“How Wayne Gets Things Done”

When it comes to investing, doers (with understanding and wisdom) get more done in less time with the right tools. It is reminiscent of Home Depot’s slogan “How Doers Get More Done.” ™ DIY (Do It Yourself) investing does not have to be difficult, nor does it have to be time-consuming. It isn’t time-consuming for me, and we have an extensive stock and ETF portfolio.

“Home Depot consistently releases its annual report while simultaneously announcing a new advertising slogan. Many of their campaigns seem to divert away from one of their longstanding slogans of days past. The latest slogan arrived in 2019 and reads “How Doers Get More Done.” This changed from 2009 when they switched from the more fiscally-sensitive tone of “More saving. More doing.” – ProTool Reviews

In June one of my blog readers, Bill, sent me a message that included the following: “On another note, I’ve been following your success with options trading—it’s impressive how you’ve grown that income stream while directing it toward meaningful family projects. I’ve read your articles and watched several of your videos, and I was wondering if you’ve ever outlined your best practices in a structured way. Something like a breakdown of your weekly review process, how you decide which stocks to add for contracts, how you log your trades, and if you’ve noticed certain days or conditions that work best for executing strategies.”

There are four good blog ideas in this question. Let me start with my weekly review process. This is not a time-consuming endeavor, but it helps to be free to look at some basic data before the market opens and then quickly look at the price behavior of my investment holdings. As you read this you will be tempted to think that this is too complicated. Remember this: you don’t start by trading dozens of options contracts. You should start with one. Therefore, the time spent looking at the review process is good because you can do it very quickly for one contract. Using this process will then speed up your review time when you have ten contracts. This is best done on the weekend or on Monday morning.

Is It Worth It? Does It Work?

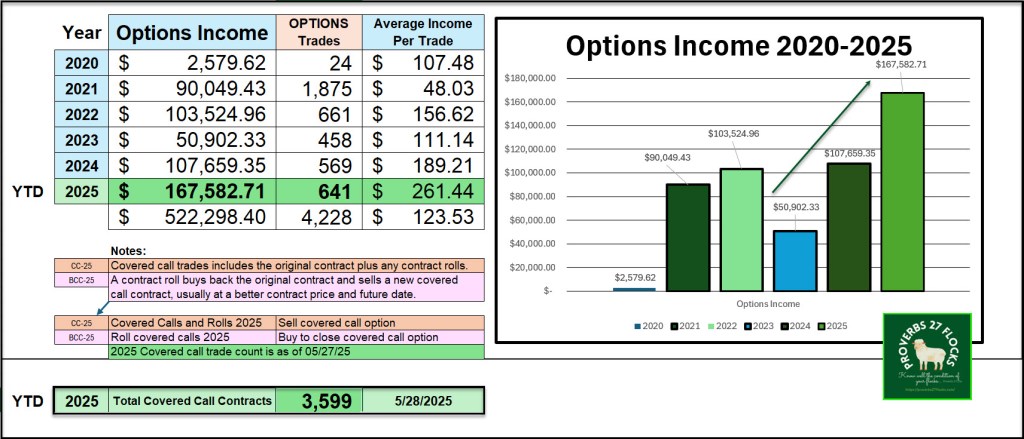

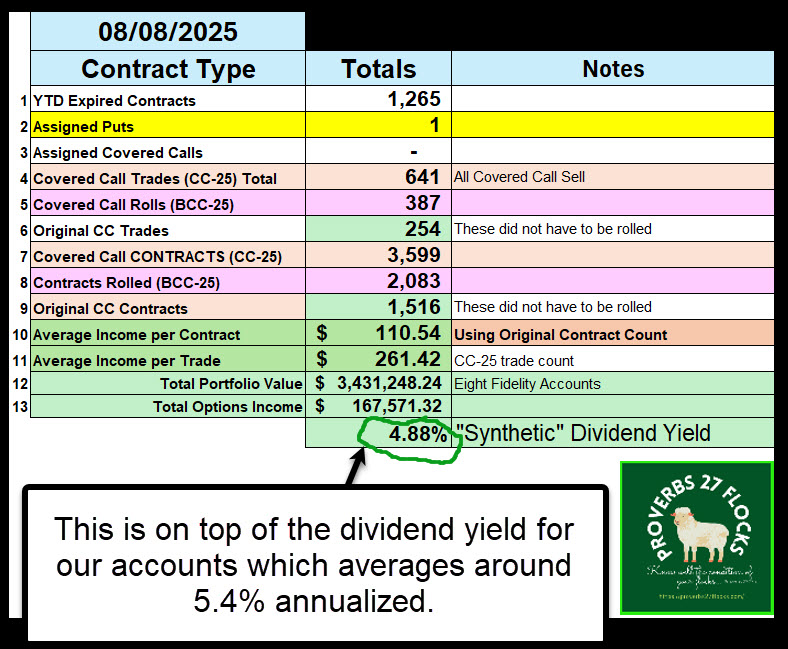

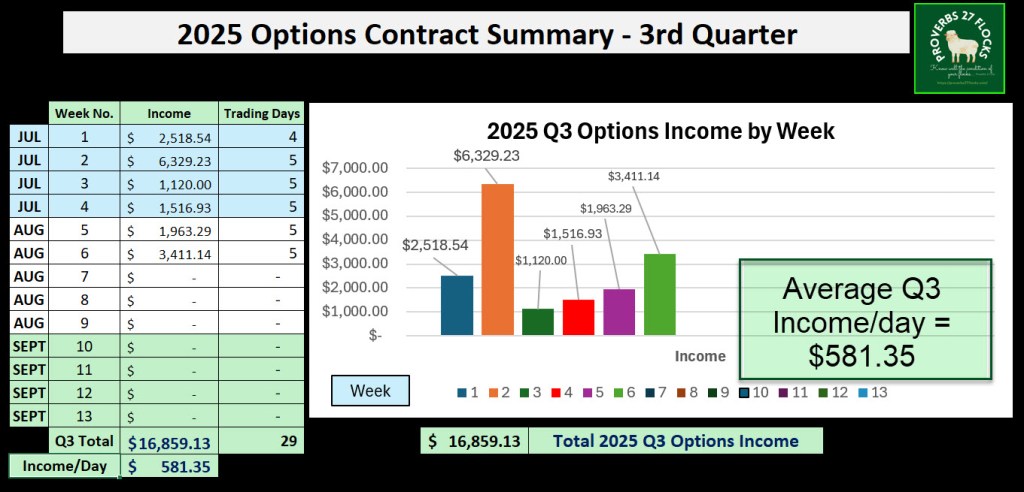

Before we dive into the process, you deserve to know if my process works. YTD options income is now $167,582. That is a synthetic dividend yield of 4.88%. Now ask yourself this question: “If I get a dividend yield of 3% on my shares and can add another 4% as a “synthetic” dividend (option income), would I take it?” Here are some images from my current results for 2025.

Breakdown of My Weekly Review Process

Before the Market Opens

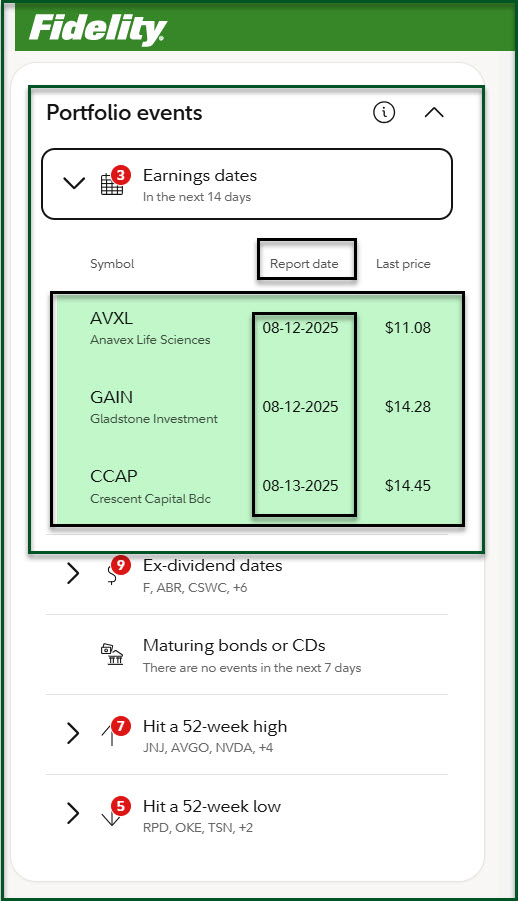

There are three basic pieces of information I look at each week before the market opens. They are: 1) Review open options contracts that expire soon, 2) Look at contracts that expired last Friday (August 8) and 3) Look at the earnings announcement dates for our investment holdings.

1. Review of Open Options Contracts

I’m going to talk about this in detail, as this is the piece of the puzzle that often prevents me from having to sell my shares due to a contract price that is too low. While this seems complex it really isn’t that complicated, and it doesn’t take much time to do.

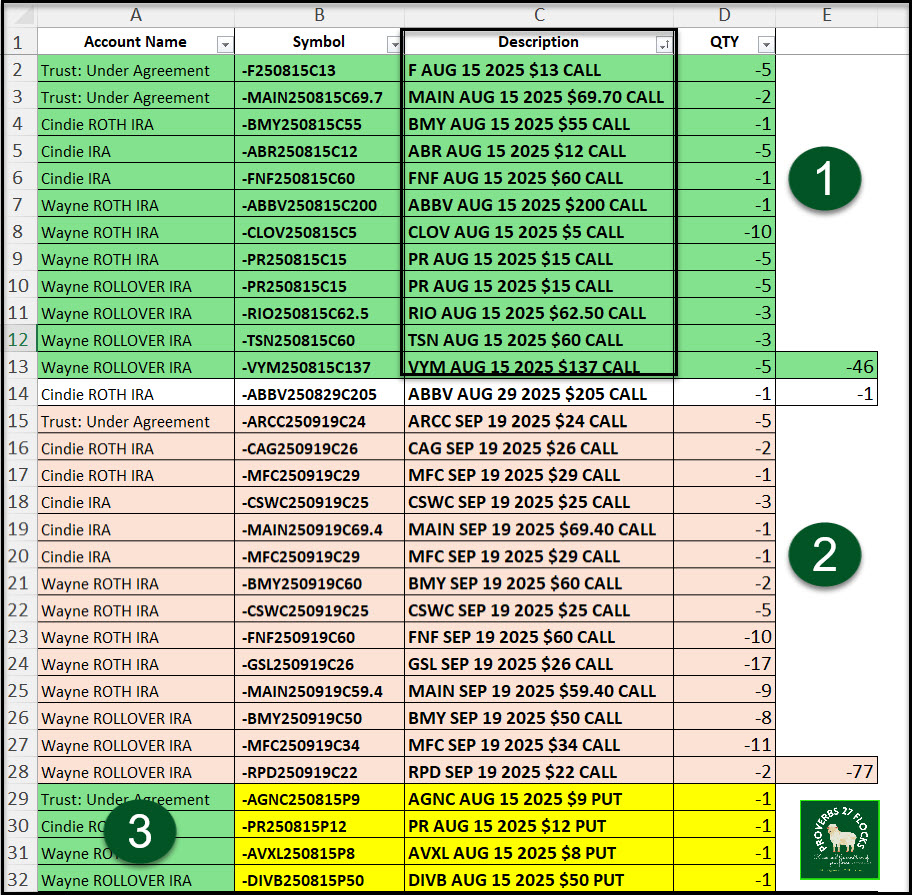

The first step in my process is to review open options contracts that will expire on Friday. Because many options expire on the third Friday of the month, and August 15 is the third Friday, I have 46 contracts that are due to expire or to be called. However, I don’t have to do 46 trades. Using the “ROLL” option feature in Fidelity’s Active Trader Pro I can take care of all of them with twelve trades. Therefore, if I want to roll my ten CLOV contracts, I enter a single trade in about 2-3 minutes, and I’m done. If the contract is unlikely to be called, I do nothing. For example, my PR Permian Resources Corporation contracts in both my ROTH IRA and Traditional IRA have contract prices of $15. I doubt the price will jump that high, so I will probably do nothing.

As another example, the ABBV shares in my ROTH IRA (1 contract for 100 shares) have a contract price of $200, I want to verify that the closing price does not go above $200 on Friday. On Friday ABBV shares closed at $198.05 per share. There is quite a bit of probability that they could close above $200 on Friday. Therefore, I may roll the contract up to $205 per share with an expiration date of September 19. That would be the third Friday in September. I would only do this if I could make money on the option trade.

The Ex-Dividend Date for ABBV is 07/15/2025, and I will already receive the $1.64/share dividend on Friday (08/15/2025), so that is of no consequence for this trade.

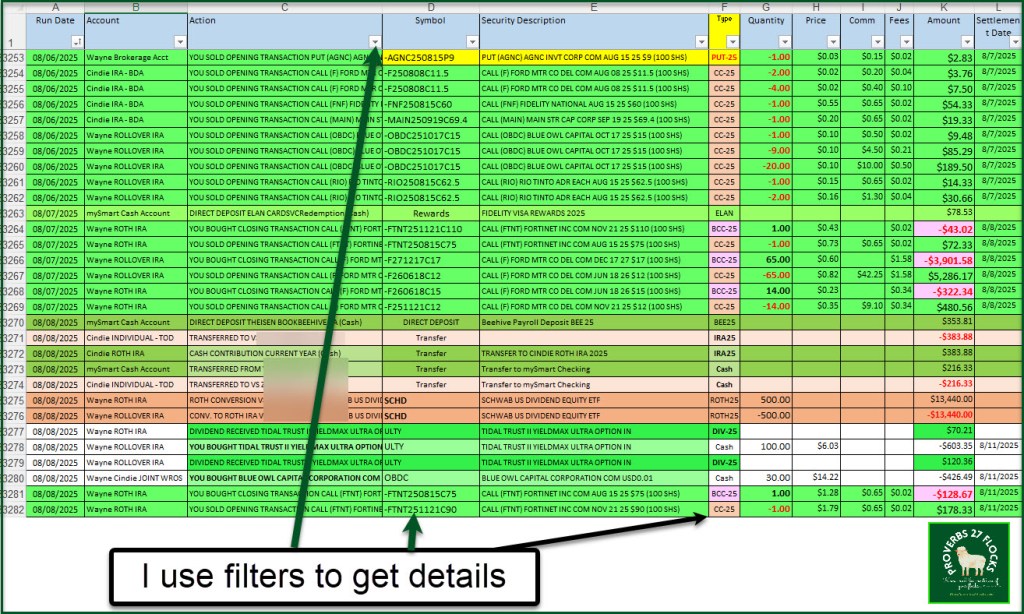

You may be wondering “How did Wayne create this spreadsheet?” It is a bit of work to get it set up initially, but then it becomes a template for future weeks. The data is easy: Just download your positions and sort them by the SYMBOL. All options contracts start with a dash, so they will sort together. Then, keep only those rows and turn on filters. It is easy to filter Column “C” for “AUG 15 2005” or any other date like “SEP 19 2025.”

In the illustration above (that I colorized to show the different contracts), you can see the 46 contracts that expire on Friday, one that expires on AUG 29, and a bunch that expires on the third Friday in September. The last section, in yellow, are four cash covered put option contracts that expire on Friday.

Notice that one of the put contracts is for PR (Permian Resources Corporation) with a price of $12. If the share price drops below $12 at Friday’s market close, I will acquire 100 shares at $12 per share. The current price per share is $13.26, so it is unlikely that I will get the shares and the contract will expire. I already have the income from the put option, so that is fine with me.

2. Look at Contracts that Expired last Friday

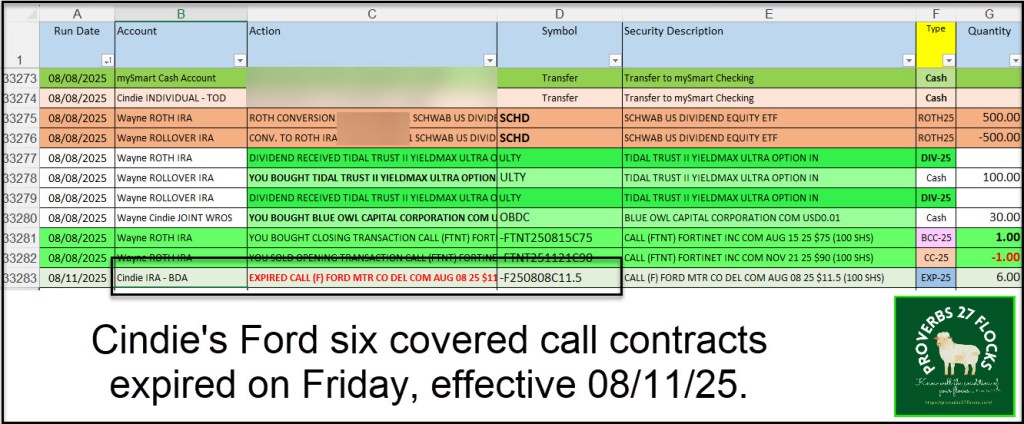

This is super easy. When I downloaded the Activity csv for the week just ended I can see all of the expired contracts.

Sometimes the list is long and sometimes there are no expired contracts. On Friday Cindie’s six Ford “covered call contracts” expired. She keeps the money she received for her contracts, and she keeps her 600 shares of Ford stock. This is good news, as the next Ex-dividend date is 08/11/2025 (today!) so she will also get the fifteen cents per share dividend on the pay date: September 2.

Let’s say on Friday that all 46 contracts expire and I keep my shares. On Monday, August 18 I have another opportunity to enter into 46 new “covered call contracts.”

For example, if the ten CLOV contracts expire, I can enter into ten new covered call contracts (with one trade) to make even more options income. The same is true for F, MAIN, BMY, ABR, FNF, ABBV, PR, RIO, TSN and VYM.

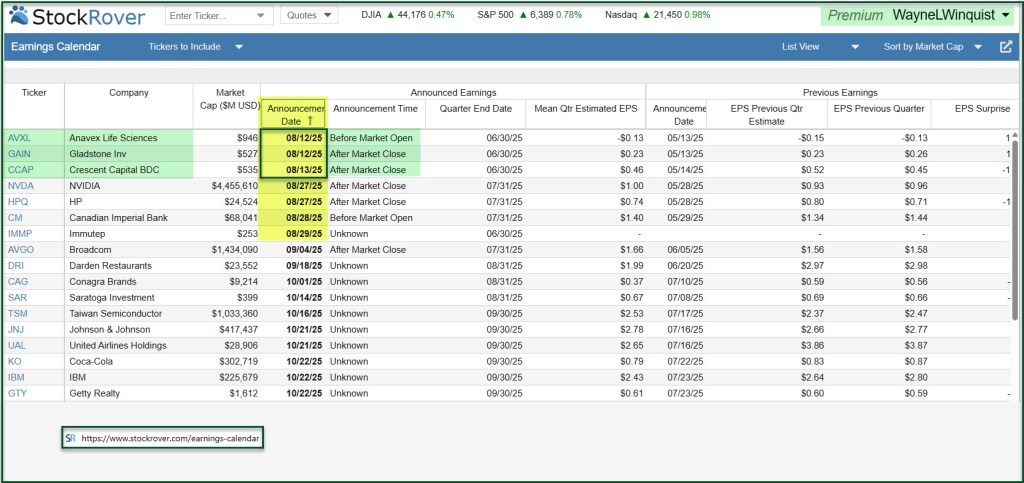

3. Look at the Earnings Announcement Dates

Because I care about earnings dates, I always review the stocks I own to see if they are announcing earnings. The easiest way to do this is to use StockRover’s “Earnings Calendar”.

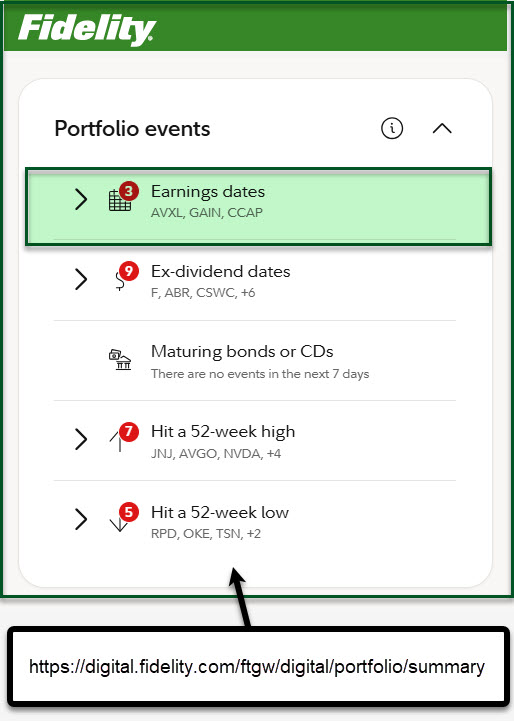

However, it is also possible to see a bit of information on the Fidelity Portfolio Summary Page in a box of choices called “Portfolio Events.” By clicking the right arrow you can see some of the information. Unfortunately, Fidelity’s view does not give the details you can see on StockRover, but it is a start. The Word template I use always forces me to review and consider the earnings date before I do an option trade. Also, Fidelity’s ATP shows me the earnings date in Trade Armor, so I don’t have to dig to see this.

If time permits there is one other thing that is a very small piece of my review process. It is best to do this after the market opens, but you can often see the “Pre-Market” price for your important holdings on Seeking Alpha. If you are using Fidelity’s ATP you can also see the bid/ask prices for your holdings. Here is what I do after the market opens: look for opportunities.

After the Market Opens

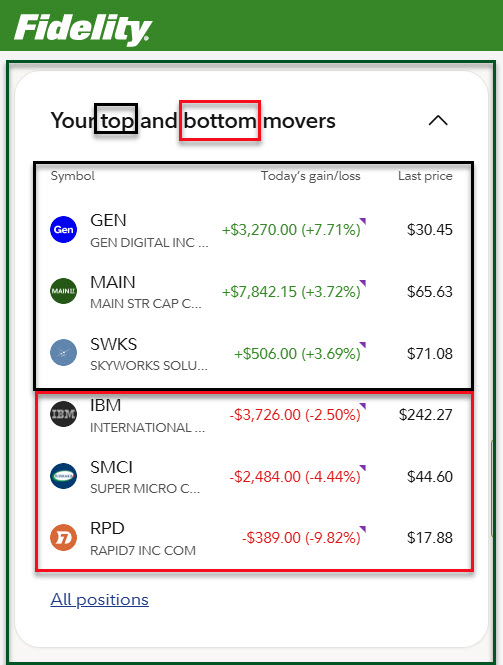

At around 9 AM (CST) I look at the main Fidelity Portfolio Summary Page for a box that is called “Your Top and Bottom Movers.” The following image shows the top movers were GEN, MAIN, and SWKS. The bottom movers were IBM, SMCI, and RPD. It just so happens that I have open covered call options contracts and one “cash covered put” option on these holdings.

There are two potential opportunities that may be actionable. The first is my desire to maximize my profit when I sell any position. So, for example, it might be possible to roll my GEN covered call option contract to a higher price with a date farther into the future. I usually only do that if I can make a profit on the contract trade.

The second is to consider if I could benefit from the drop in price of the shares of a holding like IBM. For example, I might either roll the contract down to an earlier expiration date or I might roll it up to a higher contract price per share. If my current contract price is $240, then it might be possible and advantageous to do a roll up to $250 for a future date.

Recommendation: Options For Investing Doers

If you build a process, you can save a lot of time. Do the same thing over-and-over and it doesn’t require too much hard thinking or complicated math. Start small, and use the process to find opportunities or to take opportunities.

In my next post I will continue to dive into Bill’s other requests. The remaining questions are:

1. How I decide which stocks to add for contracts, 2. How you log your trades, and 3. If I’ve noticed certain days or conditions that work best for executing strategies.”

As always, don’t hesitate to ask questions. And, thank you Bill for your questions!

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.