“How Wayne Gets Things Done”

This is the third of a four-part series to answer a question one reader (Bill) asked. His question was: “How do you log your trades?”

Keeping records is a part of almost every part of life. When there are presidential elections, records are kept. When you go to the doctor, it is likely that myChart is full of a record of your vital statistics, lab work, medications and the doctor’s observations and recommendations. Churches keep records about members and giving. Businesses keep copious records, especially those that are publicly-traded. The US Census Bureau keeps records. And, of course, there are lots of records that are part of filing the income tax returns at the end of the year.

While many would avoid the extra work of keeping records, there is one very good reason to do so. The more trades you do, the more you learn. Records help you recall the logic and data that was used to determine if a covered call option trade made sense or not.

When I first started tracking trades, I did it on a sheet of paper. That was time-consuming and made it harder to do any kind of analysis. I then graduated to a spreadsheet, and that was better. However, it was hard to “see” what I did in previous trades of the same position without some extra steps. As a result, I created a Word “template” that I use for each position within each account to track the nature of each trade. I will show some examples in a moment.

Two Types of Records: Decisional and Income

There are really two types of records worth keeping. The first type is “what trade did I do and what was the data and logic that drove my decision?” This can help inform future options trades. This record-keeping is also especially helpful when doing option rolls. As I have grown in my knowledge of options trading, the number of option rolls I execute has increased. Part of this increase is due to the discipline of keeping a record of past trades – what worked and what failed.

The second type of record is: “Is this worth my time?” This is the income portion of the record keeping. This is actually the easiest piece, so I will start with this record keeping task.

Is It Worth My Time to Trade Options?

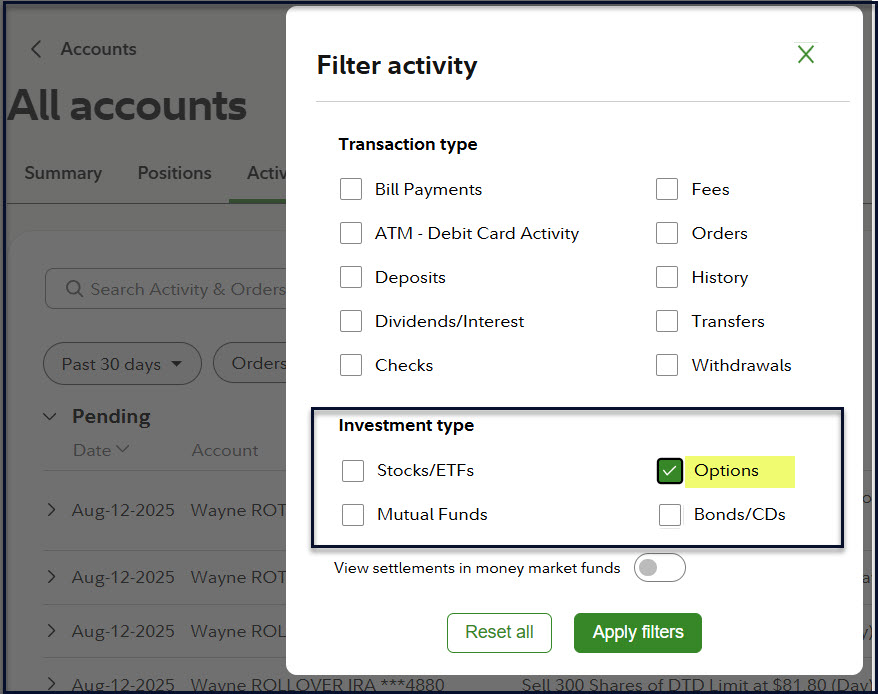

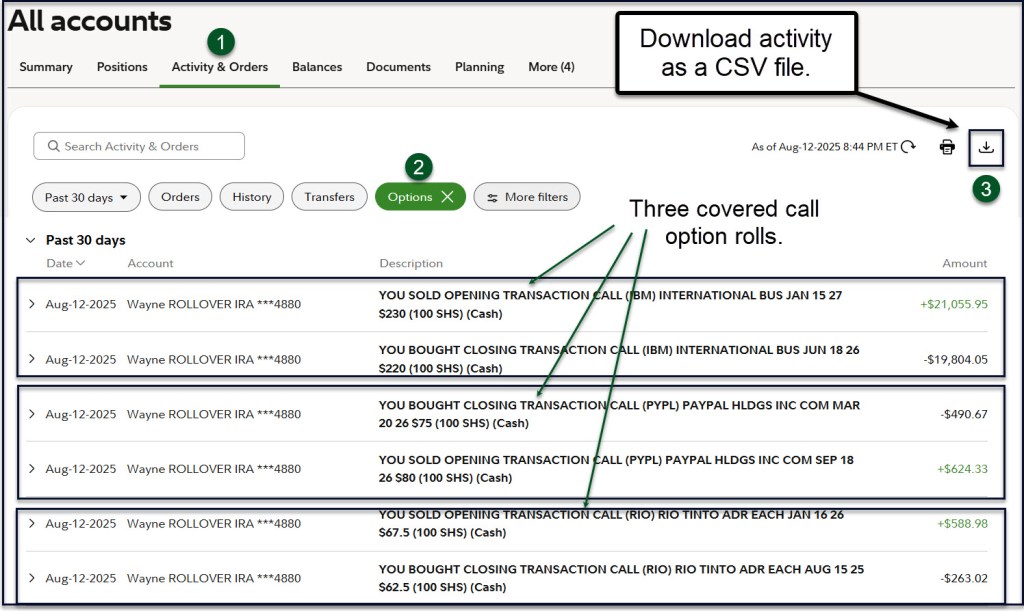

There is one primary reason to trade options. The reason is to add income that is on top of the dividend income we receive from our investments. Thankfully, Fidelity provides the data for you. You just have to download the data as a csv file and open that file in Excel (or any spreadsheet software.) I experimented with this portion of Fidelity’s “Activity & Orders” (1) menu. You can turn on a FILTER for “Options” (2). Then, using the down arrow icon on the far right of the screen (3), you can capture all of the transactions and keep track of your total income.

If you download the activity weekly or monthly and add it to a master spreadsheet, you will know how you did by month, by year or even by position using filters.

This is how I know that I have received $169,592.89 in options income in 2025 YTD. It is also how I know that we have received $524,308.58 in options income (synthetic dividends) from 2020 to the present. You read that right. We have earned over a half million dollars in 5.5 years of options trading. Therefore, my answer to the question, “Is it worth my time?” is “YES!.”

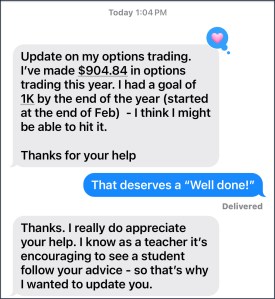

On a related note, it is always encouraging for a teacher to hear about a reader’s success in trading options. Yesterday one of my friends who received training in covered call options trading on February 21 sent me an encouraging text. Using what I taught him he has almost achieved his 2025 goal and there are still four more months of opportunity for options trades. I also have other friends and family members who have had success in their first year of options trading.

Decisional Record Keeping

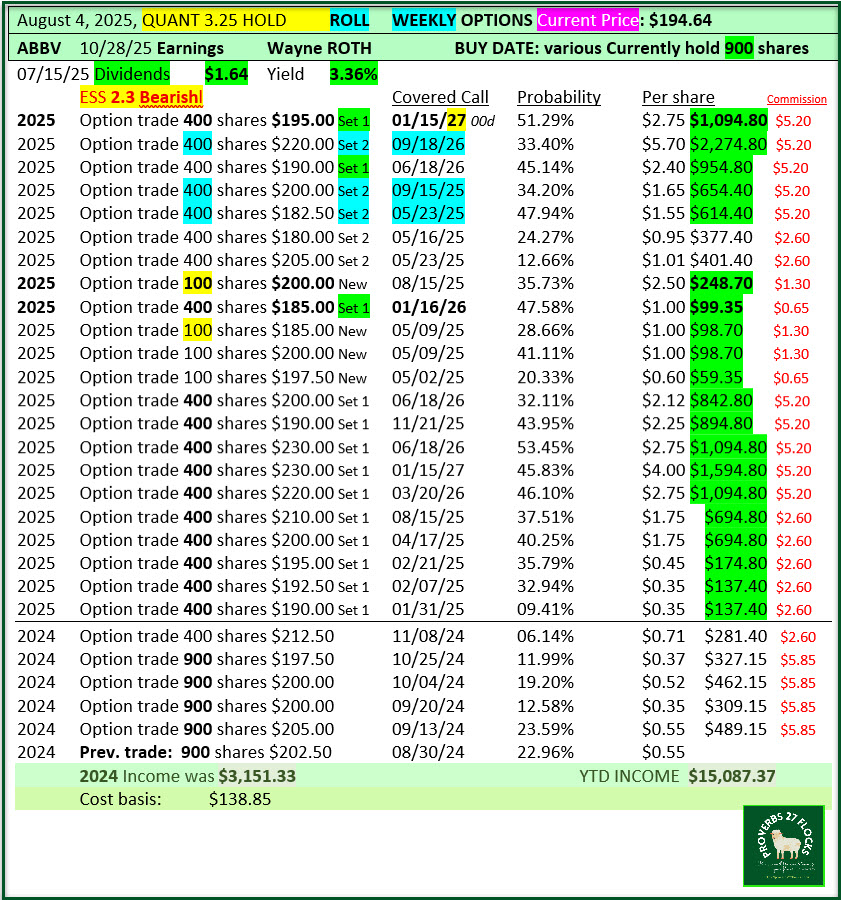

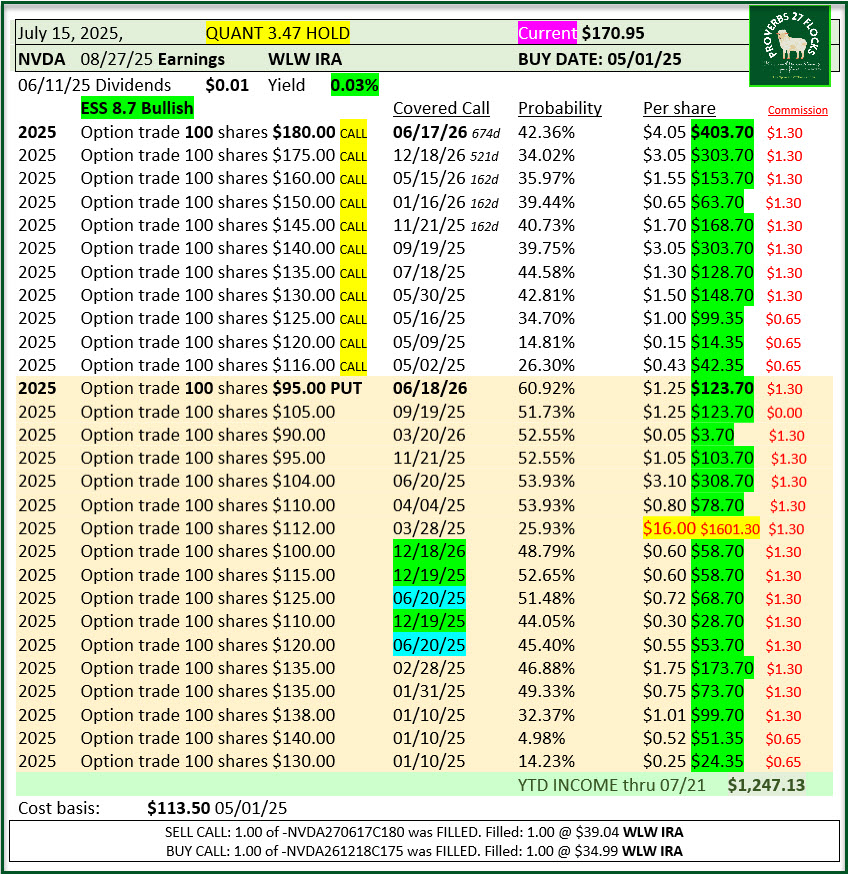

The only way to know if your decisions are working is to keep track of the decisions. In the following two examples you can see portions of my master Word document. One of the positions is ABBV in my ROTH IRA. The other one is NVDA in my traditional IRA.

1. I don’t think your document has to be like mine, but I would encourage you to capture the data elements that drove your decision. So, in my case, I want to know and remember the cost basis for the shares I am trading. That is shown at the bottom of each set of data. (Generally speaking, I want to make a profit if my shares are called away. Of course, I’d usually like to keep my shares.)

2. At the top I record the Seeking Alpha QUANT rating. I change it to reflect the current rating each time I do a trade. That helps me see if the rating is going up or down. When a rating is moving up there may be an upward move in the price of the shares. That is not always the case, but ratings can drive investor behaviors.

3. At the top I also record the current price for the shares. Therefore, on August 4 when I did the option roll of my 400 ABBV shares from $190 to $195, I knew that rolling up was prudent given the upward trajectory of the share price. If the share price drops, it may be another opportunity for a future roll.

4. I also want to be mindful of the Earnings Date and the Ex-Dividend Date before I enter a trade. That is shown in the top section, along with the quarterly dividend amount and the current dividend yield. Earnings and dividends often influence investor’s behaviors.

5. Finally, I add a line at the top of the list of transactions to record the following: the number of shares, the new contract price, the covered call expiration date, the probability that the shares will be called, the per-share profit I am seeking when I enter the trade, and (in green) the profit I will receive if the trade executes. That profit already reflects the commission amount, which is shown in a smaller font on the far right.

Finally, at the bottom of the column of profits is the actual total YTD profit from the ABBV options trades in my ROTH IRA: $15,087.37. That number was from the “Activity & Orders” csv download.

At first this may seem like a lot of work. However, because much of it is just copy/paste and updating a few values, it takes less than a minute to complete.

Recommendation: Options For Investing Doers

If you build a record keeping process, you can save a lot of time. You might want to start like I did with a pen and paper. Some might want to stick to Excel. I use a combination of Excel and Word to help me visualize both my decisions and my results.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.