Dividend History Matters

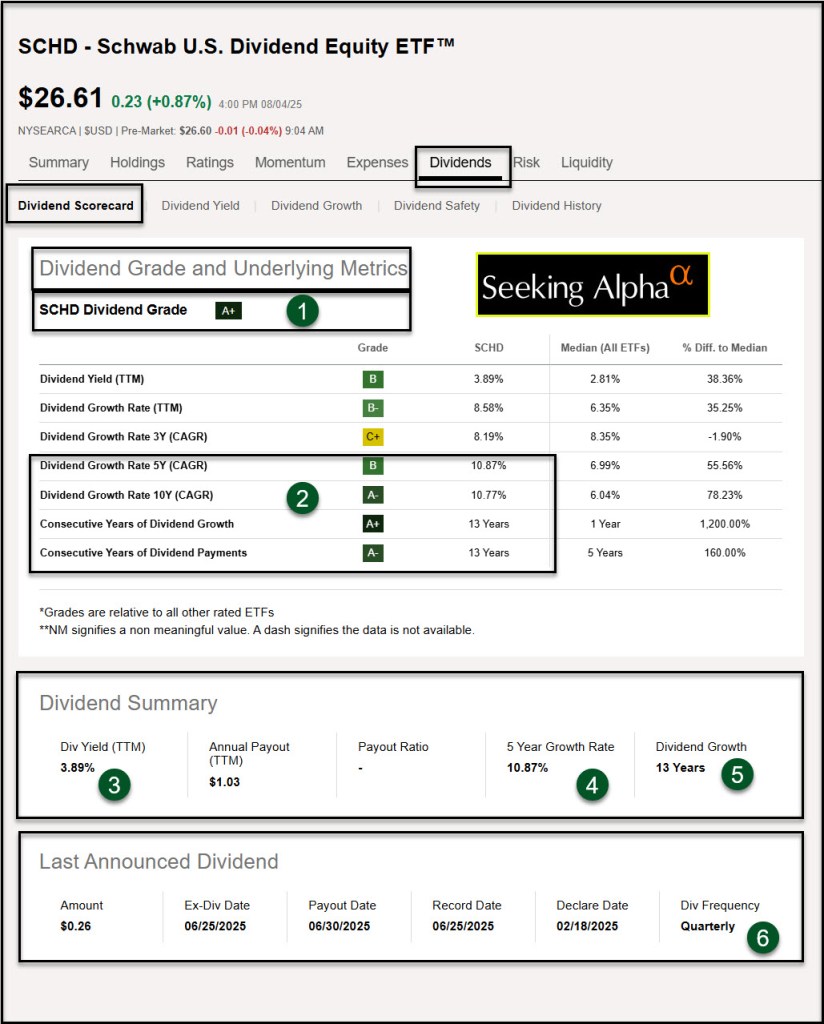

In addition to looking at ten-year total returns, the prudent investor wants to know something about the dividends for dividend paying stocks and ETFs. Because I want easy income that grows over time, I want to see a history of rational dividend growth. For example, ETF SCHD (Schwab U.S. Dividend Equity ETF™) has a history of dividend growth.

Having said that, SCHD is not the darling of some investors. The reason is quite simple. SCHD’s holdings are not focused on the mega-cap stocks like Amazon, Microsoft, Google, and Facebook. Included in the top ten investments in SCHD are Chevron Corp, ConocoPhillips, PepsiCo Inc, Cisco Systems Inc, AbbVie Inc, Altria Group Inc, Amgen Inc, Merck & Co Inc, The Home Depot Inc, and Verizon Communications Inc.

If you look at VOO, you will see that it has a top ten focus of NVIDIA Corp, Microsoft Corp, Apple Inc, Amazon.com Inc, Meta Platforms Inc Class A, Broadcom Inc, Alphabet Inc Class A and Class C, Berkshire Hathaway Inc Class B, and Tesla Inc. The “problem” with this for a retiree is that VOO has a poor dividend yield of 1.21% while SCHD has a 3.89%.

Samuel Smith’s Thinking

I tend to agree with Samuel Smith. I generally recommend buying additional shares of SCHD when working with my friends. I already have 2,300 shares of SCHD in my ROTH, 1,500 shares in my traditional IRA, and also buy SCHD shares for our grandchildren. Cindie has 1,200 shares of SCHD in her ROTH IRA as well.

Here are three quotes from Mr. Smith:

“The next battle-tested dividend growth machine that I think is very attractive right now, despite recent underperformance, is the Schwab U.S. Dividend Equity ETF (SCHD). Yes, over the past few years, it has significantly lagged behind the broader market, but this is also very understandable.” – Samuel Smith, Seeking Alpha

“Specifically, it is because it does not hold any of the mega-cap tech stocks that have boomed so strongly due to the AI revolution.” – Samuel Smith, Seeking Alpha

“However, just because the stock prices of its underlying holdings have not soared higher does not mean that its underlying value as a dividend payer and dividend grower has declined. In fact, nothing could be further from the truth, as it has continued to grow its dividends at a rapid rate over that period of time, and today yields nearly 4%.”– Samuel Smith, Seeking Alpha

Templates for Finding Dividend Information.

I like Seeking Alpha’s “Dividend Scorecard” because it provides four pieces of information that investors want to see. I like to see the dividend yield, the 5-year dividend growth rate, the number of years the dividend has been growing, and the dividend frequency. The normal frequency is quarterly, but some good investments pay monthly dividends.

An investment like SCHD does not have a “payout ratio”, but that is an important number for individual company stocks like MSFT. MSFT’s payout ratio is a paltry 24.34%. I’m an investor in ABBV, which has a much nicer payout ratio of 61.10%. Some investments, by their very nature have an even higher payout ratio. ARCC, a business development company (BDC), has a ratio of 90.14%.

The primary caution for dividend growth investors is to avoid non-BDC investments with payout ratios that are not sustainable. If a company is paying out more than 100% of earnings you have to wonder where they are finding the cash to pay you.

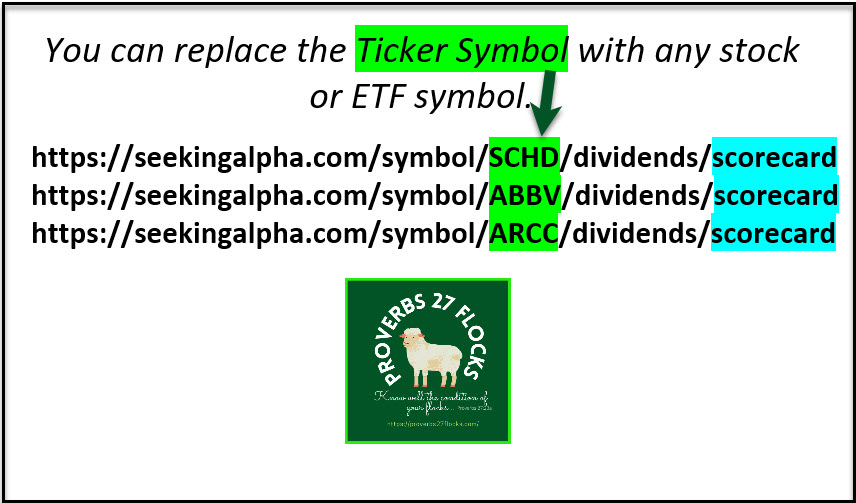

You can modify the ticker symbol in any of the following examples to look at the dividend scorecard for any investment you might want to buy.

https://seekingalpha.com/symbol/SCHD/dividends/scorecard

https://seekingalpha.com/symbol/ABBV/dividends/scorecard

https://seekingalpha.com/symbol/ARCC/dividends/scorecard

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.