The Easy Income Strategy Includes Puts for Investing Doers

Most readers of my easy income strategy post want to focus on dividend income once they understand the reasons for purchasing healthy and growing companies and ETFs that include healthy and growing companies. That is prudent, but that approach can leave money on the table. When you have cash in your account there are at least four ways to make your cash work in your favor. This post focuses on one way, but at the end I will summarize four ways you can make your cash do more than earn interest.

If someone met you for lunch and said they wanted to give you $50 as a birthday gift (in $5 bills) and set the envelop with the money on the table, would you take $25 and leave the rest, or would you say, “thank you” and take the entire ten $5 bills?

Trading “covered call” options is the other half of the equation. That is where you make money on stocks and ETFs you own, and that income can be weekly or monthly, depending on the stock/ETF you own. But did you know you can earn income from stocks or ETFs you don’t own? If you have some cash in your account, you can sell what is similar to a term life insurance contract to another investor. They give you money for the contract and you may never own the shares specified in the contract.

Using Coca Cola Stock as an Example

For example, let’s say I don’t own shares of Coca Cola (KO). Other investors do own shares of this huge beverage company. Some of those investors are willing to give me $50-$200 (or more) for my agreement to buy their shares if the share price of KO falls to or below the contract price we agree on in advance. The Coca-Cola Company shares closed on Friday at $69.92. If I bought 100 shares of KO, they would cost me $6,992. Let’s say I have $6,800 in my ROTH IRA account but I don’t have any KO shares. However, I would be willing to own shares if they cost $68 per share.

The current owner of the 100 shares is willing to give me $200 if I agree to buy their shares for $68 on August 22. However, I only have to purchase their shares if the shares fall to (or below) $68/share. I “write” the options contract and submit it on Fidelity’s Active Trader Pro “Trade Armor,” and they buy the contract and immediately pay me $200. That is my “synthetic dividend” and I did not have to own the shares of KO to get this dividend.

Now we are waiting for Friday. If the share price stays above $68, I don’t have to buy their shares, but I do keep the $200. There is a second possible outcome.

What is the “Risk?”

If the share price drops to $67 per share, then I am still obligated to buy their shares for $68/share. However, my cost basis for the shares is not $68. Rather, I subtract the $200 I received from the options contract, so my real cost basis is $66/share. In other words, rather than spending $69.92 for the shares on Friday, I wait one week and can potentially get them for a net cost of $66/share. That is a good deal – assuming I want KO shares. I “saved” $392 ($6,992 – $6,600) by using the cash covered put option.

How a Put Option Works

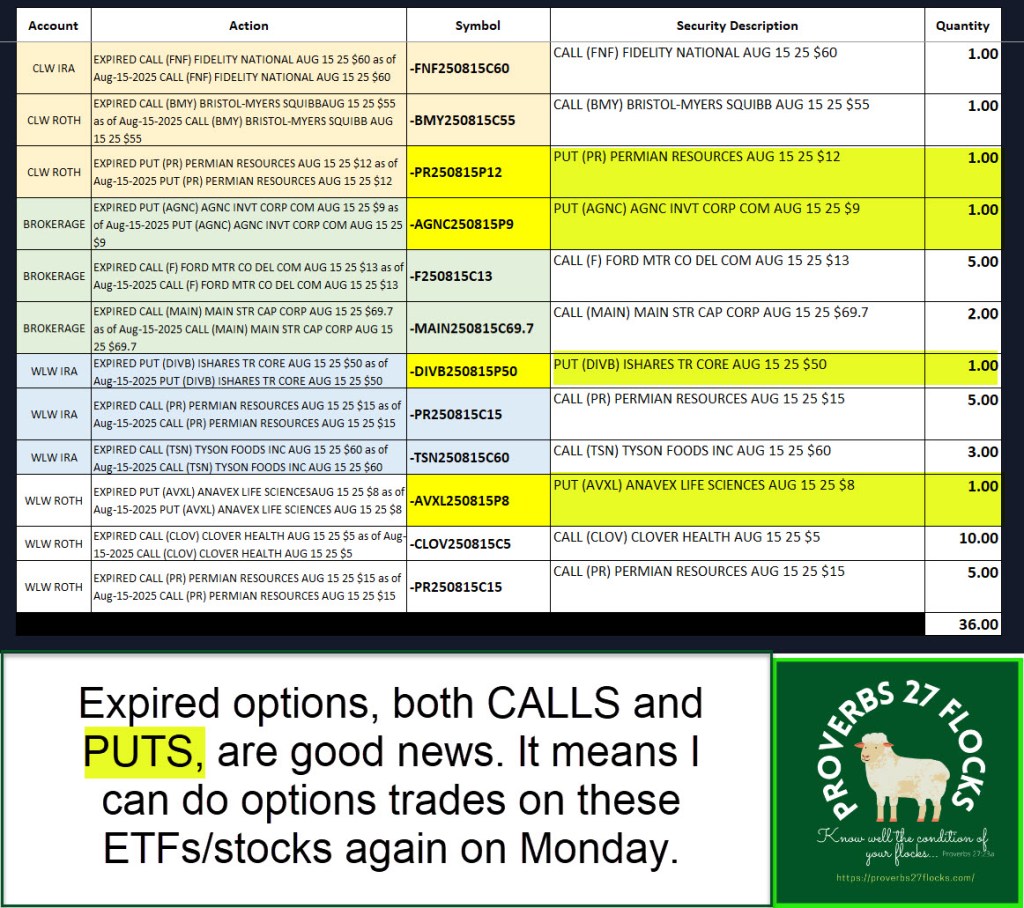

A cash-covered PUT option is a contract where you agree to buy 100 shares of a stock or ETF at a set price until the contract expires. This can also be a practical way to (potentially, but not with certainty) buy shares of an investment at a price below the current price. For example, I sold cash covered put options on one ETF (DIVB) and on three stocks: AGNC, AVXL, and PR. Today I learned that I won’t be getting any of the shares, but I’m not unhappy about this outcome. This is like the Coca Cola example above where the share price did not drop the contract price by Friday, August 15.

Income from DIVB, AGNC, AVXL, and PR

Why is this true? For the DIVB contract I received $39.32, which is mine to keep. For AGNC I did not get much, but I did receive $2.83 in profit. For AVXL I received $51.32 and for PR Cindie received $14.32. In other words, other investors gave us a total of $107.79 for the protection they wanted to avoid having to sell their shares at further loss. They are happy because their shares did not lose value, and I am happy because they paid me “insurance” premiums in the form of PUT options to avoid a loss.

The price of the option varies over time. “A put option becomes more valuable as the underlying stock or security’s price decreases. Conversely, a put option loses its value as the price of the underlying stock increases. As a result, they’re typically used for hedging purposes or to speculate on downside price action.” – Investopedia

A put option is one investor risk management strategy. It is called a “protective put.” Think of it as investment insurance that helps you avoid losing more than a predetermined amount on your stock or ETF investment. This strategy, in my opinion, is far better than setting stop loss orders on your shares.

Stop Loss Orders

I used to enter stop loss orders to protect me from huge drops in the price of an investment. It didn’t take long for me to see that this was a risky way to “sell” my shares. There are some serious disadvantages of using Stop-Loss Orders: “A downside to stop-loss orders is price gaps. If a stock’s price gaps past the stop price, the order triggers, and the stock is sold (or bought) at the next available price, regardless of a sharp price move.” – Investopedia

In other words, you might think you will get $50 for your shares, because that was your stop loss price. However, if the price plummets to $45 per share, you will only get $45 per share. That isn’t a good deal.

The other part that I learned was undesirable was what happens in a volatile stock market. “Another disadvantage concerns getting stopped out in a choppy market that quickly reverses itself and resumes in the direction that was beneficial to your position.” – Investopedia

Recommendation: For Ways Investing Doers Leverage Cash

There are four ways to leverage cash in your investment account. First of all, when interest rates exceed the rate of inflation there is no need to rush to buy any investment. Rushing often turns into regret. Secondly, everyone should have some sort of emergency fund. That includes your investment fund. This is especially important in your retirement years.

Then, of course, you can earmark some of your cash for future stock/ETF purchases by entering buy limit orders. When you do that you reduce the cash available for other types of trades, but you continue to earn interest on the cash until the price per share drops to your buy limit price.

Lastly, you can leverage your cash for extra income using cash-covered puts. When you do this, remember that you are still earning interest on your cash until the contract is assigned or expires. This is a way to increase your yield on the cash in your account.

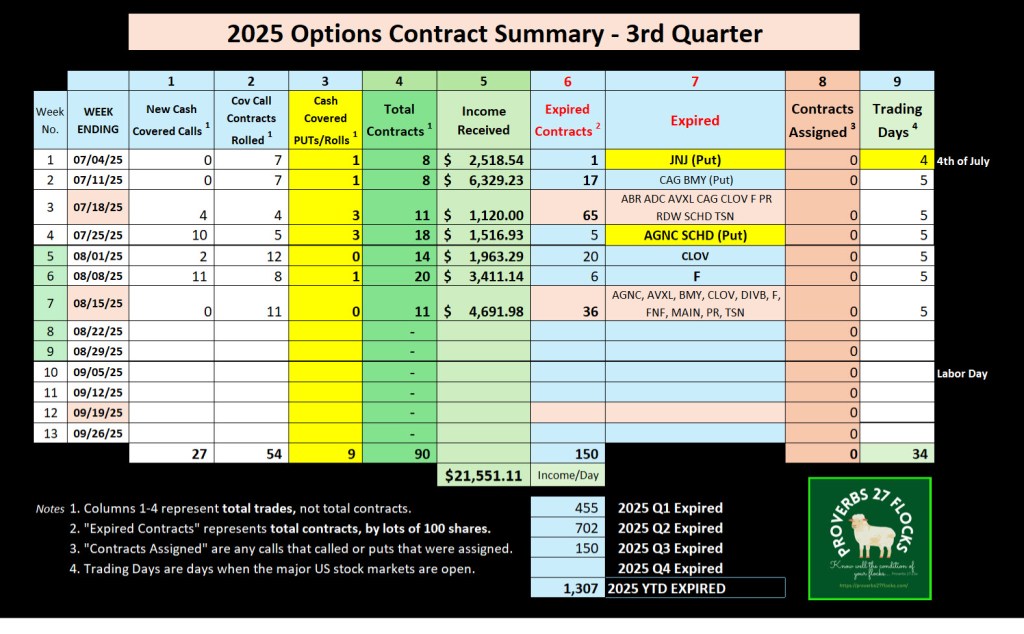

Last Week’s Expired Options

Last week several contracts expired. I keep the cash I earned, and I can enter new contracts today. The ticker symbols for the expired contracts were: AGNC, AVXL, BMY, CLOV, DIVB, F, FNF, MAIN, PR, and TSN. This was a mix of covered calls and cash covered put options. The image on the left is from Fidelity’s web. The image on the right is my Activity spreadsheet, downloaded as a CSV file from Fidelity. They both reveal the same information.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.