A Restaurant Disaster for Investors

Sometimes the best way to see the reality of an investment is to look at the desperate attempt of company management to fix what is broken by doing things that irritate their customer base. Cracker Barrel has been a poor investment for a long time. If you have seen the news and noticed the recent drop in their share price of 7.15%, you might be tempted to think that buying shares of CBRL would now be a good idea. Let me explain why that thinking is probably very wrong.

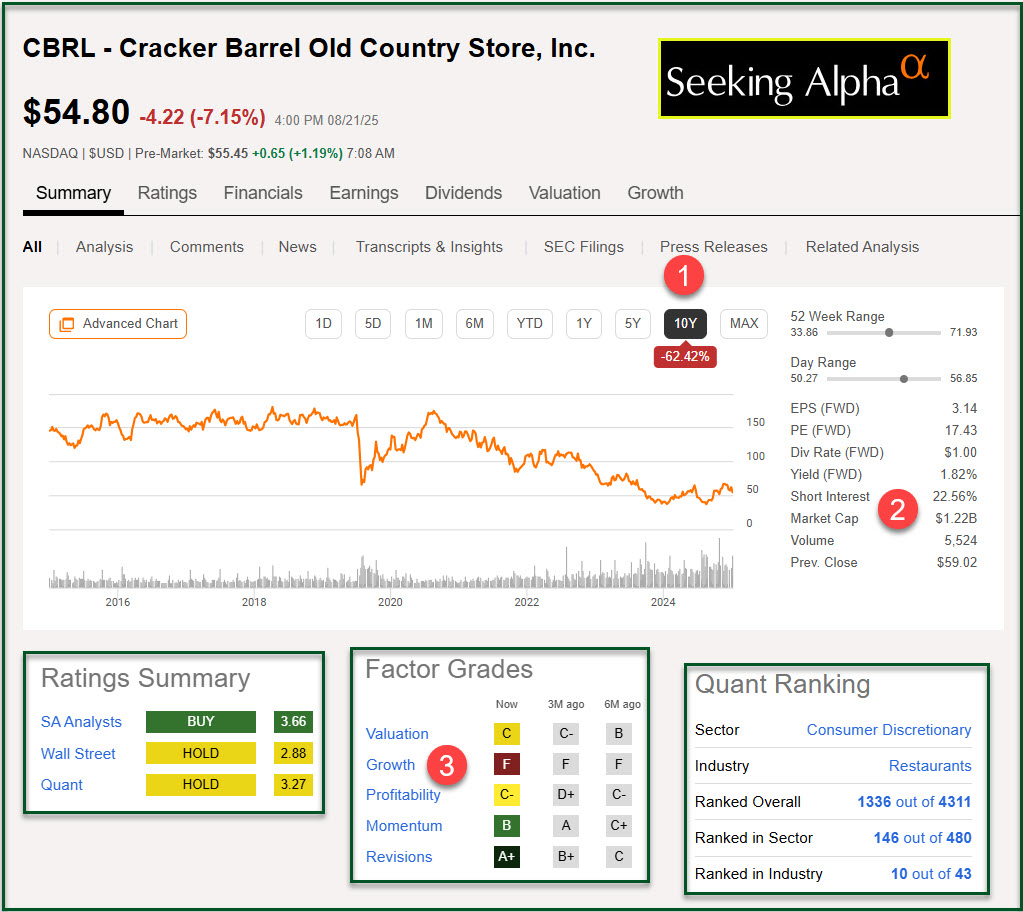

Seeking Alpha makes it easy to quickly see why I would not buy shares of CBRL. First, let me share that I bought shares of CBRL for Cindie’s brother in January 2016. Shortly thereafter, I sold the shares in June 2016 for $158.58 per share. That was prudent. The shares are now trading at $54.80.

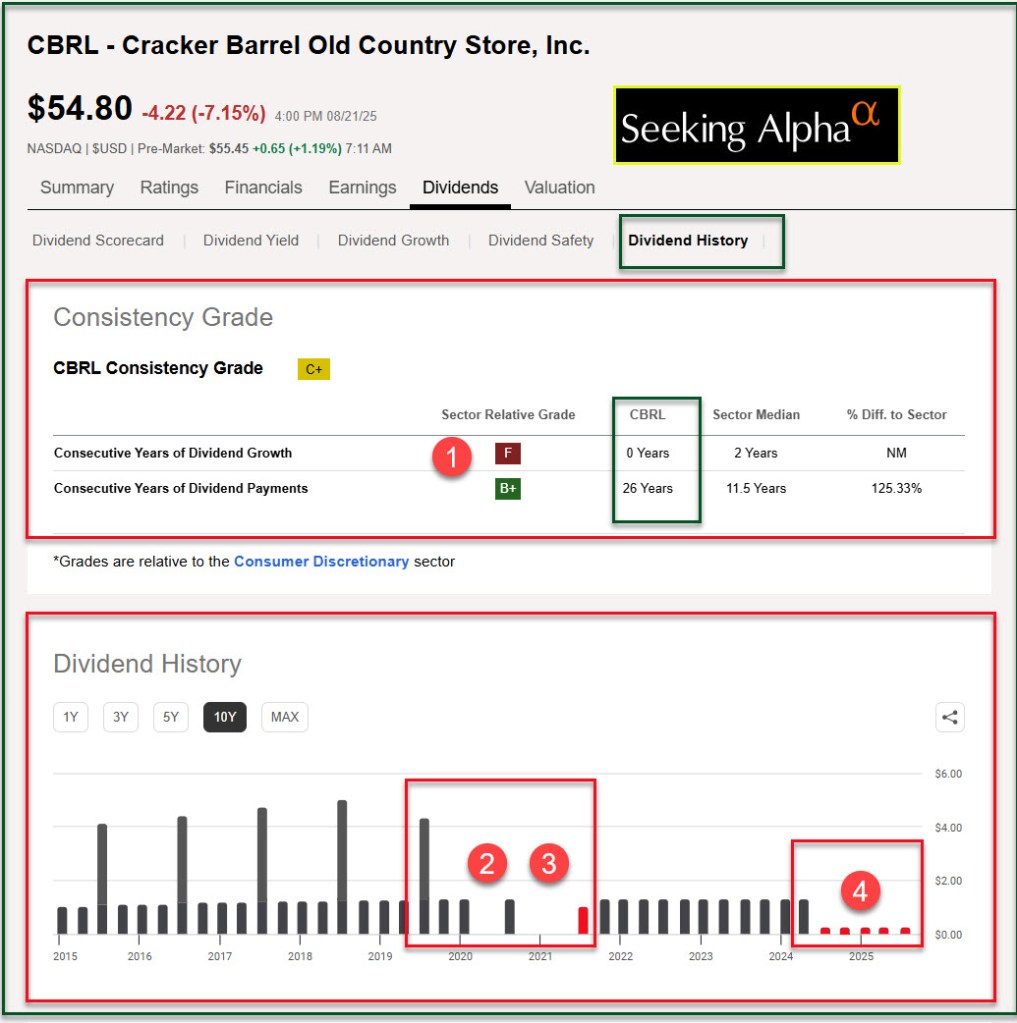

Back then the quarterly dividend was $1.10 per share. It moved up to $1.30 in 2019. There were gaps in the dividend payment during Covid. Then, in 2024 the dividend was slashed to $0.25 per share. That should have been a warning to all investors.

At one time CBRL shares were trading for $180 per share (November 2018). Those who bought and held their shares are now very unhappy. But even if they bought recently they would also be unhappy.

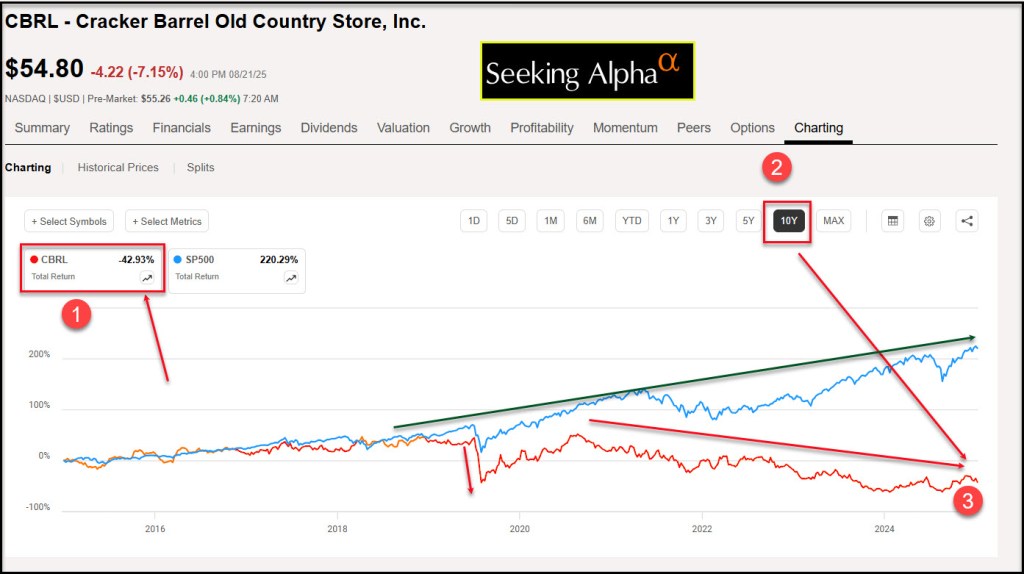

How To View the Barrel Now: Share Price Returns

Look at the ten-year price returns. Negative 62 percent. That is very painful! If you add in the dividends it isn’t quite as bad, but it isn’t good. If you add in dividends the return is a negative 43 percent. If you like losing money, then buy CBRL.

Short Interest

Short interest is currently 22.56%. That means many investors think the stock will go lower. If any stock has a short interest of more than 1-2%, be cautious about buying shares for the long-term. (You can see short interest for CBRL using this link: CBRL) It is shown to the right of the graph.

Growth

Pay attention to the potential for growth in any investment. For CBRL the Growth grade on Seeking Alpha is F. That means fail.

Dividend History

Pay attention to the ten-year dividend history. Not only have there been gaps in the dividend (during Covid) but the dividend was drastically reduced in 2024. Prudent investors see that as a time to exit. Of course, it would have been better to sell shares when the dividend was not growing between 2022 and mid-2024. This does not qualify as “Easy Income” by any definition.

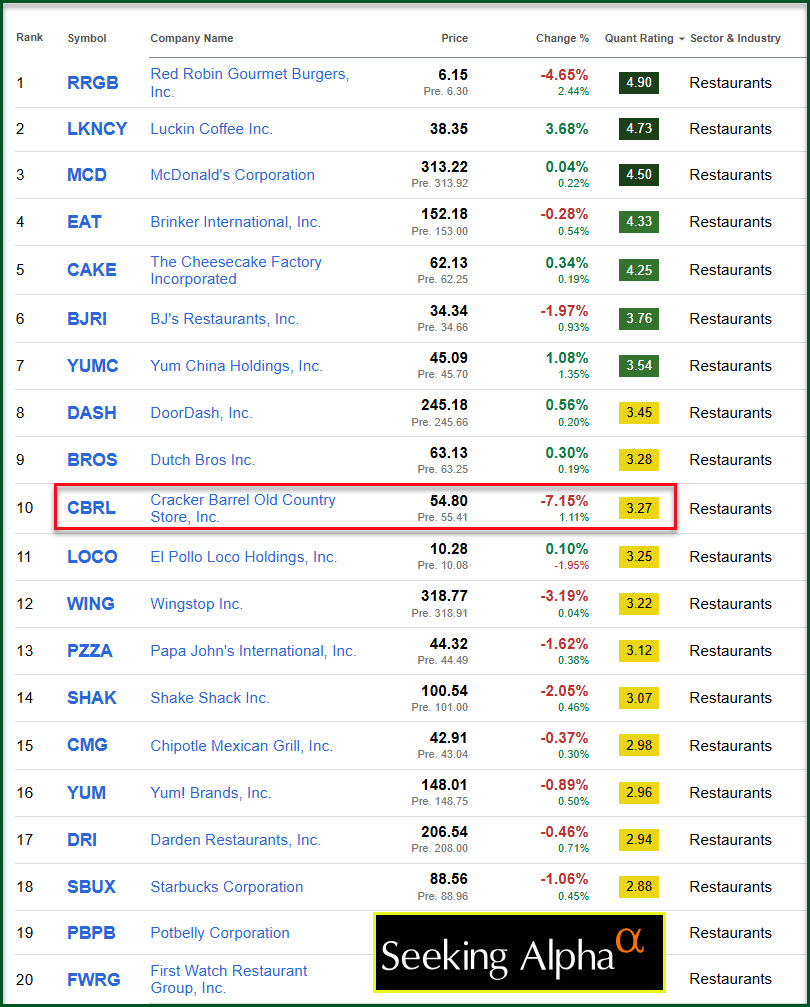

Restaurants Rating

What baffles me is that CBRL is number ten in 43 restaurant stocks. You can see that here: CBRL

If you must buy a restaurant stock then I would say McDonald’s. Whatever you think about MCD’s food, it is a good long-term investment. However, I should tell you that I don’t own shares and don’t plan to buy shares.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.