Five Percent Rule: Any Single Investment

Do you know where most of your dollars are invested? Is it possible that you have too much focus on a single stock or perhaps a single business sector? I often examine the statements of friends and find some high-risk overlap the friend did not see. My rule of thumb is this: avoid having more than five percent invested in any single stock unless you have a very good reason for doing so. This creeps into mutual fund and ETF investing as well. (There are other sources that talk about this issue. If you want more information see these links: FOOL or VALUE OF STOCKS or JPMORGAN.)

If you are a Fidelity Investments client there are at least three ways to discover the way(s) you have a potential risk due to investing too many dollars in any single investment. The methods are the monthly statement, and various pages on the Fidelity website. The statement is an easy way to check for problems, but it doesn’t cover all of the bases. It focuses on a limited number of positions.

Where Are the Risks? Stocks and Funds!

This isn’t just about individual stocks. This risk of investment imbalance is also true if you invest in ETFs and mutual funds (MFs). While the five percent rule doesn’t apply in most cases if a person only has 3-4 ETFs or MFs, I have seen situations where a friend has multiple ETFs or MFs that all have far too much exposure to the top ten stocks in the S&P 500. It is also possible to focus all of your investments in just two ETFs or MFs and be in a high-risk focus. Here are some examples.

Vanguard S&P 500 ETF – VOO

For example, a quick look at the Vanguard S&P 500 ETF (VOO) top ten holdings reveals that they are the usual suspects: NVDA, MSFT, AAPL, META (Facebook), AVGO, GOOGL, GOOG, BRK.B, and TSLA. In fact, NVDA makes up over eight percent of the VOO fund.

iShares Core S&P 500 ETF – IVV

If you examine IVV, (iShares Core S&P 500 ETF) you will see the same top ten. In IVV NVDA makes up 7.7% of the fund. Most people would not mistakenly have both VOO and IVV in their investment portfolio, but a few do. They don’t understand the risk. In fact, the technology sector is over-represented in the top ten of both funds. For VOO, as an example, 35.35% of the investments are in technology. The next largest is a mere 13.23% (financials).

iShares Core S&P Total U.S. Stock Market ETF – ITOT

But it doesn’t end there. Let’s say that in addition to VOO your advisor also buys shares of ITOT. ITOT is the iShares Core S&P Total U.S. Stock Market ETF. The top ten in this fund are the same as the top ten in VOO and IVV. So if you bought IVV and then thought, “I will diversify even more by adding ITOT shares so that I have the total market covered”, you just took on significant additional risk when a bear market arrives.

Why? Because history has proven that the technology sector can be very scary when there is a major market correction. When that happens, investors sell. That isn’t a wise reaction, but it is understandable when your account value drops by 40-50% due to a lack of true diversification.

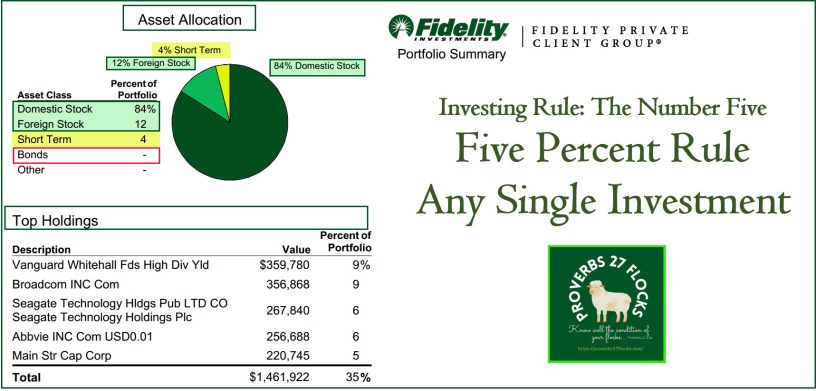

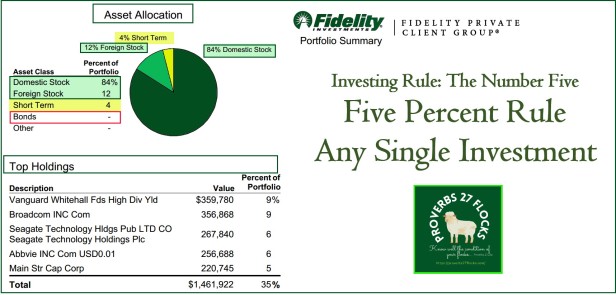

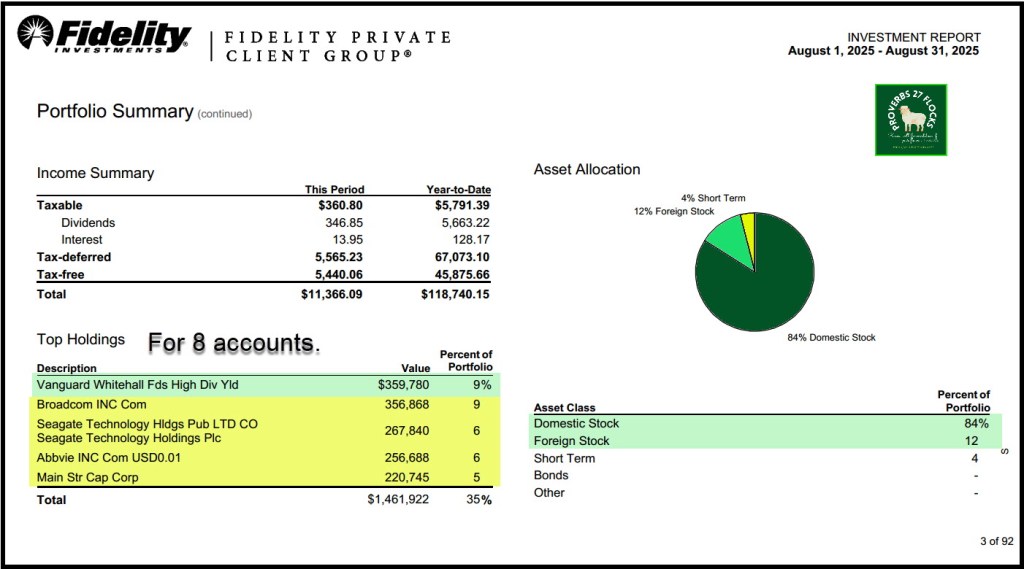

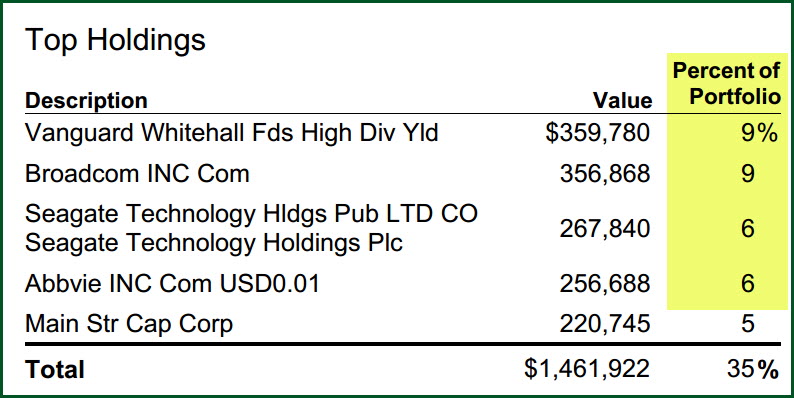

The Fidelity Statement

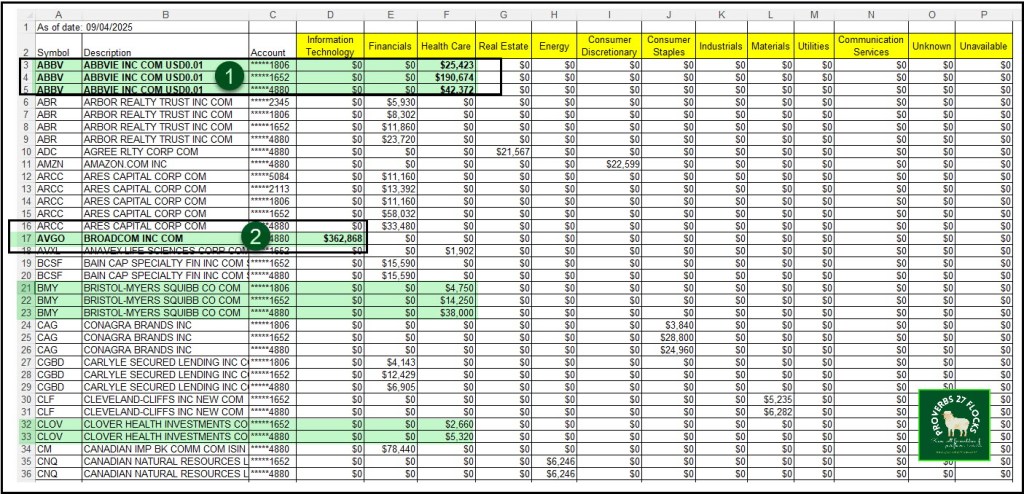

If you look at the following image, you will see that we own VYM as our largest holding. You should also notice that we have three stocks that exceed the five percent “rule.” The three are AVGO, STX, and ABBV. MAIN is right on the border with five percent.

However, for these you should understand that I trade covered call options on these positions. Ten AVGO contracts (1,000 shares) will be called away on December 19, 2025. This will put AVGO below the five percent mark. I also have options for STX and ABBV that will likely call those shares away as well. I’m ready for that and it was part of my plan to sell my shares using options contracts.

This strategy of being overweight has worked for me. In the case of AVGO, I have received $45,737 in options income since September 2021. For STX I have received $31,987 in options income since January 2021. ABBV is another good example, with $24,569 in options income. During the time I have owned these shares, the dividends have kept pouring in as well. I have received over $15.8K in dividends from the AVGO investment, $21.3K in STX dividends, and $26.7K in ABBV dividends. So, some of the “risk” is softened by the consistent and increasing dividends plus the synthetic dividends from options trades.

Fidelity Website

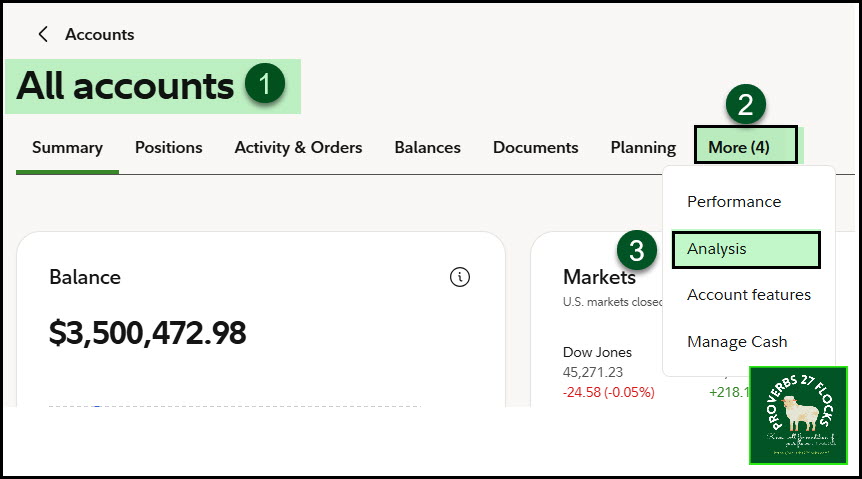

The Fidelity website has a “hidden” feature that you can use to look at your allocations and sector weightings. In the following image you can see “More (4)” and the dropdown menu for More includes “Analysis.” Within Analysis there are some helpful screens along with the ability to download a spreadsheet for further analysis.

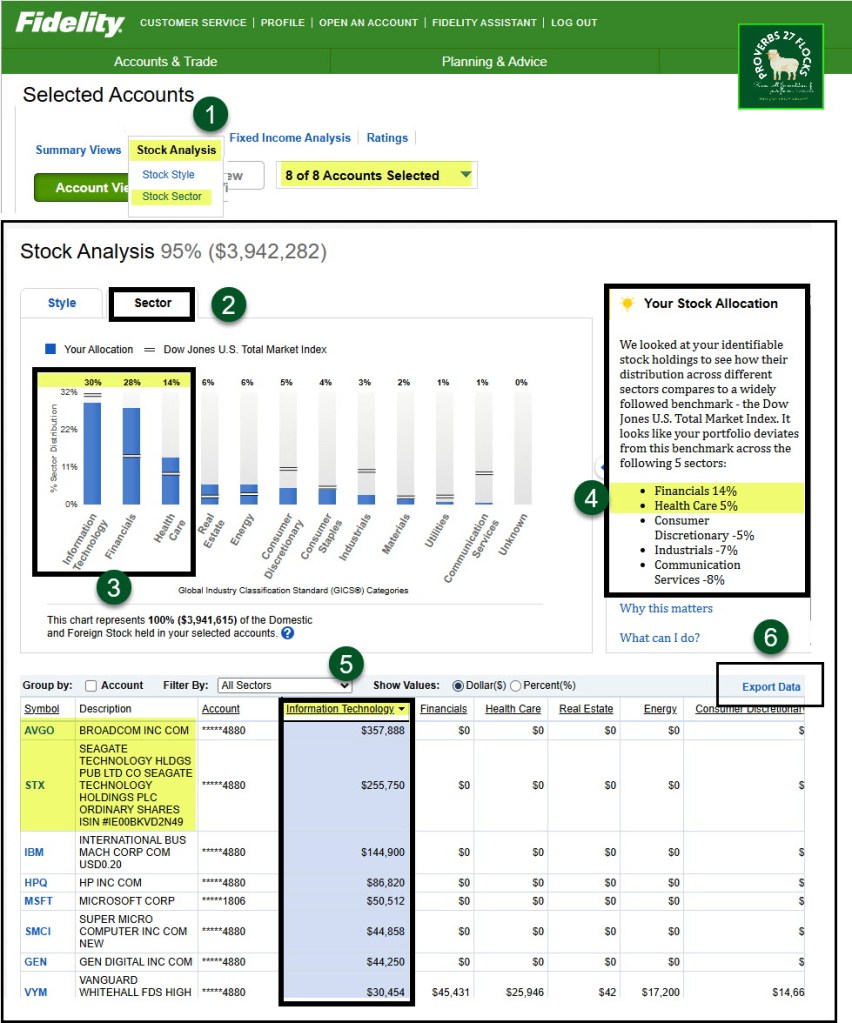

I like this tool for several reasons. First of all, you can look at your investments by “Style.” I won’t focus on that today, but it is a helpful view. The second option is for “Sector,” which is very helpful for both sector weightings and for the investments within the sector.

I am slightly under the total market allocation of 32% for technology stocks at 30%. However, I have a much higher (28%) allocation in the financials (banking, insurance, BDCs) sector. My allocation is 14% more than the overall market’s allocation. This is not a problem for me. Financials can be very profitable investments. The same is true for healthcare’s sector. I am 14% while the market’s allocation to healthcare is at 9%.

It is possible to sort the sectors (5 on the image) so I did that with technology. This quickly shows me that AVGO and STX are my two largest technology investments. I can also download the results using the “Export Data” link on this page.

In Real Retirement Life

The number five is an important number. This number can help you avoid surprises, especially if you have multiple accounts with Fidelity. You might not spot a problem unless you see your allocations across all of your investment accounts. In our case this includes IRAs, ROTHs, and brokerage accounts.

RECOMMENDATION

At the very least look at your monthly statement to see your “Top Holdings.” Do you like what you see? If not, you may want to make some changes. However, don’t stop there. If the top investments are some ETFs or MFs, then you need to look at the top ten holdings in those funds. Seeking Alpha makes this very easy to do.

Next Time – We will continue looking at the seven Investing Rules: 3, 4, 5, 10, 22, 72, and 100

We have covered numbers 3, 4, 5, and 10. There are three numbers left: 22, 72, and 100. I think I will do 72 next.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser. We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.