Four Percent Rule: Retirement Withdrawals

What is a wise withdrawal strategy in retirement? This is the third “Number” in the seven-blog series about “Seven Investing Rules.” Today we will examine the number four.

For decades (probably at least four decades) you have been working or will have worked when you “retire.” During those 40 years you receive income. You were wise and set aside at least ten percent of your income for the future. Over time your retirement account grew to $1,000,000 – at the very least. Now it is time to start withdrawals. How much can you or should you withdraw? Some of that depends on whether or not you have Social Security income or a pension.

Of course, if you have a traditional IRA, you will be forced to start withdrawing, and the amount is determined by a formula. That will be your required minimum distribution (RMD). Sadly, you won’t get to keep every dollar because the government has been waiting patiently for their cut of your withdrawals as well.

The 4% Rule: Withdraw up to this Amount

So if the 4% rule is a good one, and you have $1,000,000 saved in your retirement account, then you can withdraw $40,000 (4% of your total account) the first year. Now, if you aren’t overly conservative with your investments, and you have dividend growth, it is highly likely that your account at the end of the year will have a balance greater than $1,000,000 even after the withdrawal. In fact, if your dividend investments yield 4% on average, then you are only withdrawing and spending the dividends. The value of your stocks and ETFs can continue to grow. Even in a bad year you just stay the course.

Bear in mind that you probably cannot spend the entire $40K. You will have to add up all of your income and be ready to pay Uncle Sam, and, in our case, Uncle Wisconsin.

Schwab’s Suggestion

The common wisdom is that you want to outlive your money. That may be wise, although it may not. I’m not going to argue for either position. However, a wise person does think about their family and that needs to be a priority. Investments are like a flock of sheep. The flock can continue after you are gone. Therefore, I hope some of my sheep are still producing when I am gone.

“The 4% rule is frequently misunderstood to mean you should withdraw just 4% of your portfolio every year if you want it to last. Some take it to mean you should seek a 4% yield from stocks and bonds and live off that.” – Schwab

“However, the rule actually suggests that you add up all your investments during your first year of retirement and withdraw 4% of that total. In subsequent years, you would adjust the resulting dollar amount you withdraw to account for inflation. By following this formula, you should have a very high probability of not outliving your money during a 30-year retirement.” – Schwab

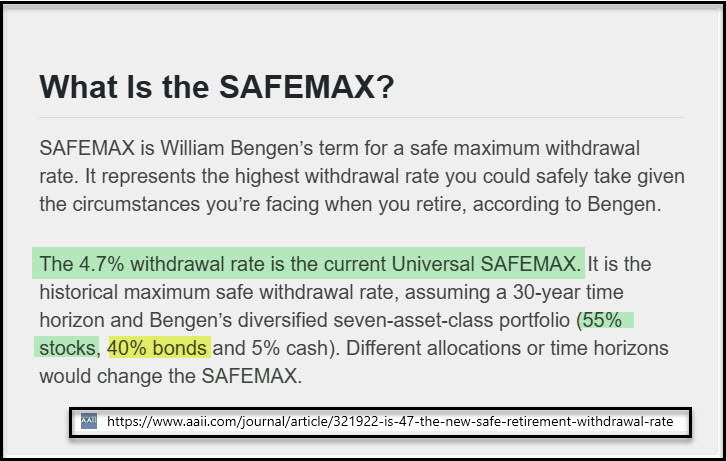

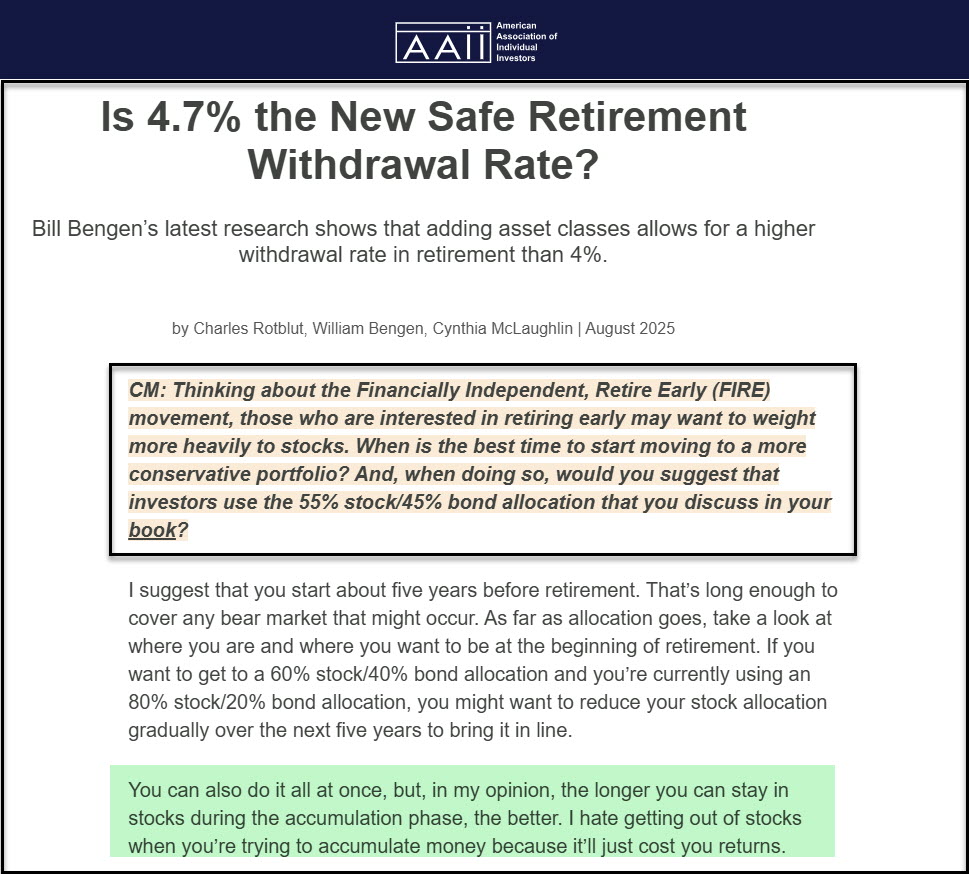

AAII and William Bengen’s SAFEMAX Withdrawal Rate

In the August 2025 AAII Journal there was an article that is also helpful. The article was “Is 4.7% the New Safe Retirement Withdrawal Rate?” If that is true, then your withdrawal could be $47,000 before income taxes. This article was written in interview style. Cynthia McLaughlin asked a question about the FIRE movement, where FIRE is “Financially Independent, Retire Early.” Like many advisors, there is a school of thought that says you should start to move to bonds in retirement. I don’t belong to that school. However, here is a portion of that article:

“CM: Thinking about the Financially Independent, Retire Early (FIRE) movement, those who are interested in retiring early may want to weight more heavily to stocks. When is the best time to start moving to a more conservative portfolio? And, when doing so, would you suggest that investors use the 55% stock/45% bond allocation that you discuss in your book?

I suggest that you start about five years before retirement. That’s long enough to cover any bear market that might occur. As far as allocation goes, take a look at where you are and where you want to be at the beginning of retirement. If you want to get to a 60% stock/40% bond allocation and you’re currently using an 80% stock/20% bond allocation, you might want to reduce your stock allocation gradually over the next five years to bring it in line.

You can also do it all at once, but, in my opinion, the longer you can stay in stocks during the accumulation phase, the better. I hate getting out of stocks when you’re trying to accumulate money because it’ll just cost you returns.” – AAII Journal August 2025

In Real Retirement Life

The number four (or 4.7) is an important number. This number can help you estimate your annual income in retirement from your IRA or ROTH IRA withdrawals.

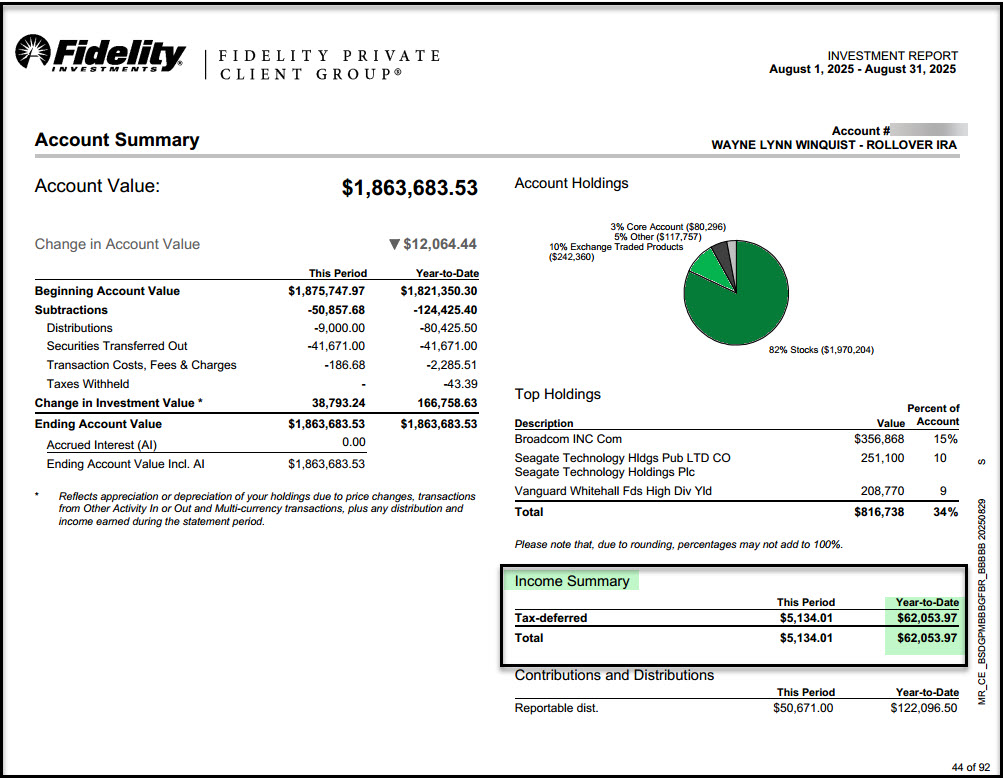

In 2025 my required minimum distribution is $71,425.50. The current balance of my traditional IRA is $1,863,683.53. That means my RMD is 3.8% of my current balance. However, I have given all of my RMD to good causes using QCD’s. QCD’s are Qualified Charitable Distributions. Now I am moving positions from my traditional IRA to my ROTH to save on taxes in the future and to reduce or minimize my IRA RMD. That is better than just taking the withdrawals.

My August IRA statement shows that my IRA has earned about $62K YTD in income. It should be obvious that the dividends will easily cover the RMD. Because of this, I don’t have to sell any positions to fund the RMD. That is one part of my investment strategy: growing dividends should cover growing RMDs.

Here are three examples: SCHD, VYM, and DGRO.

The current balance of my ROTH IRA is $1,079,919.89. I could certainly withdraw 4.7% from that account, but I see no need to do so. I hope that it will be of help to Cindie when (if) she is a widow because she is named as the primary beneficiary. If not, then my ROTH contingent beneficiary specifies that the ROTH goes to the “Winquist Revocable Trust.” (The same is true of my traditional IRA.)

The trustees of the trust are our son and daughter. The trust details how the assets in the trust are to be distributed, including designations for specified charities.

RECOMMENDATION

Do the following math: Take your entire retirement account balance(s) and multiply that number by 4.0% or 4.7%. Then divide that number by twelve to get your monthly income. Do you like what you see? If not, then more work is needed. If nothing else, don’t buy bonds. They won’t help you get there.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.