History Matters When Buying an Investment

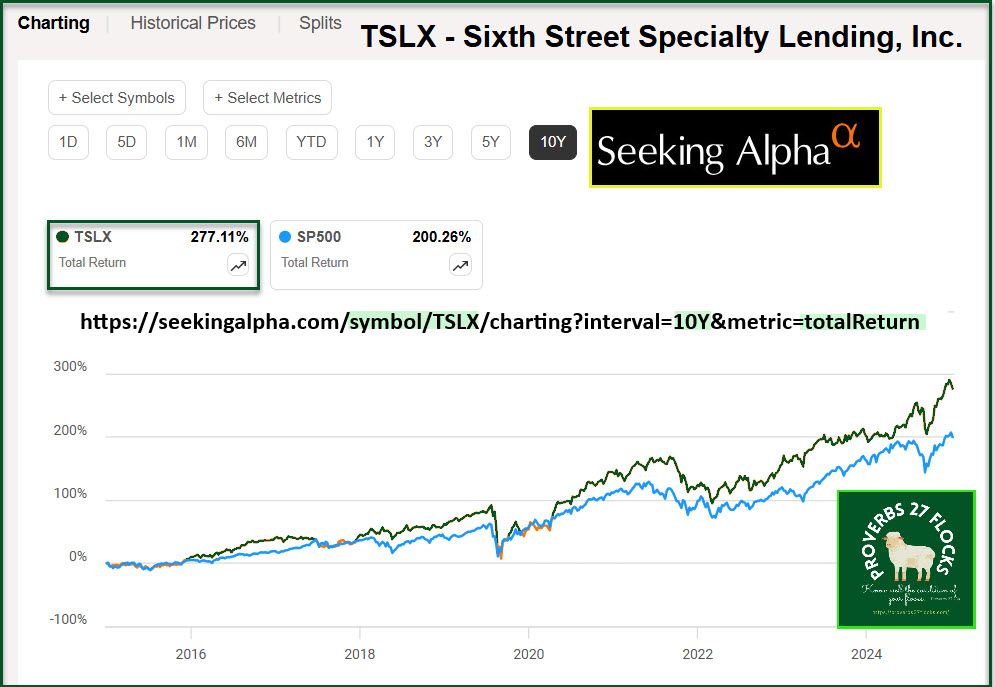

If you look at the true returns of bonds and bond funds you would not buy the lie that they are a “safe” investment. One key tool on Seeking Alpha is to look at Charting and filter on total returns. Then look at the ten-year returns. If they are less than 100% then you might want to reconsider buying the bond fund, stock or ETF. There are, of course, other considerations, but if the ten-year total returns are 20.58% (like bond fund ILTB – iShares Core 10+ Year USD Bond ETF) Then be ready to recognize you are losing money when you think about inflation. Seeking Alpha ILTB Total Return Graph

What is total return of an investment?

Total return is a measure of the overall performance of an investment, including both capital gains and income received, such as dividends or interest, over a specific period. It is expressed as a percentage of the initial investment amount. If you want to double your investment balance in 7.2 years, then you must strive for at least ten percent average annualized returns. That will never happen with bonds, bond funds, or CDs.

TSLX – Sixth Street Specialty Lending, Inc.

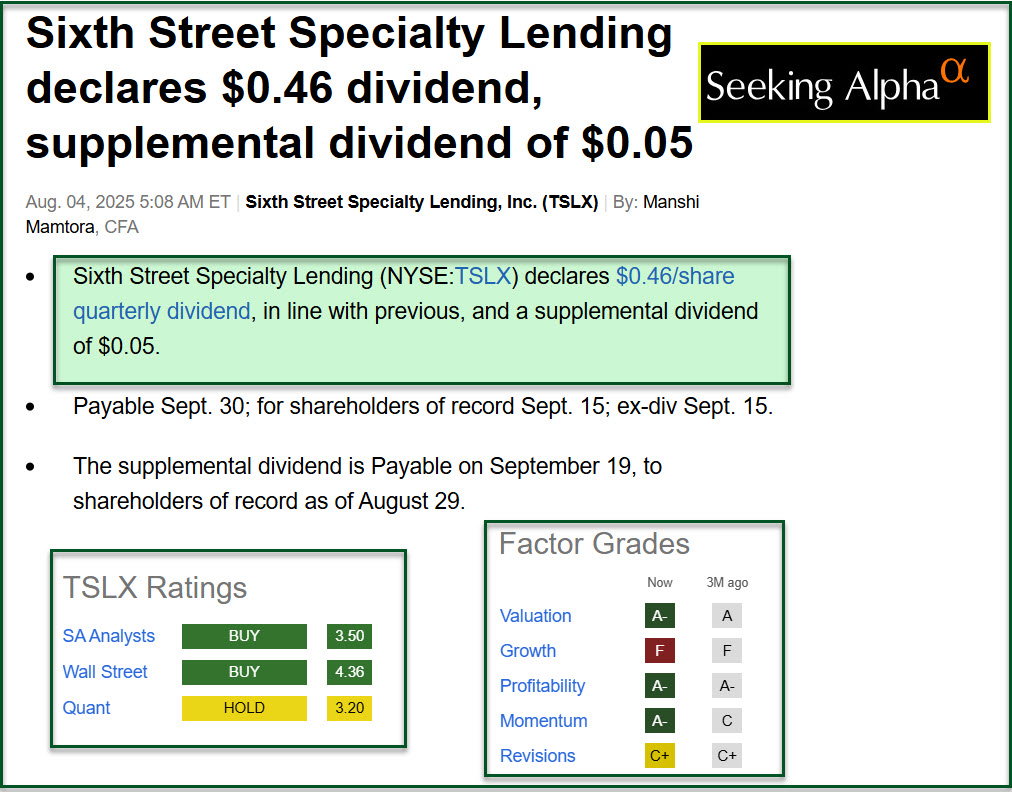

The good news keeps rolling in for our 2,800 shares of TSLX. “Sixth Street Specialty Lending (NYSE:TSLX) declares $0.46/share quarterly dividend, in line with previous, and a supplemental dividend of $0.05. Payable Sept. 30; for shareholders of record Sept. 15; ex-div Sept. 15. The supplemental dividend is Payable on September 19, to shareholders of record as of August 29.” – SEEKING ALPHA

How About Total Returns?

When you look at my returns on Fidelity’s Active Trader Pro, you might think my returns are less than ideal. For example, the current G/L % for my 2,000 shares in my traditional IRA is 14.59%. However, this number is not total returns. This is price returns or what my capital gain would be. The dividends are a huge factor. You cannot spend capital gains until you sell. You can spend the income you receive in dividends.

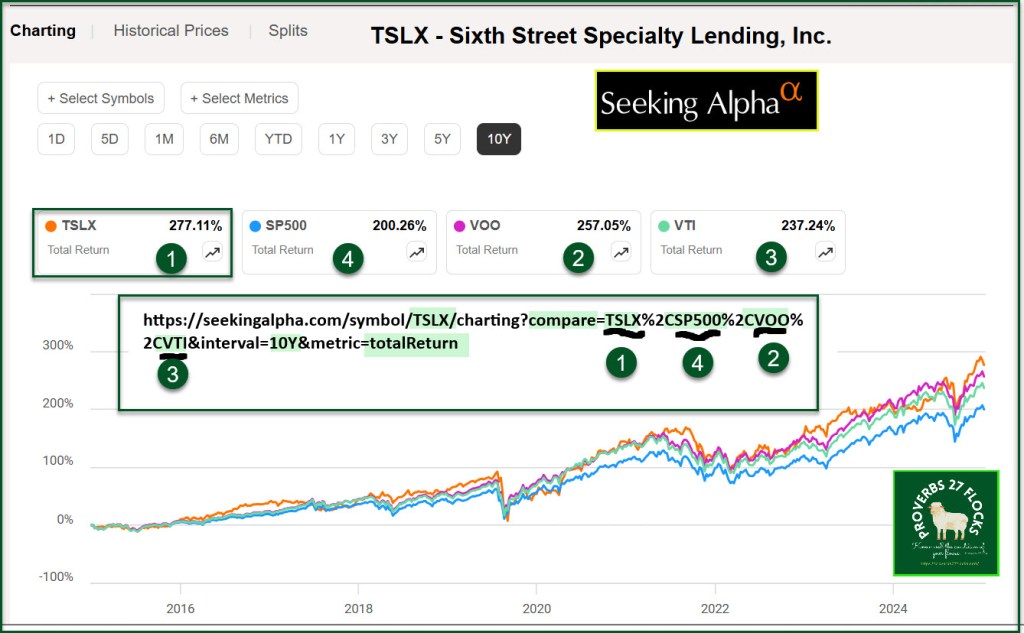

I like to compare the total returns of an investment with the returns on the S&P 500. For example, the ten-year total returns for VOO (Vanguard S&P 500 ETF) are 257%. The ten-year total returns for ETF VTI (Vanguard Total Stock Market Index Fund ETF Shares) are 237%. TSLX, by way of comparison, has a ten-year total return of 277%.

If you only focus on price returns you may miss the boat. If you look at TSLA’s returns you will see that they are 277%. However, Tesla does not pay a dividend. You cannot spend TSLA returns until you sell shares. Target’s (TGT) ten-year returns are 69%. Verizon’s (VZ) are only 55%. Of course, don’t make every decision solely on the 10-year returns. Ten-year returns are HISTORICAL not FUTURE returns. They are, however, one way to eliminate truly bad investments like bonds.

TSLX and Covered Call Options

I can also trade options on my TSLX shares. I hesitate to do so, as I don’t want to run the risk of seeing the price of the shares skyrocket. It is, however, another way to create additional income. I could always buy the shares again if they were called away.

Quick Links on Seeking Alpha

If you save a template of an https address, you can change the ticker symbol and quickly see any investment of interest to you. Here are some of my templates to give you a starting point.

ILTB https://seekingalpha.com/symbol/ILTB/charting?interval=10Y&metric=totalReturn

TSLX https://seekingalpha.com/symbol/TSLX/charting?interval=10Y&metric=totalReturn

TSLX and VOO/VTI https://seekingalpha.com/symbol/TSLX/charting?compare=TSLX%2CSP500%2CVOO%2CVTI&interval=10Y&metric=totalReturn

RQI (Real Estate ETF) https://seekingalpha.com/symbol/RQI/charting?interval=10Y&metric=totalReturn

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.