It Probably Is Not 2.7%

Did you know that Medicare premium inflation for 2026 will be 11.6%? While “inflation” may only result in a 2.7% increase Social Security income boost, the cost of the Medicare health care component significantly reduces that increase.

For 2025 Cindie and I should receive a combined total of $50,316 in Social Security benefits. That sounds pretty good. The problem is that due to the Medicare Part B premium (medical insurance that helps pay for doctor visits and medical equipment) and a nasty IRMAA additional adjustment, our real Social Security income is $43,771.20. We have to pay $6,544.80 in Medicare premiums. That means 13% of our income is taken before we even receive it.

But that isn’t all. We then pay Federal income taxes on some of the Social Security income as well. For 2024, our total income from Social Security was $49,096 and we had to pay income taxes on $41,732 of that income. For the Federal income tax, that means an additional 15.3% (based on our adjusted gross income) was paid in taxes. In reality, another $6,385 was subtracted from the $49K.

So the total cash we received was about $13K less than the total “Social Security benefit.” You can trust the government to make a benefit less by the things they take from you before and after you get paid.

Look At The Numbers

Do you see how this works? Do you understand the impact? The Social Security cost-of-living adjustment (COLA) for 2026 is estimated to be around 2.7%, which would increase the average monthly benefit for retirees by approximately $54.18. This adjustment is intended to help benefits keep pace with inflation, but rising Medicare premiums offset this increase.

In our case, a 2.7% increase in Social Security is an annual increase of $1,359. That works out to be about $113 per month. Will we get that amount? No. The issue is the Medicare Part B premium deduction from the deposit we will receive.

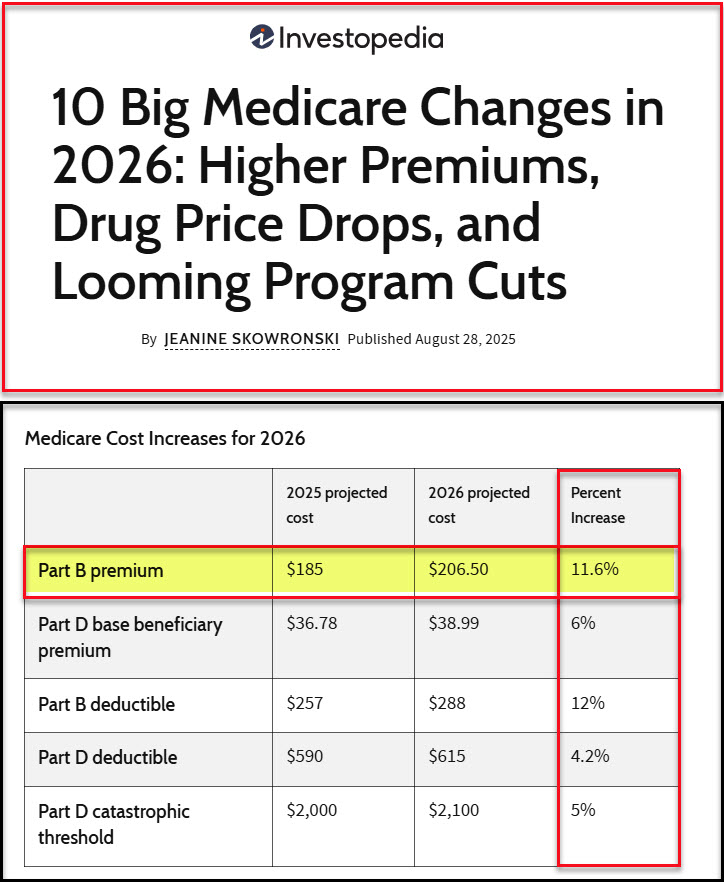

The 2026 Medicare Part B Premium

According to the most recent update, “You’ll Pay More for Medicare Parts B and D. Premiums for Medicare Part B (medical insurance that helps pay for doctor visits and medical equipment) are projected to rise 11.6%, from $185 to $206.50, while Part D (optional prescription drug coverage) base beneficiary premiums are expected to increase by an estimated 6%, from $36.78 to $38.99.” – Investopedia

Assuming we don’t have to pay the extra amount for IRMAA (and I suspect that we will due to our IGA), that means our total combined monthly premium increase will be $516. Say goodbye to the $1,359 increase. Not only that, but the Medicare Part D increase will be six percent. I did not do the math, but the 2.7% “increase” is no where near even two percent. Which of my readers believes that their auto insurance, housing costs, or food costs will be two percent more in 2026?

“Medicare year-over-year cost increases aren’t new. They typically tie to inflation—specifically, the rising cost of health care. (Last year, the Part B premium increased by $10.30.) Still, the cost hikes can strain budgets, particularly for cash-strapped seniors.” – Investopedia

“The lower your income, the more fixed your income, the more you’re going to feel it,” said George Huntley, CEO at the Diabetes Patient Advocacy Coalition. – Investopedia

Oh, and there will also be increases in the deductible amounts. So you will wind up paying more of the true medical costs in 2026.

The Way Inflation is Calculated

There is another problem with the 2.7% inflation “cost of living adjustment.” The adjustment is based on what the government calls inflation and what they choose to exclude from their calculations. The costs of someone in retirement are typically different from those who are still in their working years. Of course, I believe the government chooses the numbers they like best, not the ones that match the reality of retirees.

A Word to the Wise

As I often repeat, Social Security is a nice annuity. However, it is certainly rarely enough to cover the real costs of living in retirement. I believe it is wise to save around 10% of your income during your working years so that you can live off of your investment income when you are no longer working full-time for yourself or an employer.

Suggestion

If you are now a bit concerned about these numbers, then you might want to read my previous post about “Investing Rule: The Number Three.” Inflation will do far more to destroy your buying power if you buy the wrong mix of investments.