Going to the Pictures

Most people understand pictures of numbers rather than numbers. This is especially true if you are looking at numbers over time. It is difficult to “see” the changes in a table of numbers, but a chart of those same numbers can be most illuminating. Today’s post covers four “Lessons For Investors” in picture format. Each one informs me of my optimal investing behaviors. Some of these images were captured from the Fidelity Learning Center.

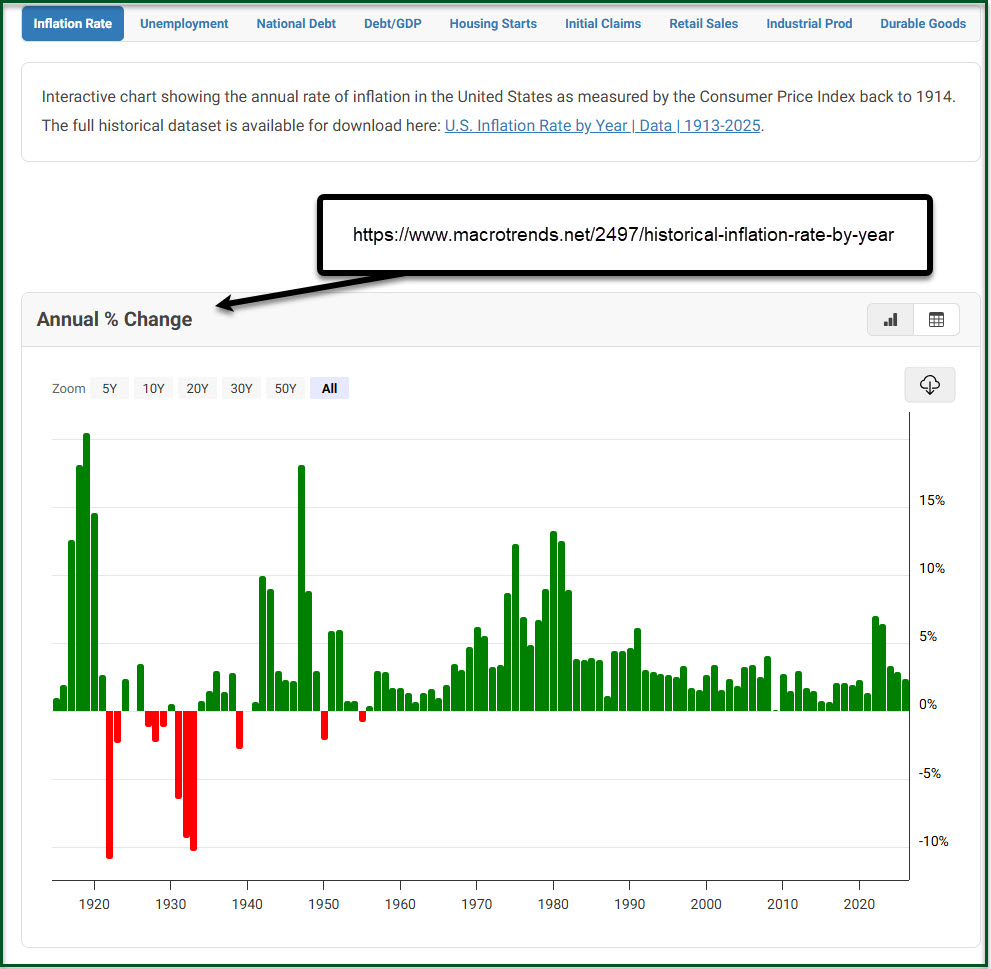

Now Showing: Inflation

Inflation rarely goes down. The simple reality is that you can expect to pay more in the future for the same things. Some common examples are bread, beef, electricity, gasoline, and insurance. If you don’t want to pay more, then you will buy less – if you can. This should inform your investment choices. Do your investments sabotage your investment returns? In the following graph the green bars show how much less your dollar is really worth over time.

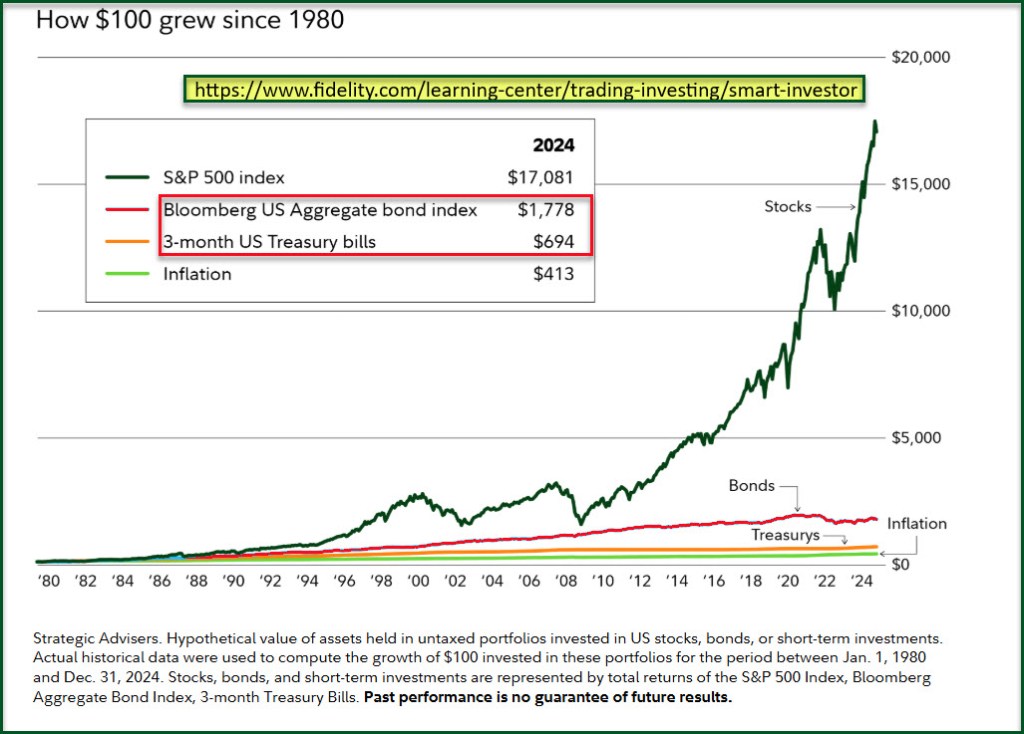

Now Showing: Stocks and Bonds

The average person thinks “bonds are safe” or “bonds have less risk.” The reality is that bonds are wonderful for the one selling them to you (usually) and not so good for you. If you don’t care about inflation, then by all means buy bonds.

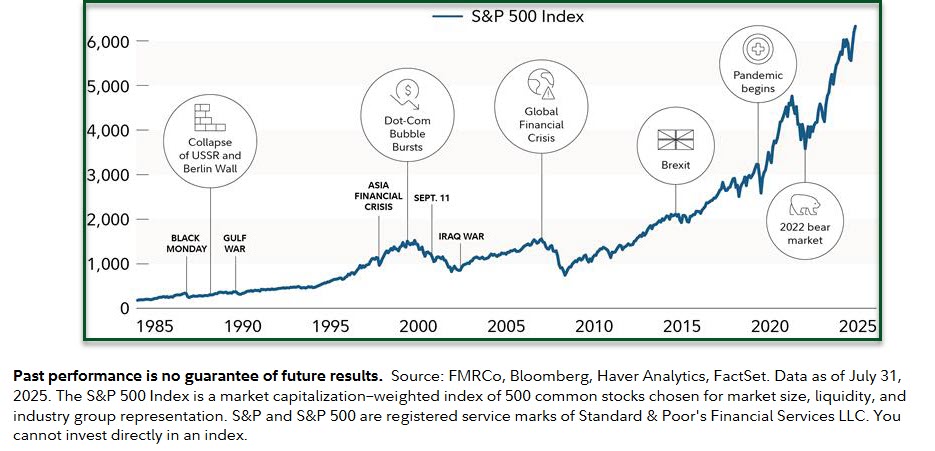

Now Showing: Historical Crashes, Crisis’s and Bear Markets

Will the Dot-Com bubble burst? It did. Will there be a financial crisis? There have been more than one. Will pandemics make investors nervous? Recent history replies with a “Yes!” Are there bear markets and bull markets? Of course. When these things happen you should do one or both of the following: Nothing or buy more. If you do nothing during a crisis, you will avoid a common mistake. If while doing nothing you buy more, you will be doing what most don’t do.

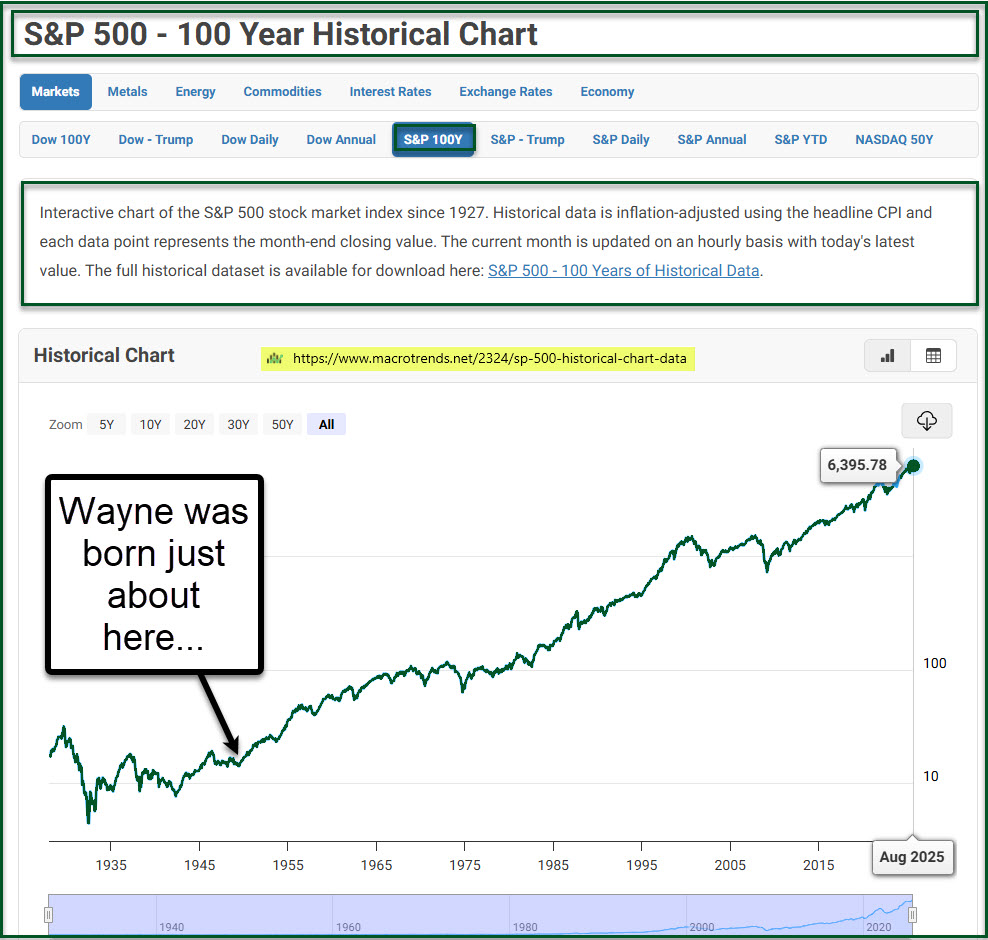

Now Showing: S&P 500 Chart

Look at the year Wayne was born. Then look at the S&P 500 today. The line is jagged. But there is a trend, and it informs my investment decisions.

Reflection and Recommendation

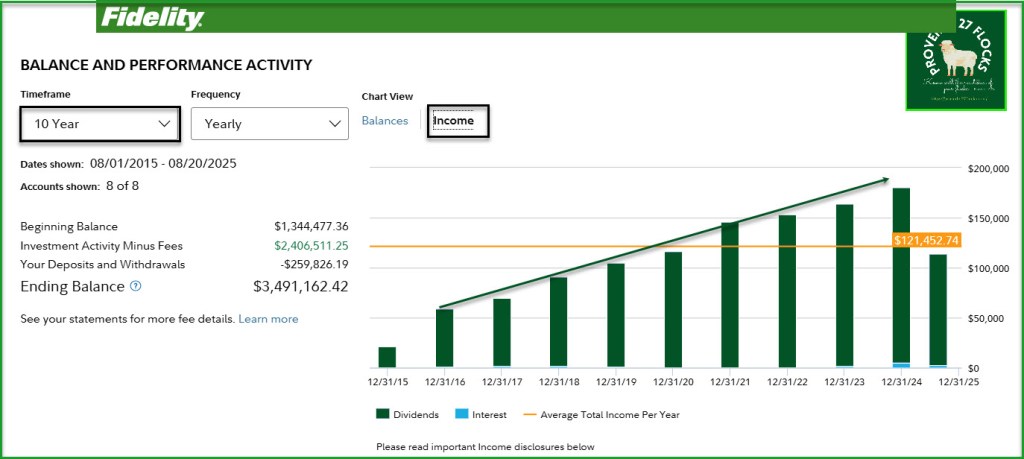

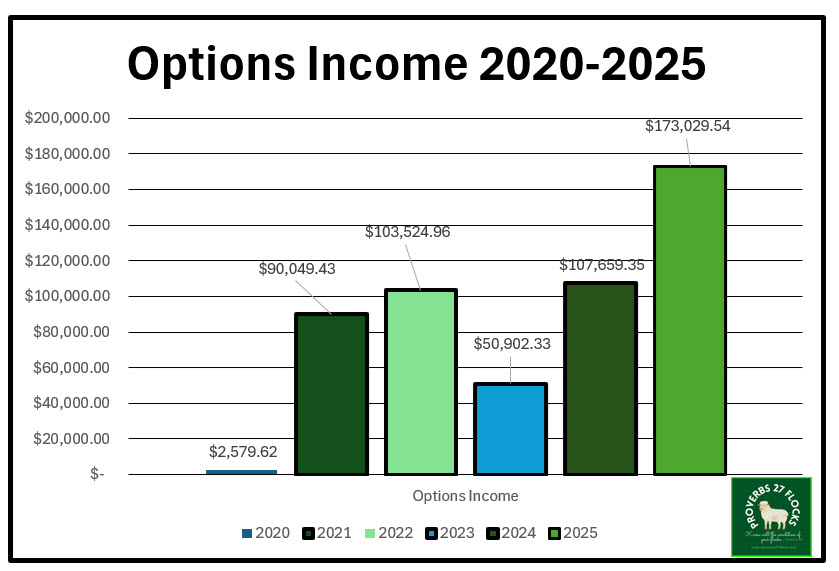

It pays to graph your own investing history. Fidelity does that for you, but I also keep specialized graphs about some of my investing activities. My recommendation is to look at the results of your investment advisor in graphical format. Pictures will tell you a story.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.