Recent Investment Purchases and Sales

Caution: this will be a much longer post and I will cover a lot of material. However, I believe it will be educational and helpful for those who appreciate easy income tactics.

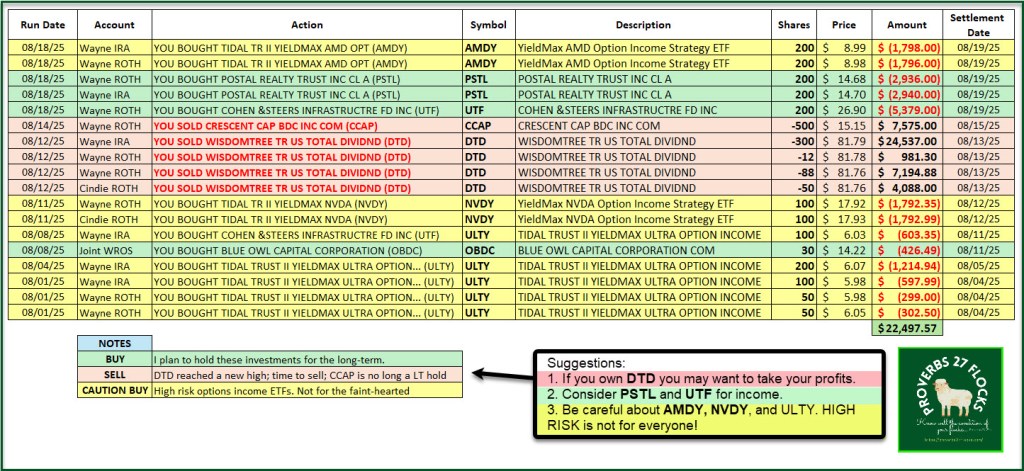

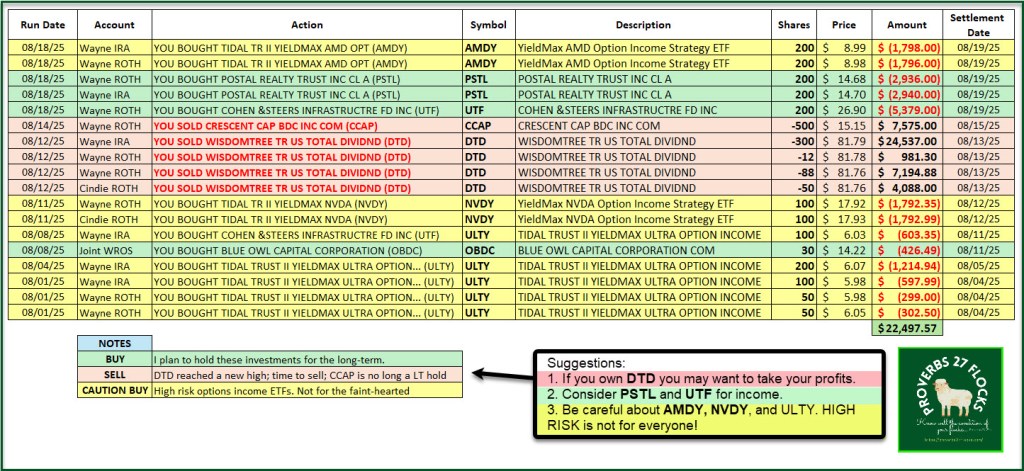

While I generally don’t want to do a lot of buying and selling of investments, there are times when I think it is prudent to do so. For example, DTD (WisdomTree U.S. Total Dividend Fund ETF) is a good ETF for dividend growth, but it isn’t great. The 5-year growth rate is 3.19%. However, the price of our shares increased significantly so I sold all of our holdings so that I could free up cash.

There is another consideration regarding DTD. Because the share price increased, the yield was just under two percent. In the present market a money market fund like SPAXX is paying more each month than DTD was paying in its monthly dividend.

One of the investments I purchased was PSTL (Postal Realty Trust, Inc.) which is a REIT. The current QUANT rating for PSTL is a STRONG BUY at 4.96. Furthermore, PSTL’s dividend yield currently stands at 6.61% and the 5-year dividend growth rate is a sweet 6.24%.

Why go postal? “Postal Realty Trust, Inc. (NYSE: PSTL) is an internally managed real estate investment trust that owns properties primarily leased to the United States Postal Service (“USPS”). PSTL is focused on acquiring the network of USPS properties, which provide a critical element of the nation’s logistics infrastructure that facilitates cost effective and efficient last-mile delivery solutions.” – Seeking Alpha

Teaching Beginners

Last night I had a good Zoom meeting with a young couple in Louisville, Kentucky. I met them during a trip to Amite Louisiana a couple of years ago. We talked about three things: 1) My recommended reading list and resources for new investors, 2) How to use the Fidelity website and 3) What investments I would recommend they buy once they move some cash to Fidelity. The two investments I encouraged them to start with were VYM and SCHD. Before you buy PSTL, focus on good dividend growth ETFs like SCHD and VYM.

Helping a Friend Invest

I am also doing some investing for a friend at our church. I sold all of her high-cost mutual funds and bond funds. She now has a very large stash of cash. Therefore, over time I am buying investments for her and am adding to the ETFs, REITs, and BDCs I purchased on her behalf. It should come as no surprise that I have been adding shares of SCHD and VYM to her accounts, along with DGRO. But I also recently added to her PFE (Pfizer) holdings and her UTF shares. UTF is the Cohen & Steers Infrastructure Fund, and it pays a dividend yield of 6.96% on a monthly payout. I also purchased shares of PSTL for her because she can benefit from having more REIT exposure and get the 6.61% yield in quarterly payouts.

Higher Risk Buys with an Options Twist

As my readers know, I am an options trader. I trade covered-call options and cash-covered PUT options. There are ETFs that will do that for you. However, you give up the driver’s seat when you turn this over to a fund manager. Therefore, although I did purchase three options-oriented ETFs, they will be a very small slice of our total investment portfolio. The three that I purchased are AMDY, NVDY, and ULTY. Of the three, AMDY offers the best “safety” in my opinion. However, I repeat, all three are much higher risk than PSTL.

You should notice three things about these specialized ETFs. 1) All three have high expense ratios. That is due to the fact that the fund manager wants to be paid for trading options for you. 2) All three have crazy high dividend yields (there is risk!), and 3) they are not diversified. Only ULTY is diversified, but its holdings are high-risk investments.

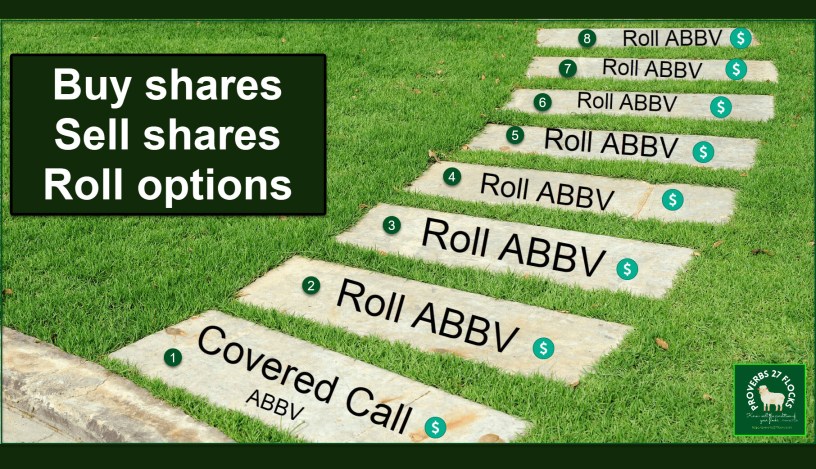

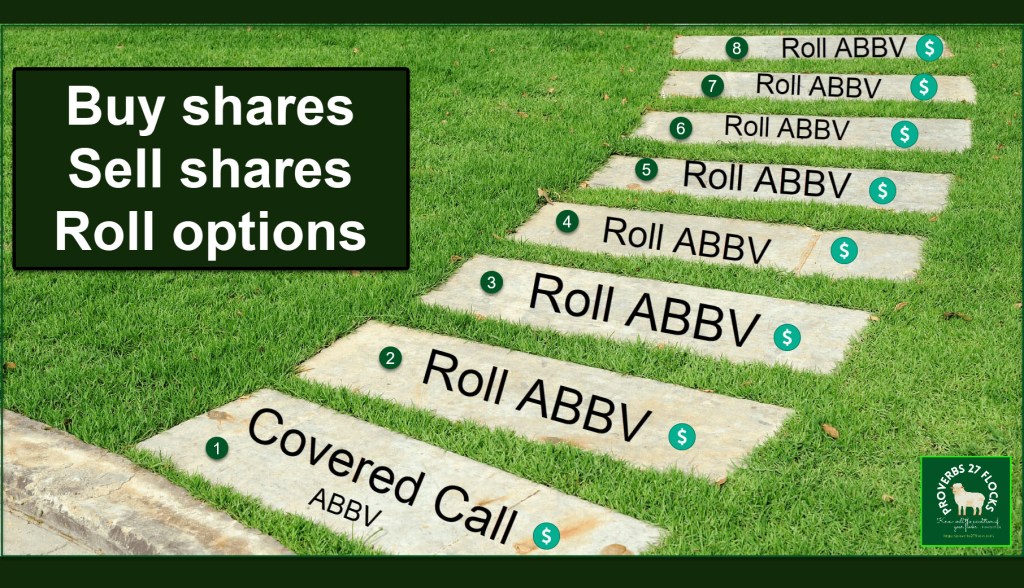

Now lets talk about options trading with a focus on rolling covered call options in particular.

Rolling Options Up and Down

Follow the Market

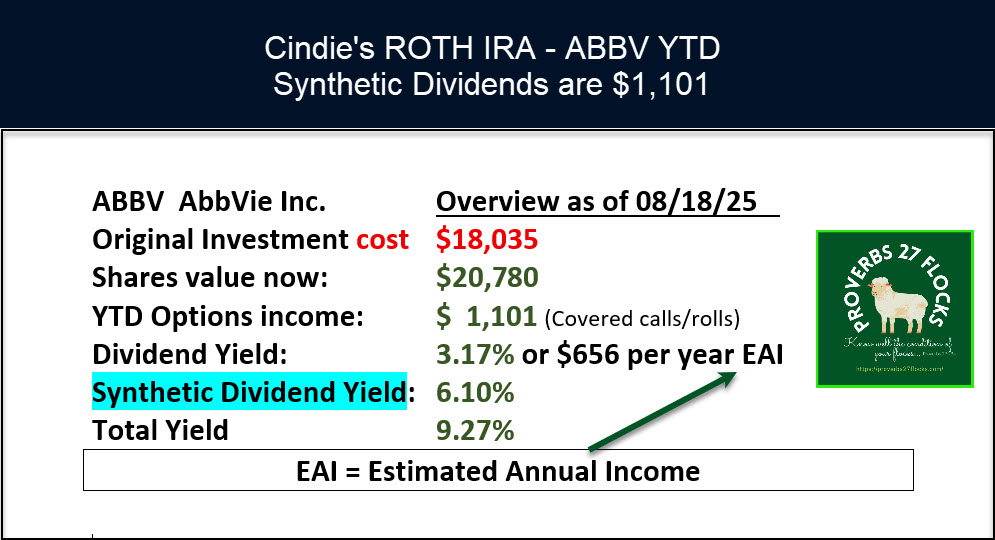

One of our largest holdings is ABBV. AbbVie Inc., a research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide. At the present time Cindie and I own a combined 1,220 shares. Of those, 120 are in Cindie’s ROTH account. The estimated annual income in dividends for these shares is $8,003.20. That is good income, but there are synthetic dividends to be gained as well.

Some investors are content with dividend income and investment growth. I am content, but I like to earn even more when the opportunity is presented. With the exception of Cindie’s twenty extra shares, there are open options contracts on all of the shares we own. The shares are worth about $252K, but their value is greater than that number. The reason is that the options income is significant.

The total YTD options income from the ABBV shares stands at $18,335. That is equal to 7.3% more in synthetic dividends.

The Steppingstones to Success

One thing that I did not do in my first year of options trading (2020) was selling Put options. I also did not roll any covered call options. I focused on learning how to trade covered call options, and I did twenty-four trades that first year. I also made one “expensive” mistake that cost me $160.69. Even including the mistake, I made $2.6K in options income from covered calls. The total number of contracts was 31. Thankfully, I was careful and none of my contracts were called, so I kept my shares.

In 2021 I added cash-covered puts to my options trading. I only did a few of them for PFE shares. However, I did not roll any of the covered call contracts and still earned over $69K in options income.

In 2022 I began experimenting with rolling covered-call option contracts. I did 239 rolls that year. The income that year was over $96K. Hopefully you see the trend here. I started small and gradually learned more about options trading.

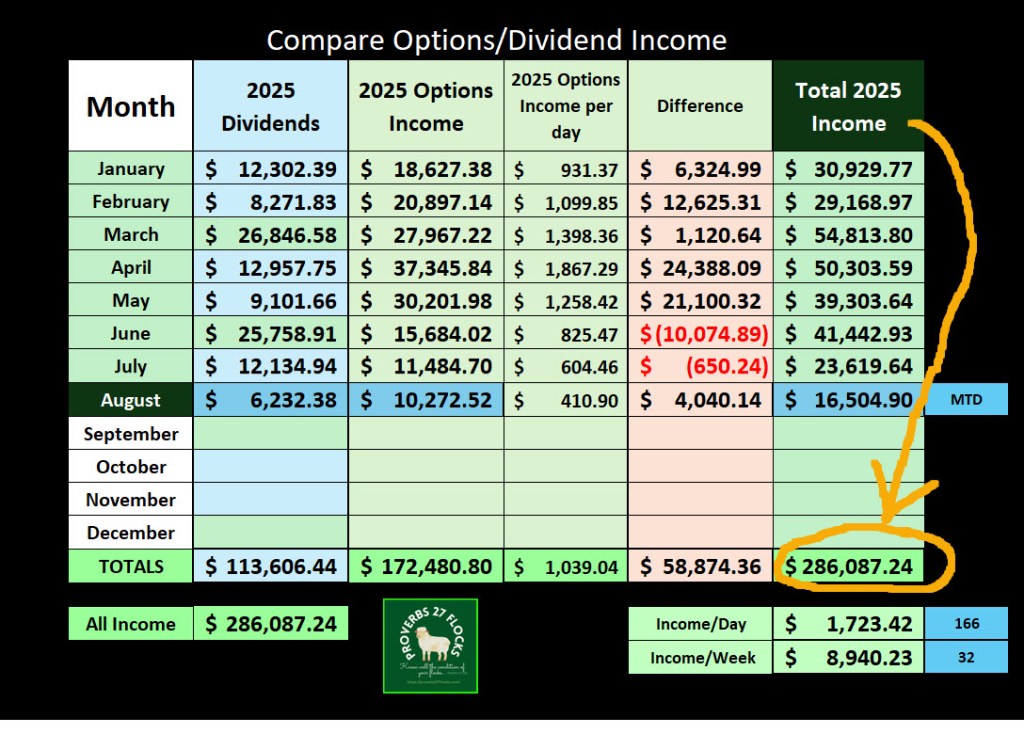

This year, I have already completed 406 contract trades to roll contracts totaling 2,129 contracts. I only have completed 654 new contracts. Most of my activity is rolling existing contracts. I have also done more PUT contracts on stocks like NVDA and CAG. This effort has yielded over $172K in additional income year-to-date.

Here is Cindie’s ABBV Options as an Example

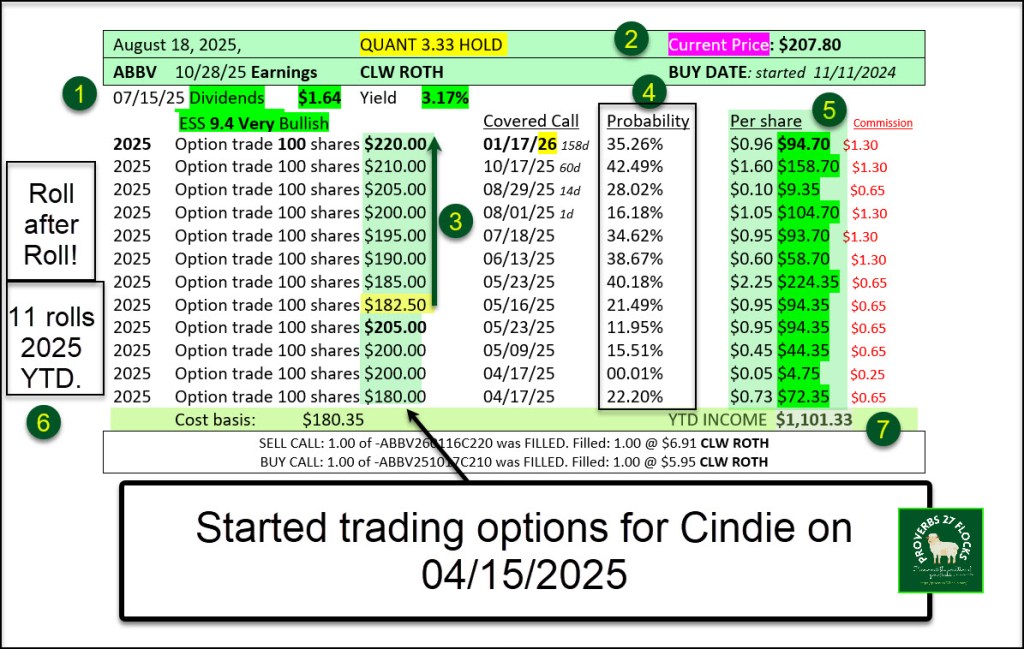

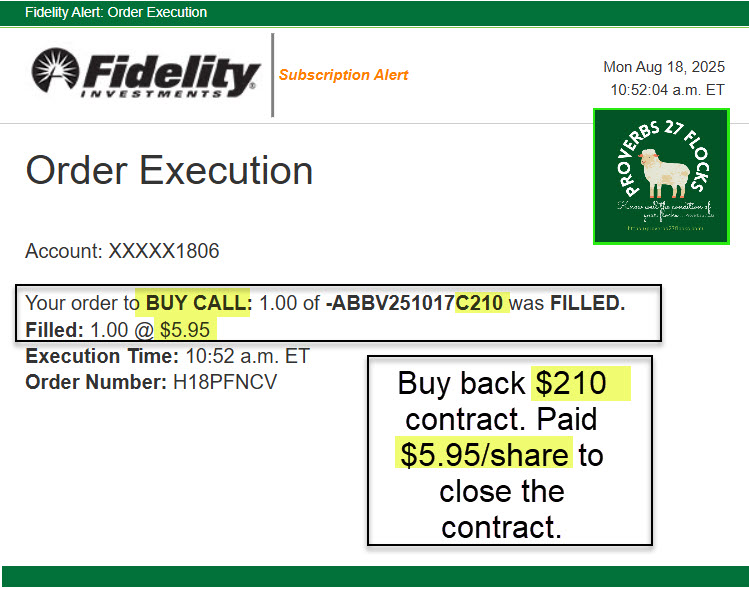

Cindie does not trade options. I do it for her. In the following example you can see all of the covered call option rolls for 2025.

I always look at the 1) earnings and ex-dividend dates; 2) the current share price; 3) “should I roll up or down” based on which direction the share price is going; 4) the probability that Cindie will have her shares called (usually want this to be less than 30%); 5) the income Cindie can receive from the roll of her contract; 6) the cost basis of her 100 shares (I don’t want her to have to sell her shares at a loss); and 7) YTD income.

Cindie has been successful! She has earned an additional $1,101.33 in “synthetic” dividend income from options rolls. The first trade earned her $72.35 and the most recent trade earned her $94.70. She can buy a lot of Diet Coke’s at Kwik Trip with that type of income.

Recommendation: Options For Investing Doers

We covered a lot of ground. If you are new to investing, I suggest you focus on buying ETFs like SCHD, VYM and DGRO. If your portfolio is larger, then consider buying shares of a good REIT like PSTL.

Then, if you want to trade options, start slowly and sell covered calls. After a couple of months add a few cash-covered puts and then start rolling your options. You won’t be disappointed if you learn a new trick. Old dogs can learn new tricks. I did.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.