Raise Your Hand if You Like Paying Income Taxes!

I recently ordered a used copy of Patrick Kelly’s book. The idea of a “tax-free” retirement certainly sounds great. The downside of Kelly’s book is that he really spends most of his time talking about the basics. Chapters 3-11 cover obvious “Financial Land Mines.” At least to me these were obvious.

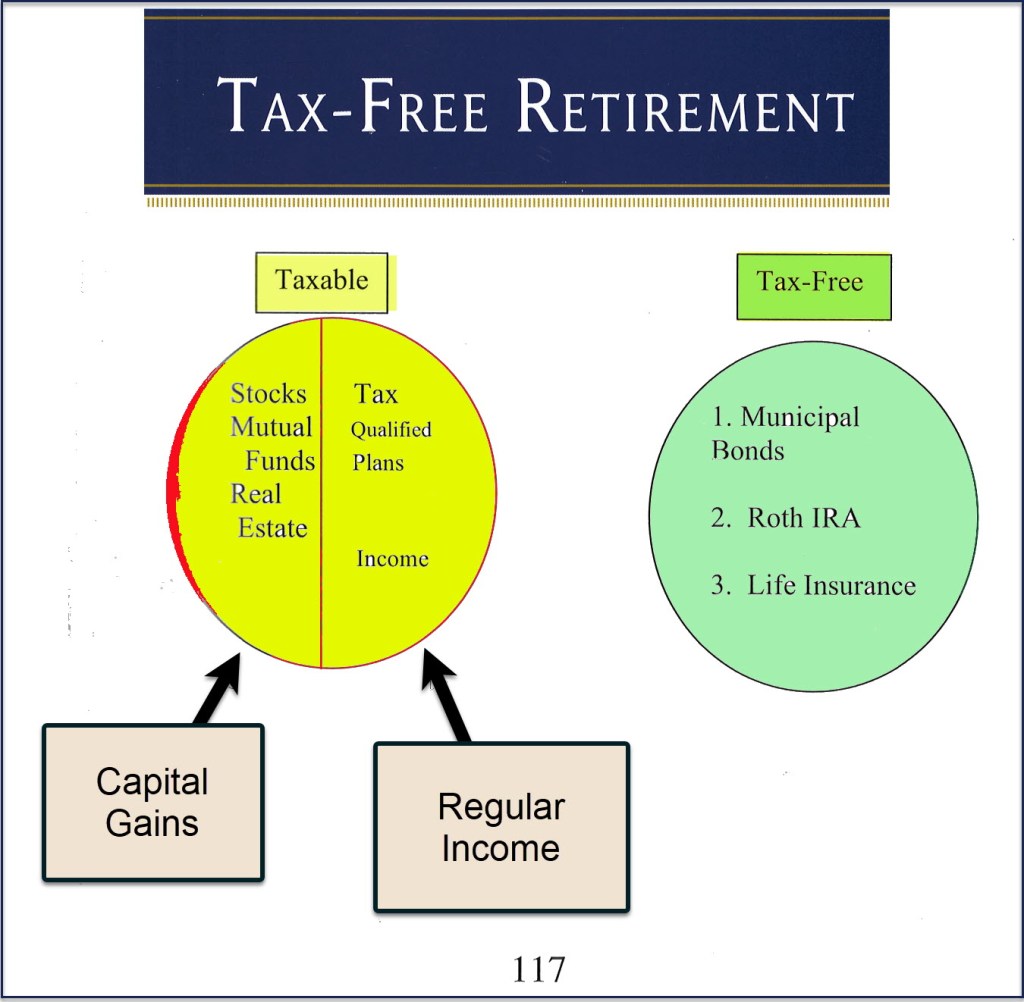

Chapters 12-16 cover “The Hidden Retirement Traps.” There were some helpful and insightful ideas presented in those chapters. Part IV, “The Retirement Solution” dove into what the title of Kelly’s book proclaims. He offers three ideas: tax-free municipal bonds, ROTH IRA (and 401k) accounts, and universal life insurance. He really missed the mark in explaining the nuances of why the ROTH is the best of the three options he presented.

He correctly rejects the municipal bond idea. On page 118 he wisely states, “I disregard number one in the tax-free pot, municipal bonds, because over time they do not return enough nor provide the proper diversification to build a sufficient nest egg for retirement. So, by eliminating number one, we are left with numbers two and three.” – Tax-Free Retirement.

Number two for Kelly is the ROTH IRA and number three is life insurance. Because Kelly is a life insurance agent, his “number three” choice is not surprising. My initial examination of Universal Life Insurance happened many years ago. An insurance agent, who was a member of our church, sold Cindie and me a universal life insurance policy. However, during the “free trial” period, I realized that this just was too expensive for very little reward. We cancelled the policy and paid nothing. I don’t regret that decision.

The Right Choice (In My Opinion)

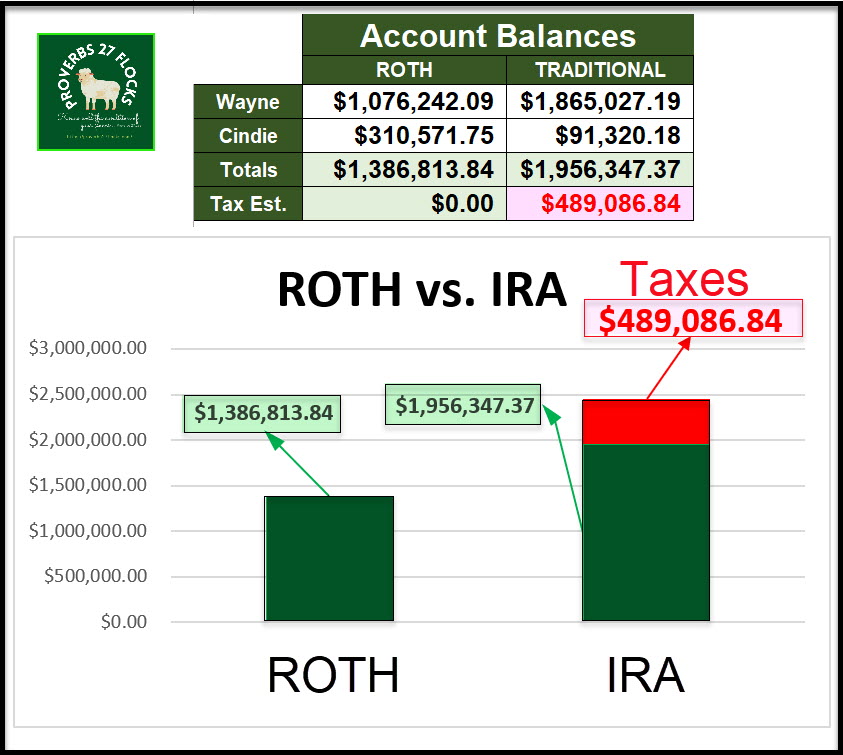

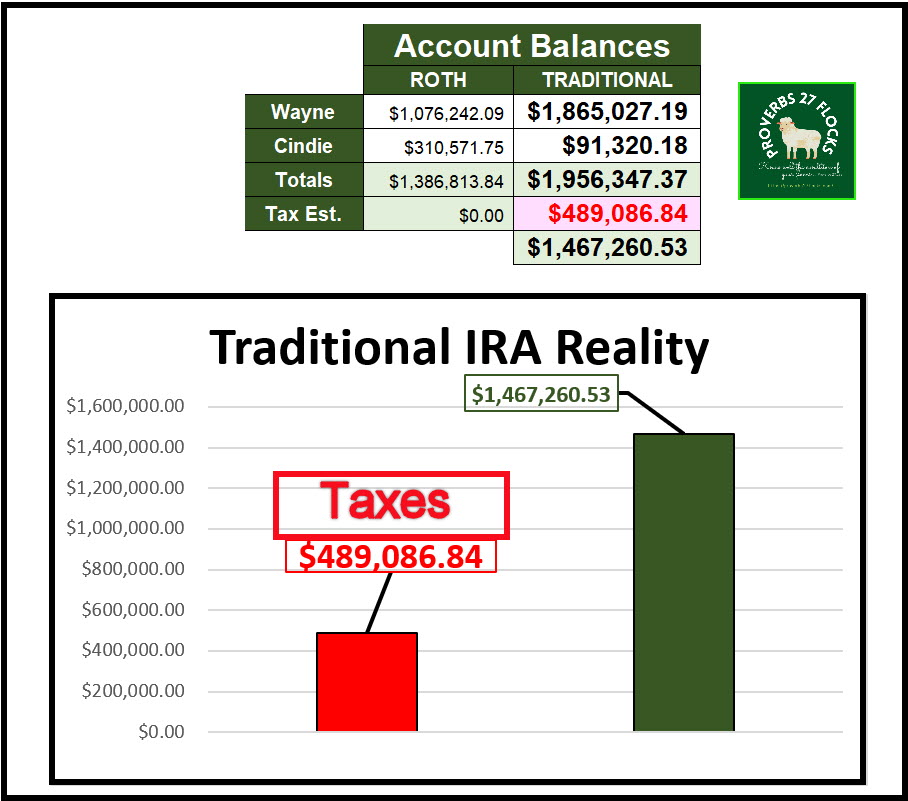

It is far better, in my opinion, to focus on the ROTH IRA. Kelly’s argument for the ROTH is compelling, especially when compared to the long-term income tax consequences of the traditional IRA or traditional 401(k). In a nutshell, the thing you must remember is that the traditional IRA/401k is not really owned entirely by you. The federal government (and in our case the state) are looking forward to the day when you must take your RMD’s.

The IRS (and perhaps your state) will be taking some of the money each time you do a withdrawal in the form of regular income taxes. If you have a balance of $1,000,000 be ready to see that as no more than $750,000 (at best) in spendable money if you have a reasonable amount of annual income. Of course this really depends on your income tax bracket. But it isn’t difficult to see how you might ultimately be in a bracket that is above 20%.

Why Kelly Likes Life Insurance

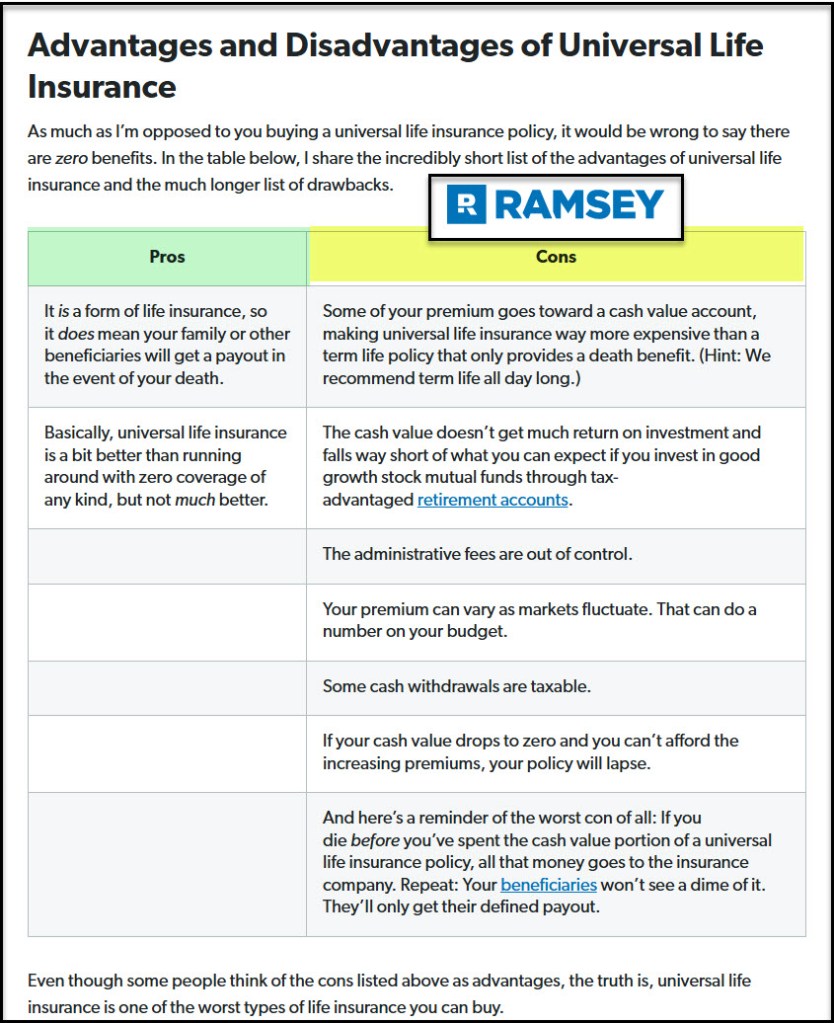

For a skeptic like me, the obvious reason is that he makes a nice chunk of change from your policy premiums. But there are other less self-serving reasons. One is that the payout from a life insurance policy is not a taxable event. Your heirs get the money and don’t have to pay taxes on it. However, that doesn’t really fund your retirement or give you a tax-free retirement, it just makes your heirs richer.

There is another aspect that he likes. You can take “loans” from your policy. Because a loan is not taxable income, you can “borrow” from your policy (and reduce its value) and not pay income taxes. However, the costs to have this type of policy far outweigh the benefits. In his defense, I can see why some high-net-worth individuals might benefit from this type of policy given the limitations of funding the ROTH IRA. In fact, Kelly covers this in the final portion of the book where he discusses the challenges faced by doctors and business owners.

Universal Life Insurance Definition

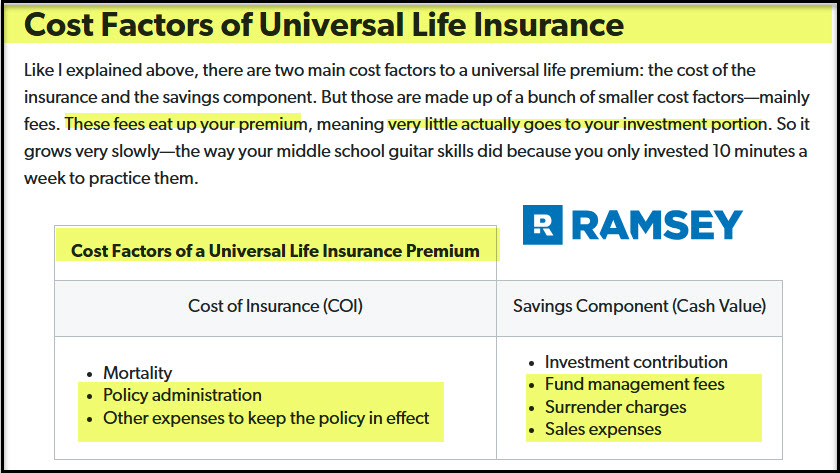

Universal life insurance is a category of permanent life insurance. In addition to the payout at death, it has a savings account built into the policy, referred to as cash value. This is where the flexibility comes in. If you put enough into the savings account, you can use the cash value to adjust your payments within limits.

Universal life insurance can be a good investment for those seeking flexible premium payments and a cash value component, but it typically offers slow growth due to fees and interest rates. It’s important to consider your long-term financial goals and compare them with other investment options.

Here are the “Key Takeaways” from the Ramsey article about Universal Life:

Note: I agree with Dave Ramsey’s assessment of life insurance. In my opinion, only term life insurance is a sensible long-term option.

- Universal life insurance’s selling point is its so-called flexibility—premiums that can be adjusted with your budget. But you still pay.

- These policies work by using your premium to pay for insurance and fund a cash value account, which you can borrow against or use later to offset rising premiums.

- While the policy builds cash value, that growth is typically slow because of fees and a measly interest rate—and may not be enough to cover the rising cost of insurance premiums as you get older.

- Term life insurance is always a more cost-effective option, allowing you to avoid outrageous fees and invest the savings on your own for bigger returns. SOURCE: Ramsey Solutions

INVESTOPEDIA also has some “Key Takeaways” about “Indexed Universal Life Insurance:

- Indexed universal life insurance combines a death benefit with cash value growth potential linked to market index performance, but it also protects against market losses.

- IUL policies offer some tax advantages, including tax-deferred growth and potentially tax-free loans, but they come with significant fees that can impact overall returns.

- These policies provide more growth potential than whole life insurance but less potential return than directly investing in the market due to participation rates and caps.

- IULs require careful long-term planning, as canceling your policy in the first years of the policy can trigger high surrender charges. SOURCE: Investopedia

As you might imagine, I have an investment strategy. It does not include municipal bonds or life insurance. Those are both less than attractive due to my focus on income and growth.

My Strategy and Why I Use This Strategy

The best strategy for both tax-free retirement income and leaving a legacy is the ROTH IRA. Therefore, each year I am moving assets from my traditional IRA to my ROTH IRA to reduce my RMD and the IRA account balance. I pay the taxes today and reap the benefits of tax-free asset growth, tax-free dividends, and tax-free options income.

Dividend Income Comparison of IRA and ROTH

Using only my ROTH IRA dividends and Cindie’s ROTH IRA dividends for 2016-2025, we received income totaling $323,343.47 in dividends. All of that income is tax-free. My ROTH IRA dividend income was $240,491.67 so the bulk of the income was in my account due to the size of my ROTH IRA.

For the traditional IRA’s, the total dividends during the same time period have been $777,416.55. All of that income is taxable, but not at the favorable dividend tax rate. Rather, this is just like earned income, and it is taxed that way when withdrawn. Assuming an average tax rate of 15%, that means the government’s share of our IRA dividends was at least $116,612. This does not include Wisconsin income taxes!

Again, because my traditional IRA has a huge balance, the dividends in that account have totaled $736,271.59. That is part of my motivation for rolling assets from my traditional IRA to my ROTH. Each stock or ETF that moves is no longer adding to the taxable income bucket. Rather, it is adding to the tax-free income bucket. I’m willing to pay a higher Medicare premium due to IRMAA when I saw the dollars that would disappear due to regular income taxes. The short-term premium payment pain is worth the long-term tax-free income gain.

Options Income Comparison of IRA and ROTH

I have been trading options since 2020, so a comparison of the options income from the two types of accounts also merits consideration. Using only my ROTH IRA options income and Cindie’s ROTH IRA options income for 2020-2025, we received income totaling $104,198.00 in options income. All of that income is tax-free. My ROTH IRA dividend income was $93,623.62 so the bulk of the income was in my account due to the size of my ROTH IRA.

The options income in the traditional IRA’s paints a painful income tax picture. Our total options income in these accounts is $409,313.63. Again, using a very modest estimate of 15% for income taxes, $61,397 is going to the Federal government and another 5% is going to the state of Wisconsin.

Therefore, I am very motivated to roll positions from my traditional IRA to my ROTH, as my traditional IRA has far more options trading opportunities due to the holdings in that account. This doesn’t even consider the growth on the value of the investments moved from the IRA to the ROTH. That helps reduce my RMD, making it easier to roll more to the ROTH sooner than I could if I did not take this approach.

The income taxes on the traditional IRA will be a huge burden for our heirs. That is another reason to reduce the size of our IRAs. We want the specified charities and our children to get the inheritance with minimal taxes taken from the assets that remain.

Recommendations

Whenever possible, sign up for the ROTH 401(k) if your employer offers this option. If not, take the traditional 401(k) if the employer offers matching contributions. If not, then I think funding a ROTH IRA should be your first choice, whether you are fifteen or fifty years old. Furthermore, if you have a 401(k) with a former employer, move it to your own Rollover IRA and start rolling assets to a ROTH IRA before you reach retirement. Even in retirement you can continue to process after you take your RMD for the year.

When you buy assets for your IRA or your ROTH IRA, don’t buy poor investments like bonds or bond funds. Also, buy quality assets with an eye on diversification. The best way to do this is to use s resource like Seeking Alpha.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.