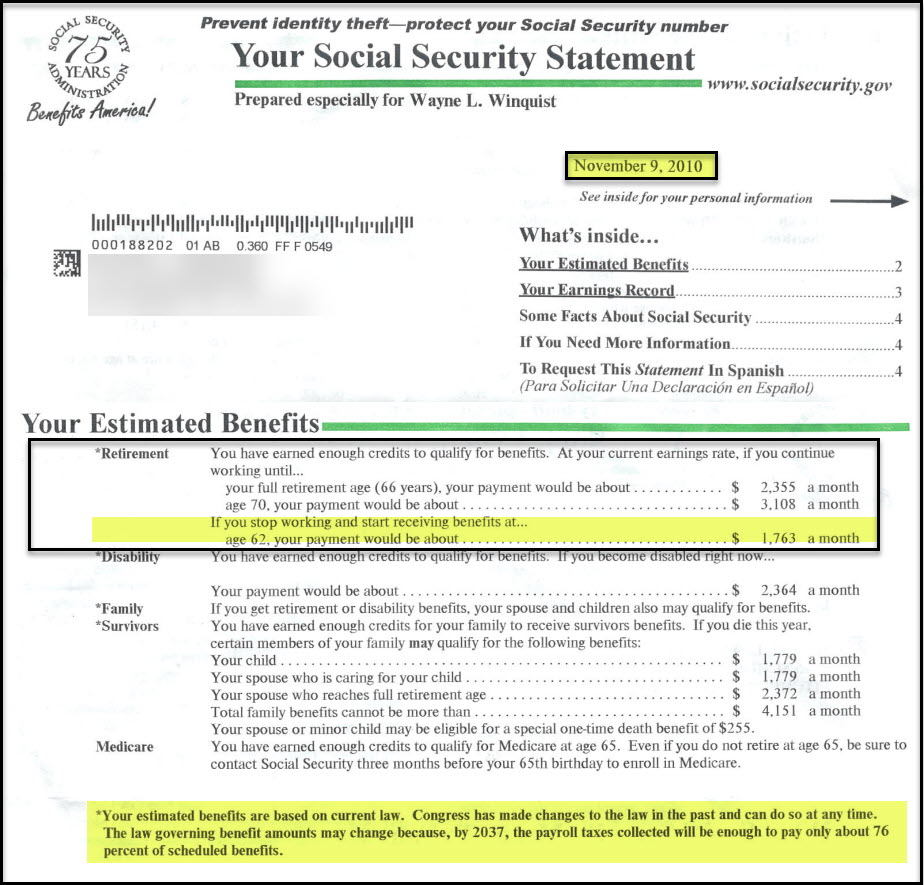

Start with Social Security, even if you don’t believe it will be all that wonderful when you retire. It pays to be a bit pessimistic, but don’t be overly cynical or gloomy. If you look at your Social Security Statement, you can get a rough idea of what you might expect in monthly income based on the age when you retire. I started taking Social Security when I was a relative youngster: I was 63 years old. My first payment was $2,002 per month. Therefore, my expected annual income was about $24K

Eleven years later my Social Security income is only $2,411 (after Medicare and IRMAA deductions). So I did not really receive much of an increase over the life of my income from that source. However, during these years of retirement I have received about $290K in benefits after all deductions.

Although I don’t know if the current statements look exactly like this, I suspect that the same information is still available if you look at your account online. Here are two snapshots from my 2008 and 2010 statements.

The Second Step

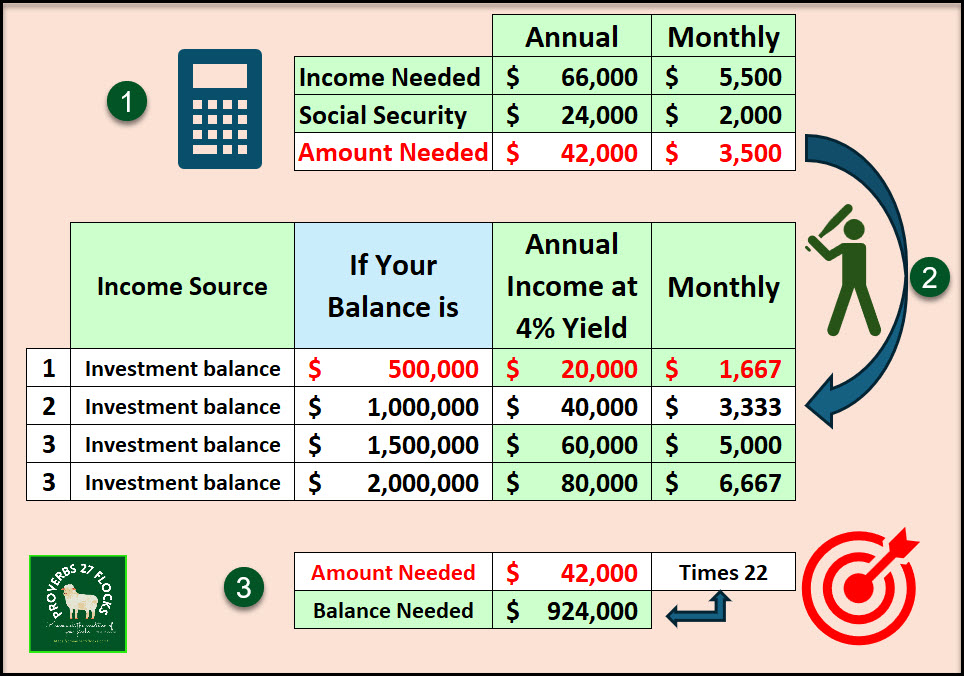

While it is a bit difficult to really forecast your income needs in retirement, lets start with some assumptions. Lets assume that you don’t have a mortgage and no auto loans or other drains on your income when you retire. If you were to look at your monthly needs, perhaps they might be about $3,000 per month. However, don’t forget about inflation. For the sake of simplicity, I assume you need about $66K in annual income, or about $5,500 per month. If you are like me, then perhaps your Social Security takes care of $2,000 of your monthly income needs.

That means you will have a shortfall of $3,500 per month. A wise person would conclude that they have to find other income to make up the deficit. One way to do that is to continue to work in retirement. It is possible, however, that your health or opportunities for work might decrease in the future. This is where you start to think about your 401(k) or IRA accounts.

How big does your balance need to be to generate $3,500 in income without reducing your retirement account balance? We will assume that you can generate 4% off of your retirement account balance. I know this is possible, because I currently generate about 5.5% excluding income from options trading.

The Third Step: Apply the Rule of 22

This is easy. Take the amount of income needed in excess of Social Security and multiply it by 22. In the following illustration there are three parts. The top portion is a “Calculator” to determine the amount of income Social Security will not cover.

The center section, illustrated by the batter, shows four investment balances and the reasonable amount of income you can generate at 4% for each balance level. Clearly a $500K balance won’t meet the need, but a $1M balance comes close. The $2M balance would cover all anticipated budgeted expenses in retirement even if Social Security failed to deliver. What are you batting for? Do you want a home run?

The bottom section (a target is needed) shows what you need to do to determine your target retirement account balance. If you need $42K, you multiply that number by 22. The result is $924K. In other words, you need about $1M in savings. A better number might be $42,000 x 25 = $1,050,000.

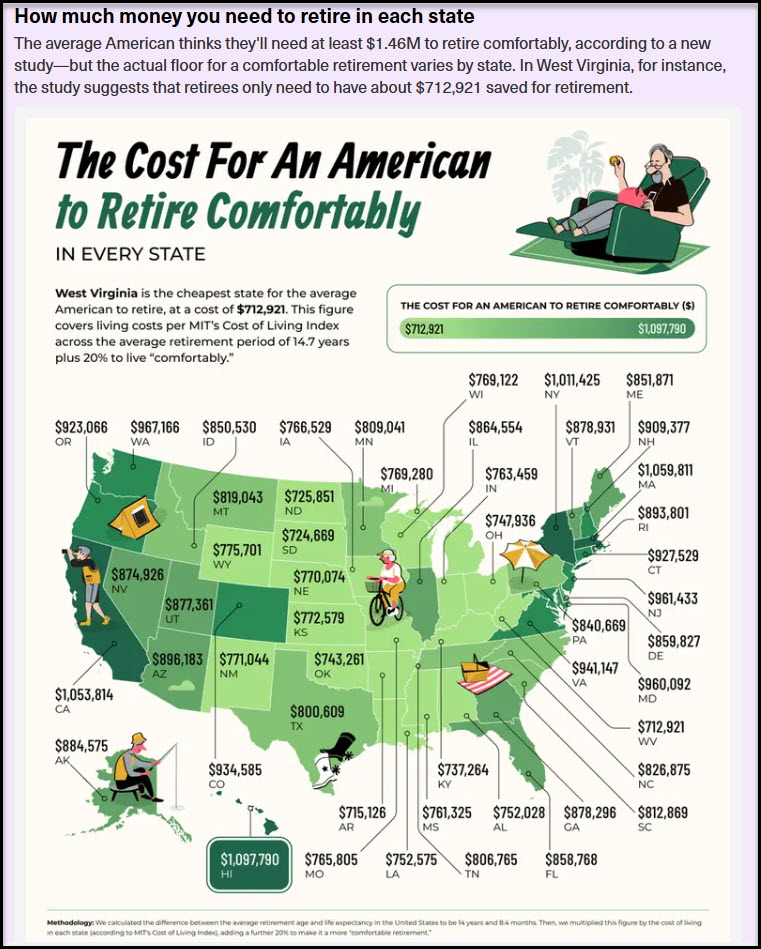

Geography Matters

Some places are more expensive. It will cost far more to live in California or New York. If you live in Kentucky or Louisiana, your needs may be less. Wisconsin is not inexpensive, but it also is not irrational if you can bear the cold. Here is another illustration from FIRE (Financial Independence, Retire Early). Bear in mind that most states also tax income. If they don’t then they find another way, like sales taxes, to grab your income every year.

Four Additional Rule 22 Resources

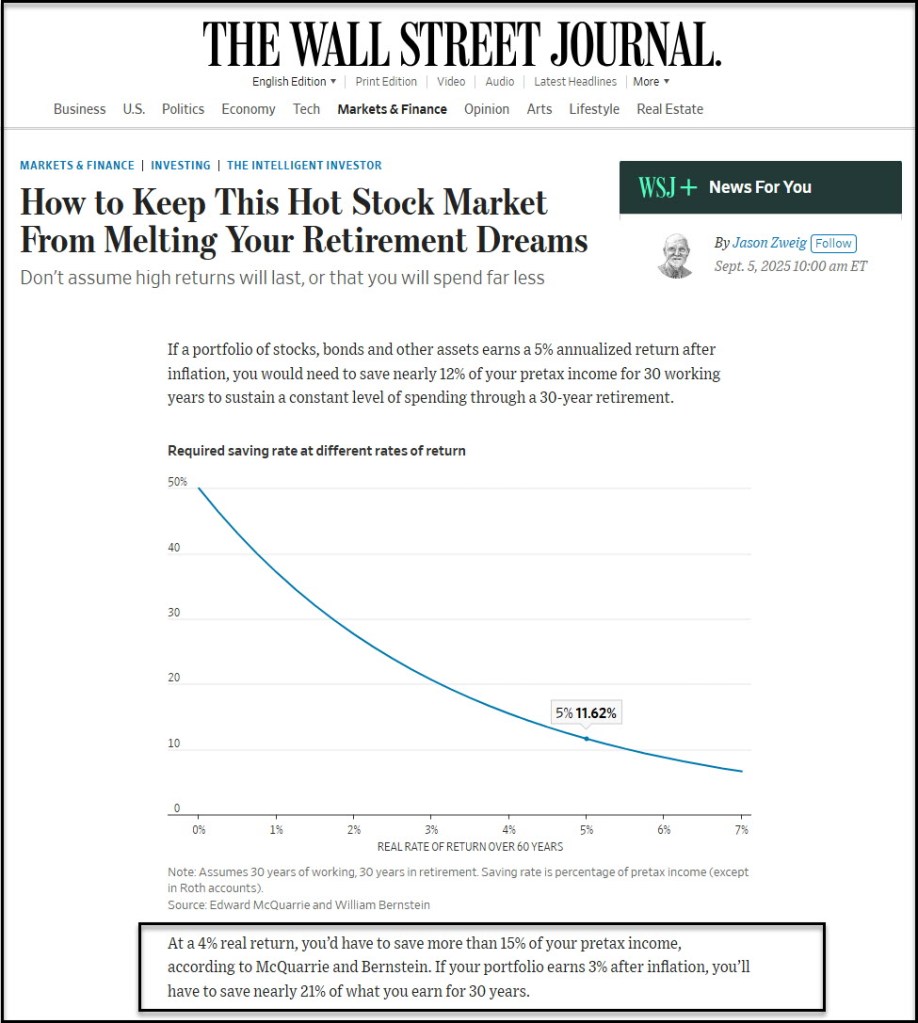

- “At a 4% real return, you’d have to save more than 15% of your pretax income, according to McQuarrie and Bernstein. If your portfolio earns 3% after inflation, you’ll have to save nearly 21% of what you earn for 30 years. Even if you work for 40 years and retire for only 20, you’d have to save 10% of your income to sustain your spending if your portfolio generates a 3% net return.” WSJ

- FIRE: “Most US workers aim to retire around age 65—but for many followers of the FIRE movement, which stands for ‘financial independence, retire early,’ that’s not the case. FIRE followers, who range from low- to high-income workers, typically prioritize high savings rates, relatively frugal living, and aggressive investing strategies in an effort to work less and enjoy life more in the long term.” – Join1440

- Financial Literacy 101: The Rule of 22 “To make it simple, I ask the same question, ‘What will you need monthly to live off of when you retire?’ This question is made for investors to think about the lifestyle they desire and the financial obligations they will have. I never get the same response as numbers range from $4,000 to $10,000 a month. For the sake of ease, let’s say you need $5,000 a month or $60,000 a year. The way the Rule of 22 works is you would multiply $60,000 by 22, giving you the total amount of monies you would need to have when you retire. After doing the simple math, you determine that you need $1,320,000. That is a big number!” – Vantage IRAs

- 4 Retirement Rules of Thumb Explained – Rule of thumb: “You should have 25x your planned annual spending by the time you retire.” “Investors who want to know if they’re saving enough for retirement sometimes start with the idea that they need 25x their current gross income—that is, their earnings before taxes and other deductions. However, this is misleading because gross income includes retirement contributions that go away in retirement. Plus, most people start receiving Social Security benefits (or a pension). There is a “25x rule” for retirement savings—but it should actually be applied to how much you think you’ll need just from your portfolio in the first year of retirement.” – Schwab

In Real Retirement Life

The number 22 is an important number. If you have not thought about income in retirement, then you are not prepared for real life. Perhaps even more disturbing is that you are not thinking about the people you love or who depend on you for shelter, groceries, healthcare, and transportation.

RECOMMENDATION

The book of Proverbs offers sound advice: You need to plan.

Proverbs 20:18 “Plans are established by counsel; by wise guidance wage war.”

Proverbs 21:5 “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.”

Next Time – We will continue looking at the seven Investing Rules: 3, 4, 5, 10, 22, 72, and 100

We have covered numbers 3, 4, 5, and 10. There are two numbers left: 72, and 100. I think I will do 72 next.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.