Use the Easy Income Strategy

Today I am featuring a helpful article that looks at paying your bills in retirement. How can you do that? What are the steps to get there?

“Only Portfolio You May Ever Need To Pay Your Bills: 6% Income Yield“

The author of this post has a good way of looking at the income side of retirement. Sadly, far too many investors have an investment portfolio that is too focused on growth to the neglect of income. That means, in retirement, that the only way to gain rational income is to sell an investment.

There are a couple of problems with that approach. The first is that you might have to sell at an inopportune time. If the market is down, you shouldn’t have to sell an investment. It is better to do that when the market is up.

That is why I have called my approach the “Easy Income Strategy.” I want our average monthly income from dividends to be more than sufficient to cover all of our expenses with plenty left over for charitable giving and special things like travel or the purchase of a vehicle or a home improvement.

But “easy income” must not come at the expense of portfolio stagnation. Therefore, bonds are out of the question as is an annuity. Easy income must be growing income and it must be easy in the sense that I don’t want to be day trading.

First Step, Second Step and Third Step: Getting Started

The first step in “paying your bills in retirement” is simple: get rid of debt. That includes any consumer loans, home equity loans, and the mortgage payment.

The second step is to create a budget that reveals your current spending patterns and the cost of living.

The third step is to create a dividend growth portfolio of investments that includes dividend growth ETFs, and in some cases, dividend growth stock investments. That is why I have the following investments in my ROTH IRA: VYM, SCHD, DGRO, ABBV, BMY, EOG, GTY, HPQ, MAIN, MRK, NNN, PFE, STAG, and VZ.

First Step, Second Step and Third Step: Consider Income Sources

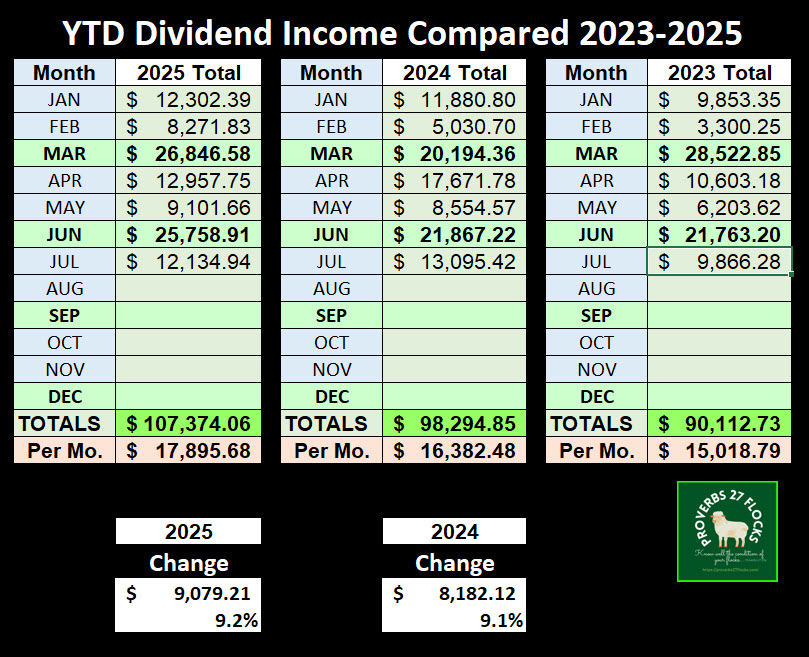

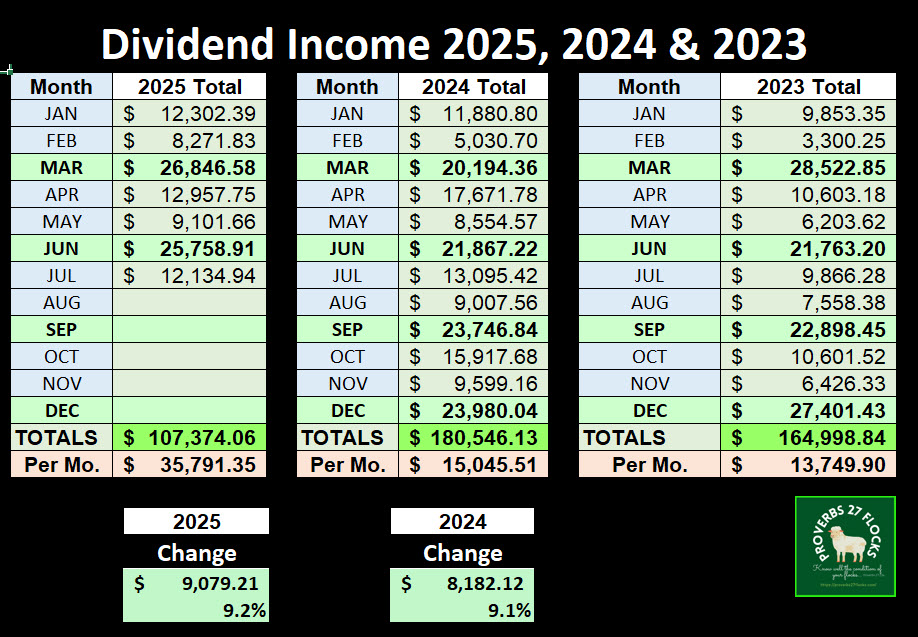

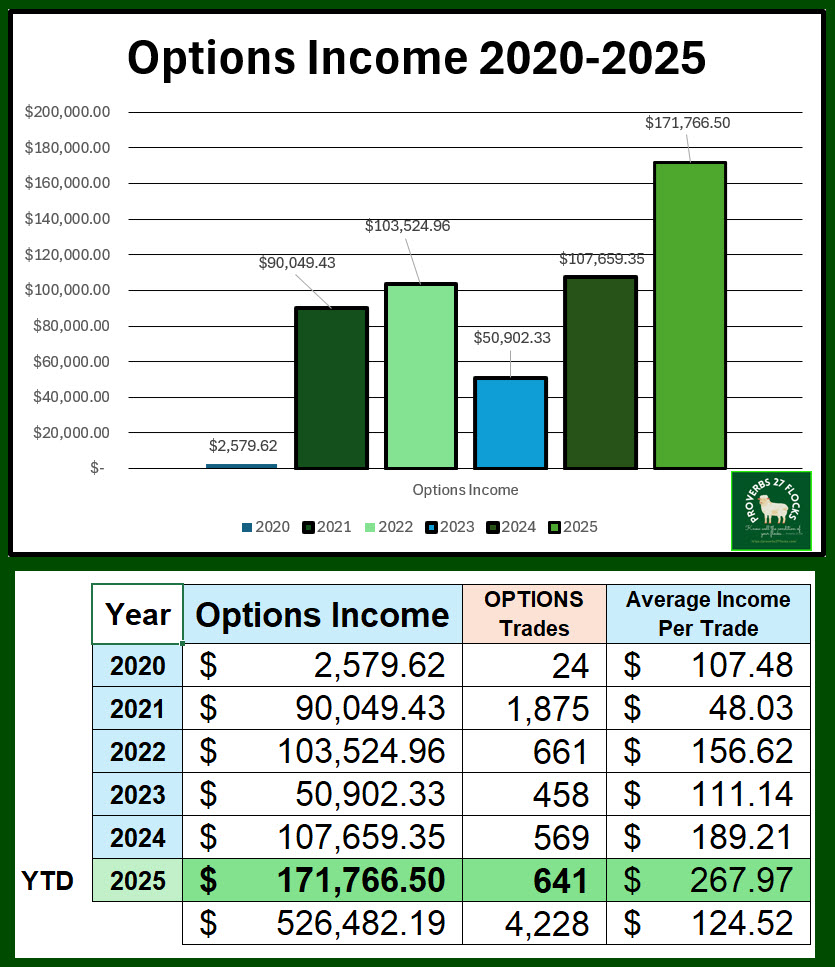

The other three steps are to evaluate the real income. Foundational is dividend income. Our YTD dividend income through the end of July was $107.374.06. YTD that shows growth over 2024 YTD. Then, you can add more income by trading covered call option contracts. My YTD options income currently stands at $171,766.50. Finally, there is the other income like Social Security and Cindie’s income working as a part-time baker at Beehive Homes in Oregon Wisconsin.

The author from Seeking Alpha only considers step one: dividend income.

“Only Portfolio You May Ever Need To Pay Your Bills: 6% Income Yield”

The “Financially Free Investor” author of this article presents a dividend and income strategy tailored to cover major retirement expenses, aiming for reliable income and inflation protection. That is wise. He (she?) aligns the portfolio to mirror day-to-day life expenses that most people have: housing, utilities, food, healthcare, and entertainment. The goal is to have a mix of high-quality stocks and funds. The other thing I like about the author’s approach is that it offers “diversification across sectors, market-matching returns, and income to sustain retirement lifestyle, but requires a long-term horizon.”

Don’t miss the diversification, market-matching, income, and long-term horizon pieces. Those mirror my easy income approach. However, let me caution you that I don’t necessarily agree with the author’s portfolio. For example, PDI (PIMCO Dynamic Income Fund) has far too much invested in bonds, so the ten-year total return of PDI is a decent 130%, but not as good as the ETFs I recommend.

For example, VYM’s total ten-year return is 191%, SCHD’s is 234% and DGRO’s is 211%. However, PDI’s current forward yield is attractive at 13.82%. I can see why it is included in the ideas he presents.

I also would not invest heavily in Verizon (VZ), AT&T (T), McDonald’s (MCD), or HOMZ (The Hoya Capital Housing ETF).

Here is Financially Free Investor’s Disclosure

I made the stocks and ETFs we own bold in his disclosure. Please note that he does not include VYM, DGRO or SCHD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, TSN, ADM, BTI, MO, PM, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, ARCC, ARDC, AWF, BME, BST, CHI, DNP, USA, UTF, UTG, RFI, RNP, RQI, EVT, EOS, FFC, GOF, HQH, HTA, IFN, HYB, JPC, JPS, TLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

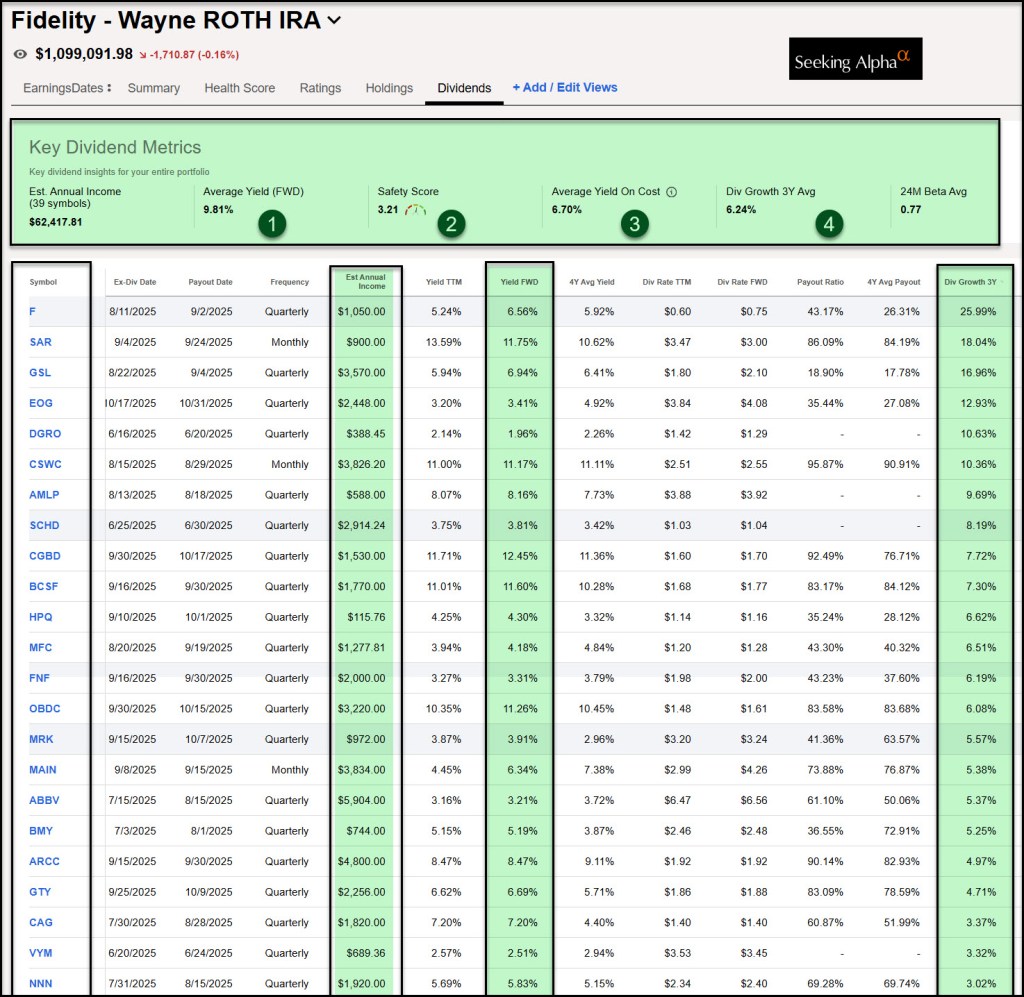

My Current Dividend Portfolio Yield

If you were to look at the total investments in my traditional IRA and ROTH IRA, you would see that I currently have an average yield of 5.4%. Some investments have a lower yield, like VYM at 2.57%, and others have a much higher yield, like ARCC (Ares Capital) which yields 8.5%. The thing you would notice about my portfolio is that it is diversified and that it provides dividend growth.

Here is a high-level view of some of the investments in my ROTH IRA, sorted by 3-year dividend growth.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.