The Quick Way to Happiness?

Those who invest, save, and spend like millionaires understand some basic practices of managing money. Of course, the goal is not “happiness” if you are thinking about your final hour on earth. I will quote a couple of “famous” millionaires to help us realize some basic truths.

Zsa Zsa Gabor said there is a quick way to make a million: “The quickest way to make a million? Marry it.” That may be true, but it doesn’t guarantee a happy marriage or happiness in general.

Does having a million make you happy? Arnold Schwarzenegger reveals a silly comparison on this faulty thinking: “Money doesn’t make you happy. I now have $50 million but I was just as happy when I had $48 million.” Many millionaires are fearful misers.

King Solomon understood the reality of misguided focus on wealth. He was even more wealthy than Arnold but wrote this in Ecclesiastes chapter five: “He who loves money will not be satisfied with money, nor he who loves wealth with his income; this also is vanity. When goods increase, they increase who eat them, and what advantage has their owner but to see them with his eyes? Sweet is the sleep of a laborer, whether he eats little or much, but the full stomach of the rich will not let him sleep.” – Ecclesiastes 5:10-12 (ESV)

Spending Habits

While it is true that some millionaires spend lavishly, the vast majority of the “silent millionaires” are frugal and thoughtful when it comes to spending and borrowing. For example, we could drive expensive cars but choose to drive fuel efficient Ford Escapes. It doesn’t have to be new to get me where I am going and it certainly doesn’t have to be a status symbol. My red Escape does not attract attention. Furthermore, when we buy an SUV, we pay cash. Financing makes sense to Ford Credit or to the bank. It makes no sense to borrow money for a depreciating asset.

Saving Habits

When I was young I learned to save and each of us had a “Savings Account” at a bank in Elm Grove Wisconsin. I did not understand the power of saving for the long-term when I was twelve years old, but I certainly understand it now. There are many prudent ways to save money. The first is to avoid spending. The second is to take advantage of any 401(k) and employer matching. Millionaires are savers.

Investing Habits

Peter Gratton suggests a good way to become a person of wealth. I can attest to his suggestion. He wrote an article titled “Can Investing in Dividend Stocks Make You a Millionaire?” The short answer is yes, but you need to be thoughtful about the stocks and ETFs you buy.

Focal Points

“What Most Successful Dividend Investors Do Differently – ‘Composure is everything,’ Byeajee said. ‘It helps you stay focused on the long-term process rather than getting caught up in the emotional highs and lows of daily market fluctuations.’ You’ll need it to reinvest your dividends while others are talking about their gains (but somehow always staying quiet about their losses) from following the latest market trends.” – Peter Gratton

Does your advisor only talk about their “gains” and downplay their losses? A gain is only a gain after you sell your investment. Until you have cash you have not locked in your gain.

Peter goes on to say “Byeajee and Tenerelli said that successful dividend investors share three key habits that set them apart:” There are three things that matter. The three are sustainability, discipline during downturns, and decades of doing the same thing over-and-over. Here are the main ideas:

“1. They focus on dividend sustainability, not the size of the dividend checks. Instead of chasing dangerous double-digit yields (companies might have dubious reasons for doing so), they look for companies with reasonable and consistent payouts that grow through various economic cycles.

2. They maintain iron discipline during market downturns. Rather than panic-selling when prices fall, they see market dips as a chance to buy quality dividend stocks at better prices.

3. They think in decades, not days. These investors understand that dividend wealth-building is a marathon, not a sprint.” – Peter Gratton

Let Me Add a Fourth: Pay Attention to Taxes

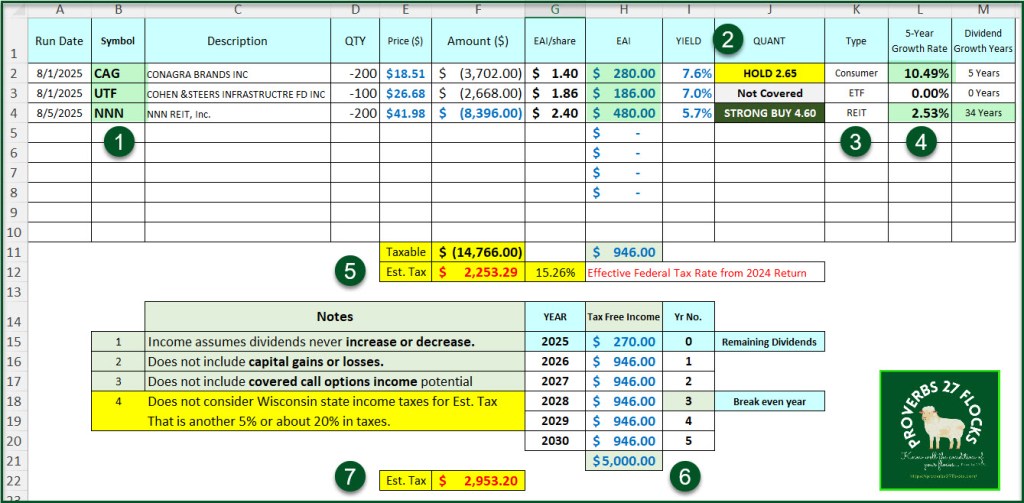

It won’t surprise those who know me that I use spreadsheets to help me make decisions. This includes a “tax” spreadsheet that gives me a long-term view of the impact of income taxes and dividends on ROTH IRA conversions.

The problem with the spreadsheet is that it cannot provide true information about the future. However, it does help in the decision-making process. For example, the spreadsheet assumes dividends never increase (or decrease). It also assumes no capital gains or losses. Finally, it does nothing to reflect the potential income I receive from trading covered call options on the converted shares. It also doesn’t reflect the power of dividend reinvestment, or the savings Cindie will see in her income taxes when I am gone.

Seven Things to Ponder

My spreadsheet gives you seven things I pondered before I pulled the lever to convert shares. The first is the dividend IRA investments I own that I want to convert. In my case there are three positions so far in 2025: CAG, UTF, and NNN. Notice that I am interested in the Seeking Alpha QUANT rating when I do the conversion. I also want diversification in the type of investment, so I have converted a consumer stock, an ETF and a REIT. An added plus is to pay attention to (4) the 5-Year dividend Growth Rate.

Then it is time to calculate the cost of the conversion. Because our “effective federal income tax rate” is 15.26% (2024), I know what the tax will be. I also know that our (7) total liability with Wisconsin income tax included is about 20%. That means we will pay about $3K in income taxes on this conversion. That means the theoretical break-even will happen sometime in 2028.

The spreadsheet, however, does not reflect the reality that my RMD will be reduced by having fewer assets in my traditional IRA. That enables much less costly ROTH conversions in the future.

SUMMARY

Think like a millionaire and pay attention to “financial secrets.” Do the math. If you have traditional IRA assets, review the long-term implications of those assets from an RMD and income tax perspective. Today is the day to start.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.